Tag Archive: newslettersent

US Storm-Skewed Report Means Nothing about Anything

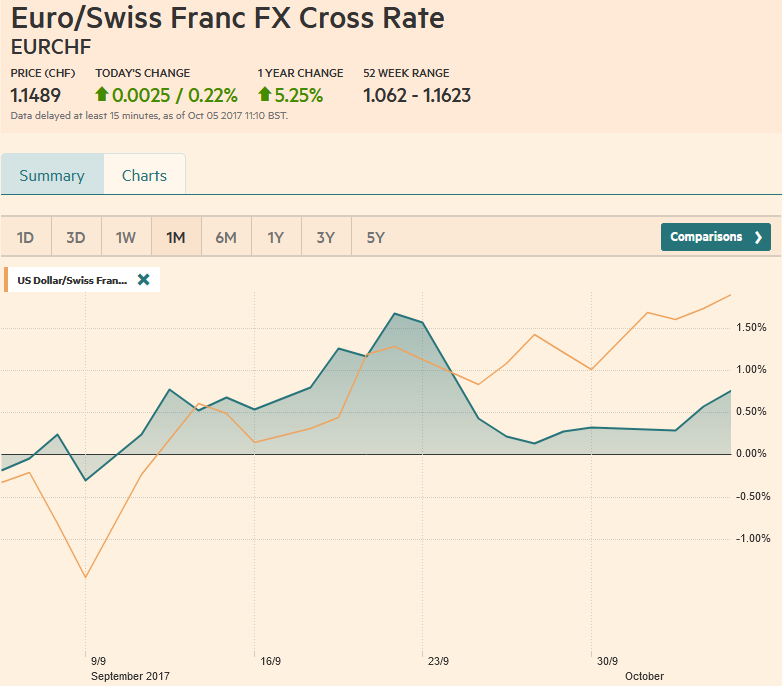

US interest rates and the dollar rose in response to the data. It was firm before the report. The US Dollar Index is up for a fourth consecutive week. It is the longest streak since Q1. US 10-year yields are near 2.40%, an area that has blocked stronger gains for nearly six months.

Read More »

Read More »

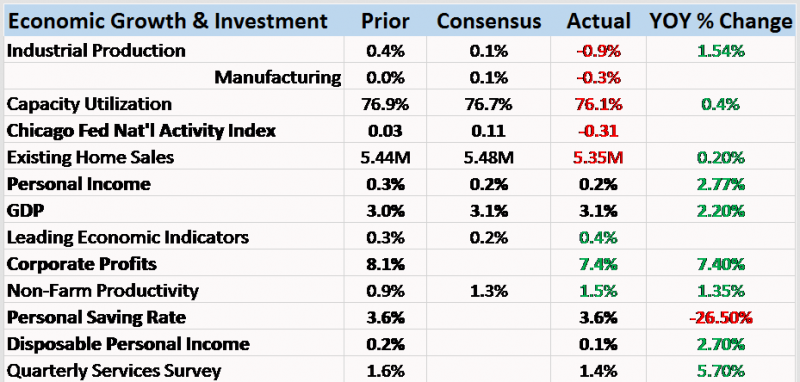

Bi-Weekly Economic Review: Maximum Optimism?

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady stream of all time highs, bond...

Read More »

Read More »

Swiss blue-chip CEOs dominate European wage ranking

The chief executive officers of Switzerland’s top firms take home almost double the median salaries of Europe’s 100 biggest companies, according to a study by consultants Willis Towers Watson.The Eurotop 100 study, presented on Thursday, studied the direct remuneration – not including pension or bonuses – of the CEOs of the 100 most highly capitalised blue-chip companies in Europe.

Read More »

Read More »

Yahoo Hacking Highlights Cyber Risk and Increasing Importance of Physical Gold

Yahoo admits every single one of 3 billion accounts hacked in 2013 data theft. Equifax hacking and security breach exposes half of the U.S. population. Some 143 million people vulnerable to identity theft. Deloitte hack compromised sensitive emails and client data. JP Morgan hacked and New York Fed hacked and robbed. International hacking group steals $300 million. Global digital banking and financial system not secure

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space as measured by MSCI, China (+4.1%), South Africa (+3.2%), and Hungary (+2.4%) have outperformed this week, while Egypt (-2.8%), Qatar (-2.7%), and Mexico (-1.7%) have underperformed. To put this in better context, MSCI EM rose 1.9% this week while MSCI DM rose 0.6%.

Read More »

Read More »

FX Daily, October 6: Look Through the US Jobs Report

Traders are putting the final touches on another strong weekly performance for the US dollar. Strong economic data, including the PMIs, auto sales, and factory orders have surprised to the market. The ADP report warns that the storms that flattered some high frequency data will likely skew today's employment report (both headline and details) to the downside. Of course, investors will quickly look for the number of people who could get to work due...

Read More »

Read More »

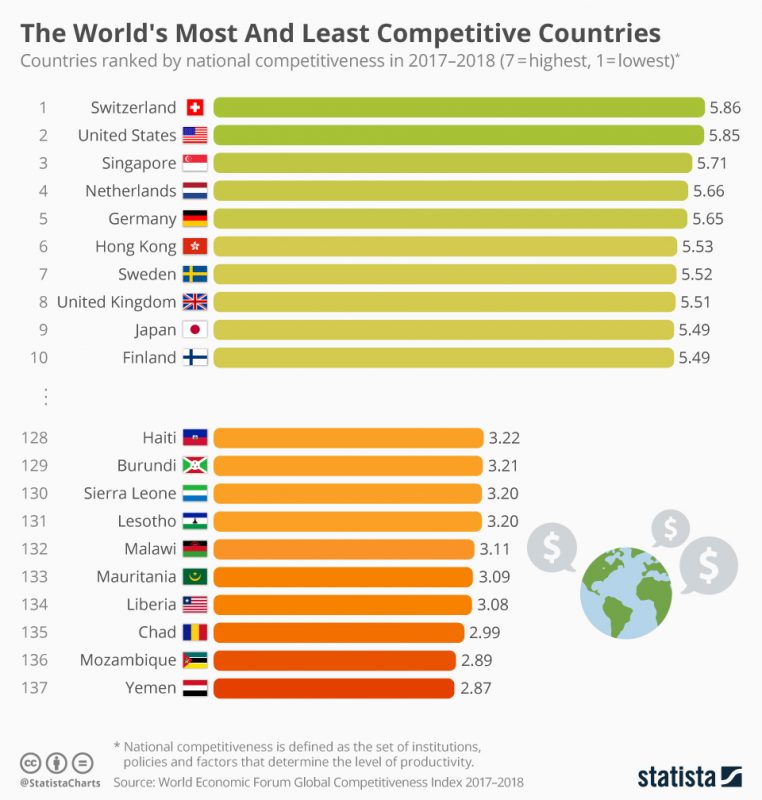

Switzerland Tops World’s Most Competitive Countries Index (Yemen Least)

Something else 'Murica is no longer #1 in... A recently released World Economic Forum report has found that the global economy is recovering well nearly a decade on from the start of the global financial crisis with GDP growth hitting 3.5 percent in 2017. The eurozone in particular is regaining traction with 1.9 percent growth expected this year. As Statista's Niall McCarthy points out, the improvement in Europe's economic fortunes can be seen in...

Read More »

Read More »

Surprise! The Rules Will Change (But Not to Your Benefit)

These expedient fixes end up crippling the mechanisms that are needed to actually solve the systemic sources of the crisis. We can add a third certainty to the two standard ones (death and taxes): The rules will suddenly change when a financial crisis strikes. Why is this a certainty? The answer is complex, as it draws on human nature, politics and the structure of societies/economies ruled by centralized states (governments).

The Core Imperative...

Read More »

Read More »

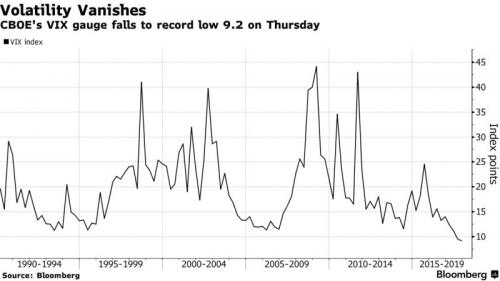

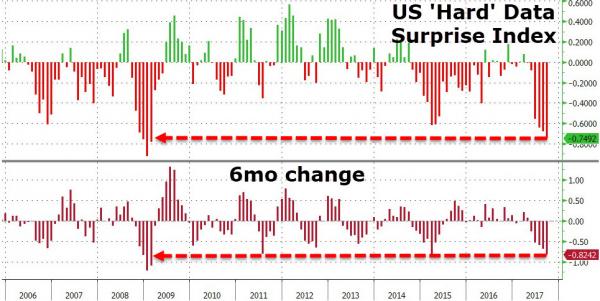

Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown - the 4th-longest streak since 1928... So everything is awesome...BUT...US 'hard' economic data has not been this weak (and seen the biggest drop) since Feb 2009...Q3 Was a Roller-Coaster...Q3 was the 8th straight quarterly gain in a row for The Dow - the longest streak since Q3 1997.

Read More »

Read More »

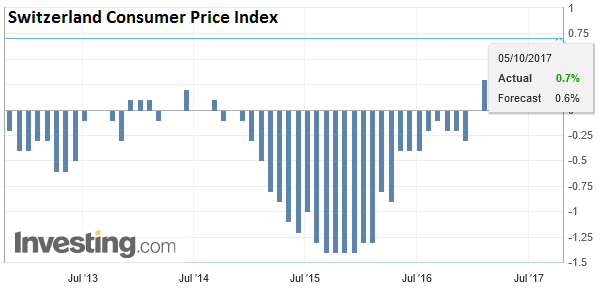

Swiss Consumer Price Index in September 2017: Up +0.7 percent against 2016, +0.2 percent against last month

The consumer price index (IPC) increased by 0.2% in September 2017 compared with the previous month, reaching 100.9 points (December 2015=100).

Read More »

Read More »

FX Daily, October 05: Sterling and Aussie Weakness Featured in the Otherwise Becalmed FX Market

The US dollar is mostly little changed as the broad consolidation that has emerged this week continues. The two powerful forces that have emerged--expectation of a Fed hike at the end of the year and European political challenges--appear to have reached a tentative equilibrium.

Read More »

Read More »

Critical Swiss-German rail route back to normal

Commuters using a busy stretch of railway between the Swiss city of Basel and Karlsruhe in Germany will be relieved to learn that services will return to normal on Monday following long-running repairs to a German tunnel.

Read More »

Read More »

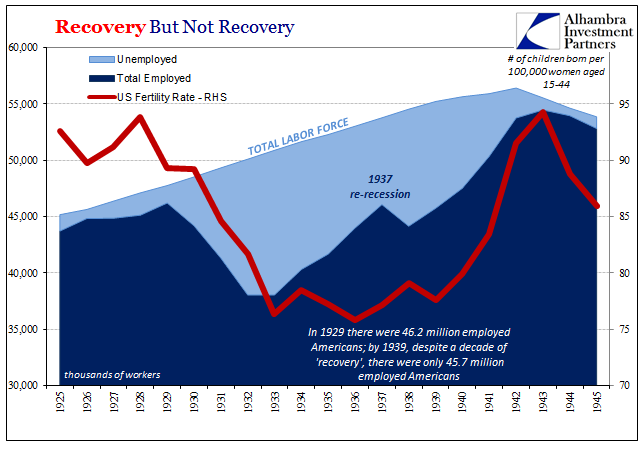

US: Reflation Check

There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply.

Read More »

Read More »

FX Daily, October 04: Consolidative Tone in FX Continues

The US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager's call that Minneapolis Fed President, and among the most dovish members of the FOMC, Kashkari would be the next Fed chair.

Read More »

Read More »

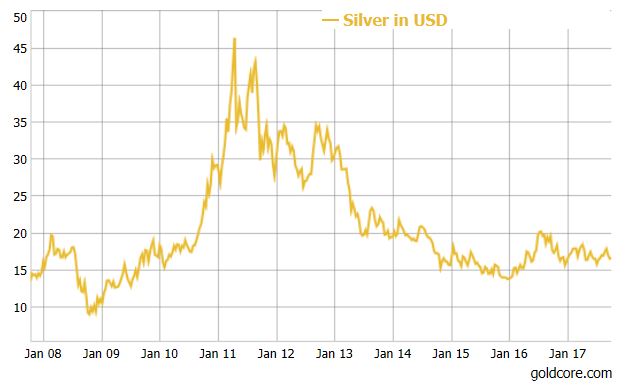

Safe Haven Silver To Outperform Gold In Q4 And In 2018

Safe haven silver to outperform gold in Q4 and 2018. “Expect silver to eventually outperform gold” say Metals Focus. 2017 YTD, silver has underperformed gold, climbing by 5% versus 11%. Silver undervalued versus gold and especially stocks, bonds and many property markets. Will follow gold’s reactions to macroeconomic & geopolitical factors and should outperform gold. Special report on India shows it accounts for just 16% of global silver demand....

Read More »

Read More »

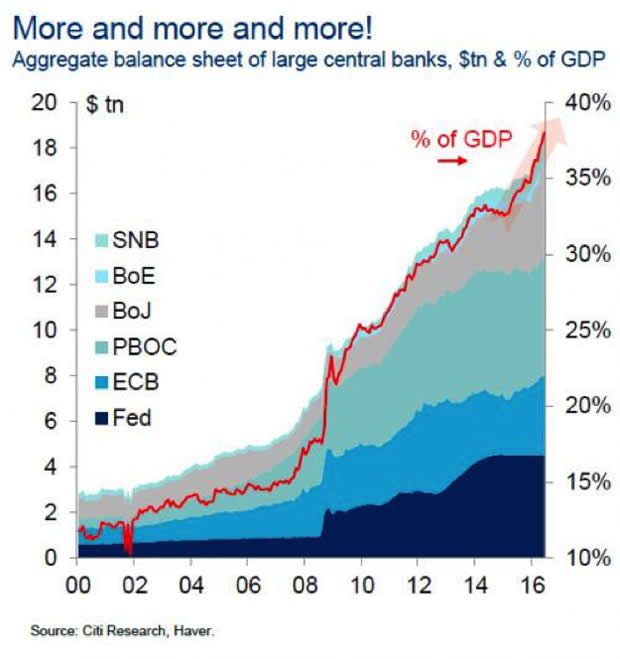

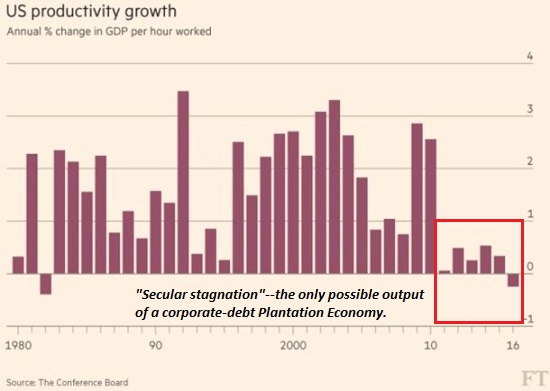

Stagnation Is Not Just the New Normal–It’s Official Policy

Japan is a global leader is how to gracefully manage stagnation. Although our leadership is too polite to say it out loud, they've embraced stagnation as the new quasi-official policy. The reason is tragi-comically obvious: any real reform would threaten the income streams gushing into untouchably powerful self-serving elites and fiefdoms.

Read More »

Read More »