– Listen to Jesse Livermore and ignore the noise of short term market movements, central bank waffle and daily headlines

– Stock and bond markets are overvalued but continue to climb… for now

– What goes up must come down and investors should diversify and rebalance portfolios despite market noise

– Behavioural biases currently drive markets, prompting legendary investors to be confused and opt out

– Lesson is to prepare portfolios for long-term and invest in assets that will act as hedge in next market correction or crash

– Gold performs well over the long-term and delivers to those “sitting” and being patient

When it comes to your investment portfolio it is harder than ever to sift through market and central bank noise and focus on the fundamental drivers and long-term strategy.

Take for example a quick glance at financial news pages this morning:

- A story about bitcoin’s rise from $200 in 2013 to $5000 just three weeks ago – a gain of 2,400%

- Fed rate hike odds in December have soared to 78% thanks to Yellen’s “noisy” comments yesterday

- Luxury homes in London’s best neighborhoods are set to rise by 20.3% over next five years – allegedly

- Warnings of supply gap in oil production next year

Meanwhile, we look at more quiet, conservative gold and it has varied no more than $200/oz over the last four years.

It can be difficult to correlate this with a background of markets that are teeming with behavioural biases. Market reactions are short-tempered thanks to this age of instant information… and disinformation.

Greed and fear become more exaggerated than ever and greed is currently dominant.

The most recent individual to get frustrated with this state of affairs is money manager Hugh Hendry. Hendry recently decided to close his hedge fund, after 15 years. Hendry joined the likes of Eric Mindich, Leland Lim and John Burbank all of whom have shuttered hedge funds this year.

Market frustrations make us want to jump on money making bandwagon

In his round of send-offs Hendry explained how frustrating he had found markets. By nearly every measure they are over-priced, but few seem to care.

Hendry told Bloomberg:

“To my great, great, great horror, I became deeply correlated to the travails of President Trump’s presidency and of course these geopolitical events, which were sparked off in the Korean peninsula.”

Markets are reacting to short-termisms and click-bait headlines.

Consider this: stocks, bonds and property prices are at all-time highs. They’re not alone, private equity and some collectibles (considered alternative assets) are also at all time highs.

But they keep on going.

Occasionally it can feel as though nothing will take the steam out of the sails of markets which by all measures should be dramatically faltering.

Momentum is a powerful thing … especially in the short term.

At the end of H1 2017 the S&P500, the Dow and Nasdaq Composite posted their biggest gains in recent years.

Stock prices fluctuate on a daily, monthly and even quarterly basis. These fluctuations often have very little to do with the fundamental value of the business.

Short-termism, speculation and stock buy backs are the main drivers of stocks today.

In 1960 the average period for holding a NYSE stock was eight years and four months. Today, according to Credit Suisse, the average period for holding a stock across the broader US stock market is four months.

We know from experience that this kind of trading behaviour and pricing activity cannot continue.

What goes up must come down. But obviously no-one knows when.

This is frustrating in this day and age. At a time when information is at my fingertips it can be infuriating to not have an answer.

But, we must be patient.

Importance of patience – a time-old skill

We were reminded of one of the greatest examples of investing with patience by Tim Price of Price Value International.

Price tells the story of Jesse Livermore, a legendary trader.

Livermore was extraordinary. Born in 1877, Livermore ran away from home as a child and soon began trading stocks.

By the time he was 20, he had already amassed a fortune of $3 million, more than $75 million in today’s money.

Livermore sold short, i.e. bet that stock prices would fall, just prior to the 1907 crash, as well as the 1929 crash.

His bets were so lucrative that, going into the Great Depression, Livermore had a fortune of more than $100 million, or about $1.4 billion today.

But Livermore wasn’t just great at making money from overheated markets. He was also a master of losing money.

This book is widely and rightly regarded as an investment classic. It is also crammed with valuable observations about the practice of speculation and successful trading.

Among them, the importance of being patient and disciplined:

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made big money for me. It was always my sitting.”

The success of long-term investing and damage of short-term reactions is not just anecdotal.

In its 2016 Quantitative Analysis of Investor Behaviour, US investment firm Dalbar found the leading cause of 20 years of diminished returns was investors’ own behaviour.

They tended to indulge in ‘panic selling, excessively exuberant buying and attempts at market timing’.

Time pressures of thinking

We shouldn’t be surprised that investors struggle to take a Jesse Livermore approach these days. Not only are we surrounded by instant news but we are also pressured into delivering regular results.

Hedge fund managers such as Hendry have to give their clients regular updates. All of us who hold investments with managers receive quarterly or annual reports. Money managers must report their results.

Of course, this is good for transparency but can you imagine how most people these days would feel if they thought money managers were telling them their investments hadn’t done very much? They would want to move their money, they’re not seeing much change which in today’s minds means their is little value.

This is why we like gold

For precisely this point, we like gold. It requires patience, over the long-term it likes to filter out the noise that comes from the likes of Trump tweets and pumped up stocks.

Gold has performed extremely well since 1999. During the tech-fuelled stock market collapse of 2000-2003 gold stood strong. It made further gains during the disaster of the Iraq war, further boosted by the likes of Enron-esque scandals.

Following the financial crisis in 2007/ 2008, it posted some of its biggest gains.

Not bad for something that has just sat in the background for the last near-twenty years.

Regardless of how much gold you choose to hold in your portfolio the main message is clear: do not manage your portfolio on a daily basis, consider it as something which requires care over the long-term. This is why gold serves a portfolio so well.

This is something those who are just beginning to consider their long-term finances should seriously pay attention to.

Millennials take note

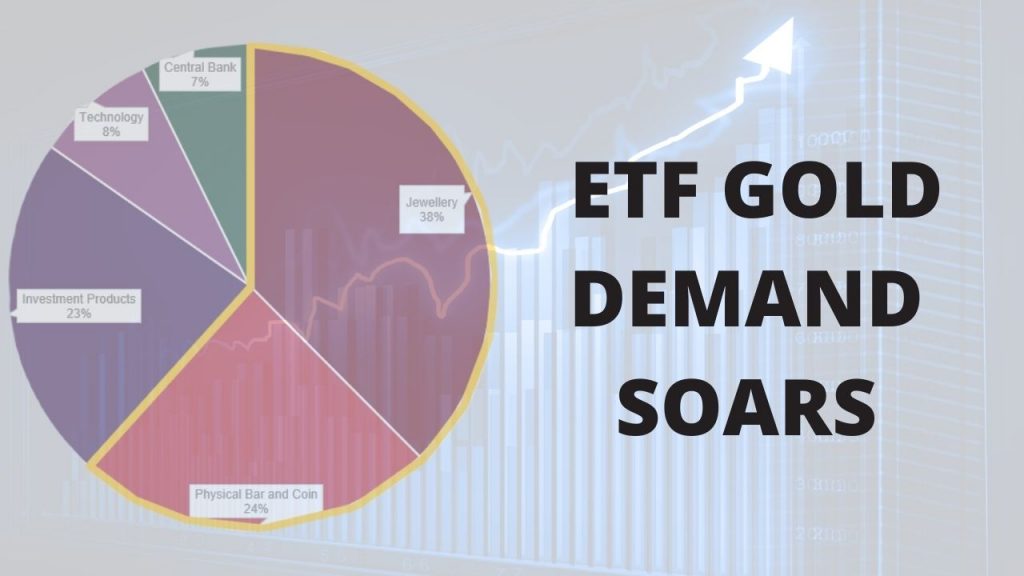

Earlier this year The World Gold Council’s John Reade, chief market strategist and head of research (and former managing partner at Paulson & Co.) spoke about the need for millennials to consider not only long-term investing and diversification but how gold played a key role.

“Millennials are an interesting case study; they are going to be working and investing a long time so you need to think about more than just the short term … Gold is a great diversifier for a portfolio but it is more than that. It is a source of returns that is commiserate with equities over the last 10, 20 years.”

Investing in gold is a commitment for the long-term. In order to enjoy long-term investing, participants must have both patience and an ability to tolerate periods of less-than-desireable performance.

It is vital millennials consider the performance of an asset over a long-period of time, as they are just starting to build their portfolios and need to prepare for the next 20, 30, 40 years or more.

The most prominent financial event in millennial’s memory is the collapse of Lehman brothers. Those who invested in gold before or soon after the financial crash have fared well.

Gold is the true reward of patient investing

Investing expert Warren Buffet famously stated that his preferred time to hold a stock is “forever.”

We know that equities are different to gold bullion but there is some transferable knowledge here.

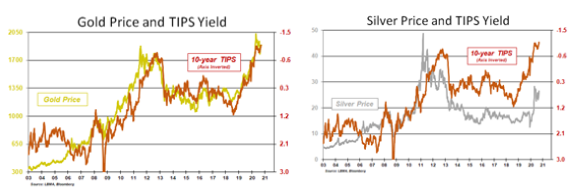

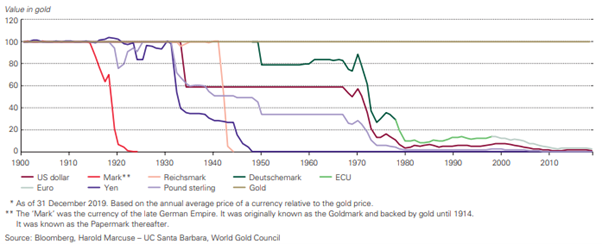

The precious metal has delivered solid returns on a long-term basis. Investors must not be put off by the weaker performance of the last four years. Instead they should ask what has driven the price over the last ten, twenty and forty years since the end of the Gold Standard.

Those long-term drivers have not suddenly disappeared. Currencies continue to be devalued, savers continue to earn very little on their savings and uncertainty is ever-growing in the political and economic worlds.

Gold is a proven hedge against instability and market turmoil. In recent years it has gained in popularity thanks to low interest rates and financial uncertainties.

In the long-term, holding on to gold has been shown to be quite lucrative for many investors. But the key is a long-term focus, patience and “sitting” …

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent,Warren Buffet