Tag Archive: newslettersent

Great Graphic: Progress

The world looks like a mess. While the economy appears to be doing better, disparity of wealth and income has grown. Debt levels are rising. Protectionism appears on the rise. Global flash points, like Korea, Middle East, Pakistan, Venezuela are unaddressed. At the same time, this Great Graphic tweeted by @DinaPomeranz, with a hat tip to @bill_easterly is a helpful corrective.

Read More »

Read More »

Digitalisation will reverse offshoring trends, says ABB head

Thanks to advances in robotics and digitalisation, the trend towards the offshoring of manufacturing jobs to cheaper countries is set to be reversed, according to the president of Zurich-based industry giant ABB group. In an interview published Sunday in the NZZ am Sonntag newspaper, Peter Voser said that digital progress is bringing manufacturing and markets closer together again.

Read More »

Read More »

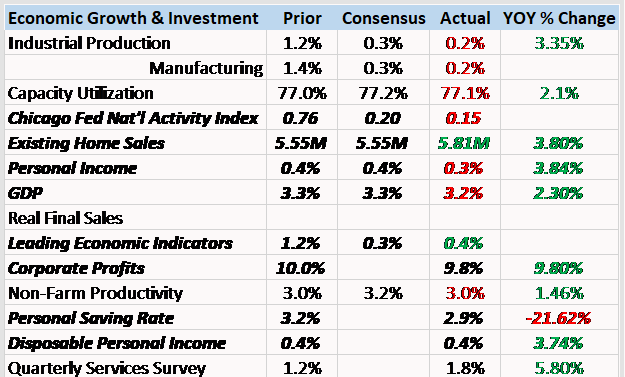

Bi-Weekly Economic Review: Housing Market Accelerates

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the economy.

Read More »

Read More »

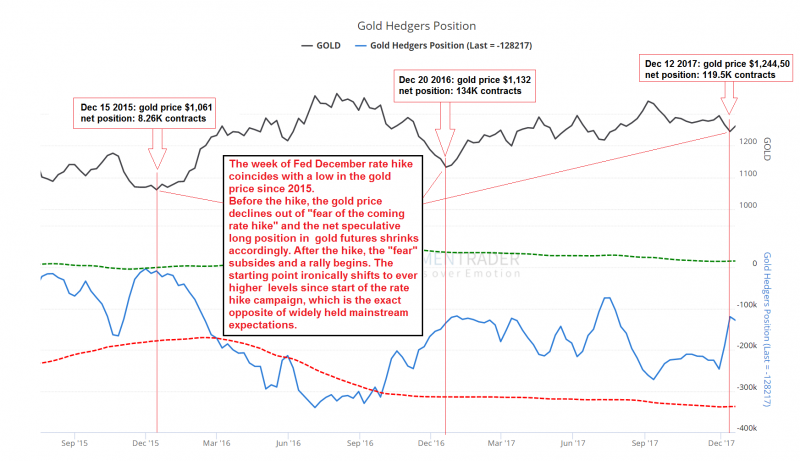

98,750,067,000,000 Reasons to Buy Gold in 2018

98,750,067,000,000 Reasons to Buy Gold in 2018. World equity index market capitalization touching distance of $100 trillion dollars at beginning of December. Key indicators across global financial markets are looking decidedly bubble-like. Little indication that we are through the worst of the financial crisis that started in 2007. Apparent lack of concern regarding the over-heated and overpriced markets.

Read More »

Read More »

FX Daily, January 2: Dollar Slump Accelerates

The US dollar's slump seen in the final two weeks of 2017 is carried into today's activity. The greenback's sell-off extends to the emerging market currencies as well. The Hungarian forint is the strongest rising nearly 1%, ostensibly helped by the euro approaching last year's high. However, our sense that fumes and momentum more than fresh news is pushing the dollar down is illustrated by the Korean won. It has gained nearly 0.9% today even though...

Read More »

Read More »

Swiss VAT rate to fall in 2018

The current rate of 8% is set to drop on 1 January 2018. Temporarily increased by 0.4% in 2011 to shore up funding for disability welfare, the rate will revert to 7.7%. The 0.1% difference between the new rate and pre 2011 rate of 7.6% is a new increase that will be used to help finance rail infrastructure.

Read More »

Read More »

Thousands of Swiss take VW to court in emissions scandal

Some 6,000 people in Switzerland have banded together to sue German car manufacturer Volkswagen and a Swiss car dealer for damages related to the exhaust scandal. The Consumer Protection Organisation (SKS)external link announced on Friday that it had filed a claim on behalf of about 6,000 car owners at the Zurich Commercial Court. The owners say they suffered financial losses because the vehicles’ exhaust systems had been manipulated.

Read More »

Read More »

Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future

Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future. Futurist guide to 2028 shows a world of uncertainty and disruption. One scenario suggests cybersecurity attacks will result in bitcoin and blockchain’s dominance of financial systems. Cybersecurity threat will still loom large and wreak havoc. Gold, silver and other real assets will benefit. Adoption of cryptocurrencies and blockchain will send gold price soaring....

Read More »

Read More »

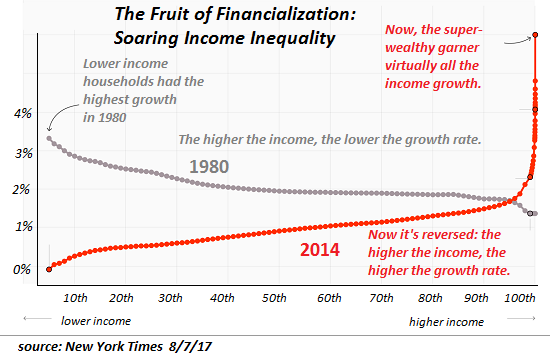

The Hidden-in-Plain-Sight Mechanism of the Super-Wealthy: Money-Laundering 2.0

Financial and political power are two sides of one coin. We all know the rich are getting richer, and the super-rich are getting super-richer. This reality is illustrated in the chart of income gains, the vast majority of which have flowed to the top .01%--not the top 1%, or the top .1% -- to the very tippy top of the wealth-power pyramid.

Read More »

Read More »

Why Monetary Policy Will Cancel Out Fiscal Policy

Good cheer has arrived at precisely the perfect moment. You can really see it. Record stock prices, stout economic growth, and a GOP tax reform bill to boot. Has there ever been a more flawless week leading up to Christmas?

Read More »

Read More »

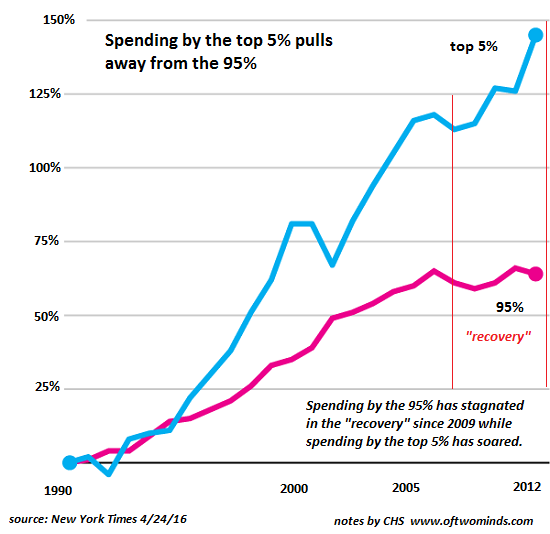

“Wealth Effect” = Widening Wealth Inequality

Note that widening wealth and income inequality is a non-partisan trend. One of the core goals of the Federal Reserve's monetary policies of the past 9 years is to generate the "wealth effect": by pushing the valuations of stocks and bonds higher, American households will feel wealthier, and hence be more willing to borrow and spend, even if they didn't actually reap any gains by selling stocks and bonds that gained value.

Read More »

Read More »

Nestle tops list as most valuable Swiss company

With a market value of $264 billion (CHF258 billion), Nestlé has claimed second place in Europe behind Royal Dutch Shell ($276 billion) in global rankings published by consultancy EY on Friday. However, that only put them in 17th and 18th place respectively, well below the global ranking leaders: the Silicon Valley tech giants Apple ($876 billion), Alphabet ($733 billion) and Microsoft ($661 billion).

Read More »

Read More »

Getting easier to get to Swiss business hubs

Swiss business hubs like Zurich are more globally accessible than they were a few years ago. According to the latest “accessibility index” from economic research institute BAK Economicsexternal link in Basel, Zurich has jumped in the rankings from 34 to 28. This is due to improved connections to business hubs in China, India and the United States, says BAK.

Read More »

Read More »

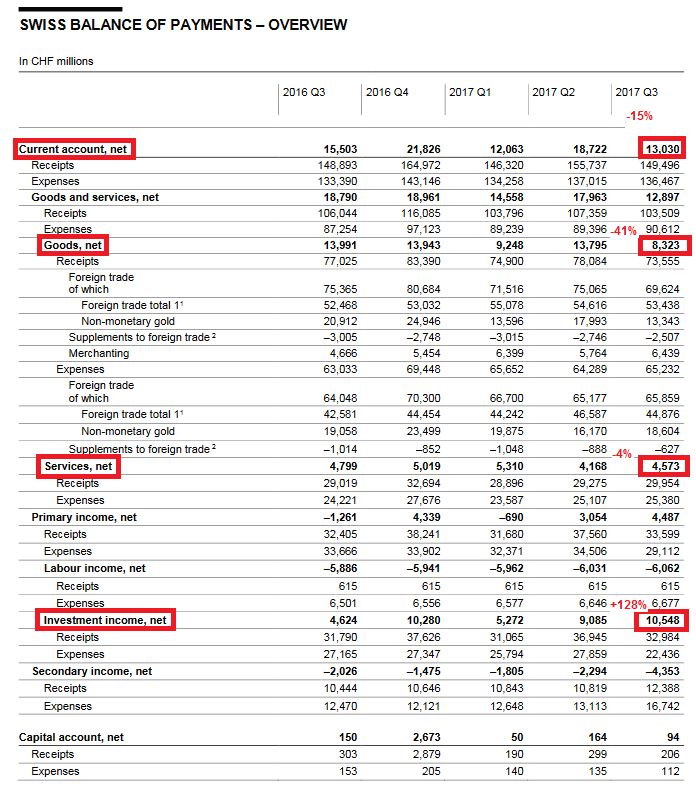

Q3/2017: Swiss Current Account Surplus significantly down

The Swiss current account surplus went down by 15% against the same quarter in 2016. In the third quarter of 2015. The current account surplus was still at 22 bn. CHF.

It seems to be a change in the usual movement that sees a higher Q3 surplus compared to the other quarters.

Read More »

Read More »

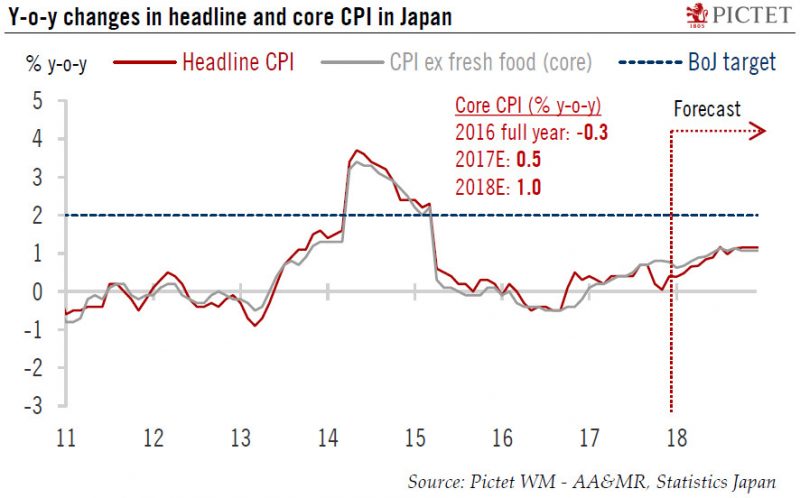

The BoJ is sticking to monetary easing

The BoJ remains the last major central bank still firmly committed to large-scale monetary easing.After its Monetary Policy Meeting of December 21, the Bank of Japan (BoJ) announced its intention to keep its current monetary easing programme intact. The BOJ will continue with its “Quantitative and Qualitative Monetary Easing with Yield Curve Control ”, aiming to achieve and overshoot the core inflation target of 2%.

Read More »

Read More »

St Moritz becomes first Swiss ski resort to accept Bitcoin

Ski lifts in and around St Moritz in the Engadine Valley have started accepting Bitcoins as payment for passes. According to Swiss public television, SRF, and the newspaper Südostschweiz, Engadin St Moritz is the first Swiss lift company to recognise payments with cryptocurrencies.

Read More »

Read More »

Die Magie des gesetzlichen Zahlungsmittels

Seit der Aufhebung der Golddeckung durch Präsident Nixon im Jahre 1971 sind die meisten Währungen der westlichen Welt reines Fiatgeld. Was heisst das? Zur Beantwortung der Frage beziehe ich mich ganz bewusst – wie übrigens soweit möglich im ganzen Text – auf keine Lehrbücher oder anderes universitäres Material. In Wikipedia (Stand 3.9.2017) steht:

Read More »

Read More »

Petro-Yuan? Really?

The launch of futures on Bitcoins was rushed so quickly through the regulatory channels that the anticipation was short-lived. And as the recent price action amply demonstrates, the existence of a derivative market has not tamed the digital token's volatility. It is still the early days, but Bitcoin futures do not look likely to change the world.

Read More »

Read More »

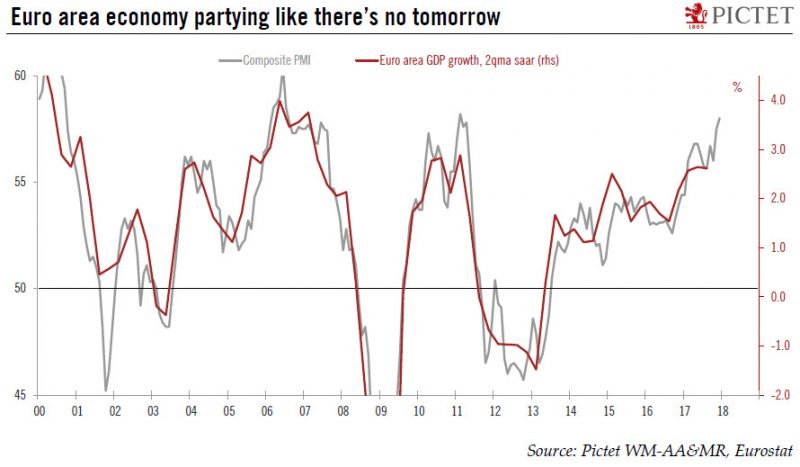

Global macro: 10 surprises for 2018

Having laid down our expectations for the World economy in 2018, in this note we describe a number of potential surprises to the outlook. The usual suspects, or ‘known unknowns’, include a larger-than-expected fiscal boost from US tax cuts, (geo-)political risks, economic policy mistakes, inflation surprises, a financial bubble burst, or a Minsky moment in China, to name a few.

Read More »

Read More »