Tag Archive: newslettersent

FX Weekly Review, January 16 – 21: Dollar Still Appears to Carving out a Bottom

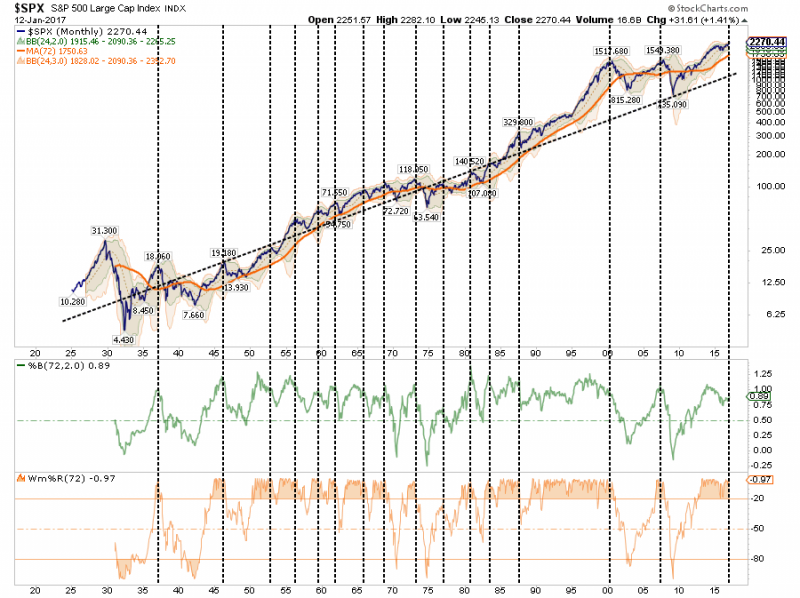

The US dollar turned in a mixed performance over the past week. The technical indicators continue to support our expectation that after correcting since mid-December, following the Fed's hike, the dollar is basing.

Read More »

Read More »

The Psychological Impact Of Loss

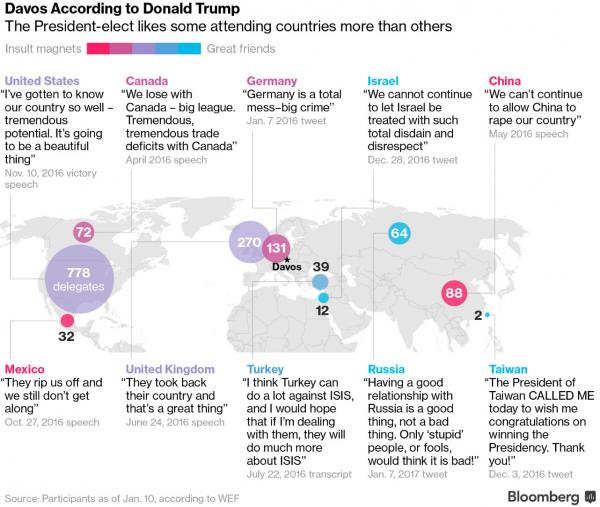

For the third time in four weeks, the market was closed on Monday due to a holiday. Not only is this week shortened by a holiday, it is also coinciding with the annual Billionaire’s convention in Davos, Switzerland and the Presidential inauguration on Friday. Increased volatility over the next couple of days will certainly not be surprising.

Read More »

Read More »

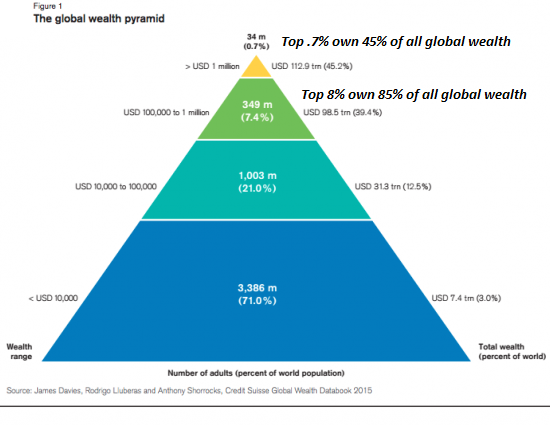

25 Years of Neocon-Neoliberalism: Great for the Top 5 percent, A Disaster for Everyone Else

It cannot be merely coincidental that the incomes and wealth of the top 5% have pulled away from the stagnating 95% in the 25 years dominated by neocon-neoliberalism. One unexamined narrative I keep hearing is: "OK, so neocon-neoliberalism was less than ideal, but Trump could be much worse." Let's start by asking: would Syrian civilians agree with this assessment?

Read More »

Read More »

Davos (According To Donald Trump)

Bloomberg's Anne Swardson, Zoe Schneeweiss, and Andre Tartar perfectly summed up the state of play right now during their discussion of the World Economic Forum's annual get-together: "Never before has the gap between Davos Man and the real world yawned so widely."

Read More »

Read More »

Swiss mortgage rates climb in 4th quarter

After reaching a historical low in the third quarter of 2016, rates started rising in the fourth quarter. Rate increases hit mortgage tenors of five and ten years. Compared to Q3, fixed mortgage rates on loans of ten years went up an average 0.2% to 1.62% according to price comparison website Comparis.ch.

Read More »

Read More »

How The West Has Been Selling Gold Into A Black Hole

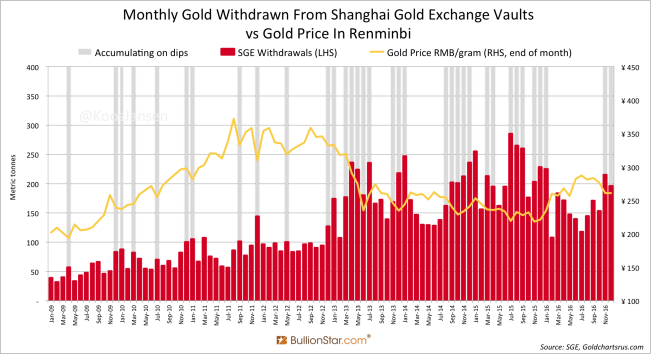

In December 2016 Chinese wholesale gold demand, measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), accounted for 196 tonnes, down 9 % from November. December was still a strong month for SGE withdrawals due to the fact the gold price trended lower before briefly spiking at the end of the month, and the Chinese prefer to buy gold when the price declines (see exhibit 1).

Read More »

Read More »

Cool Video: Bloomberg’s Daybreak – Dollar Correction

I was on Bloomberg's Daybreak: Americas today. The issue at hand was about the dollar's losses since the start of the year. I suggest that the correction actually began a day or so after the Federal Reserve hiked rates in mid-December. I noted that the correction was not just about the dollar but also interest rates.

Read More »

Read More »

Emerging Markets: What has Changed

Prime Minister Phuc said Vietnam will ease the limits on foreign ownership of banks this year. Russia’s government is working on measures to limit ruble volatility, including possible FX purchases. Turkey’s central bank start auctioning FX swaps to help support the lira. Brazil’s central bank resumed rolling over FX swaps. Brazilian Supreme Court Judge Zavascki was tragically killed in a plane accident. Chile’s central bank started the easing...

Read More »

Read More »

These Are The 3 Main Issues For Europe In 2017

What will the year ahead look like for Europe? 2017 will be another chapter in the European Union’s slow unraveling… a process that has been underway for over a decade. The EU is a union in name only. The transfer of sovereignty to Brussels was never total, and member states are independent countries… each with their own interests at stake.

Read More »

Read More »

FX Daily, January 20: Trump Day

The dollar peaked against the yuan two days after the Federal Reserve hiked interest rates in the middle of last month. We argue that that is when the market correction began, not at the turn of the calendar. Despite claims that China's currency is dropping like a rock, it has actually risen for the fifth consecutive week. That is the longest rising streak for the yuan since early 2016.

Read More »

Read More »

Great Graphic: Trade and Tariffs-End of an Era?

This Great Graphic was tweeted by the Financial Time's John Authers, who got it from @fathomcomment. The green line is the inversion of global trade (right-hand scale). The blue line is a trade-weighted average global tariff rate. What the chart shows is that since 1990, the decline in the average tariff coincided with an increase in trade (remember green line is inverted).

Read More »

Read More »

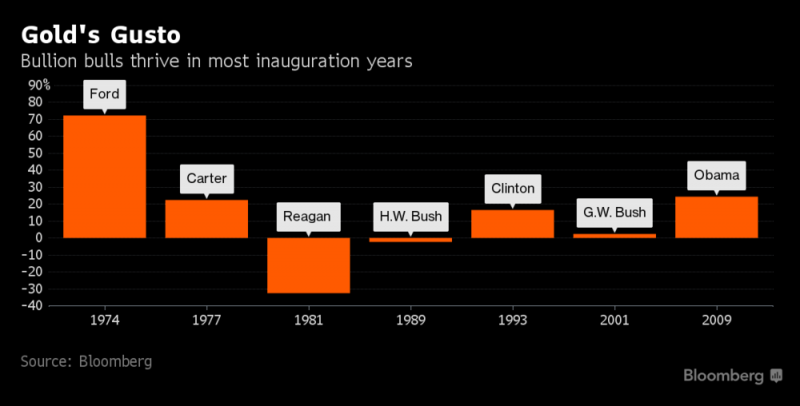

Gold’s average gains in inauguration years of 15 percent since 1974

Gold’s average gains in inauguration years of 15% since 1974. First year of new President frequently a time of increased uncertainties and risks. Gold rose 30% in the 12 months after Obama inauguration. Massive political uncertainty. President’s conflict with the CIA. ‘Strong dollar policy’ to end as U.S. has $120 trillion plus debt. Trump inherits Bush and Obama’s humongous debt.

Read More »

Read More »

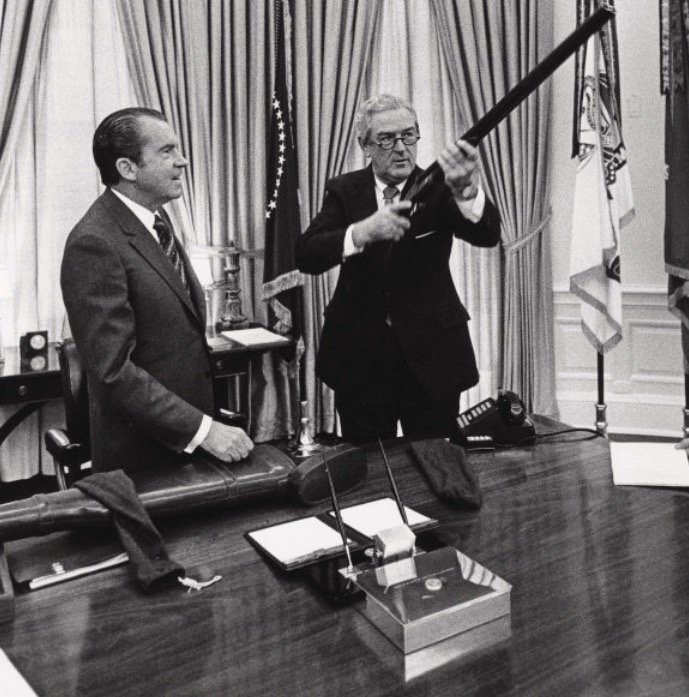

Declassified CIA Memos Reveal Probes Into Gold Market Manipulation

The CIA recently released a series of declassified 1970s memos relating to the gold market and the newly created SDR. These memos give new insight how the CIA viewed the gold market, the perceived manipulation of gold and the potential for the SDR to become a gold substitute in the international monetary system.

Read More »

Read More »

Donald and the Dollar

John Connally, President Nixon’s Secretary of the Treasury, once remarked to the consternation of Europe’s financial elites over America’s inflationary monetary policy, that the dollar “is our currency, but your problem.” Times have certainly changed and it now appears that the dollar has become an American problem.

Read More »

Read More »

Swiss Real Estate Focus 2017: Vacancy rates rising at the end of the real estate cycle

Record-breaking purchase prices and increased vacancy rates are making property investments a careful balancing act. Achieving full occupancy for an investment property now requires active space management and discounted rents – in every segment. Rents for investment properties are expected to fall this year, while house prices stagnate.

Read More »

Read More »

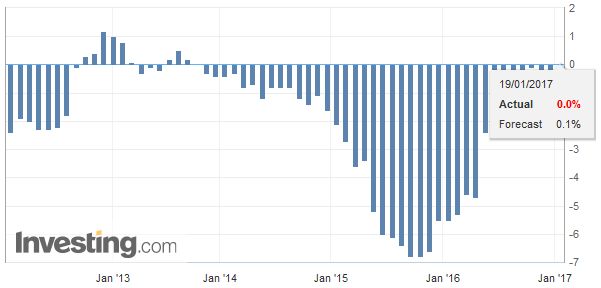

Swiss Producer and Import Price Index, December 2016: +0.2 percent MoM, -1.8 percent YoY

The Producer and Import Price Index rose in December 2016 by 0.2% compared with the previous month, reaching 100.0 points (December 2015=100). Inflation was 0.0% in comparison with December 2015. The average annualised inflation rate in 2016 was -1.8%. These are the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Draghi Lets Steam out of Euro

US reported stronger than expected series of data, including a large drop in weekly jobless claims for the week of the next NFP survey. Draghi remained dovish, with key phrases retained. Euro needs to break $1.0575 now to confirm a top is in place. Markets still uncertain ahead of the start of the new Administration.

Read More »

Read More »

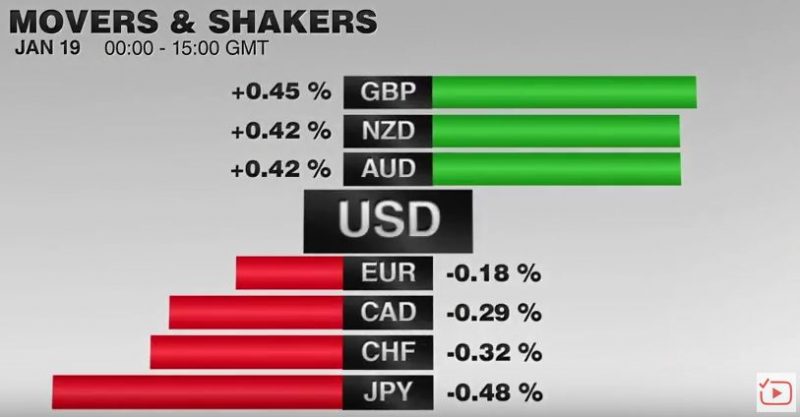

FX Daily, January 19: Dollar Gives Back Most of Yellen-Inspired Gains

While the US 10-year yield is unchanged, the dollar is consolidating its gains against the yen in a relatively narrow range of about half a big figure below JPY115.00. It has seen its gains pared more against the euro and sterling, where most of Yellen-inspired gains have been unwound. Sterling found support near $1.2250 and was bid up to $1.2335 by early in the European sessions.

Read More »

Read More »

Pension Funds Need Gold before It’s Too Late

Tens of millions of Americans and their employers pour money into pension plans each month, counting on those funds to grow and to be there when needed at retirement. But a time bomb awaits. The bulk of U.S. pension funds are dangerously underfunded, and the assets are often invested in securities that have bleak prospects for providing income that keeps up with a general decline in purchasing power.

Read More »

Read More »

Lagarde Urges Wealth Redistribution To Fight Populism

As we scoffed oveernight, who better than a handful of semi, and not so semi, billionaires - perplexed by the populist backlash of the past year - to sit down and discuss among each other how a "squeezed and Angry" middle-class should be fixed. And so it was this morning as IMF Managing Director Christine Lagarde, Italian Finance Minister Pier Carlo Padoan and Founder, Chairman and Co-CIO of Bridgewater Associates, Ray Dalio, espoused on what's...

Read More »

Read More »