Tag Archive: newslettersent

Survey offers clues to why Swiss rejected last Sunday’s pension reform

A survey by Tamedia offers clues to why 52.7% of Swiss voters rejected the pension reform plan that was put to a vote last Sunday. 20% of those voting “no” thought it was a pseudo reform that didn’t go far enough, while 26% felt it left too much of a burden on younger taxpayers. In 1981, when the life expectancy of an average Swiss woman was 79.2 years, the average time spent collecting the state pension was 15.2 years. Now an average Swiss woman...

Read More »

Read More »

Emerging Markets: What has Changed

India Prime Minister Modi announced an INR163.2 bln program to deliver electricity to all households. Poland’s President Duda is trying to reach a compromise on judicial reforms. Fitch raised the outlook on Russia’s BBB- rating from stable to positive. Saudi Arabia announced it will remove the ban on women driving. South Africa’s biggest labor organization stepped up its opposition to President Zuma.

Read More »

Read More »

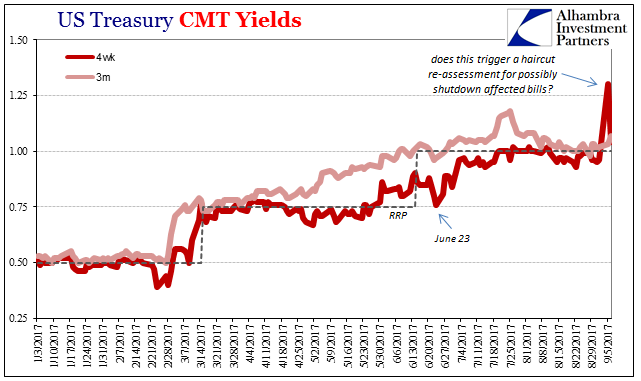

It Was Collateral, Not That We Needed Any More Proof

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. Within two days of that move in bills, the GC market for UST 10s had gone insane.To be honest, it was a rhetorical exercise.

Read More »

Read More »

FX Daily, September 29: Dollar’s Gains Pared, but Set to Snap Six Month Losing Streak Against the Euro

Supported by a sharp rise in interest rates and ideas of tax reform, the US dollar is closing one of its best months of the year. The Dollar Index is snapping a six-month decline, and the euro's monthly advance since February is ending. This month, the US 10-year yield has risen 18 bp, and the two-year yield has risen 13 bp. It is the biggest increase since last November.

Read More »

Read More »

Swiss want TV tax cut by half, according to survey

Some who move to Switzerland might not be aware that they are almost certainly required to pay one of the world’s highest broadcasting fees. An annual Swiss licence costs CHF 451.10 per household. A successful vote in 2015 changed the rules on who must pay the fee. From 2019, it will be compulsory for anyone with a primary or secondary residence in Switzerland to pay it, effectively making it a tax on all households. At a new lower price of CHF 400...

Read More »

Read More »

Gold Standard Resulted In “Fewer Catastrophes” – FT

“Going off gold did the opposite of what many people think” – FT Alphaville. “Surprising” findings show benefits of Gold Standard. Study by former Obama advisor in 1999 and speech by Bank of England economist in 2017 make case for gold. UK economy was ‘much less prone to extremes’ under than the gold standard – research shows. ‘Gold standard seems to have produced fewer catastrophes for Britain’ – data shows . FT still wary of gold standard arguing...

Read More »

Read More »

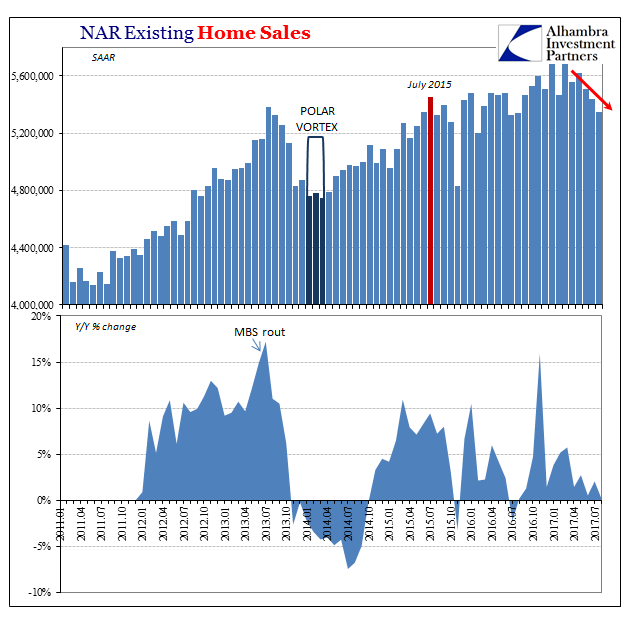

The Real Estate View For A Second Lost Decade

The National Association of Realtor (NAR) reports today that sales of existing homes in the US were down 1.7% in August 2017 from July. At a seasonally-adjusted annual rate of 5.35 million, that’s the lowest pace for resales since July 2016. It is yet another data point reflecting the almost certain end of “reflation” in the economic sense.

Read More »

Read More »

FX Daily, September 28: Greenback Consolidates while Yields Continue to March Higher

The US dollar is consolidating inside yesterday's ranges against the euro and yen while extending its gains against sterling and the dollar-bloc currencies. The sell-off in the US debt market continues to drag global yields higher. The 10-year Treasury yield reached 2.01% on September 8 and now, nearly three weeks later, is near 2.35%. It had finished last week at 2.25%.

Read More »

Read More »

Housing in Zurich and Geneva only moderately overvalued, says UBS

The UBS Global Real Estate Bubble Index 2017 describes housing in Zurich and Geneva as only moderately overvalued. The two Swiss cities rank 6th (Geneva) and 9th (Zurich) in a list of 20 selected global cities.

The top eight: Toronto, Stockholm, Munich, Vancouver, Sydney, London, Hong Kong and Amsterdam are all classified as bubble risk. Only Chicago is undervalued.

Read More »

Read More »

How Much Space Does $1,500 Rent In The World’s ‘Most Magnetic’ Cities?

New Yorkers who wince every time they slip a $1,500 rent check under their super’s door should consider moving to Shanghai, or maybe Berlin. According to a new study published on RentCafe, $1,500 will buy you three times more space in Shanghai than in Los Angeles and twice as much in Frankfurt. Meanwhile, rents per square foot are five times higher in San Francisco than they are in Berlin.

Read More »

Read More »

Financial Advice From Man Who Made $1+ Billion in 1929 – Importance Of Being Patient and “Sitting”

Listen to Jesse Livermore and ignore the noise of short term market movements, central bank waffle and daily headlines. Stock and bond markets are overvalued but continue to climb… for now. What goes up must come down and investors should diversify and rebalance portfolios despite market noise. Behavioural biases currently drive markets, prompting legendary investors to be confused and opt out.

Read More »

Read More »

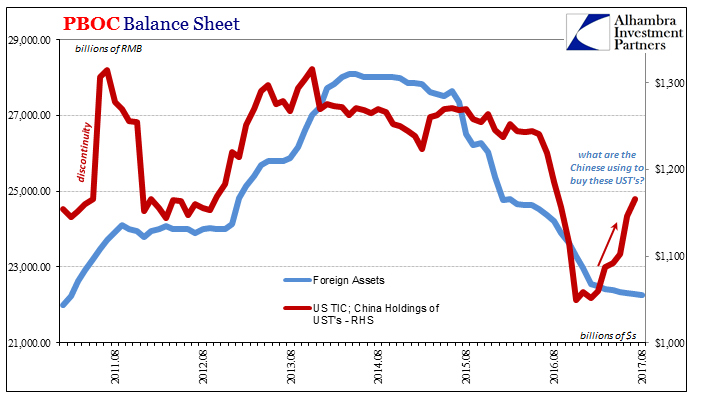

Little Behind CNY

The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely.

Read More »

Read More »

Liquidités et dirigisme des banquiers centraux.

En 2013, puis en 2014 lorsque les questions du Taper et de la normalisation de la politique monétaire ont été évoquées, les grands noms de la Banque mondiale , les patrons de JP Morgan, Citi , Goldman se sont émus. Ils ont évoqué avec un bel ensemble le problème de la liquidité des marchés, en particulier obligataires. Ils l’ont évoquée pour se plaindre bien entendu de son insuffisance; les marchés sont trop étroits et trop peu profonds disaient...

Read More »

Read More »

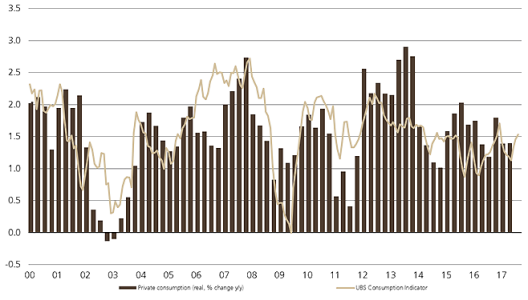

Switzerland UBS Consumption Indicator August: A pleasant end to summer

The UBS consumption indicator increased to 1.53 points in August thanks to robust new car registrations and encouraging numbers of hotel stays by Swiss residents, indicating consumption growth slightly above the long-term average of 1.5%. However, the UBS economists still project 1.3% consumer spending growth for the year overall.

Read More »

Read More »

FX Daily, September 27: Dollar Builds on Gains

The Federal Reserve may not be on a coordinated campaign to convince the markets of a pending rate hike as it did so effectively in late February and early March. But investors are getting the message. The Bloomberg calculation of the odds of a rate hike before the end of the year has risen to 70% from 53% before last week's FOMC meeting and 33.5% at the end of last month. The CME puts the odds at 81% up from 37% a month ago.

Read More »

Read More »

Watch industry unperturbed by new ‘Swiss made’ regulations

The majority of Swiss watch executives surveyed by consulting firm Deloitte are positive about new rules requiring at least 60% of a watch’s manufactured costs to be incurred in Switzerland. According to the Deloitte Swiss Watch Industry Study 2017external link, released on Wednesday, 44% of 60 watch executives surveyed consider the new “Swiss made” rules to be positive compared to 20% who believed they would have a negative effect.

Read More »

Read More »

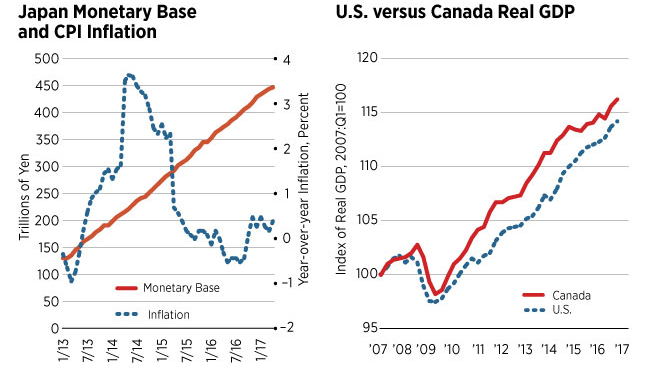

Why The Fed’s Balance Sheet Reduction Is As Irrelevant As Its Expansion

The FOMC is widely expected to vote in favor of reducing the system’s balance sheet this week. The possibility has been called historic and momentous, though it may be for reasons that aren’t very kind to these central bankers. Having started to swell almost ten years ago, it’s a big deal only in that after so much time here they still are having these kinds of discussions.

Read More »

Read More »