Tag Archive: newslettersent

French Election – Bad Dream Intrusion

The French presidential election was temporarily relegated to the back-pages following the US strike on Syria, but a few days ago, the Economist Magazine returned to the topic, noting that a potential “nightmare option” has suddenly come into view. In recent months certainty had increased that once the election moved into its second round, it would be plain sailing for whichever establishment candidate Ms. Le Pen was going to face. That certainty...

Read More »

Read More »

More Thinking about Trade as Pence and Ross Head to Tokyo

Pence and Ross may "feel out" Abe for interest in a bilateral trade agreement. The US enjoys a small trade surplus with countries it has free-trade agreements. Ownership-based framework of the current account and value-added trade suggest the US trade imbalance is not a significant problem.

Read More »

Read More »

The Left’s Descent to Fascism

The Left is morally and fiscally bankrupt, devoid of coherent solutions, and corrupted by its embrace of the Corporatocracy. History often surprises us with unexpected ironies. For the past century, the slide to fascism could be found on the Right (conservative, populist, nationalist political parties).

Read More »

Read More »

FX Daily, April 18: US Dollar Consolidates Yesterday’s Gains

The US dollar is consolidating the gains scored late in the US session yesterday in response to a Financial Times interview with US Treasury Secretary Munchin who seemed to play down the strategic importance of Trump's recent complaint about the greenback's strength.

Read More »

Read More »

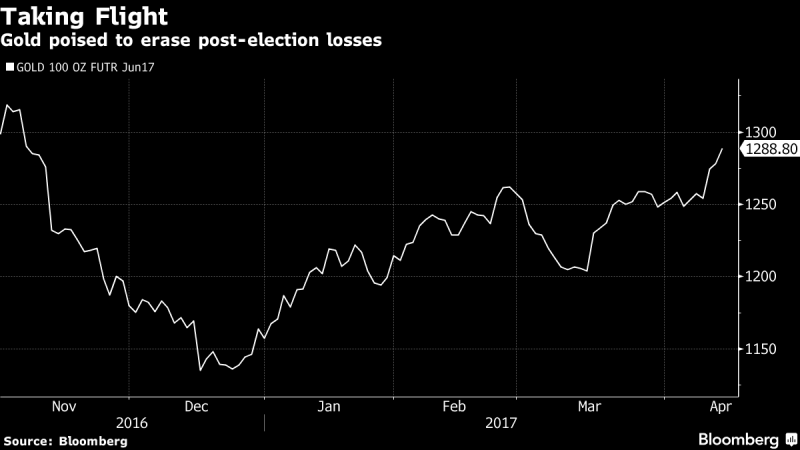

Gold Bullion Erases Post- Election Fall as Trump Wrong on Dollar – Daily Prophet

President Donald Trump sent currency markets into a tizzy late Wednesday when he signaled his preference for a weaker dollar. “I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me,” Trump told the Wall Street Journal.

Read More »

Read More »

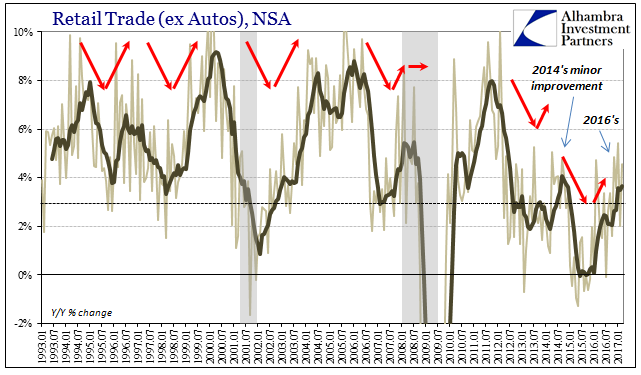

The Expanded Retail Sales Gap

Retail sales growth in February 2017 was going to be low by virtue of its comparison to February 2016 and the extra day in that month. The Census Bureau’s autoregressive models are supposed to normalize just these kinds of calendar irregularities so that we can make something close to apples to apples comparisons. The seasonally-adjusted estimate for February, however, was calculated to be less than the one for January 2017, therefore suggesting...

Read More »

Read More »

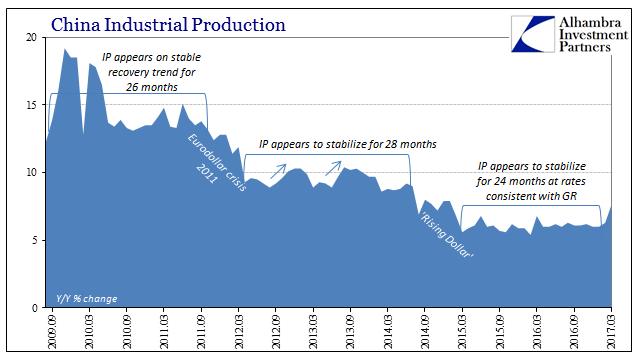

Assessing China’s Economic Risks

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful.

Read More »

Read More »

Hell To Pay

Economic nonsense comes a dime a dozen. For example, Federal Reserve Chair Janet Yellen “think(s) we have a healthy economy now.” She even told the University of Michigan’s Ford School of Public Policy so earlier this week. Does she know what she’s talking about?

Read More »

Read More »

FX Daily, April 17: Markets Trying to Stabilize in Holiday-Thin Activity

Financial centers in Europe are closed for the extended Easter holiday. Australian and New Zealand markets were also closed. The drop in US 10-year Treasury yields in early Asia, with a brief push below 2.20%, appears to have kept the dollar under pressure. As the North American market prepares to open, the dollar is softer against the all major currencies and many emerging market currencies.

Read More »

Read More »

Death Spiral for the LBMA Gold and Silver auctions?

In a bizarre series of events that have had limited coverage but which are sure to have far-reaching consequences for benchmark pricing in the precious metals markets, the LBMA Gold Price and LBMA Silver Price auctions both experienced embarrassing trading glitches over consecutive trading days on Monday 10 April and Tuesday 11 April. At the outset, its worth remembering that both of these London-based benchmarks are Regulated Benchmarks, regulated...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mostly firmer last week, helped by Trump comments and softer US data. Whilst this seems positive for EM, the global backdrop remains uncertain. Some in EM (Russia, Turkey, and Korea) remain vulnerable to geopolitical concerns. In addition, idiosyncratic domestic political risks remain in play for other EM countries, such as Brazil, South Africa, and Turkey. We expect the investment climate for EM to remain challenging this week.

Read More »

Read More »

Monetary Policy is Important, but US Fiscal Stance Moving Center Stage

Monetary policy is off the table for at least the next two months. Several fiscal issues are coming to a head. Despite the GOP majority in Congress and White House, brinkmanship cannot be ruled out.

Read More »

Read More »

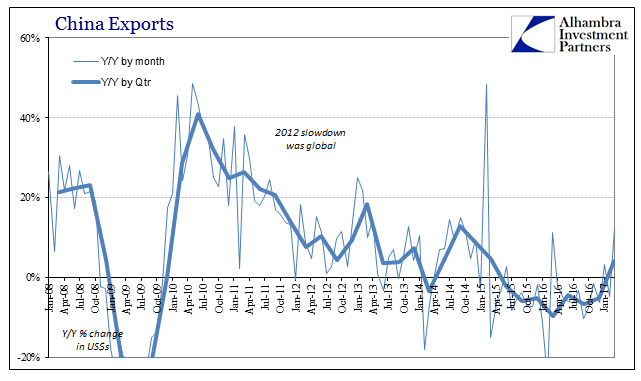

What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency.

Read More »

Read More »

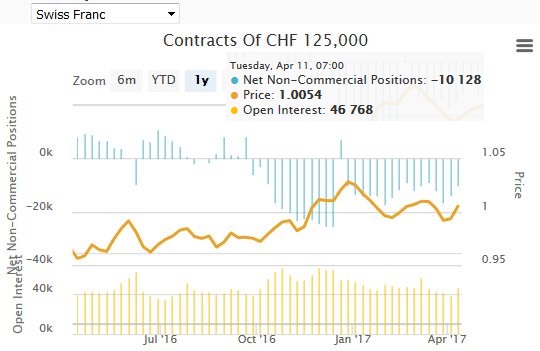

Weekly Speculative Positions (as of April 11): Adding To Foreign Currency Exposure Before Trump’s Talk

The net short CHF position has fallen to 10K contracts (against USD). In the days before US President Trump expressed concern about the dollar's exchange value, speculators in the futures market mostly added to the gross long foreign currency positions.

Read More »

Read More »

Emerging Markets: What has Changed

Malaysia’s central bank said it will allow investors to fully hedge their currency exposure. Egypt declared a 3-month state of emergency after two deadly church attacks. South Africa’s parliamentary no confidence vote has been delayed. Argentina central bank surprised markets with a 150 bp hike to 26.25%. Brazil central bank accelerated the easing cycle with a 100 bp cut in the Selic rate.

Read More »

Read More »

FX Weekly Preview: What to Watch in the Week Ahead

Many observers misunderstood US President Trump's "American First" rhetoric. Trump's earlier writings show that this is not a reference to the 1940s effort to keep the US out of WWII, with its isolationist tint. Rather, Trump's use goes back to the original use by President Harding in the 1920s. It was a rejection of the Wilsonian multilateralism (e.g. League of Nations) and a robust defense of unilateralism.

Read More »

Read More »

FX Weekly Review, April 10-14: Swiss Franc loses against the Yen, but wins against Dollar

Last week the Swiss Franc improved against both euro and dollar, but - compared to its safe-haven counterpart Japanese Yen - it had a bad performance. We expect strong SNB interventions.

Read More »

Read More »

Decoupling of Oil and US Interest Rates

US yields have trended lower as oil prices have trended higher. The correlation between the 10-year breakeven and oil has also weakened considerably. Technicals readings are getting stretched, but no compelling sign of a top.

Read More »

Read More »

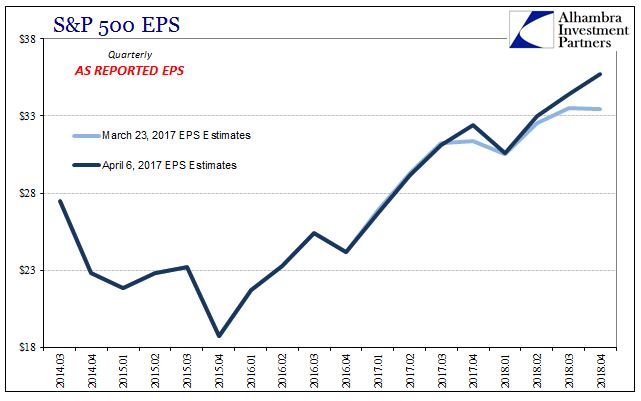

Earnings per Share: Is It Other Than Madness?

As earnings season begins for Q1 2017 reports, there isn’t much change in analysts’ estimates for S&P 500 companies for that quarter. The latest figures from S&P shows expected earnings (as reported) of $26.70 in Q1, as compared to $26.87 two weeks ago. That is down only $1 from October, which is actually pretty steady particularly when compared to Q4 2016 estimates that over the same time plummeted from $29.04 to $24.16. At $26.70, that would...

Read More »

Read More »

Perth Mint Silver Bullion Sales Rise 43 percent In March

Perth Mint’s silver bullion sales rise 43% in March. Perth Mint’s monthly gold coin, bars sales fall 12%. Gold silver ratio of 32 – 32 times more silver ounces sold. Gold: 22,232 oz and Silver: 716,283 oz – bullion coins and minted bars sold. Gold is 2.6% higher and silver surged 3.1% in the shortened week with markets closed for Good Friday tomorrow.

Read More »

Read More »