The Treasury Borrowing Advisory Committee (TBAC) was established a long time ago in the maelstrom of World War II budgetary as well as wartime conflagration. That made sense. To fight all over the world, the government required creative help in figuring out how to sell an amount of bonds it hadn’t needed (in proportional terms) since the Civil War. A twenty-person committee made up of money dealer bank professionals and leaders was one of the few no-brainers of that day.

Outside of that, over the intervening decades, the TBAC has faded into obscurity. That doesn’t mean it doesn’t do anything, just what it has done hasn’t reached the level of public consciousness. And for good reason. The Treasury Department just hasn’t run into much if any trouble raising funds.

To give you an example of what I mean, on the Department’s website portion dedicated to the TBAC the last entry is from May 2016. It was a letter from then-outgoing Chairman Mathew Zames, at the time JP Morgan’s Chief Operating Officer. In it he describes three major contributions from the committee during his eight years in that position.

The most consequential, in his as well as any estimation, was one of the first undertaken by Zames as Chairman. As a consequence of the 2008 economic collapse, the federal government was suddenly in need of financing a trillion plus deficit. They did it initially in the manner the Treasury Department has historically met such needs – a flood of T-bills (and even some cash management instruments that weren’t strictly about budget deficits; i.e., repo).

What the TBAC advised, and what Mr. Zames was proud to have contributed, was that because Treasury was so shortening its effective outstanding duration it might want to consider instead lengthening it; which over time it did. In other words, the TBAC provided the kind of financial advice to the Treasury Secretary he could have readily received from any discount brokerage shop or single shingle RIA that has ever existed. That’s their big 21st century story.

It’s not hard to wonder exactly why the public doesn’t know a thing about the TBAC. They are, really, a relic of a different time.

And yet, there they are in the just-released meeting minutes of the most recent FOMC policy action. For December 2017, the Federal Reserve’s policymaking body referred directly to the TBAC. Why? A poor and really transparent attempt to answer (for) the yield curve.

|

UST Central Curve, Jan 2007 - Dec 2017 |

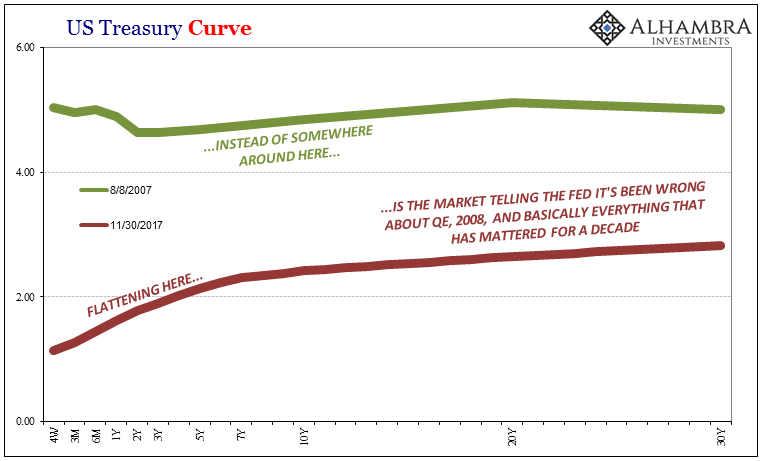

| It was immediately reminiscent of the Verizon excuse for lack of inflation success (there were a few months in the middle of 2017 where the FOMC kept blaming the telecom’s entry into unlimited data plans for what counted as a sixth year of “transitory”). To be perfectly honest, I was expecting nothing about the yield curve in the minutes except to note like any beat reporter that it had flattened; which is probably what the committee should have done.

Like their shifting confidence over their handle of inflation dynamics, the TBAC stuff contains more than a whiff of desperation. As did this sentence. |

US Treasury Curve, Aug 2007 - Nov 2017 |

| They generally agreed that the current degree of flatness of the yield curve was not unusual by historical standards. |

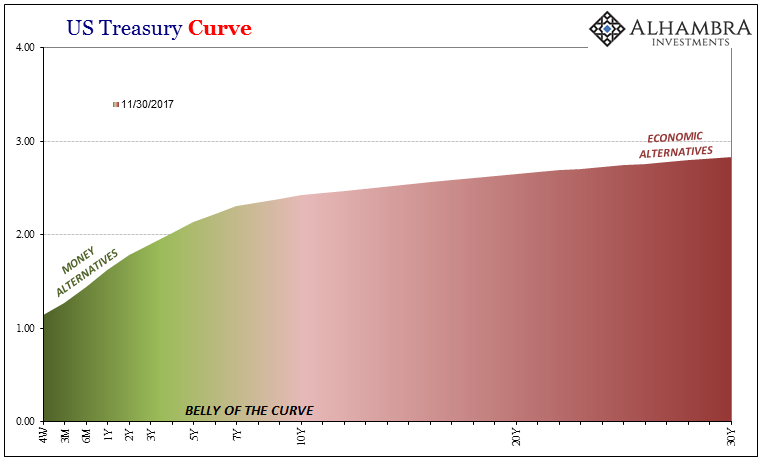

US Treasury Curve, Nov 2017 |

| That’s true in a technical sense; yield curves are not supposed to be steep. But that is almost surely disingenuous, although given who we are dealing with we can’t rule out sheer incompetence. It doesn’t matter as much that the yield curve is flattening, since that was the gameplan all along. What matters more than anything is where it is flattening.

For that, they have no answer even though that is the only one they should at this point be insistent on providing. Make peace with the yield curve, and a whole lot more clicks into place. |

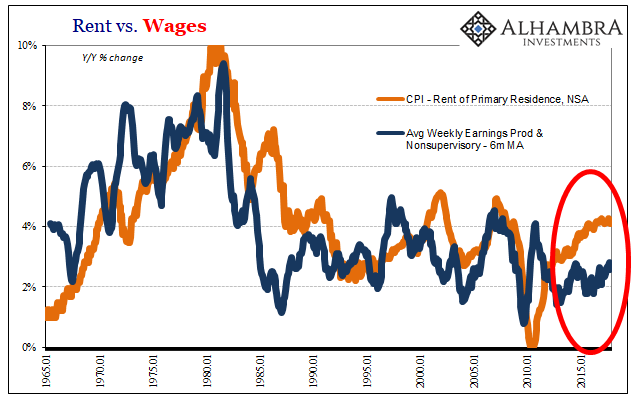

Rent vs Wages, Jan 1965 - 2017 |

| Instead, what’s left is merely the unemployment rate. They keep looking at it dropping and expecting it to mean something even as it hasn’t for years now. Going back as far as 2014, if it was going to it would have long before now. To continue insisting that it will tomorrow or the next day amounts to dangerous delusion – as the yield curve continues to point out month after month.

I don’t mean dangerous in “another 2008 is coming” kind of way, either. We are way beyond that now, the economic damage of such monetary delinquency long absorbed by the global economy, the eventual cost still rising each and every quarter no matter the low-level positive GDP. The conditions that made it necessary to create the TBAC in the first place, war, are inevitably what follows from prolonged economic insufficiency, stagnation, and depression; the forties weren’t a surprise given the thirties. Last month, the real estate web-firm Zillow published an internal study that showed a scary increase in the proportion of cohabitation among US workers. According to their findings, a stunning 30% of working age adults now live in “doubled-up households.” That’s a nearly 50% increase from 2005 when only 21% did. What happened in between wasn’t Baby Boomer retirements. |

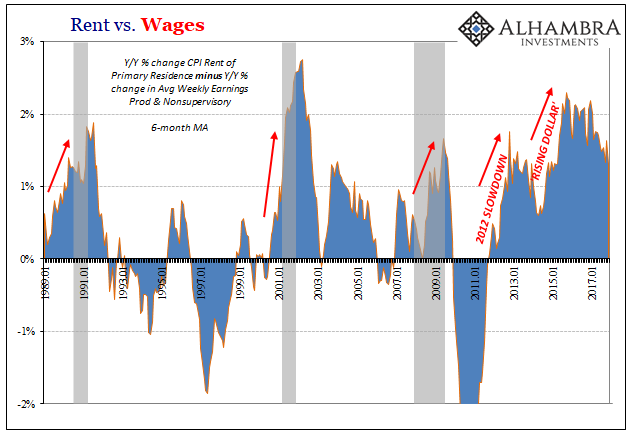

Rent vs Wages, Jan 1989 - 2018 |

As bad as that might be, the primary reason for it should be exactly what the FOMC (or TBAC, for that matter) focuses on each and every policy discussion from here on out.

|

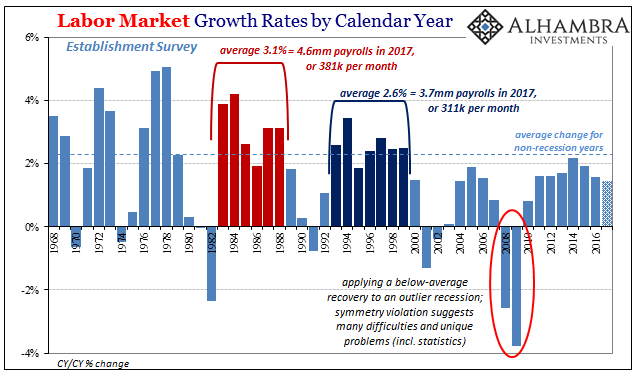

Labor Market Growth Rates, 1968 - 2017 - Click to enlarge |

| For far, far too many, they have been living in recession-like conditions for years – perhaps as long as a decade given the what’s gone on in the real (rather than the imaginary one of the unemployment rate) labor market.

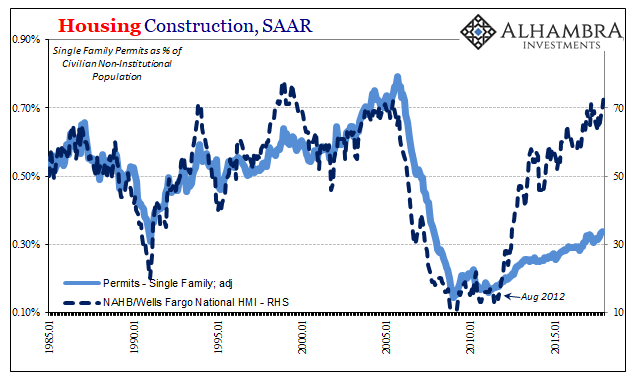

It breeds more than just anomalies in labor market data for Economists to wrongly obsess about. There are to start with very real second order economic effects, such as the now-typical chasm between sentiment and economic reality we find everywhere (to further add to the official confusion). It helps to further hide the fact that the housing market is nowhere near recovered, a segment of the economy that used to be (and still is, only now in the wrong direction) one of the most pro-cyclical of baseline setting factors. |

Housing Construction, Jan 1985 - 2018 |

More than all that, however, this unrecognized (in the official sense) economic misanthropy (which is what it really is) leads toward greater social discontent – the real danger here. I wrote a few months ago about similar data unsurprisingly pointing to the same problem and predictably leading in the same alarming direction:

For much of the first part of the lost decade since August 9, 2007, the proverbial millennial stuck in their parents’ basement was an intuitive cliché. The thirties gave us the emblematic vision of the poor sap stuck in a bread line, while the Great “Recession” has hit particularly the young and college educated who have been reduced to getting their bread in the house they grew up in.

The product of that hidden depression is what we see more and more of:

An entire generation of our people has grown up hearing repeatedly how things are getting better, the economy is growing again. If this is “better”, can you blame them for giving up (that puts it a bit too harshly) or acting out? There is no mystery at all to the deepening mistrust of institutions and establishments, the fraying of the social fabric or the political paradigm. The world seems to be coming apart because a lost decade has left so many behind, far too many, and the “elite” rarely if ever acknowledge it is possible even when the data is altered more and more against their denials.

The FOMC debates, then symbolically raises their policy toys, all because they see a version of economic reality that doesn’t even exist where it should (wages, inflation, bonds). Rather than truly appreciate what markets and that data are all telling them, seeing these poor people stuck in a life they never imagined, they would rather point to some obscure WWII era dinosaur in order to at least provide some kind of plausible sounding answer for why they keep receiving clearly failing grades on their one primary task.

They promised recovery and instead act on the “recovery” so many others will now have to live with – for as long as these others decide to accept it. In Japan, that was a big problem. In the US and elsewhere around the world, it’s a political paradigm shift, an ultimately unpredictable whirlwind just waiting to happen.

Tags: currencies,economy,federal funds,Federal Reserve/Monetary Policy,FOMC,Markets,Monetary Policy,newslettersent,Socialism,U.S. Treasuries,US Treasury,wages,Yield Curve