Brexit Risks Increases – London Property Market and Pound Vulnerable

– Brexit uncertainty deepens as UK government in disarray

– BOE warns of earlier and larger rate hikes for Brexit-hit UK

– UK property prices fall second month in row, London property under pressure

– No deal Brexit estimated to cost UK £80bn according to government analysis

– Transition period causing major uncertainty for UK and pound

– Pound expected to fall as Brexit fears remain into 2018

Editor: Mark O’Byrne

| Brexit risks have increased in recent days. A Reuters poll published on 8th February shows the pound is expected to fall this year as uncertainty around Brexit grows. Meanwhile London property prices continue to fall.

The median view of more than 60 foreign exchange specialists asked by Reuters, concluded the pound will struggle as the UK heads towards its exit of from the trading bloc in 2019. This will come as a shock to many who had thought sterling had seen the worst of times following the 2016 referendum. After all, the currency was one of the world’s best performing currencies in 2017 after the over 30% collapse versus gold in 2016. |

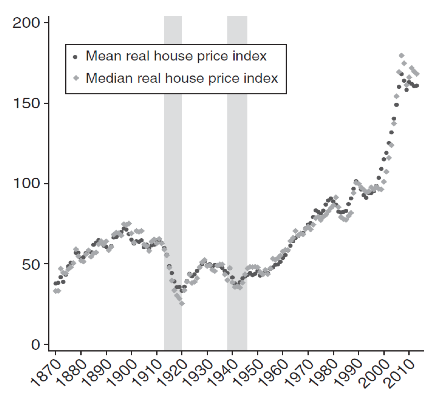

Real House Price Index, 1870 - 2018 |

| Much of the 6.5% gain since October 2016 has been thanks to a stable monetary policy expectations. This is likely to remain in the short term but long term the Bank of England will no doubt struggle to handle the fallout of the current bubblicious environment, the immediate impact of Brexit uncertainty and rapidly changing geopolitics.

Also last week a government analysis was published stating that £80 billion would be the cost to the UK should a Brexit result in a ‘no deal’. As well as costs to businesses, food and drink prices are predicted to climb by 21% and 17%, respectively. The pound has been in a precarious position ever since the referendum result. It will continue to be as more unknowns rear their heads. Savers may be pleased to hear about the prospect of a rate hike as suggested by the MPC this week, but how much difference does it make when the currency is floundering, significantly devalued and the country appears vulnerable until post-Brexit? |

Gold In GBP, Jul 2013 - Jan 2018 |

Is the EU working against the UK?

Brexit has been a sore point since the referendum but since negotiations began the divisions and wounds have grown deeper and deeper.

Naturally the EU has to be seen working against an event such as Brexit as it questions the trading bloc’s very existence. Last week Michel Barnier managed to behave so anti-UK that he managed to do one thing Theresa May has so far failed to do – unite the British government.

Barnier brought up new demands for a Brexit transition agreement. He suggested that the UK be subject to sanctions if the EU believe laws have been infringed. The country could be fined, suggested Barnier, without the EU having to go through the usually lengthy court process.

In short, Barnier and the EU would like to be able to punish the UK as it deems fit, during the transition period. Sanctions might come about should the country be considered to be operating against the EU’s interests in say, trade deals.

This development further underlines why the most dangerous time for the UK is the 19-month transition period. It is the most dangerous as it is the most unknown. It appears to be negotiations surrounding this that are causing the most damage to the the pound and the future of the UK economy.

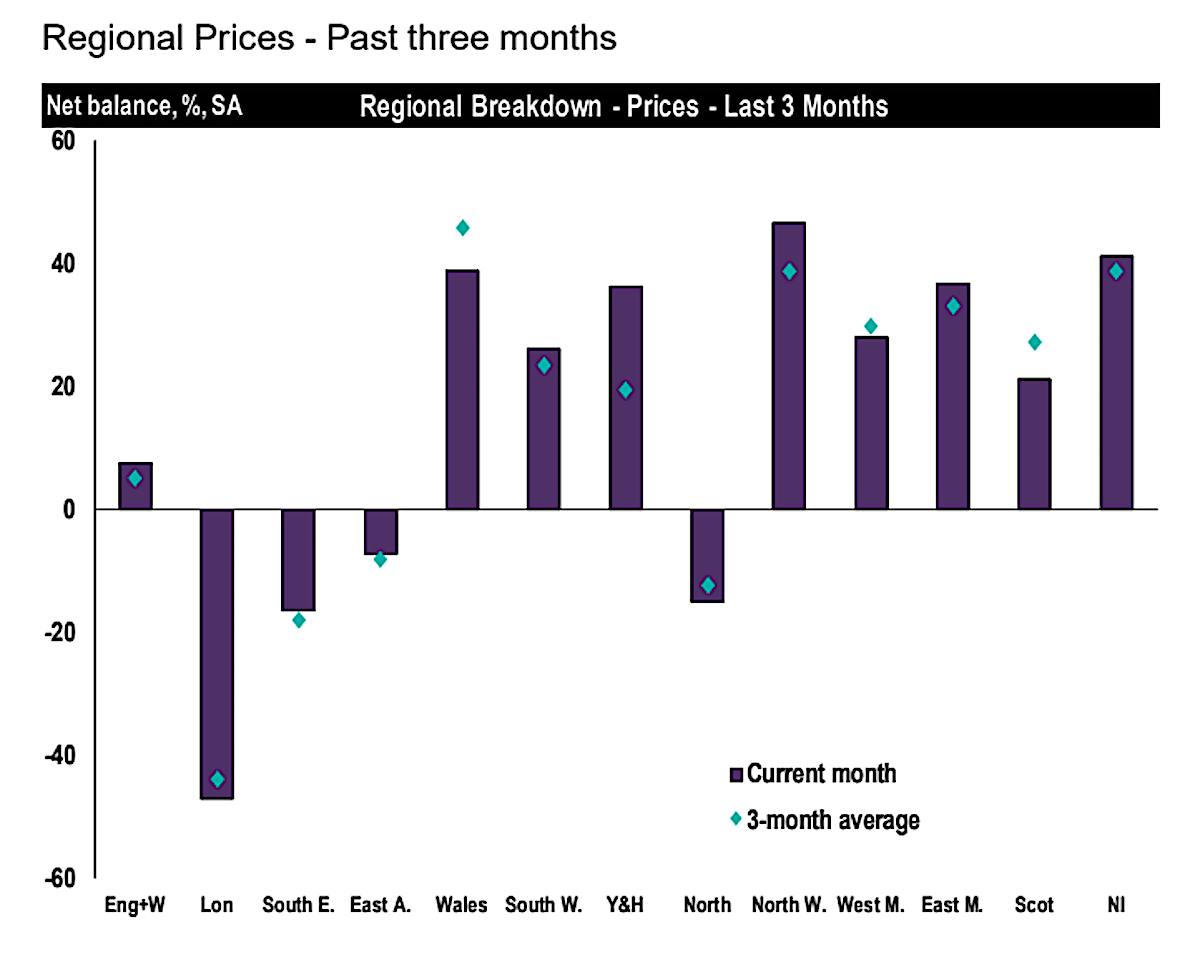

Is London ‘dying’?The financial hub of London has long been revered as one of the most established and most respected in the world. The City’s power was one of the rallying cries of both the remain and leave campaigners during the referendum. The leavers stating that the financial power of London would only be strengthened by Brexit, the remainers saying it would only be weakened. Politico’s Capital Markets summit this week gained some interesting insights from EU finance bods. Olivier Guersent, the director general of the EC’s financial services directorate told the UK’s financial services to be prepared to be treated ‘as a third country’ whilst Claudio Costamagna, chairman of Italy’s Cassa Depositi e Prestiti, said that London’s financial centre is ‘dying’. This does not bode well for a capital and country which is seeing poor results on various fronts of late, most notably in housing and the property market. Financial services companies are delaying setting up here, as are other international bodies, because of uncertainty surrounding Brexit. This has had a major impact on demand, which is one of many factors pushing down the capital’s much hyped-up property market. January’s RICS survey showed London’s house prices remain firmly in the red as more participants reported falling rather than rising prices. According to Business Insider, the outlook isn’t set to improve much either: While prices are expected to flatline nationally in the next three months, London is once again the exception, with most respondents expecting prices to fall — although the net balance ticked up from -41% in December to -21%. You can read more about the bursting London property bubble here. |

Regional Prices |

Transition policy in place by March?This week the MPC decided to keep interest rates on hold but warned hikes may come thicker and faster. Unsurprisingly Mark Carney was questioned at length about the impact of Brexit on the MPC’s decision. Carney said that should there be no transition deal by the end of March the MPC will be forced to look at the impact on household and business confidence before deciding how this will affect the economy. The BofE forecast is predicted on the assumption that there will be a smooth transition, which Carney believes will be the case. Secondly, it is based on the view that the MPC has no further information than anyone else does. Carney hopes that we will be better informed by the end of the year and asks markets to consider how ‘nimble’ monetary policy can be. This does not bode well for a country that has seen a fall in the value of its currency recently. Much of this is thanks to ‘nimble’ monetary policy. So far, markets have reacted well to the latest announcement that the MPC may hike rates sooner than expected. How will this work out for those who are participating in the London housing market? |

|

|

Many homeowners are practically mortgaged up-to-the-eyeballs having only ever lived with low-interest rates. Combine this with the uncertainty of jobs due to Brexit, plus increased living costs…the future is not looking bright for the property market and those exposed to it. Expensive: Uncertainty is the only certainty of BrexitIt certainly seems as though the country and its government are distracted with the transition deal, sticking to the course of the UK’s departure by March 2019. The problem is that distraction is creating a frothiness in the daily news cycle, surrounding all things Brexit. Rumours are swirling, papers are being leaked and MPs are throwing tantrums at every opportunity. What does all this mean for the average UK and EU citizen? Major uncertainty. Ultimately nothing has been decided. For now the Brexit negotiations rage on, with very little achieved since they began. Sadly markets don’t wait to see what the final outcome will be. They operate on news today and expected outcomes. The real news is that British citizens are more in the lurch than ever. At the moment the expected outcome is unknown and wholly uncertain when it comes to how the UK will fare. Those who diversify away from sterling and other fiat currencies and into gold will be hedged. The price of gold in sterling will rise in the medium and long term, as we saw with the collapse of the pound following the Brexit referendum. Gold thrives in environments such as these. UK investors would be prudent to pound cost average into gold while prices remain relatively depressed. |

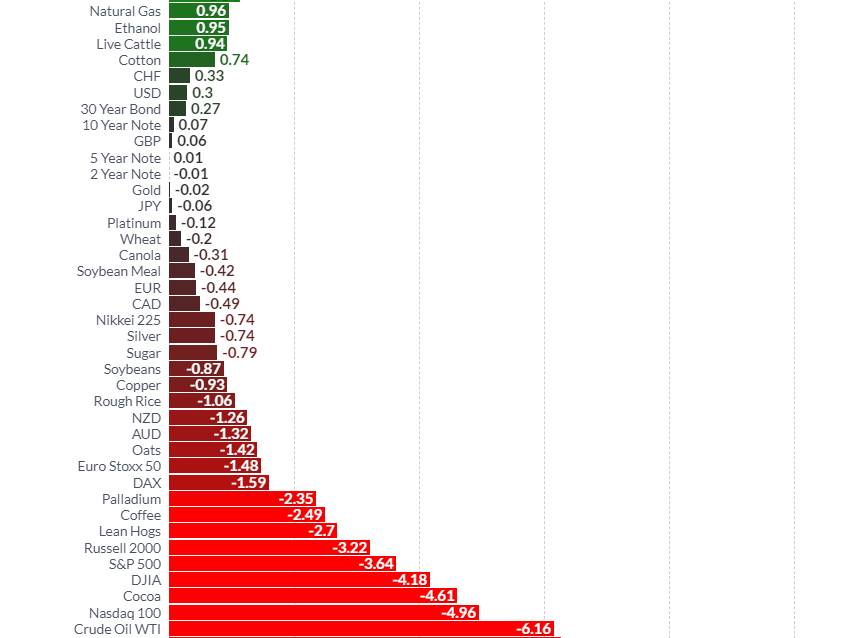

S&P 500 Index, Jan 2018 |

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,Weekly Market Update