Tag Archive: newslettersent

Draghi Does Nothing and Talks about It

Draghi confirms rate on hold and maintains easing bias. Growth risks are becoming more balanced. Inflation has yet to get on a sustained upward path.

Read More »

Read More »

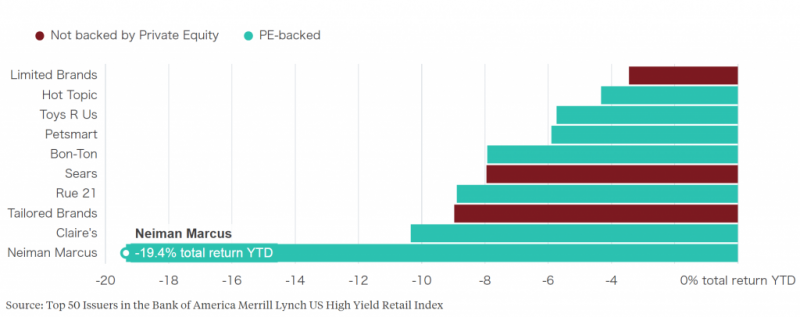

Cracks in Ponzi-Finance Land

Retail Debt Debacles

The retail sector has replaced the oil sector in a sense, and not in a good way. It is the sector that is most likely to see a large surge in bankruptcies this year. Junk bonds issued by retailers are performing dismally, and within the group the bonds of companies that were subject to leveraged buyouts by private equity firms seem to be doing the worst (a function of their outsized debt loads).

Read More »

Read More »

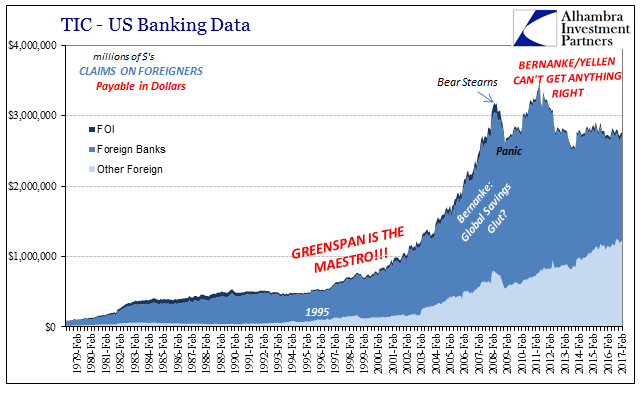

To The Asian ‘Dollar’, And Then What?

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property).

Read More »

Read More »

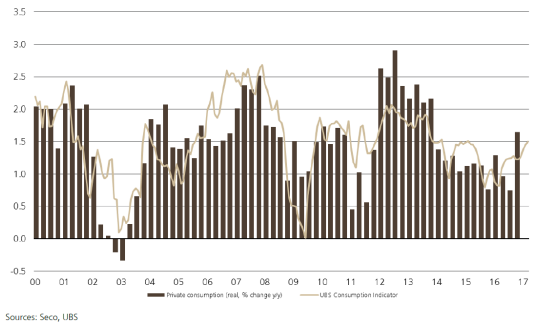

Switzerland UBS Consumption Indicator March: Problem child in retail

The UBS consumption indicator registered at 1.50 points in March, indicating private consumption growth around the long-term average. Solid automotive demand drove this figure. Domestic tourism, on the other hand, took a breather after a strong start in 2017. Pessimism still prevails in retail.

Read More »

Read More »

FX Daily, April 26: Dollar Stabilizes Ahead of Trump and ECB

The US dollar was marked down in response to the French election and saw some follow through selling yesterday, but the momentum had slowed, and now it is stalled. The greenback is posting upticks against nearly all the major currencies. There is a good reason to be cautious.

Read More »

Read More »

French Selection Ritual, Round Two

The nightmare of nightmares of the globalist elites and France’s political establishment has been avoided: as the polls had indicated, Emmanuel Macron and Marine Le Pen are moving on to the run-off election; Jean-Luc Mélenchon’s late surge in popularity did not suffice to make him a contender – it did however push the established Socialist Party deeper into the dustbin of history.

Read More »

Read More »

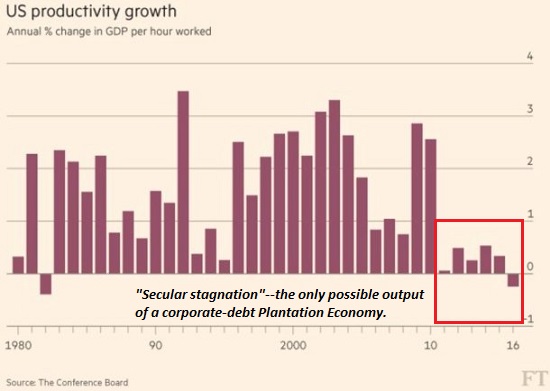

Our State-Corporate Plantation Economy

I have often discussed the manner in which the U.S. economy is a Plantation Economy, meaning it has a built-in financial hierarchy with corporations at the top dominating a vast populace of debt-serfs/ wage slaves with little functional freedom to escape the system's neofeudal bonds.

Read More »

Read More »

Weekly Speculative Positions (as April 18): CHF Position Stands at same Level

The net short CHF position stands at 13K contracts (against USD). In the CFTC reporting period ending April 21, speculators to significant positions in the euro, sterling and the Mexican peso. Bulls and bears were took more exposure in the euro and sterling, while in the peso the former added on while later sought cover.

Read More »

Read More »

Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we'll present the data and evidence that they've not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we're talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that are linked to them, as well...

Read More »

Read More »

FX Daily, April 25: Euro Consolidates Gains, Bond Market Sell-Off Continues

The US dollar is again at the fulcrum of the foreign exchange market. The dollar-bloc currencies are under pressure, along with the Japanese yen, while the European complex is posting modest gains. The euro is consolidating in the half cent below $1.09. Yesterday's marked up in early Asia saw the euro complete the 61.8% retracement of the losses since the US election, which was found near $1.0935

Read More »

Read More »

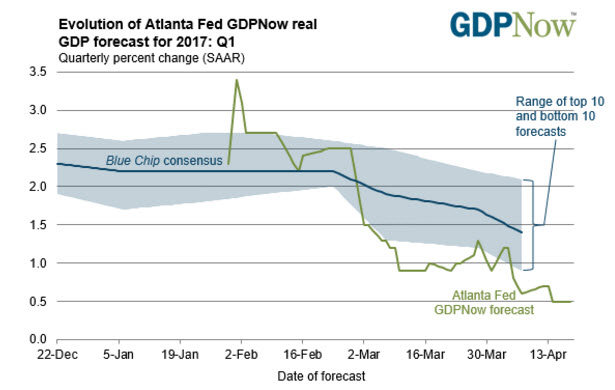

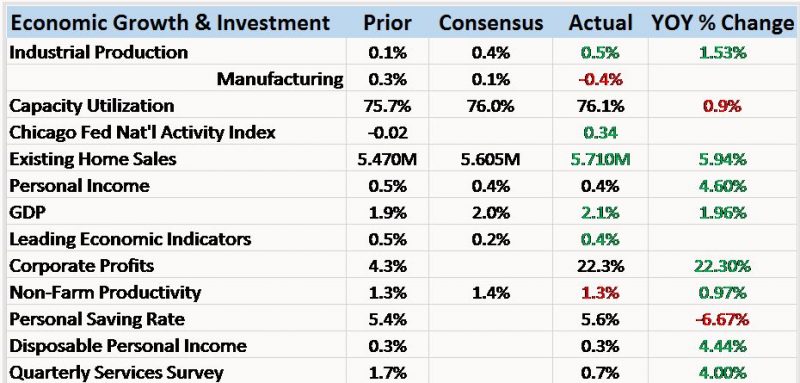

Bi-Weekly Economic Review

It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is about the art of the possible and that is proving a short list for now.

Read More »

Read More »

Gold Sovereigns – ‘Treasure’ Trove Found In UK – Don’t Be The Piano Owner

The gold sovereigns – semi-numismatic gold coins made up of both gold sovereigns and half gold sovereigns dating from the reigns of Victoria, Edward VII and George V – were discovered inside an old piano after it was donated to a school last year.

Read More »

Read More »

Euro gains against Swiss franc on French election result

The official French presidential election results place Emmanuel Macron (23.8%) and Marine Le Pen (21.5%) in first and second places in the first round of the French presidential race. The run off between these two will take place on 7 May 2017, when most forecasters expect Macron to win and become France’s next president.

Read More »

Read More »

FX Daily, April 24: Dramatic Response to French Election

The results of the first round of the French election spurred a dramatic response in the capital markets. Our thesis that there is no populist-nationalist wave sweeping the world is supported by the previous results in Austria, the Netherlands, and now France.

Read More »

Read More »

FX Weekly Preview: Politics and Economics in the Week Ahead

Provided Le Pen and Macron or Fillion make to the second round, the market response to the French election results may be short lived. BOJ, Riksbank and ECB meetings. Spending authorization and some announcement from the White House on tax policy are in focus as Trump's 100th day in office approaches.

Read More »

Read More »

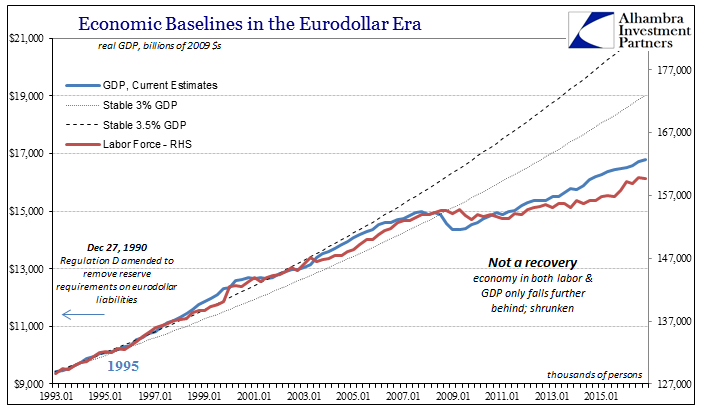

Money In America

In 1830, France was once more swept up in revolution, only this time at the end of it was installed one king to replace another. Louis-Phillipe became, in fact, France’s last king as a result of that July Revolution. The country was trying to make sense of its imperial past with the growing democratic sentiments of the 19th century.

Read More »

Read More »

Central Banks Have a $13 Trillion Problem

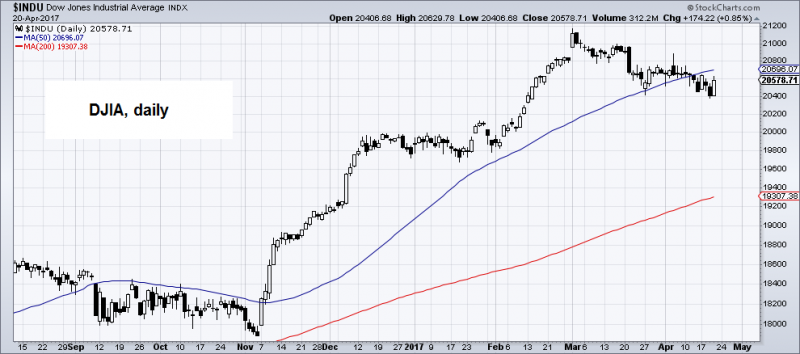

GUALFIN, ARGENTINA – The Dow was down 118 points on Wednesday. It should have been down a lot more. Of course, markets know more than we do. And maybe this market knows something that makes sense of these high prices. What we see are reasons to sell, not reasons to buy.

Read More »

Read More »

FX Weekly Review, April 17 – 22: Dollar Technicals Trying to Turn, but…

While the dollar index had another bad week with a 0.75% less, the Swiss Franc currency index could accumulate the corresponding gains. Main reason is that the EUR/CHF rose over 1.07.

Read More »

Read More »

Big bonuses contrast big losses at Credit Suisse, despite bonus haircuts

The management of Credit Suisse Credit Suisse reduced their bonuses by 40% after severe criticism from shareholders. The reduction amounts to around CHF 20 million. Some are still outraged. The group made a loss of CHF 2.7 billion in 2016 and one of CHF 2.9 billion in 2015.

Read More »

Read More »