Tag Archive: newslettersent

Silver bullion will likely outperform gold bullion going forward

Normally the action in the gold and silver futures markets tends to be pretty similar, since the same general forces affect both precious metals. When inflation or some other source of anxiety is ascendant, both metals rise, and vice versa. But lately – perhaps in a sign of how confused the world is becoming – gold and silver traders have diverged.

Read More »

Read More »

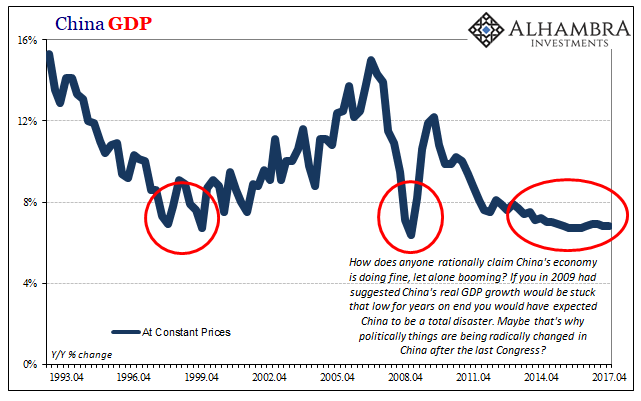

China Going Boom

For a very long time, they tried it “our” way. It isn’t working out so well for them any longer, so in one sense you can’t blame them for seeking answers elsewhere. It was a good run while it lasted. The big problem is that what “it” was wasn’t ever our way. Not really. The Chinese for decades followed not a free market paradigm but an orthodox Economics one. This is no trivial difference, as the latter is far more easily accomplished in a place...

Read More »

Read More »

FX Daily, March 07: Renewed Threat of Trade War Makes Investors Angry

In response to the resignation of one of the few "globalist" advisers in the US Administration, the resignation Cohn has sent ripples through the capital markets. Stocks have been marked down across the world. The prospects of a trade war are also not good for growth and it may be adding to the pressure on yields.

Read More »

Read More »

UN’s Geneva staff planning a strike over pay cuts

Employees of the United Nations in Geneva are planning a half-day strike on Tuesday to protest against wage cuts. The work stoppage would take place during a busy week, with dozens of ministers and officials expected at various events. "We have tried other forms of protest in vain before," said Ian Richards, head of the Staff Coordinating Council at United Nations Office at Geneva, on Sunday. "They left us no choice."

Read More »

Read More »

2017 saw upswing in Swiss engineering jobs

The Swiss mechanical, electrical and metal industries are recovering, as indicated by increases in turnover and employment. The industry lobby group Swissmemexternal link reported on Thursday that 4,500 additional jobs were generated in 2017 compared to the previous year, taking the industry total to 322,100. In contrast, 12,600 jobs were cut in 2015 and 2016 combined.

Read More »

Read More »

Never Mind Volatility: Systemic Risk Is Rising

So who's holding the hot potato of systemic risk now? Everyone. One of the greatest con jobs of the past 9 years is the status quo's equivalence of risk and volatility: risk = volatility: so if volatility is low, then risk is low. Wrong: volatility once reflected specific short-term aspects of risk, but measures of volatility such as the VIX have been hijacked to generate the illusion that risk is low.

Read More »

Read More »

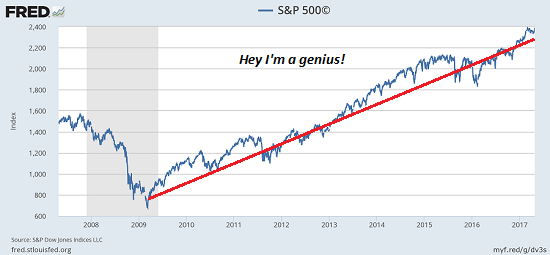

US Stock Market: Conspicuous Similarities with 1929, 1987 and Japan in 1990

There are good reasons to suspect that the bull market in US equities has been stretched to the limit. These include inter alia: high fundamental valuation levels, as e.g. illustrated by the Shiller P/E ratio (a.k.a. “CAPE”/ cyclically adjusted P/E); rising interest rates; and the maturity of the advance. Near the end of a bull market cycle there is always the question of when a decline will begin, and above all, how large will it be.

Read More »

Read More »

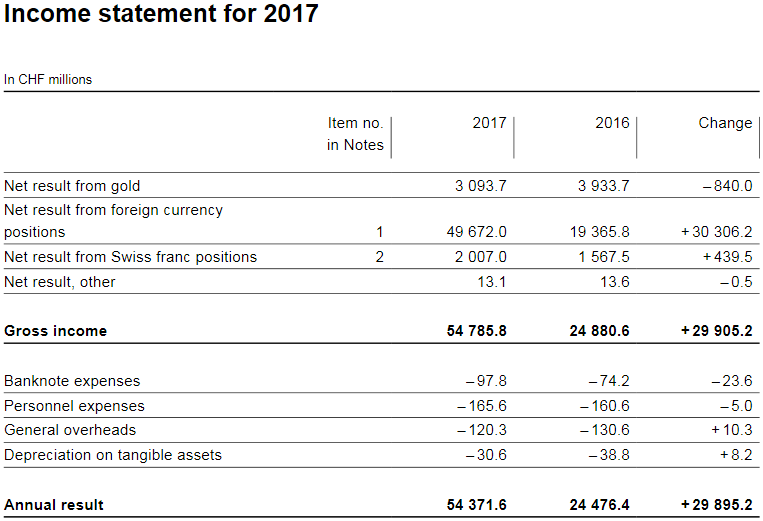

SNB reports a profit of CHF 54.4 billion for 2017

The Swiss National Bank (SNB) reports a profit of CHF 54.4 billion for the year 2017 (2016: CHF 24.5 billion). The profit on foreign currency positions amounted to CHF 49.7 billion. A valuation gain of CHF 3.1 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 2.0 billion.

Read More »

Read More »

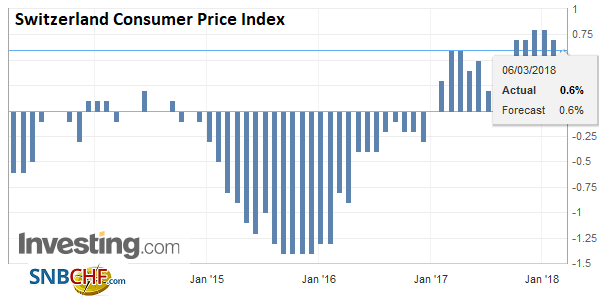

Swiss Consumer Price Index in February 2018: +0.6 percent YoY, +0.4 percent MoM

The consumer price index (CPI) increased by 0.4% in February 2018 compared with the previous month, reaching 101.1 points (December 2015=100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, March 06: Resiliency Demonstrated

The resiliency of the status quo is again on display. After much chin wagging and finger pointing after the Italian elections and the modest decline in Italian assets, they have bounced back today. Italian bonds and stocks are participating in today's advance. Italian equities were off 0.5% yesterday and are up a 1.1% near midday in Milan. Italy's 10-year yield rose three basis points yesterday is off five today.

Read More »

Read More »

Weekly Technical Analysis: 05/03/2018 – USDJPY, EURUSD, GBPUSD, EURGBP, AUDUSD

The USDCHF pair shows sideways trading around the EMA50, noticing that the EMA50 shows clear negative signals on the four hours’ time frame, while the price settles below the intraday bullish channel’s support line that appears on the chart.

Read More »

Read More »

Great Graphic: Is the Canadian Dollar a Buy Soon against the Mexican Peso?

This Great Graphic composed on Bloomberg shows the Canadian dollar against the Mexican peso since the start of last year. There have been three big moves. The Canadian dollar trended lower against the peso as it corrected from the sharp sell-off induced in great measure to the candidate Trump's rhetoric against Mexico. However, shortly before the inauguration, the peso began recovering continued through H1 17.

Read More »

Read More »

Quarter of Swiss companies fail to pay bills on time

23.3% of businesses in Switzerland did not pay their bills on time in 2017, found the business information service Bisnode D&Bexternal link in a survey published on Wednesday. That’s 0.3% less late-payers compared to 2016. The average delay of payments was also shorter in 2017, averaging 14.4 days, compared to 15.7 in 2016.

Read More »

Read More »

FX Daily, March 05: Italian Election Weighs on Italian Assets, but Little Systemic Risk Seen

The US dollar is narrowly mixed. The Japanese yen remains firm. The dollar appears stuck in a narrow range. Near JPY105.20 the seems to be some short-covering pressure in front of JPY105. On the top side, the greenback is encountering offers in front of JPY105.80. Sterling is firm against the dollar as it recovers against the euro. Before the weekend, the euro reached GBP0.8950, its best levels since last November. The euro is testing GBP0.8900...

Read More »

Read More »

Rosier economy should boost Swiss housing market

The economic upturn should drive demand for Swiss property after a period of record construction and lower rental prices, a survey claims. The improved economic situation should “revive demand in all segments” of the Swiss housing market, according to Credit Suisse’s Swiss Real Estate Market 2018 reportexternal link, published on Tuesday.

Read More »

Read More »

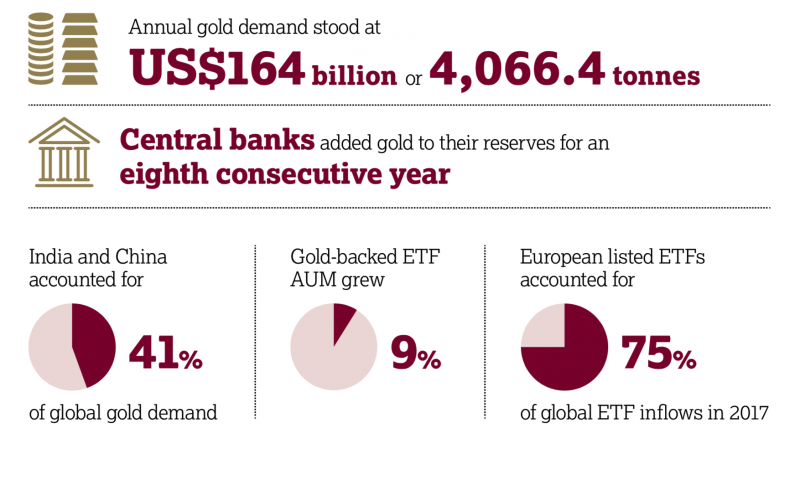

Four Key Themes To Drive Gold Prices In 2018 – World Gold Council

Four key themes to drive gold prices in 2018 – World Gold Council annual review. Monetary policies, frothy asset prices, global growth and demand and increasing market access important in 2018. Weak US dollar in 2017 saw gold price up 13.5%, largest gain since 2010. “Strong gold price performance was a positive for investors and producers, and was symptomatic of a more profound shift in sentiment: a growing recognition of gold’s role as a wealth...

Read More »

Read More »

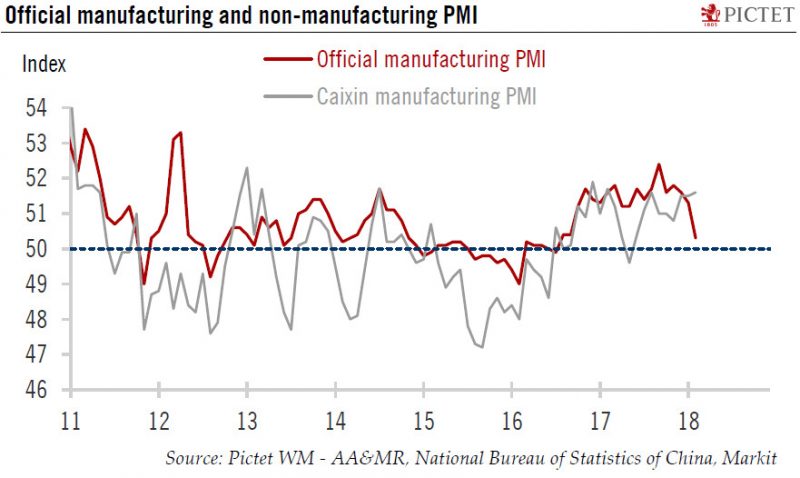

China: February PMIs point to deceleration in industrial activity

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely.

Read More »

Read More »

FX Weekly Preview: Thumbnail Sketch Four Central Bank Meetings and US Jobs Data

The German Social Democrats have endorsed the Grand Coalition, ending the period of political uncertainty and paralysis in Germany since the last September's election. The polls have suggested nearly 60% of the SPD would support joining the government and the actual outcome looks to be closer to 66%. In 2013, when the SPD had a similar vote, three-quarters favored a Grand Coalition. Among the differences is that the SPD public support has waned,...

Read More »

Read More »