Tag Archive: newslettersent

Yes, But at What Cost?

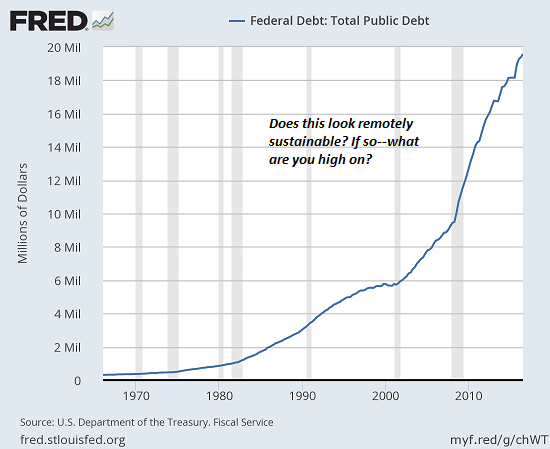

This is how our entire status quo maintains the illusion of normalcy: by avoiding a full accounting of the costs. The economy's going great--but at what cost? "Normalcy" has been restored, but at what cost? Profits are soaring, but at what cost? Our pain is being reduced--but at what cost? The status quo delights in celebrating gains, but the costs required to generate those gains are ignored for one simple reason: the costs exceed the gains by a...

Read More »

Read More »

UBS-Präsident Axel Weber wird sein blaues Wunder erleben – mit der Zahlungsunfähigkeit der SNB

Axel Weber hat zwei Seelen in seiner Brust: eine als Ex-Notenbanker, eine als UBS-Präsident. Als Präsident der Deutschen Bundesbank hatte der Deutsche Weber gesagt, es gäbe keine Einlösungsverpflichtung der Deutschen Bundesbank für eine Banknote. „Wirtschaftlich gesehen sind unsere Banknoten eine Verbindlichkeit des Eurosystems.

Read More »

Read More »

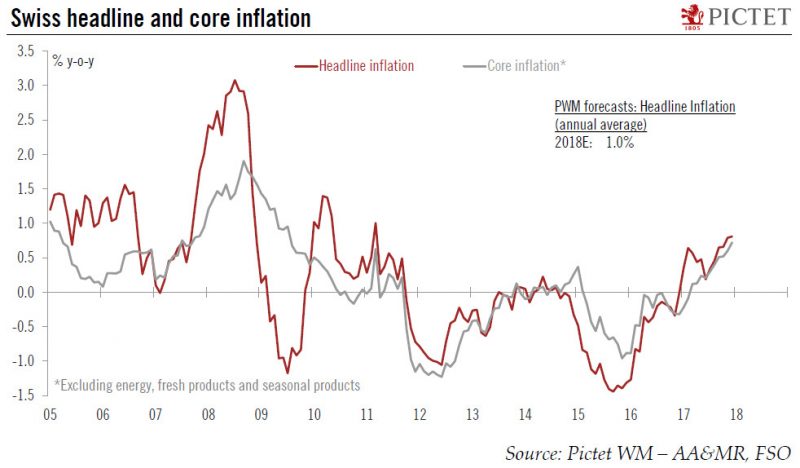

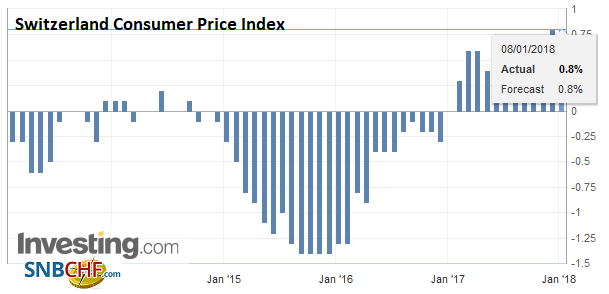

Switzerland: Inflation at a seven-year high

According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% y-o-y in December, in line with consensus expectations, meaning that Swiss inflation stayed at its highest rate in almost seven years at the end of 2017.

Read More »

Read More »

FX Daily, January 10: Yen Short Squeeze Extended

Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00. It fell to about JPY112.35 yesterday, near the 50% retracement of the greenback's bounce from the late-November lows near JPY110.85.

Read More »

Read More »

Trade Unions Call for Fewer Hours, More Gender Equality

The Swiss Trade Union Federation is demanding shorter work weeks, compensation for pension losses and enforcement of equal pay for men and women. At its annual media conference in Bern on Thursday, the Swiss Trade Union Federationexternal link pointed out that employees have been suffering since the financial crisis.

Read More »

Read More »

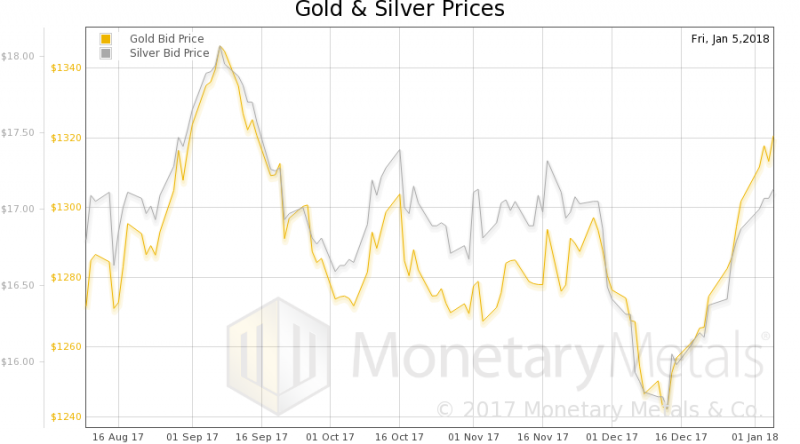

10 Reasons Why You Should Add To Your Gold Holdings

10 Reasons Why You Should Add To Your Gold Holdings. Gold currently undervalued. Since 2000, the gold price has beaten the S&P 500 Index. A ‘a once-in-a-decade opportunity’ as gold-to-S&P 500 ratio is at its lowest point in 10 years. Reached ‘peak gold’ as exploration budgets continue to tighten. $80 trillion sits in global equities, a ‘ticking time bomb’. Gold remains an appealing diversifier in the current environment of high valuations and...

Read More »

Read More »

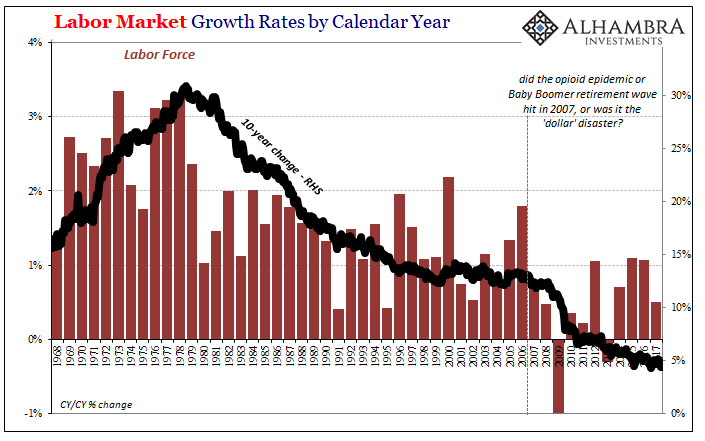

The Reluctant Labor Force Is Reluctant For A Reason (and it’s not booming growth)

In 2017, the BLS estimates that just 861k Americans were added to the official labor force, the denominator, of course, for the unemployment rate. That’s out of an increase of 1.4 million in the Civilian Non-Institutional Population, the overall prospective pool of workers. Both of those rises were about half the rate experienced in 2016.

Read More »

Read More »

Swiss National Bank expects annual profit of CHF 54 billion

According to provisional calculations, the Swiss National Bank (SNB) will report a profit in the order of CHF 54 billion for the 2017 financial year. The profit on foreign currency positions amounted to CHF 49 billion. A valuation gain of CHF 3 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to CHF 2 billion.

Read More »

Read More »

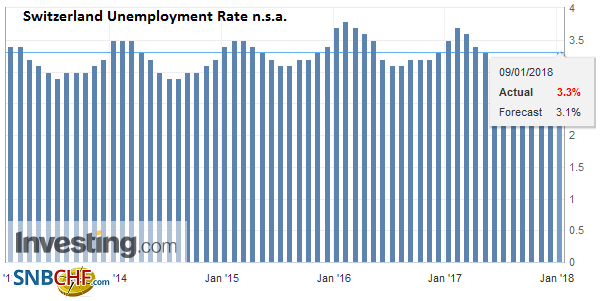

Switzerland Unemployment in December 2017: Up to 3.3 percent due to winter, seasonally adjusted unchanged at 3.0 percent

Registered unemployment in December 2017 - According to the State Secretariat for Economic Affairs (SECO) surveys, 146,654 unemployed people were enrolled at the Regional Employment Centers (RAV) at the end of December 2017, 9,337 more than in the previous month. The unemployment rate rose from 3.1% in November 2017 to 3.3% in the month under review. Compared to the same month of the previous year, unemployment fell by 12,718 (-8.0%).

Read More »

Read More »

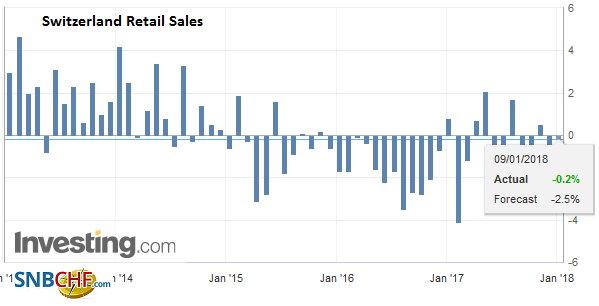

Swiss Retail Sales, November: +0.2 Percent Nominal and -0.2 Percent Real

Turnover in the retail sector rose by 0.2% in nominal terms in November 2017 compared with the previous year. Seasonally adjusted, nominal turnover rose by 1.4% compared with the previous month. These are the provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, January 09: Dollar Correction Extended

The US dollar's upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen's modest gains have been registered despite the firmness in US rates and continued advance in equities; both factors associated with a weaker Japanese currency.

Read More »

Read More »

Swiss Retailers Suffered Lacklustre Sales growth in 2017

Switzerland’s retail sector failed to profit from a weaker franc and improving economy last year and business remains sluggish, according to a Credit Suisse report. Retail sales increased by 0.1% in 2017 after two years’ decline, Credit Suisse noted in its annual industry surveyexternal link published on Tuesday.

Read More »

Read More »

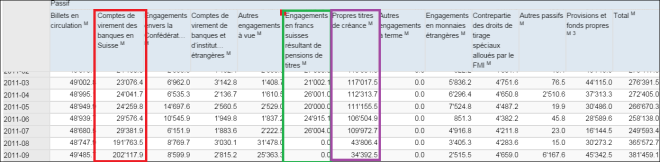

L’endettement des banques centrales est une réalité! Exemple de la BNS

Avant-propos: Le texte de la conférence de M Jordan de 2011 semble ne plus être disponible sur le net. Du coup, nous le publions ici malgré le Copyright. Ce genre de documents doit être connu du grand public, puisqu’il est le garant de cette institution privée (société anonyme cotée en bourse, soumise à une loi fédérale. L’actionnariat est réparti ainsi: https://www.snb.ch/fr/iabout/snb/org/id/snb_org_stock ), qu’est la BNS.

Read More »

Read More »

Swiss Consumer Price Index in December 2017: +0.8 YoY, unchanged MoM

The consumer price index (CPI) remained unchanged in December 2017 compared with the previous month, reaching 100.8 points (December 2015=100). Inflation was 0.8% compared with the same month of the previous year. Average annual inflation reached 0.5% in 2017. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, January 08: Dollar Posts Modest Upticks to Start the New Week

The US dollar is enjoying modest but broad-based gains after trading firmly at the end of last week despite the slightly disappointing jobs report. The dollar's upticks are understood to be corrective in nature. The Canadian dollar appears to be protected by the increased prospects of a rate hike next week after its stellar employment report.

Read More »

Read More »

FX Weekly Preview: Accommodative Officials and Synchronized Upturn Drive Markets

The investment climate is being shaped by two powerful forces. First is the very accommodative policy stance. This includes the United States, where despite delivering the fifth rate hike in the cycle, adjusted by headline CPI, remains negative. The balance sheet has begun being reduced, financial conditions in the US are easier now than a year ago.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks.

Read More »

Read More »

Italian Election–Two Months and Counting

Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority governments. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press the Visegrad group of central European countries to conform to the values of Western European members.

Read More »

Read More »

Palladium Prices Surge To New Record High Over $1,100 On Supply Crunch Concerns

Palladium prices surge to new record high over $1,100/oz today. Palladium surges past record nominal price seen in 2001 after 55% surge in 2017. Best-performing precious metal and commodity of 2017 is palladium. Palladium prices top platinum prices for first time in 16 years. Strong Chinese car demand and switch from diesel to petrol cars sees demand surge. Supply crunch as six year supply deficit & 2017 deficit expected to hit 83,000 ounces

Read More »

Read More »