Tag Archive: newslettersent

When Budget Deficits Will Really Go Vertical

United States Secretary of Treasury Steven Mnuchin has a sweet gig. He writes rubber checks to pay the nation’s bills. Yet, somehow, the rubber checks don’t bounce. Instead, like magic, they clear. How this all works, considering the nation’s technically insolvent, we don’t quite understand. But Mnuchin gets it. He knows exactly how full faith and credit works – and he knows plenty more.

Read More »

Read More »

Swiss stock market holds up amid global turbulence

After a week marked by declines on Wall Street and stalling Asian markets, the Swiss stock market closed on Friday relatively unscathed, with the index of blue chip stocks dropping 0.93% to 8682.00 points. Over the course of the week, the Swiss Market Index (SMI) of leading Swiss stocks fell by 3.1%.

Read More »

Read More »

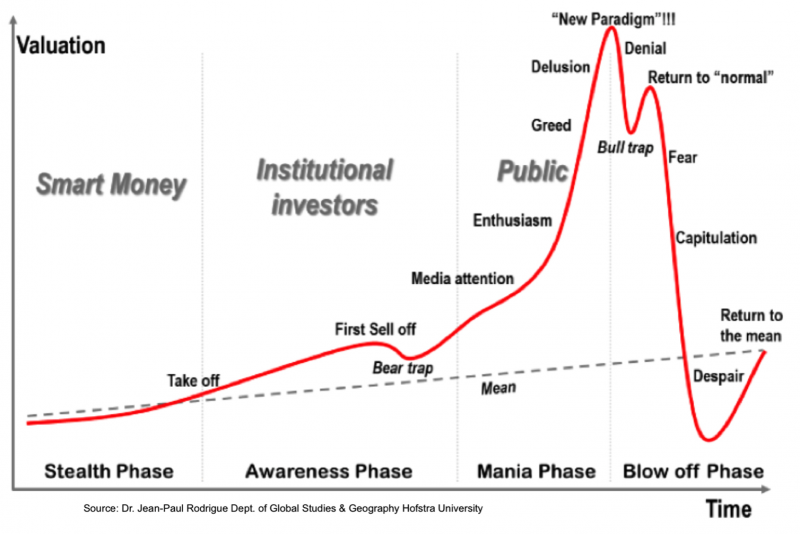

“This Is Where They Completely Lost Their Minds” – Hussman

“This Is Where They Completely Lost Their Minds” – Hussman. Hussman warns ‘the S&P 500 to lose approximately two-thirds of its value over the completion of this cycle’. ‘the market has lost value, even since 2009, when overvalued, overbought, overbullish conditions were joined by divergent internals’. Believes the market is going to learn lessons about the crash ‘the hard way’.

Read More »

Read More »

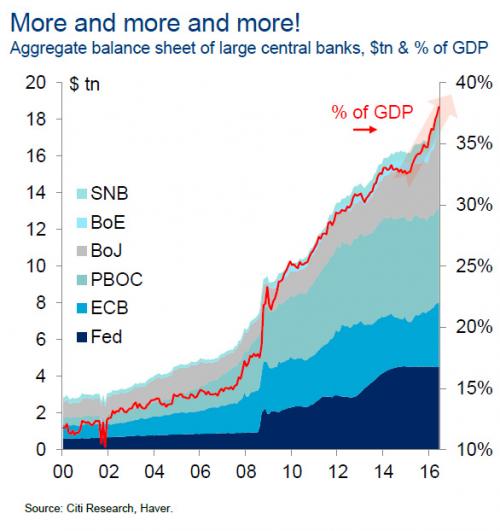

Three Crazy Things We Now Accept as “Normal”

How can central banks "retrain" participants while maintaining their extreme policies of stimulus? Human habituate very easily to new circumstances, even extreme ones. What we accept as "normal" now may have been considered bizarre, extreme or unstable a few short years ago.

Read More »

Read More »

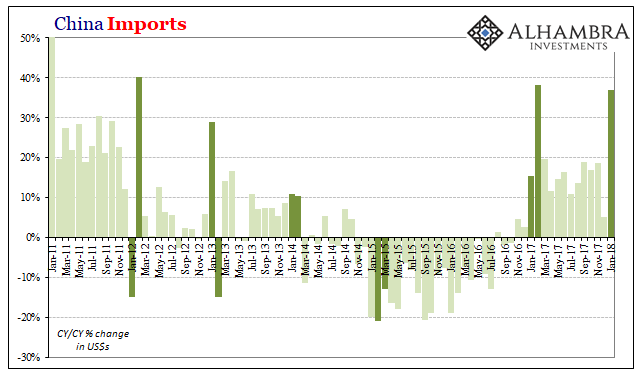

China: CNY, Not Imports

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February.

Read More »

Read More »

US Stocks – Minor Dip With Potential, Much Consternation

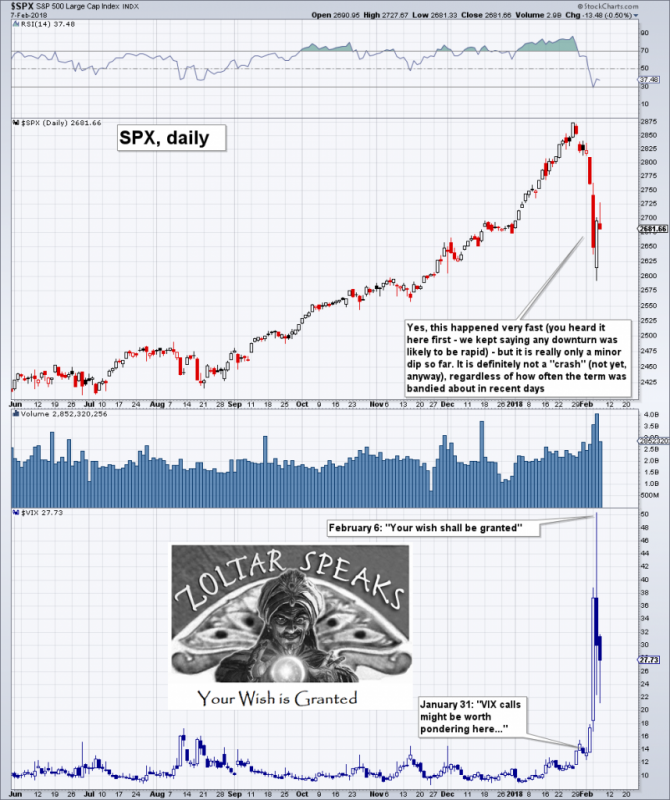

On January 31 we wrote about the unprecedented levels – for a stock market index that is – the weekly and monthly RSI of the DJIA had reached (see: “Too Much Bubble Love, Likely to Bring Regret” for the astonishing details – provided you still have some capacity for stock market-related astonishment). We will take the opportunity to toot our horn by reminding readers that we highlighted VIX calls of all things as a worthwhile tail risk play....

Read More »

Read More »

Emerging Markets: What has Changed

Reuters reported that China may loosen controls on outbound capital flows (QDLP). Samsung chief Lee was set free in an unexpected court reversal. Romania central bank hiked rates by 25 bp and raised its inflation forecasts for the next two years. South Africa President Zuma appears to be on the way out. Ecuador voters approved a referendum that reinstates term limits for the president. Venezuela central bank restarted FX auctions for the first time...

Read More »

Read More »

South Korea and Switzerland set a currency swap

South Korea and Switzerland are entering into a bilateral currency swap agreement, it was announced on Friday. The move is aimed at strengthening buffers against external financial shocks for both countries. “The swap agreement enables Korean won and Swiss francs to be purchased and repurchased between the two central banks, up to a limit of KRW11.2 trillion, or CHF10 billion [$10.6 billion],” a Swiss National Bank statement saidexternal link.

Read More »

Read More »

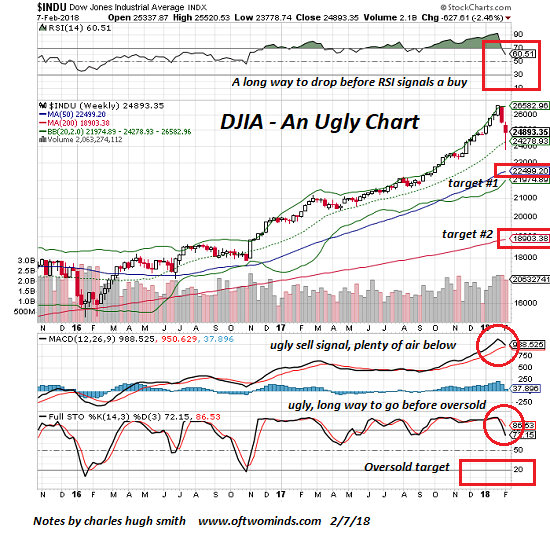

Before You “Buy the Dip,” Look at This One Chart

There's a place for fancy technical interpretations, but sometimes a basic chart tells us quite a lot. Here is a basic chart of the Dow Jones Industrial Average, the DJIA. It displays basic information: price candlesticks, volume, the 50-week and 200-week moving averages, RSI (relative strength), MACD (moving average convergence-divergence), stochastics and the MACD histogram. These kinds of charts are free (in this case, from StockCharts.com).

Read More »

Read More »

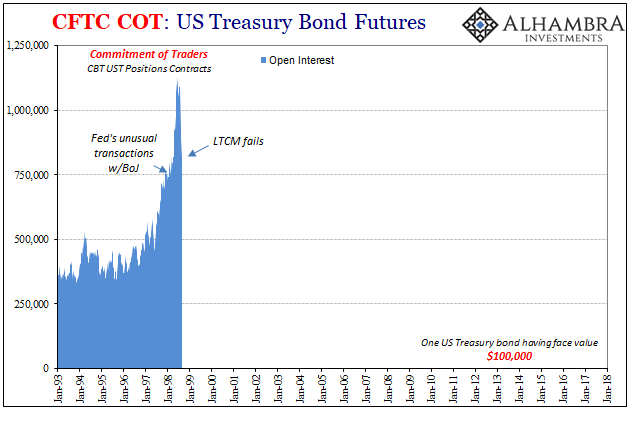

COT Blue: Interest In Open Interest

For me, the defining characteristic of the late nineties wasn’t the dot-coms. Most people were exposed to the NASDAQ because, frankly, at the time there was no getting away from it. It had seeped into everything, transforming from a financial niche bleeding eventually into the entire worldwide culture. We all remember the grocery clerks who became day traders.

Read More »

Read More »

FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude of the regional losses. At one point the CSI 300 of the large Chinese mainland shares was off more than 6% before closing off 4.3% (and 10% for the week). The H-shares index was down 3.9% and 12% for the week.

Read More »

Read More »

Great Graphic: FX Vol Elevated, but Still Modest

With the substantial swings in the volatility of equities that have captured the imagination of journalists and punished investors who bought financial derivatives that profited from the low vol environment, we thought it would be helped to look at the implied volatility of the leading currencies against the US dollar. The Great Graphic looks at the three-month implied volatility for the euro (white line), the yen (yellow line), and sterling (green...

Read More »

Read More »

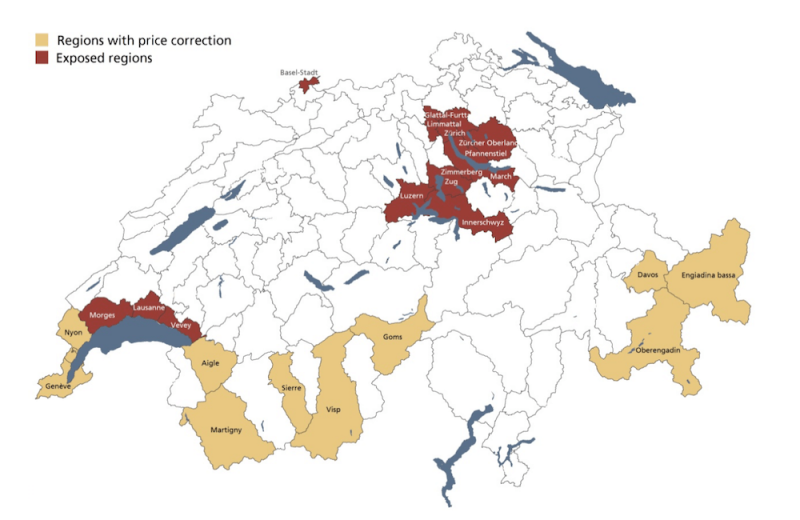

Swiss real estate risk falls two quarters in a row, says UBS

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction.

Read More »

Read More »

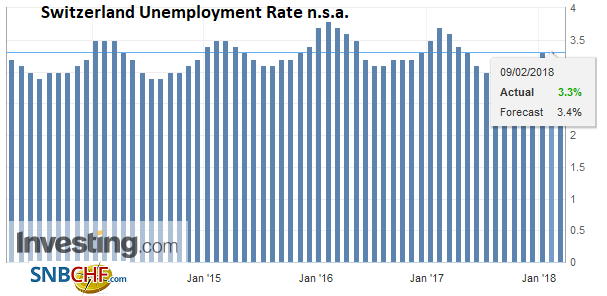

Switzerland Unemployment in January 2018: Unchanged at 3.3 percent, seasonally adjusted unchanged at 3.0 percent

Registered unemployment in January 2018 - According to SECO surveys, at the end of January 2018, 149,161 unemployed people were enrolled in the Regional Employment Centers (RAV), 2,507 more than in the previous month. The unemployment rate remained at 3.3% in the month under review. Compared with the same month last year, unemployment fell by 15,305 (-9.3%).

Read More »

Read More »

Swisscom reports job cuts, data breach

The Swiss telecom company, whose majority shareholder is the government, announced plans to reduce up to 700 jobs by the end of the year as part of cost-cutting measures. It also revealed a data breach of client information. “By the end of 2018, Swisscom expects to have a headcount of around 17,000 FTEs [full-time employees] in Switzerland, around 700 fewer than at the end of 2017,” said a company statementexternal link released on Wednesday.

Read More »

Read More »

Brexit Risks Increase – London Property Market and Pound Vulnerable

Brexit Risks Increases – London Property Market and Pound Vulnerable. Brexit uncertainty deepens as UK government in disarray. BOE warns of earlier and larger rate hikes for Brexit-hit UK. UK property prices fall second month in row, London property under pressure. No deal Brexit estimated to cost UK £80bn according to government analysis. Transition period causing major uncertainty for UK and pound. Pound expected to fall as Brexit fears remain...

Read More »

Read More »

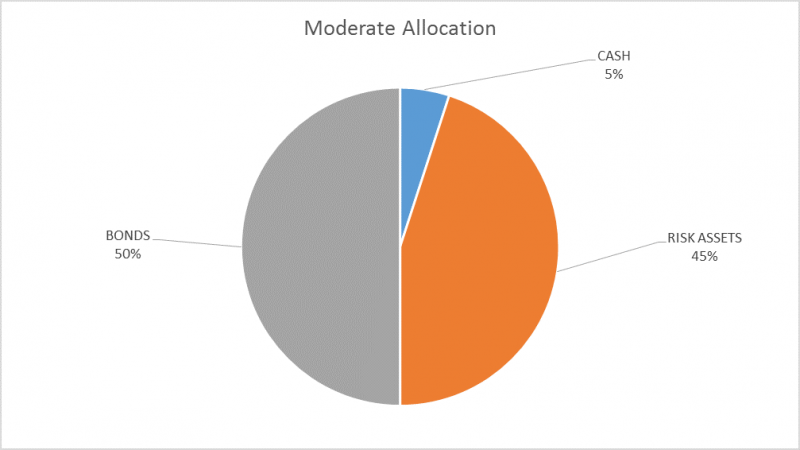

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in correction territory, down 10% from the...

Read More »

Read More »

FX Daily, February 08: Dollar Firms, While Equities Search for Stability

The swings in the equity markets are subsiding, bond yields are firm and the US dollar is extending its recovery. Although US equities closed lower, the MSCI Asia Pacific Index snapped a four-day drop by posting a 0.25% gain. However, the MSCI Emerging Markets Index is off nearly as much, though the range was modest. European markets are also lower, and the range for the Dow Jones Stoxx 600 is the smallest in more than a week.

Read More »

Read More »

Great Graphic: Major Currencies Year-to-Date

This Great Graphic was created on Bloomberg. It shows five major currencies against the US dollar this year. To avoid giving a misleading impression, the currencies are index to start this year at 100 and all the currencies are quoted in the European style of how many dollars the currency purchases. These kinds of charts are not so much for trading, but they help illustrate the relative moves that can be masked by nominal price changes.

Read More »

Read More »