Tag Archive: newslettersent

Uber to stop offering budget service in Basel

The ride-sharing firm Uber has announced it will abandon its UberPop service in the city of Basel from June 1, 2018, as it is not profitable enough. UberPop has already been discontinued in Zurich and Lausanne. According to the company, the decision was taken due to feedback from its partners, who wanted to earn more money through the more expensive UberX service. Economic success was not possible through its cheapest service UberPop, the company...

Read More »

Read More »

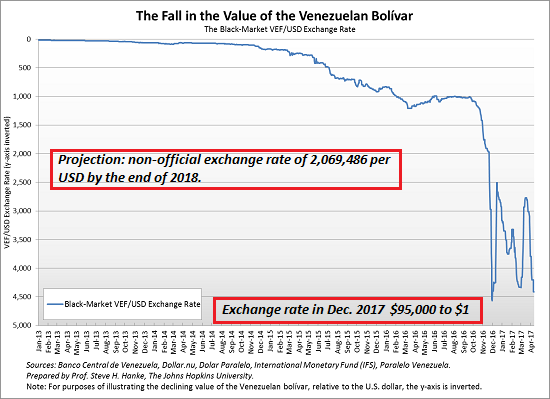

Bitcoin vs Fiat Currency: Which Fails First?

What if bitcoin is a reflection of trust in the future value of fiat currencies? I am struck by the mainstream confidence that bitcoin is a fraud/fad that will soon collapse, while central bank fiat currencies are presumed to be rock-solid and without risk. Those with supreme confidence in fiat currencies might want to look at a chart of Venezuela's fiat currency, which has declined from 10 to the US dollar in 2012 to 5,000 to the USD earlier this...

Read More »

Read More »

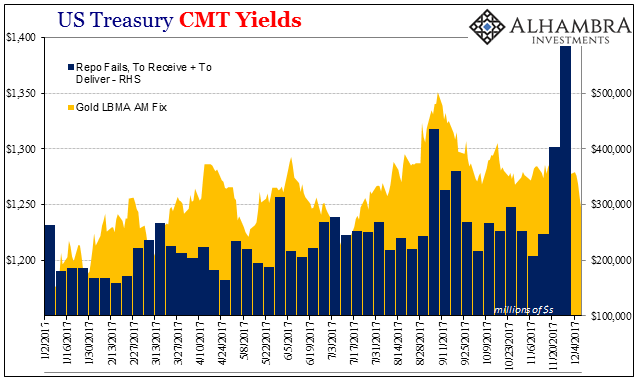

Chart of the Week: Collateral

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week.

Read More »

Read More »

China Exports and Industrial Production: Revisiting Once More The True Worst Case

As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s negative it’s bad (though in 2015...

Read More »

Read More »

The Stock Market and the FOMC

As the final FOMC announcement of the year approaches, we want to briefly return to the topic of how the meeting tends to affect the stock market from a statistical perspective. As long time readers may recall, the typical performance of the stock market in the trading days immediately ahead of FOMC announcements was quite remarkable in recent decades. We are referring to the Seaonax event study of the average (or seasonal) performance across a...

Read More »

Read More »

Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm.

Read More »

Read More »

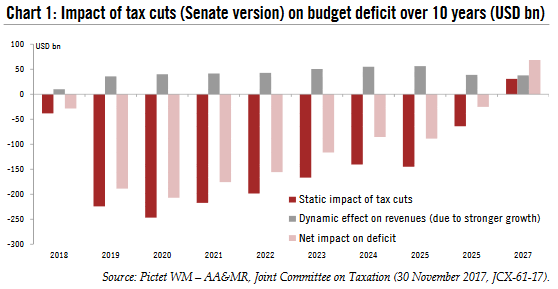

A crucial step towards US tax cuts

With the approval of the Senate tax bill in the early hours of Saturday 2 December, a key step has been taken toward tax cuts. The next chapter in the process is to reconcile this version with the House of Representatives’ tax bill, most likely in a ‘conference committee ’ from which a final version will emerge.

Read More »

Read More »

FX Daily, December 15: Premium for Dollar-Funding is not Helping Greenback Very Much

The cross-currency basis swap continues to lurch in the dollar's direction, especially against the euro, and yet the dollar is not drawing much support from it. The increasing cost reflects pressure for the year-end and does not appear to reflect systemic issues. Dollar auction by the ECB and BOJ do not show any strain. The dollar has a downside bias today against most of the major currencies. And is what is true of the day is true for the week....

Read More »

Read More »

Swiss food imports are growing faster than the population

A government study shows that imports of food products have grown by 80% — three times faster than the Swiss population — between 1990 and 2016. In that time, the quantity of imported food consumed per inhabitant went from 344 kilograms to 490 kg.

Read More »

Read More »

Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price. FOMC follows through on much anticipated rate-hike of 0.25%. Spot gold responds by heading for biggest gain in three weeks, rising by over 1%. Final meeting for Federal Reserve Chair Janet Yellen. Yellen does not expect Trump's tax-cut package to result in significant, strong growth for US economy. No concern for bitcoin which 'plays a very small role in the payment system'.

Read More »

Read More »

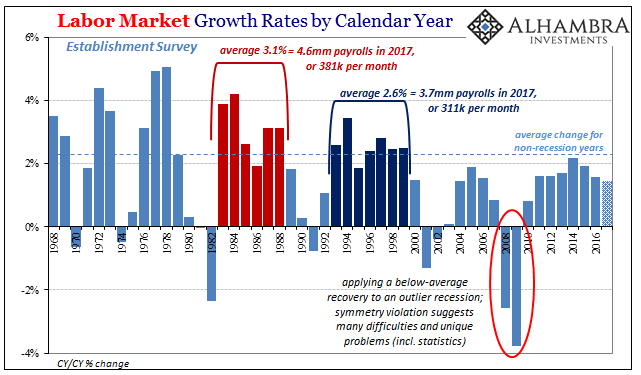

Defining The Economy Through Payrolls

The year 2000 was a transition year in a lot of ways. Though Y2K amounted to mild mass hysteria, people did have to get used to writing the date with 20 in front of the year rather than 19. It was a new millennium (depending on your view of Year 0) that seemed to have started off under the best possible terms. Not only were stocks on fire at the outset, the economy was, too.

Read More »

Read More »

News conference Swiss National Bank, Thomas Jordan

It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will then hand over to Fritz Zurbrügg, who will speak about current developments in the area of financial stability. After that, Andréa Maechler will review the situation on the financial markets and the progress in reference interest rate reform. Finally, we...

Read More »

Read More »

SNB Monetary Assessment Dec 2017, Introduction

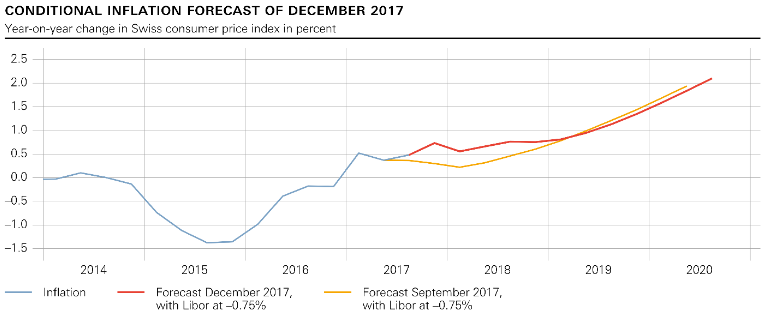

The monetary policy pursued by the large central banks was once again the focus of attention for the financial markets in the second half of the year. Given moderate inflation growth, financial market participants are expecting only a very gradual normalisation of monetary policy across the world. Against this backdrop, government bond yields have remained persistently low. Muted expectations regarding a move away from expansionary monetary policy,...

Read More »

Read More »

News conference Swiss National Bank 2017, Fritz Zurbrügg

In my remarks today, I would like to address some of the developments currently taking place in the field of financial stability. I shall look at the big banks first before turning to the domestically focused banks. I will conclude with a few words on the new banknote series.

Read More »

Read More »

SNB Monetary policy assessment of 14 December 2017

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

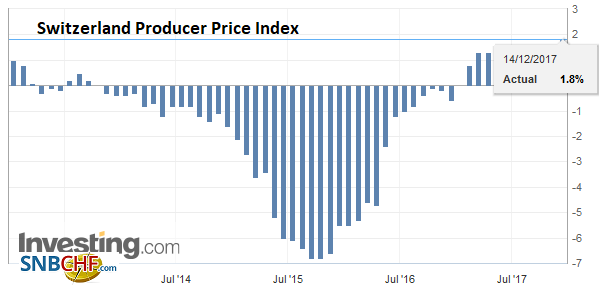

Swiss Producer and Import Price Index in November 2017: +1.8 YoY, +0.6 MoM

The Producer and Import Price Index rose in November 2017 by 0.6% compared with the previous month, reaching 101.6 points (base December 2015 = 100). The rise is due in particular to higher prices for petroleum products, chemical and pharmaceutical products and scrap. Compared with November 2016, the price level of the whole range of domestic and imported products rose by 1.8%.

Read More »

Read More »

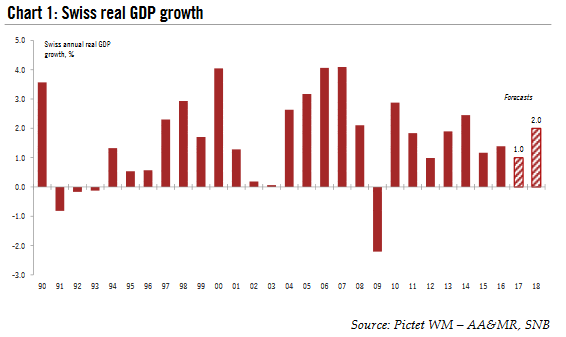

The Swiss economy is gaining momentum

Swiss growth was disappointing at the end of 2016 and in the first half of 2017. Consequently, GDP growth this year is likely to be just 1.0% , its lowest level since 2012 . However, a wide set of statistics are already painting a considerably more positive picture of strengthening growth as we approach the end of 2017. Of particular note is the increasing contribution of manufacturing to real GDP growth.

Read More »

Read More »

FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve.

Read More »

Read More »

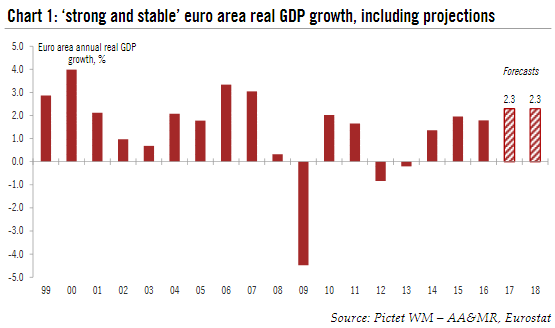

Euro Area Forecast to Grow 2.3percent in 2018

2017 was the year of the ‘Euroboom’ and the removal of political tail risks. Moving into 2018, we mark-to-market strong economic data, including carryover and revisions. We forecast annual GDP growth of 2.3% both in 2017 and 2018. Qualitatively, our forecasts reflect our view that the euro area has reached ‘escape velocity’, with important implications for investors.

Read More »

Read More »

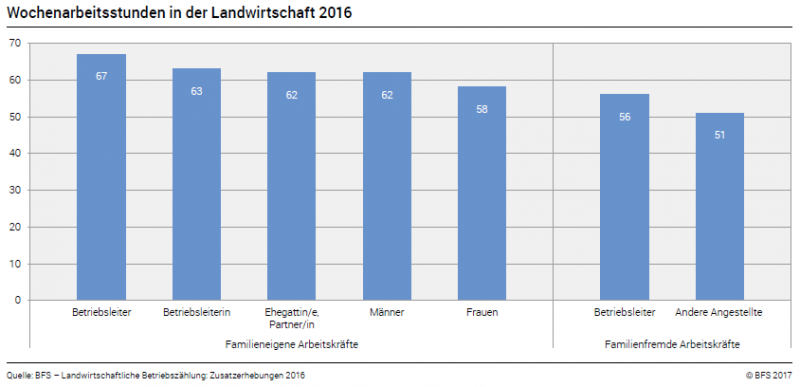

Farm Census 2016: Swiss farmers work well over 60 hours per week

For several years the average Swiss farmer has been working well over 60 hours per week. With their off-farm jobs, part-time farmers also work long hours. From 2010 to 2016, however, the hours worked fell by one hour per week. Over the same period, farms greatly increased the direct sale of farm products (+60%). Despite the long working hours, in many cases it is very likely that a family member will take over the farm. These are some of the latest...

Read More »

Read More »