Tag Archive: newslettersent

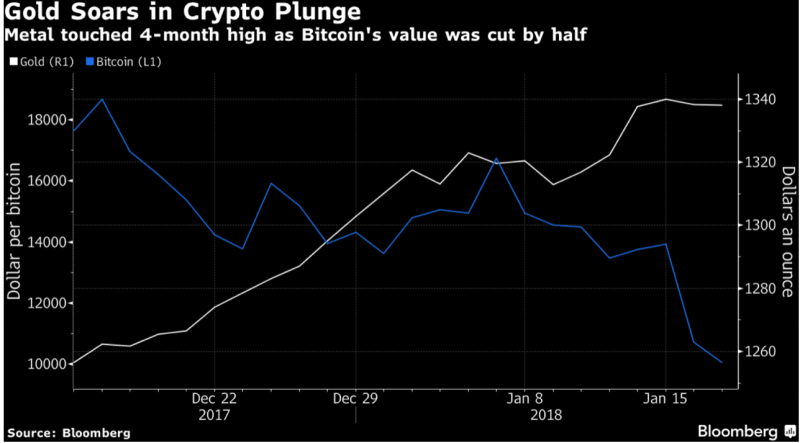

Digital Gold Flight To Physical Gold Coins and Bars

‘Digital Gold’ Bitcoin Flight To Safe Haven Physical Gold. Latest bitcoin, crypto crash causes gold coin and bar demand to surge. Bitcoin down 40% from high, Ripple down 50% and Ethereum down 30%. Ripple and ‘Digital gold’ Bitcoin fall past key psychological price levels. $300bn wiped from cryptocurrency fortunes in just 36 hours. New research says that there is ‘Price Manipulation in the Bitcoin Ecosystem’.

Read More »

Read More »

Nous sommes colonisés par le numérique des multinationales américaines

La révolution numérique est une réalité qui envahit tous les jours plus les sphères publiques et privées…. Qu’en est-il du commerce de détails? Les visuels ci-dessous nous montrent d’abord que certaines habitudes d’achats dans les commerces traditionnels sont maintenues.

Read More »

Read More »

SNB Rejects Vollgeld and Questions ‘Reserves for All’

In the NZZ, Peter Fischer reports that SNB president Thomas Jordan rejects the Vollgeld initiative and stops short of endorsing the ‘reserves for all’ proposal.

Read More »

Read More »

FX Daily, January 17: Dollar Stabilizes After Marginal New Lows

After a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the European session. The next result is a choppy but flattish consolidation compared with last week's closing prices.

Read More »

Read More »

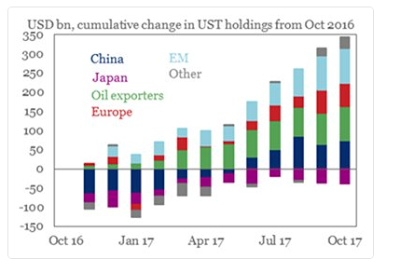

Great Graphic: Treasury Holdings

The combination of a falling dollar and rising US interest rates has sparked a concern never far from the surface about the foreign demand for US Treasuries. Moreover, as the Fed's balance sheet shrinks, investors will have to step up their purchases.

Read More »

Read More »

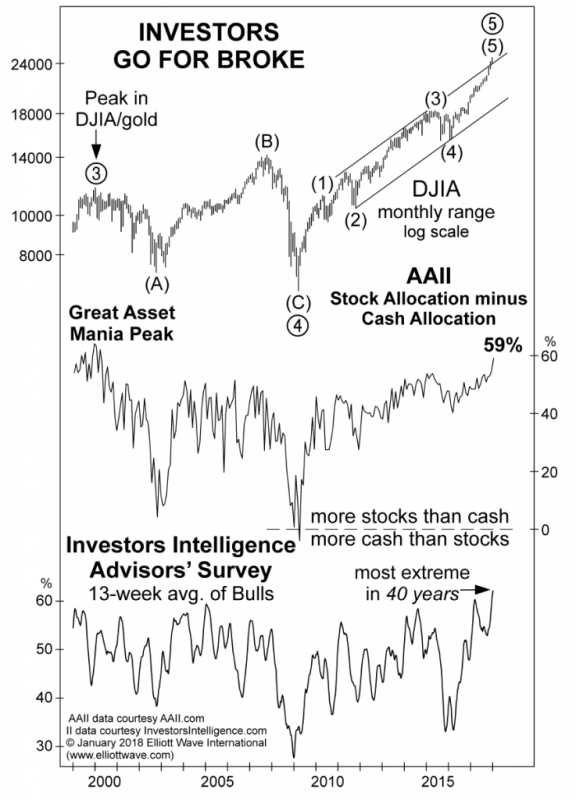

Punch-Drunk Investors & Extinct Bears, Part 1

We didn’t really plan on writing about investor sentiment again so soon, but last week a few articles in the financial press caught our eye and after reviewing the data, we thought it would be a good idea to post a brief update. When positioning and sentiment reach levels that were never seen before after the market has gone through a blow-off move for more than a year, it may well be that it means something for once.

Read More »

Read More »

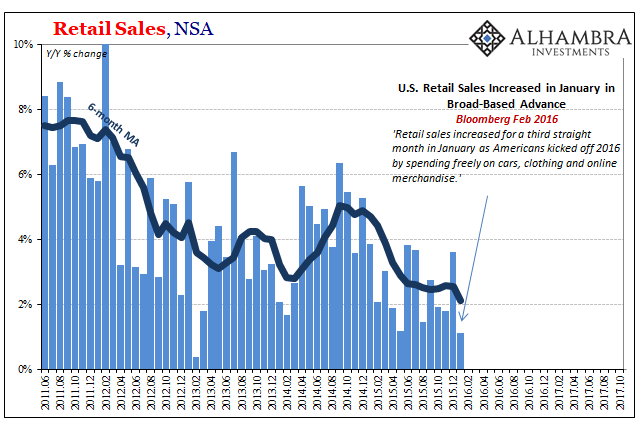

Retail Sales, Consumer Sentiment, And The Aftermath Of Hurricanes

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past.

Read More »

Read More »

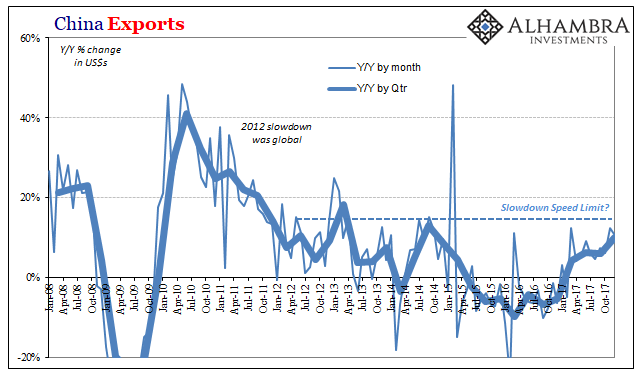

The Dea(r)th of Economic Momentum

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape.

Read More »

Read More »

FX Daily, January 16: Dollar Given a Reprieve

After extending its recent slide yesterday, which the US markets were on holiday, the dollar is firmer against all the major currencies and most of the emerging market currencies. There does not seem to be macroeconomic developments behind the dollar's stabilization, and the gains are quite minor, suggesting a pause in the downtrend rather than a reversal at this juncture.

Read More »

Read More »

Weekly Technical Analysis: 15/01/2018 – USDJPY, EURUSD, GBPUSD, WTI Oil Futures

The USDCHF pair succeeded to break 0.9656 level and hold with a daily close below it, which confirms opening the way to extend the bearish wave towards our yesterday's mentioned next target at 0.9566, noticing that the price approaches retesting the broken level now.

Read More »

Read More »

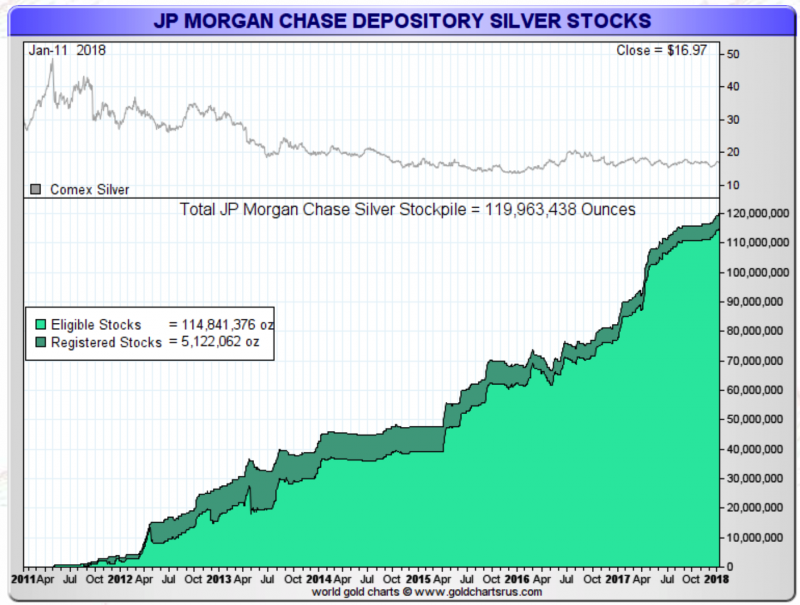

Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver”

JP Morgan continues to accumulate the biggest stockpile of physical silver in history. “JPM now holds more than 133m oz -more than was held by the Hunt Bros” – Butler. Silver hoard owned by JPM has increased from Zero ozs in 2011 to 120m ozs today. Money managers showing more optimism towards silver through record buying. “Near impossible to rule out an upside price surprise at any moment”

Read More »

Read More »

Jobless in Switzerland need more education, say social groups

Two leading Swiss organisations for social action and further education have called for big investment in training opportunities for the unemployed. At a press conference on Monday in Bern, the Swiss Conference of Social Institutions and the Swiss Federation for Further Education called on the state to invest in a schemeexternal link that they say could send 75,000 unemployed back into the job market.

Read More »

Read More »

Swiss fact: nearly 50 percent of Swiss GDP comes from 4 cantons

Switzerland is made up of 26 cantons – technically six are half cantons1 – each with its own distinct taxes, education system, hospitals and government. Land area varies significantly, from 37 sq/km Basel-Stadt to 7,105 sq/km Graubünden.

Read More »

Read More »

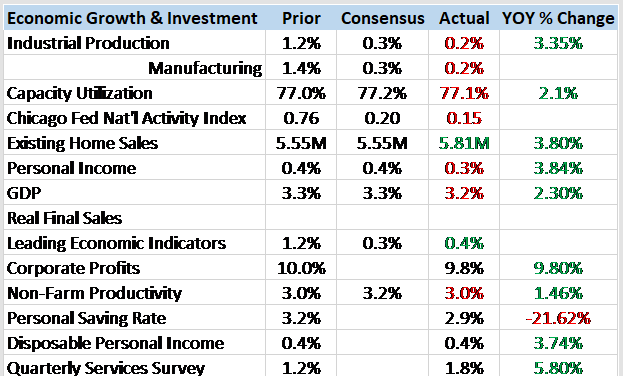

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits.

Read More »

Read More »

Swiss franc could hit 1.22 by year end, according to economists

According to Le Matin, economists at Swiss Life think the rise of the Swiss franc could be over and predict it will weaken to 1.22 to the euro by the end of the year. At the same time they point to risks that could send the currency in the opposite direction, such as the election in Italy, Brexit negotiations and uncertainty surrounding government in Germany.

Read More »

Read More »

Swiss inheritance wealth doubles in last 20 years

The Swiss are passing on more inheritance wealth to family, friends and other beneficiaries than ever before - the CHF63 billion ($65 billion) bequeathed in 2015 is double that of 20 years ago, according to the NZZ am Sonntag newspaper.

Read More »

Read More »

London Property Crash Looms As Prices Drop To 2 1/2 Year Low

London homeowners cut property prices by another 1.4% in January. Average price for a London house dropped by £22,000 to £600,926 in 2017. Takes 78 days to sell a home on average, the highest level since 2012. London’s downtrend continues after 2017 performance as worst UK housing market. UK regional house prices begin to falter as house prices climb slows down.

Read More »

Read More »

FX Weekly Preview: Drivers and Views

It is not easy to recall another week in which there were so many potential changes to the broad investment climate. The relatively light economic calendar in the week ahead may allow investors to continue to ruminate about some of those developments. Here we provide thumbnail assessments of the main drivers.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX continues to rally as the dollar remains on its back foot. With no obvious drivers this week that might help the dollar, we believe EM FX can extend the recent gains. Still, we continue to advise caution when investing in EM, as differentiation should again become evident as idiosyncratic risks remain in play.

Read More »

Read More »

The Fascinating Psychology of Blowoff Tops

The psychology of blowoff tops in asset bubbles is fascinating: let's start with the first requirement of a move qualifying as a blowoff top, which is the vast majority of participants deny the move is a blowoff top.

Read More »

Read More »