Tag Archive: newslettersent

If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange.

Read More »

Read More »

The Great Risk of So Many Dinosaurs

The Treasury Borrowing Advisory Committee (TBAC) was established a long time ago in the maelstrom of World War II budgetary as well as wartime conflagration. That made sense. To fight all over the world, the government required creative help in figuring out how to sell an amount of bonds it hadn’t needed (in proportional terms) since the Civil War. A twenty-person committee made up of money dealer bank professionals and leaders was one of the few...

Read More »

Read More »

It’s A Wonderful Life Is A Wonderful Lesson To Hold Gold Outside of The Banking System

Christmas film serves as reminder that savings are not guaranteed protection by banks. Savers are today more exposed to banking risks than ever before. Gold and silver investment reduce exposure to counterparty risks seen in financial system. Basket of Christmas goods has climbed since 2016 thanks to 11% climb in gold price.

Read More »

Read More »

Swiss court stops handover of bank employee details to US

Switzerland’s highest court has ruled against the transfer of details of third parties such as bank employees or solicitors in cases of information handovers involving tax dodgers. Wednesday’s ruling by the Federal Court upheld an earlier decision in a case brought by a US expat in Switzerland who disputed the transfer of details gleaned from his bank by the Swiss Federal Tax Administration (FTA).

Read More »

Read More »

Emerging Markets: What Changed

Tensions on the Korean peninsula appear to be easing. Relations between Pakistan and the US have worsened. The Philippine central bank is tilting more hawkish. The ANC may consider removing Zuma from the presidency at the January 10 meeting of its National Executive Committee. Turkish banker Atilla was convicted of helping Iran evade US financial sanctions.

Read More »

Read More »

Why the Financial System Will Break: You Can’t “Normalize” Markets that Depend on Extreme Monetary Stimulus

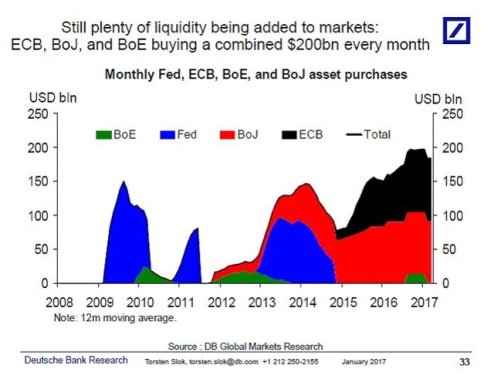

Central banks are now trapped. In a nutshell, central banks are promising to "normalize" their monetary policy extremes in 2018. Nice, but there's a problem: you can't "normalize" markets that are now entirely dependent on extremes of monetary stimulus. Attempts to "normalize" will break the markets and the financial system. Let's start with the core dynamic of the global economy and nosebleed-valuation markets: credit.

Read More »

Read More »

FX Daily, January 05: Dollar Given Reprieve Ahead of Employment Report

As the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to have helped the dollar to move off the mat. Quickly summarized, these considerations are a larger than expected Australian trade deficit, slippage in Japan's service sector PMI, a larger than expected drop in the...

Read More »

Read More »

Headline US Jobs Disappoint, but Earnings as Expected

The headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story.

Read More »

Read More »

Fintech and fake cannabis drive record number of Swiss start-ups

The year 2017 saw a record number of businesses created in Switzerland, many of them centred in the booming ‘crypto valley’ region, according to online platform startups.ch. Some 43,416 businesses were created, said the information and advisory websiteexternal link, an increase of 5% on 2016 and an absolute record in Switzerland.

Read More »

Read More »

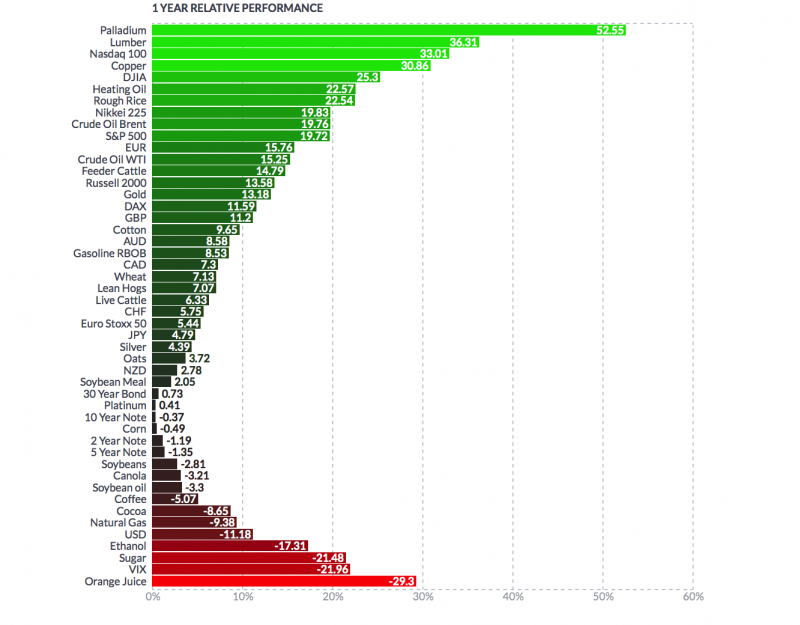

Gold Has Best Year Since 2010 With Near 14percent Gain In 2017

Gold Has Best Year Since 2010 With Near 14% Gain In 2017. Gold posted second straight annual gain in USD in 2017. Gold in 2017: up 13.6% USD, up 2.7% GBP, down 1.4% EUR. 2017 is gold’s best year since 29.5% gain in 2010. Strong performance despite rate hikes and stock bubble. India’s gold imports surged 67% in 2017, Turkish, Chinese demand strong. Gold finished 2017 with longest rally since June 2016. 2018: Currency War and The Year of the...

Read More »

Read More »

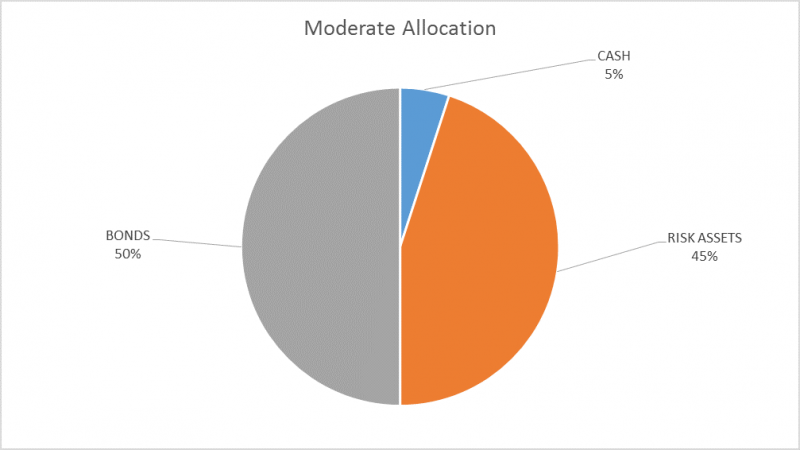

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged.

Read More »

Read More »

FX Daily, January 04: Greenback Continues to Consolidate Recent Losses

The US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened late last year and is bound to carry over into the New Year.

Read More »

Read More »

Cool Video: Is the Third Major Dollar Rally Since Bretton Woods Over?

To many, the question about the fate of the third major dollar rally since the end of Bretton Woods was resolved last year. The dollar fell broadly. It marked the end the greenback's ride higher. However, I remain less convinced that this is really the case. And that is what I discuss in this three-minute clip from Bloomberg's What'd You Miss.

Read More »

Read More »

Swiss executives predict strong economic year in 2018

Eight out of ten Swiss business executives anticipate a positive economic outlook for the country in 2018, according to an annual survey carried out by the SonntagsZeitung newspaper. Is it a sign that moods are changing after a 2017 that many would describe as turbulent? Or rather another indication of the Swiss exception, the country having largely escaped much of the economic and political turmoil that marked the past decade?

Read More »

Read More »

Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift

Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift. Two years since bail-in rules officially entered EU regulations. EU bail-in rules have wiped out billions for savers and and businesses, with more at risk. Future of many failing banks now rests on depositors who may no longer be protected by deposit insurance.

Read More »

Read More »

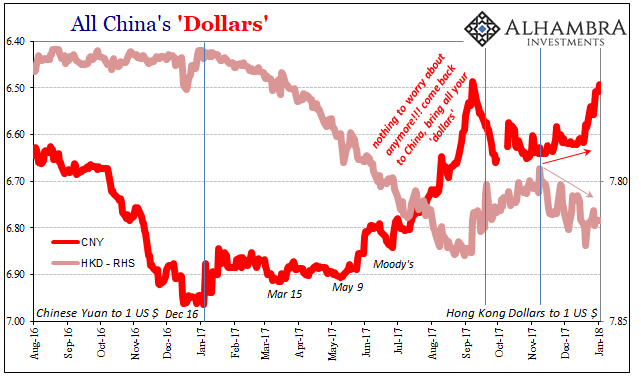

Industrial production: The Chinese Appear To Be Rushed

While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously restrained during that...

Read More »

Read More »

Several Simple Suppositions and Suspicions for 2018

The New Year is nearly here. The slate’s been wiped clean. New hopes, new dreams, and new fantasies, are all within reach. Today is the day to make a double-fisted grab for them. Without question, 2018 will be the year in which everything happens exactly as it should. Some things you will be able to control, others will be well beyond your control.

Read More »

Read More »

FX Daily, January 03: Dollar Stabilizes, but Sees Little Recovery

The US dollar is stabilizing but the tone remains fragile. The euro, which has advanced for five consecutive sessions coming into today is slightly lower. The euro had stalled yesterday as it approached last year's high set in September near $1.2090. Yesterday was also the third consecutive close above the upper Bollinger Band, which is found today near $1.2060.

Read More »

Read More »

The Past is Not Passed: 2017 Spills into 2018

The New Year may have begun in fact, but in practice, full participation may return only after the release of US employment data on January 5. The macroeconomic and policy tables have been set, though interpolating from the Overnight Index Swaps market, there is 45% chance the Bank of Canada hikes rates at its policy meeting near the middle of the month.

Read More »

Read More »