The “Nightmare Option”The French presidential election was temporarily relegated to the back-pages following the US strike on Syria, but a few days ago, the Economist Magazine returned to the topic, noting that a potential “nightmare option” has suddenly come into view. In recent months certainty had increased that once the election moved into its second round, it would be plain sailing for whichever establishment candidate Ms. Le Pen was going to face. That certainty has been shaken quite a bit lately. |

The four front-runners in the first round election, from left to right: François Fillon, Emmanuel Macron, Jean-Luc Mélenchon, Marine Le Pen. That’s right, Mr. Mélenchon, a.k.a. the “French Hugo Chavez” has actually become a serious contender. If you want to know how abysmally bad his economic program is, just consider that Thomas Piketty supports him. Photo credit: Patrick Kovarik / AFP - Click to enlarge |

| Apparently French voters were greatly impressed by far-left candidate Jean-Luc Mélenchon, who on occasion of the second televised debate once again proved his ability to out-gab his competitors. Voters already took note of him as a master of witty repartee and cutting verbal jabs in March, which promptly sent the poll results of his ideologically closest opponent, socialist candidate Benoît Hamon, into a death spiral. In the debate in early April Mélenchon reportedly outdid himself.

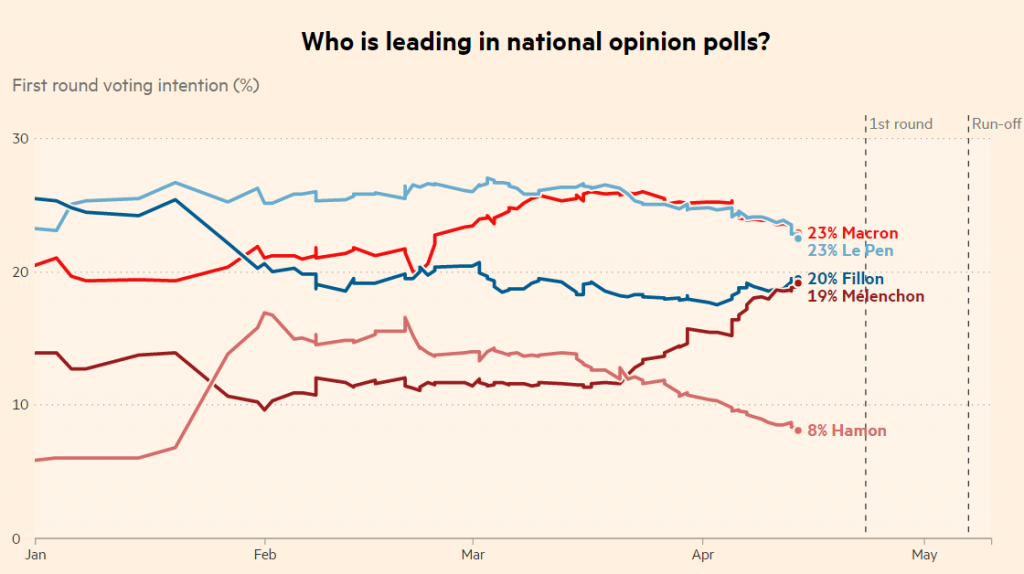

It seems Mélenchon has taken support from everyone – with the noteworthy exception of the scandal-ridden conservative candidate François Fillon of all people. The latter is slightly gaining in the polls as well, after he decided he wouldn’t let a little corruption scandal get in the way of his presidential ambitions. A chart showing first round voter intentions according to the latest opinion polls illustrates the stunning effect of Mélenchon’s debate performance: |

First Round Voting Intention, Jan 2017 - May 2017 |

| In view of the fact that Venezuela is currently spiraling down the proverbial economic toilet after many years of socialist mismanagement, it is quite astonishing that all it took for Mr. “French Hugo Chavez” to garner that much support was his sharp tongue coupled with a bunch of completely absurd and clearly unaffordable promises.

With Mélenchon at 19%, Fillon at 20%, and Macron and Le Pen at 23% each, anything is now possible, as they are all within the known margin of error of French opinion polls. The so-called “nightmare option” would of course consist of Le Pen and Mélenchon making it to the run-off election. That is still not the most likely outcome, but it has at least become possible. All it would take is a major misstep by Mr. Macron in the final days before the election. As an aside, he has never been elected to office and his party is just a few months old. It seems at least possible to us that both his and Le Pen’s poll results are distorted by the “Bradley effect” – i.e., by the fact that some voters are not revealing their true intentions in surveys, because they fear they might be seen as violating social acceptability norms. Recall that this is precisely what happened in the polls trying to gauge voter support for Donald Trump and Hillary Clinton. The lesson is that if one fosters a climate of fear in order to enforce political correctness, one ceases to get truthful replies in voter surveys (the effect is a bit similar to what happens if one attempts to elicit truthful information by means of torture). |

France Unemployment Rate, 2008 - 2017 |

| It is widely held that Le Pen would lose against any of her putative opponents if she makes it to round two – including Mélenchon. Of course, if he is her opponent, that probably won’t matter much from the perspective of market participants (or the European elites for that matter), since neither Le Pen nor Mélenchon can be accused of being europhiles. France’s continued membership in the EU and the common currency would become doubtful under either of them – even though they would face a great many practical obstacles in implementing their agenda.

We believe not even a match-up between Le Pen and one of the “moderate” candidates in the run-off would be a slam dunk; a week ago, 40% of French voters still said they remained undecided regarding their second round voting intentions and the “Bradley effect” would remain an important consideration. |

|

Mild Market ConcernsA number of financial market indicators reflect these recent developments, but all in all we would term these expressions of concern as rather mild. Here is a chart of the spread between 2 year German and French government note yields – it has certainly increased quite a bit lately, along with Mr. Mélenchon’s poll numbers, but it is still a far cry from the panic levels seen at the height of the sovereign debt crisis in late 2011. Moreover, the spread doesn’t show that French 2 year note yields remain at minus 33 bps, even though that is up quite a bit from their low of minus 71 bps in late 2016. |

France and Germany - 2 Year Bond Yield, 2012 - 2017 |

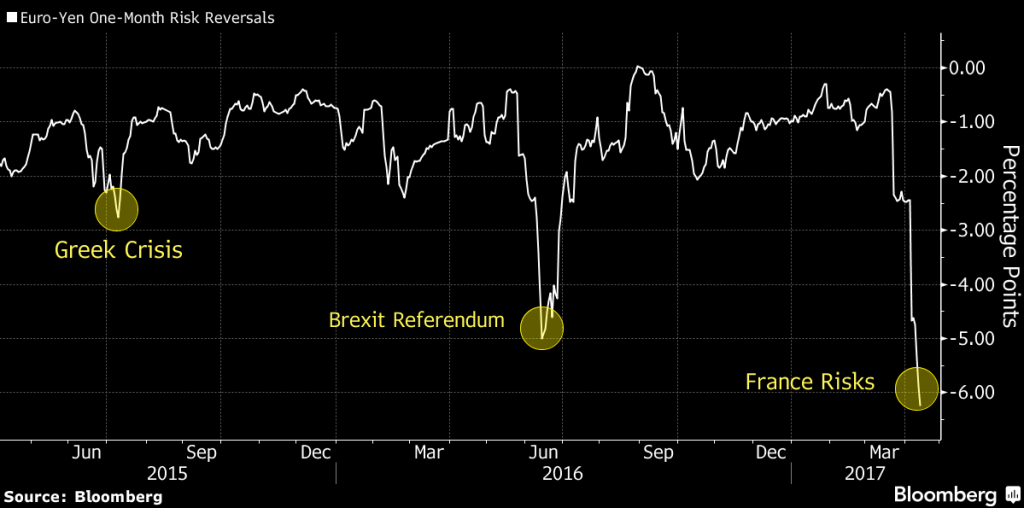

| CDS spreads on French debt are about 38 bps above German ones, which is noticeable, but not overly so. Concern is visible in currency options as well, such as those on EUR-JPY. The chart below depicts the change in the prices of one-month calls on EUR vs. JPY vs. the prices of equidistant puts. This is a reminder that the French election could potentially move the euro quite a bit, although experience indicates that betting against such large “risk reversals” is normally more likely to be profitable: |

Euro Yen Risk Reversal, Jun 2015 - April 2017 |

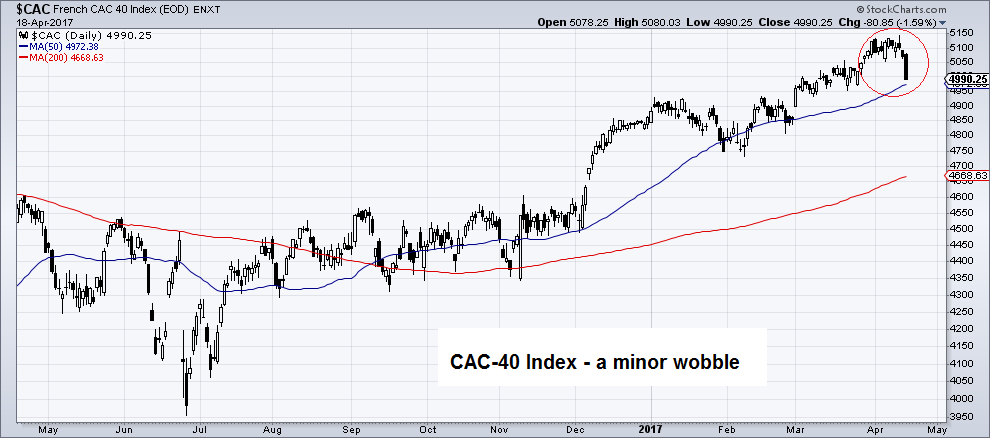

| The French stock market has been quite serene until very recently, and the decline over the past week may well have been inspired by weakness on Wall Street rather than election worries:

It is a good bet that any pairing of second-round candidates that is not named Le Pen – Mélenchon will be greeted with relief in the markets, i.e., a stronger euro, a rebound in French government debt and a contraction in assorted volatility premiums in European markets. On the other hand, if Le Pen and Mélenchon both make it to the run-off, all hell is likely to break loose in the short term. Then it will be time to consider to what extent they can impose their agenda in practice, and it seems quite certain that the National Assembly will be able and willing to sabotage them at every turn (Le Pen more so than Mélenchon, but he will also have difficulty finding support for most of his ideas). Trump has it a lot easier, and even he is so far not succeeding in getting legislators to unite behind him. |

France CAC 40 Index, May 2016 - 2017 |

Conclusion – Best not to Make AssumptionsSimilar to previous well-telegraphed potential threats to the system’s status quo, the election in France is likely to reward very nimble traders (and those making the correct guesses beforehand), but we would warn against smugly assuming that nothing unexpected can possibly happen. If the pairing of Le Pen and Mélenchon ends up moving on to the second round, the market response will likely be a lot more pronounced than on occasion of the Brexit, since France is the European core nation apart from Germany. It is probably fair to say that there is no EU without France. The markets will likely be relieved in the short term if either Le Pen or Mélenchon faces Macron in the second round and somewhat more nervous if one of them faces Fillon – who could easily get pole-axed by his still simmering scandal, which is currently under official investigation. We would nevertheless recommend to remain extremely wary if e.g. Le Pen is paired off with Macron, even though surveys indicate that the latter would have a 60:40 lead over her in the run-off. Establishment golden boy Macron enjoys the support of the media, but he has even less of a political power-base than Le Pen or Mélenchon. With a large percentage of undecided voters, a presumably quite energized political base in the “populist” camps and considering the Bradley effect, fate could well serve up another unexpected curve ball. When Geert Wilders “lost” by gaining 33% more seats in the Dutch election than in 2012, assorted Eurocrats and the European press were unanimous in asserting that the momentum of populist movements was broken. We are not so sure about that, even though it looked at one point in 2016 as though Wilders would win the election outright. |

Dutch Election Outcome, Nov 2016 - April 2017 |

| In this case an unexpected opportunity presented itself to the incumbent Mr. Rutte, which allowed him to demonstrate to the electorate that he was just as capable as Mr. Wilders in facing down unwanted Mussulmans intruding on Dutch territory. It was provided by the one Muslim Europeans are at the moment officially allowed to hate, Turkey’s rather thin-skinned president Recep Tayyip Erdoğan (henceforth probably president for life).

As we noted in Affairs of State, Mr. Erdoğan is a man entirely bereft of humor, possesses the diplomatic tact of a bull in a china shop, and simply cannot stop himself from incessantly farting in church, to stay with the metaphors. His attempts to hold political rallies to advertise a controversial referendum that has just established him as the capo di tutt’i capi of Turkey to his countrymen living in Western Europe were strongly resisted by European governments. The opportunity to do the same probably saved Mr. Rutte, who finally got a chance to let his inner Wilders hang out. That said, analogous to Wilders, Ms. Le Pen has recently also lost a bit of support (to the extent that the polls can be believed), and if she gets through to the second round, it does seem likely that she will lose regardless of who her opponent is going to be. Insofar the first round is probably the more momentous occasion, given the potential that it will result in a Le Pen – Mélenchon pairing. Still, what happened to Mr. Rutte – namely that his odds of winning the election vastly improved by means of a timely coincidence – could conceivably also happen in some form to Ms. Le Pen before the run-off election. |

France 2 Year Government Note Yield, May 2015 - April 2017 |

Charts by: Financial Times, TradingEconomics, Bloomberg, StockCharts, Economist, BigCharts

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,On Politics