Tag Archive: newslettersent

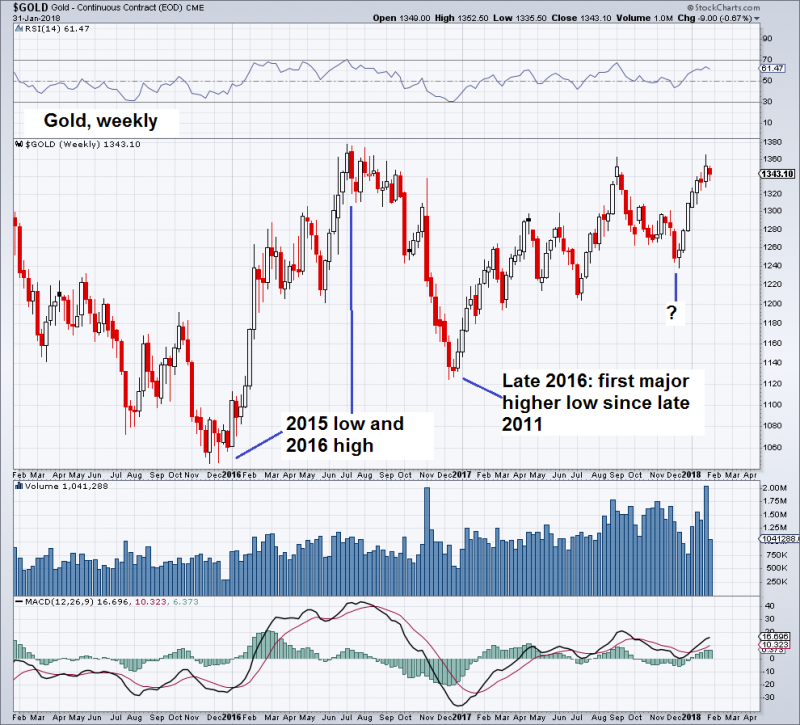

Shrinkflation Intensifies – Stealth Inflation As Thousands of Food Products Shrink In Size, Not Price

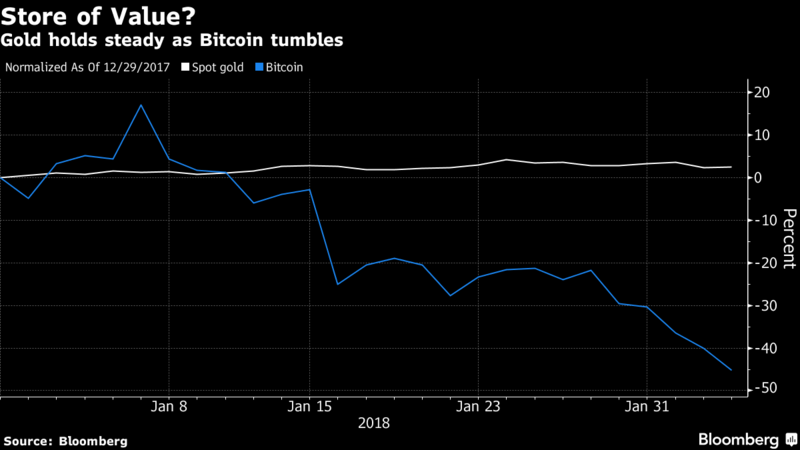

Shrinkflation continues to take hold across UK, Ireland and US for sixth year running. Shrinkflation sees consumers gets less product, but at the same or increased price. 2,500 products have shrunk according to Office of National Statistics in UK. Reported inflation is between 1.7% and 3% but actually much higher. Shrinkflation is financial fraud, unreported inflation in stealth mode. Gold is hedging inflation and shrinkflation.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a weak note and capped off a week of softness. We felt that more and more EM policymakers were getting uncomfortable with FX strength and are likely welcome this recent weakening. However, that's only if their stock and bond markets hold up, which they are (for now).

Read More »

Read More »

Is Congress Finally Pushing Back Against Security Agencies’ Over-Reach?

The last time the U.S. Congress pushed back against the Imperial Presidency and the over-reach of the nation's Security Agencies was 43 years ago, in 1975. In response to the criminal over-reach of the Imperial Presidency (Watergate) and to the criminal over-reach of the security agencies (FBI, CIA, et al.), the Church Committee finally resusitated the constitutional powers of the Congress to serve the interests of the citizenry rather than the...

Read More »

Read More »

Motorway stickers set to bring in CHF350 million

Anyone wanting to drive on Swiss motorways from Thursday will need the new 2018 vignette, a charge sticker which is placed inside one’s windscreen, costing CHF40 ($42.90). The Federal Customs Administration said on Wednesday it expected to sell around 9.6 million vignettes, resulting in a net income of some CHF347 million.

Read More »

Read More »

Swiss face longer commutes

The average commute time to work in Switzerland was 30 minutes in 2016, or 14.8 kilometres (9.2 miles), according to the Federal Statistical Office. This is 7% more than in 2010. Every day, 3.9 million people, out of a labour force of 4.8 million, commuted to work in 2016 – up from 2.9 million in 1990.

Read More »

Read More »

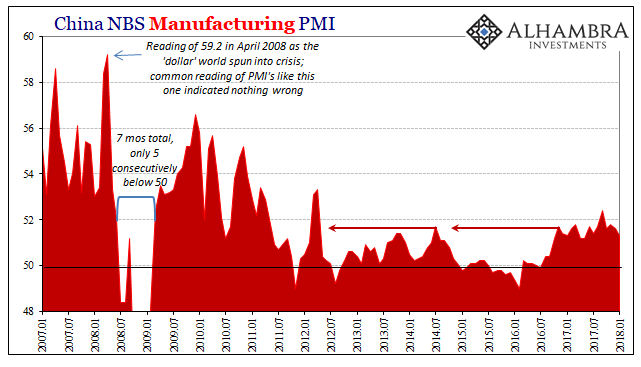

How Global And Synchronized Is A Boom Without China?

According to China’s official PMI’s, those looking for a boom to begin worldwide in 2018 after it failed to materialize in 2017 are still to be disappointed. If there is going to be globally synchronized growth, it will have to happen without China’s participation in it. Of course, things could change next month or the month after, but this idea has been around for a year and a half already.

Read More »

Read More »

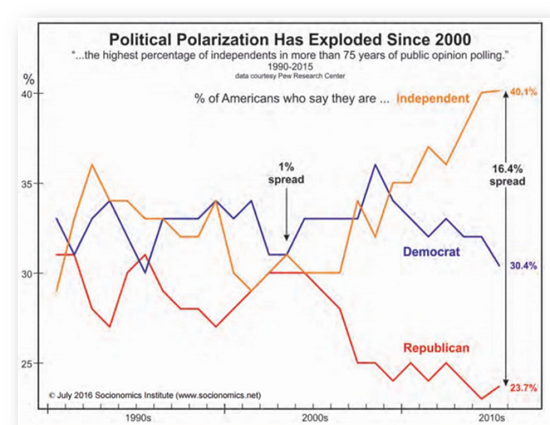

Political Correctness Serves the Ruling Elite

No wonder the Ruling Elites loves political correctness: all those furiously signaling their virtue are zero threat to the asymmetric plunder of the status quo. The Ruling Elites loves political correctness, for it serves the Elite so well. What is political correctness? Political correctness is the public pressure to conform to "progressive" speech acts by uttering the expected code words and phrases in public.

Read More »

Read More »

Emerging Markets: What Changed

India plans to increase spending and widen its budget deficit targets ahead of key elections. India appears to be cracking down on cryptocurrencies. South Africa’s parliament has scheduled a no- confidence vote for Zuma on February 22. Turkish central bank raised its end-2018 inflation forecast in its quarterly inflation report. Peru’s Popular Force party expelled Kenji Fujimori and several of his allies.

Read More »

Read More »

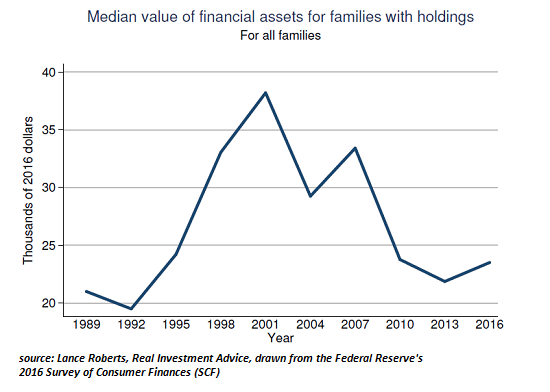

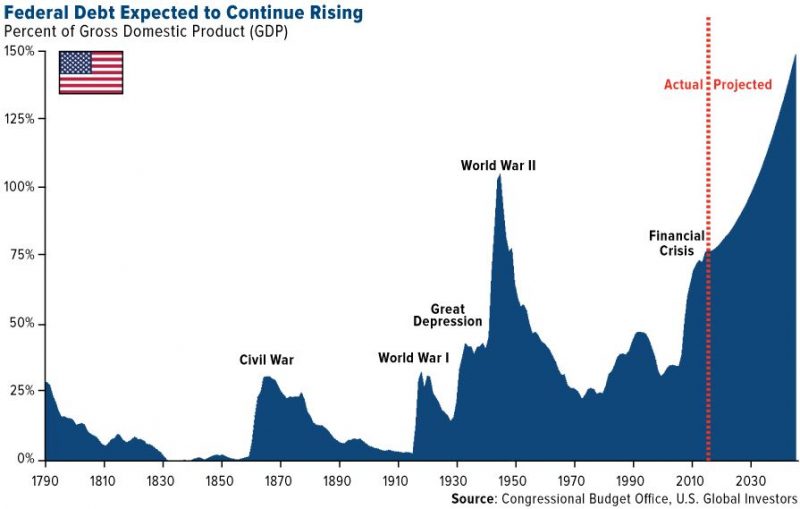

U.S. Debt Is “Extraordinarily High” and Are Stock And Bond Bubbles – Greenspan

“We have a stock market bubble” warns Greenspan. “Bond bubble will be the big issue” he tells Bloomberg TV (see video). “Fiscally unstable long-term outlook in which inflation will take hold”. “Ratio of federal debt to GDP which is extraordinarily high” (see chart). Higher interest rates, inflation and stagflation coming. Gold is the “ultimate insurance policy” – Greenspan

Read More »

Read More »

Swiss cross-border shopping not always worth it, says study

In 2015, Swiss residents made 24 million shopping trips abroad. The average Swiss-based cross-border shopper travelled 69 kilometres to shop in a neighbouring country, 55 kilometres further than they did when shopping in Switzerland, according to a study published by Credit Suisse.

Read More »

Read More »

More fighter jets grounded after cracks found

The Swiss Air Force has found cracks in a further three of its 30 F/A-18 Hornet fighter jets. The aircraft have been taken out of action, the defence ministry said on Friday. A broken hinge was first discovered on a landing flap of an F/A-18C during an intermediate inspection at the end of Januaryexternal link. It was then decided to submit all remaining F/A-18 jetsexternal link to tests, to ensure their air worthiness and safety.

Read More »

Read More »

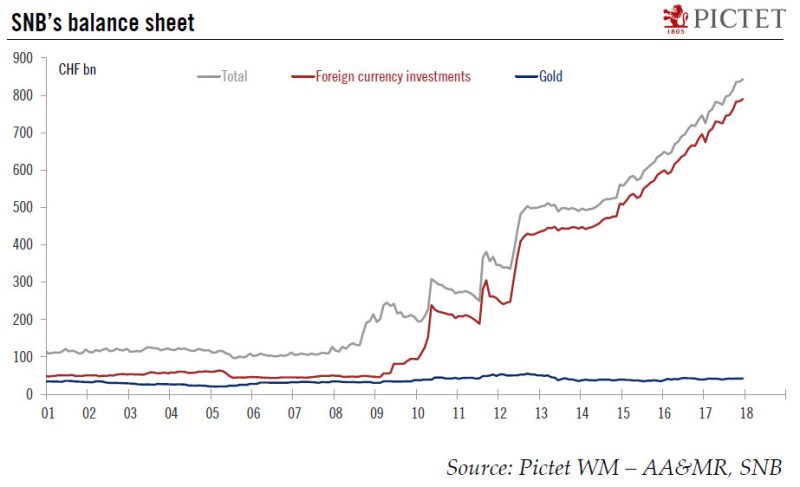

When will the SNB start the process of policy normalisation?

When the Swiss National Bank (SNB) scrapped its currency floor three years ago, its monetary policy strategy was clear: to fight Swiss franc appreciation. It did so verbally, by calling the currency “significantly overvalued”, and physically, by implementing a negative interest rate and intervening in the foreign exchange market as necessary. Three years on, the interest rate on sight deposits at the SNB remains unchanged at a record low of -...

Read More »

Read More »

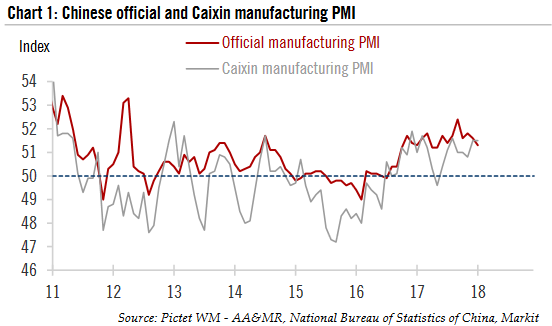

China: PMIs suggest moderation in momentum in Q1

China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1). The official non - manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month.

Read More »

Read More »

FX Daily, February 02: A Note Ahead of US Jobs Report

The US dollar is sporting a firmer profile against all the major currencies after weakening yesterday. Frequently, it seems the Australian dollar leads the other currencies, and we note that it is making a new low for the week today. Briefly, in Europe, it slipped below its 20-day moving (~$0.7985) average for the first time since December 13.

Read More »

Read More »

Switzerland ranked ‘global capital of bank secrecy’

Switzerland is the most secretive financial centre in the world, followed by the United States, according to the Tax Justice Network, a non-governmental organization that campaigns for greater transparency. The Cayman Islands, Hong Kong, Singapore, Luxembourg, Germany, Taiwan, the United Arab Emirates and Guernsey (in descending order) were ranked in the top ten of the NGOs Financial Secrecy Indexexternal link, published on Tuesday.

Read More »

Read More »

Too Much Bubble-Love, Likely to Bring Regret

Readers may recall our recent articles on the blow-off move in the stock market, entitled Punch-Drunk Investors and Extinct Bears (see Part 1 & Part 2 for the details). Bears remained firmly extinct as of last week – in fact, some of the sentiment indicators we are keeping tabs on have become even more stretched, as incredible as that may sound. For instance, assets in bullish Rydex funds exceeded bear assets by a factor of more than 37 at one...

Read More »

Read More »

The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname.

Read More »

Read More »

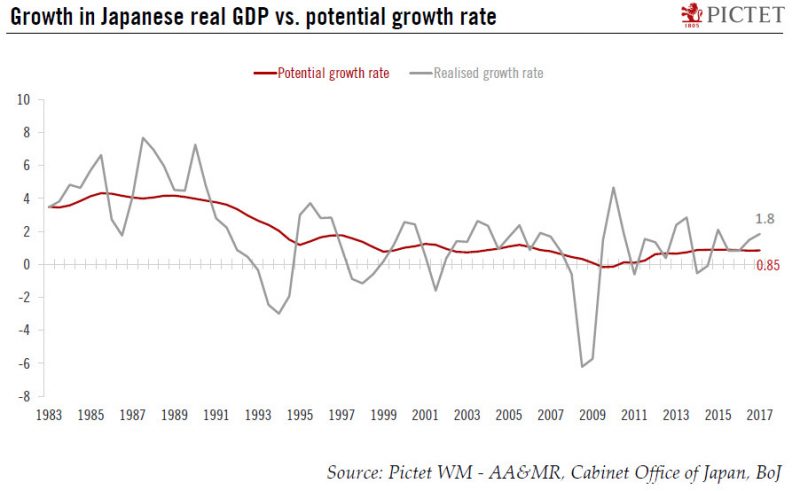

Strong growth and Abenomics mean Japanese equities continue to provide opportunities

Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11 - year high in Q4 2017. The economy may have expanded by 1.8% in 2017, up from 0.9% in the previous year. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s potential growth, which currently stands at 0.85%, according to the Bank of Japan (BoJ, see...

Read More »

Read More »

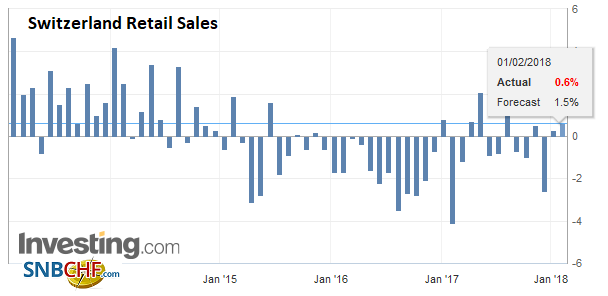

Swiss Retail Sales, December: +1.5 Percent Nominal and -0.8 Percent Real

Turnover in the retail sector rose by 1.5% in nominal terms in December 2017 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.8% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »