Tag Archive: newslettersent

Simple Math of Bank Horse-Puckey

We stepped out on our front stoop Wednesday morning and paused to take it all in. The sky was at its darkest hour just before dawn. The air was crisp. There was a soft coastal fog. The faint light of several stars that likely burned out millennia ago danced just above the glow of the street lights.

Read More »

Read More »

Marx, Orwell and State-Cartel Socialism

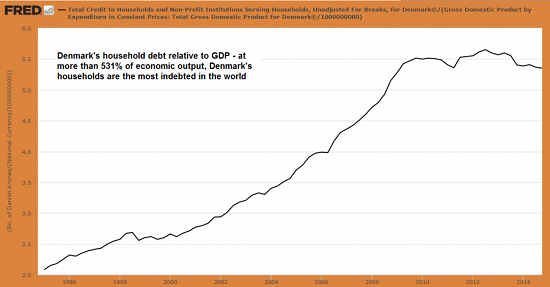

When "socialist" states have to impose finance-capital extremes that even exceed the financialization of nominally capitalist economies, it gives the lie to their claims of "socialism." OK, so our collective eyes start glazing over when we see Marx and Orwell in the subject line, but refill your beverage and stay with me on this.

Read More »

Read More »

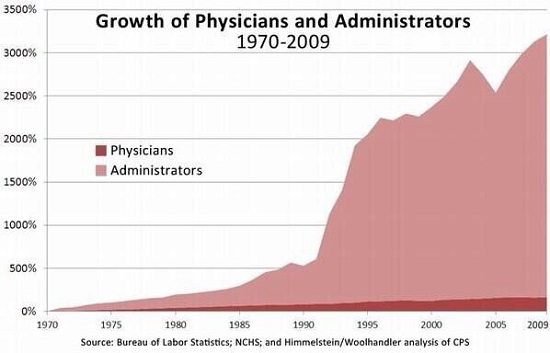

Our Intellectual Bankruptcy: The “Religion” of Economics, UBI and Medicare For All

1. Mainstream neo-classical/ Keynesian economics. As economist Manfred Max-Neef notes in this interview, neo-classical/ Keynesian economics is no longer a discipline or a science--it is a religion. It demands a peculiar faith in nonsense: for example, the environment--Nature-- is merely a subset of the economy.

Read More »

Read More »

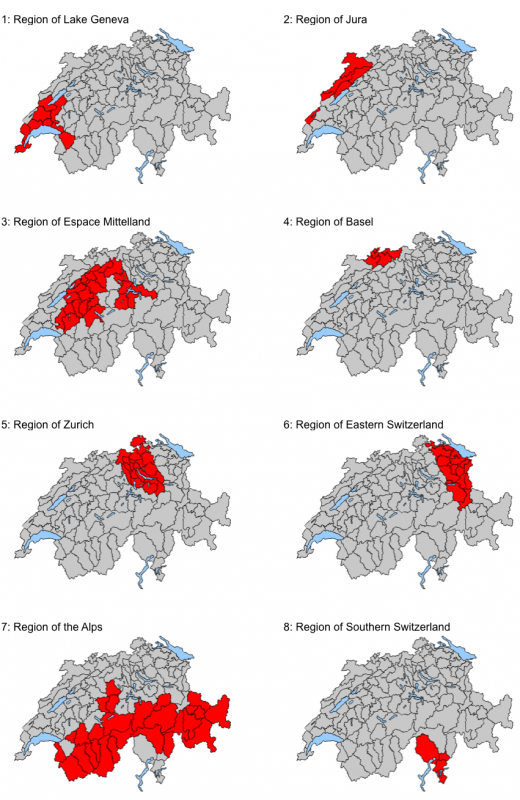

Swiss employers continue to discriminate against over 50s

Travail Suisse, an association representing Swiss employees, highlights once more the age discrimination faced by those over 50 in the Swiss job market. In March 2017, 26.8% of unemployed in the this age group had been without work for more than a year, compared to 2.3% of those between 15 and 24 and 14.1% of those aged 25 to 49.

Read More »

Read More »

State of Dollar Bull Market

The dollar market is intact, despite the pullback here at the start of 2017. We have seen similar pullbacks in 2016 and 2015. Divergence remains the key driver.

Read More »

Read More »

Silver, Platinum and Palladium as Investments – Research Shows Diversification Benefits

Silver, platinum and palladium see increased role as investment vehicles. Increase in academic output on the white precious metals is in line with this. Silver and particularly gold are safe haven assets. Silver was a safe haven at times during which gold failed to be. Platinum and palladium less so but have diversification benefits.

Read More »

Read More »

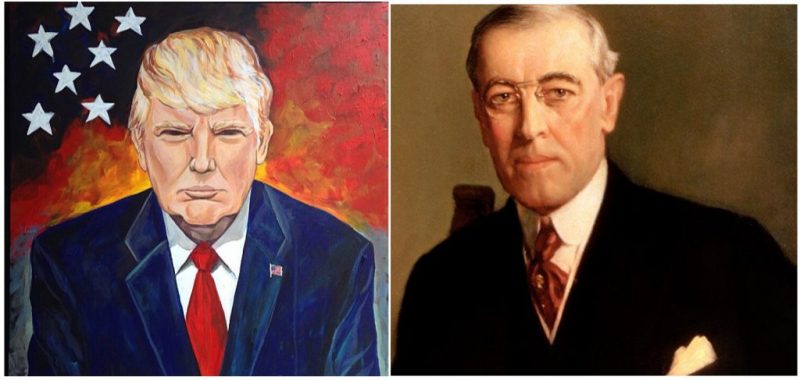

On the Commemoration of World War I: From Woodrow Wilson to Donald Trump

It is altogether fitting that the US attack on a Syrian airport, the dropping of a MOAB on defenseless Afghanistan, and the potential outbreak of nuclear war with North Korea have all come in the very month in which an American president led the nation on its road to empire one hundred years earlier.

Read More »

Read More »

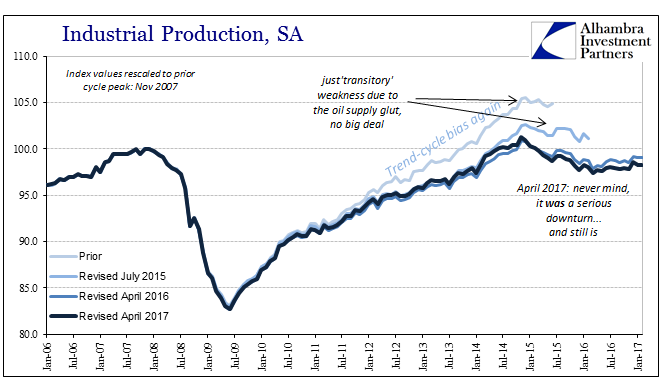

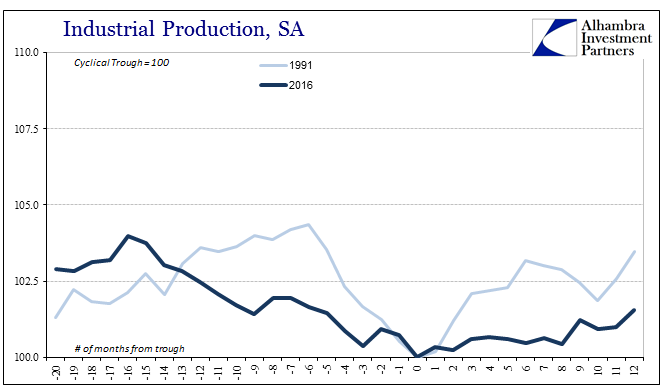

New Patterns of Disturbance

Having finally established that the economy of the “rising dollar” was appreciably worse than first estimated, we can turn our attention back toward figuring out what that means for the near future and beyond. According to the latest estimates for Industrial Production, growth has returned but in the same weird asymmetric sort of way that is actually common for the past decade. Year-over-year IP expanded by 1.5% in March 2017, the highest growth...

Read More »

Read More »

Close to a fifth of Swiss workers think corruption widespread, says survey

A survey conducted by the advisory firm EY shows a rise in perceived corruption in the workplace in Switzerland. 18% of workers surveyed by the firm in Switzerland now think bribery and corruption are widespread in the country. While high this figure is well below the 33% average for Western Europe and the 51% average across all of the 41 countries in Europe, Africa, the Middle East and India that the survey covered.

Read More »

Read More »

FX Daily, April 21: Markets Enter Consolidative Mode Ahead of Weekend

Neither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen's hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has narrowed, and gold is flat. UK retail sales fell sharply, yet sterling is holding on to the bulk of this week's gains, which are the most here in 2017.

Read More »

Read More »

Trump To “Bully” Fed Into Printing Money – Negative for Stocks, Positive for Gold

David McWilliams has written an interesting article in which he puts forward the case that Trump is likely to turn on the “enemy within,” the Federal Reserve and bully them into “printing money.” He points out that this was seen in 1971 when Nixon bullied the Fed into printing and debasing the dollar. McWilliams says this would be bad for stocks markets which would fall in value as was seen in the 1970s.

Read More »

Read More »

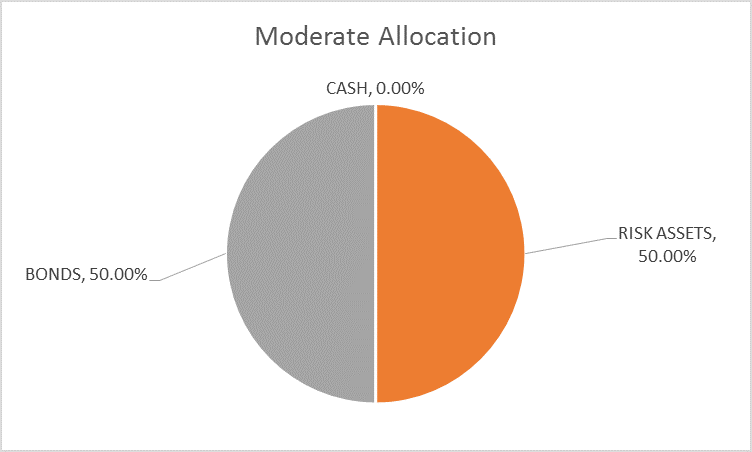

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50.

The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but unfortunately for the new...

Read More »

Read More »

India – Is Kashmir Gone?

Everything Gets Worse (Part XII) – Pakistan vs. India After 70 years of so-called independence, one has to be a professional victim not to look within oneself for the reasons for starvation, unnatural deaths, utter backwardness, drudgery, disease, and misery in India.

Read More »

Read More »

Switzerland at IMF and World Bank 2017 Spring Meetings in Washington, D.C.

Federal Councillor Ueli Maurer as Head of the Swiss delegation, Federal Councillor Johann N. Schneider-Ammann and Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, will take part in the joint Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington, D.C., from 21 to 23 April 2017. Prior to these meetings, Federal Councillor Ueli Maurer will represent Switzerland at the meeting of G20...

Read More »

Read More »

FX Daily, April 20: Dollar and Yen Push Lower

With the exception of the yen, the US dollar is lower against all the major currencies. US Treasury yields are firm, extending yesterday's rise a little. This may help keep the dollar straddling JPY109, but unwinding long yen cross positions is helping underpin the other major currencies. The Dollar Index is making a new low for the week and appears poised to test support around 98.85-99..00.

Read More »

Read More »

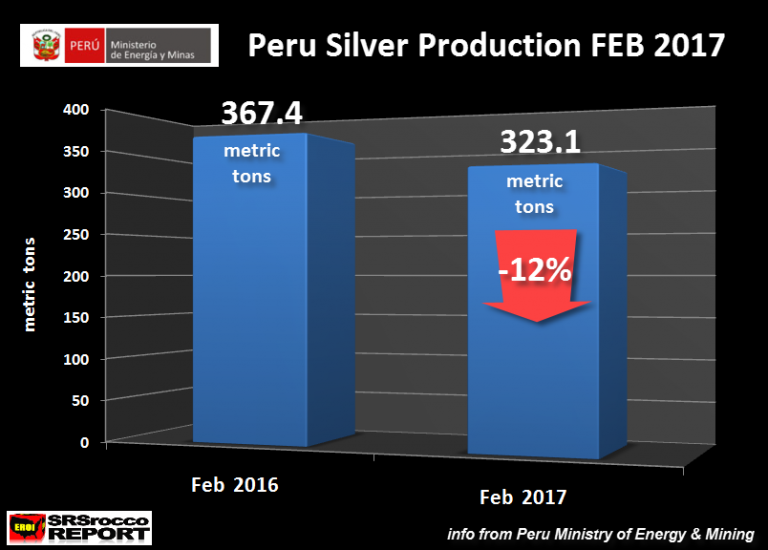

Silver Production Has “Huge Decline” In 2nd Largest Producer Peru

Silver production sees “huge decline” in Peru. Production -12% in one month in 2nd largest producer. Silver decline is due to ‘exhaustion of reserves’ in Peru. GFMS recognise that ‘Peak Silver’ was reached in 2015. Global silver market had large net supply deficit in 2016. Silver rallied 13.5% in Q1 in 2017. Base metal production accounts for 56% of silver mining.

Read More »

Read More »

May’s Early Election Bid Sends Sterling on Roller Coaster

May calls snap election for June 8. Tories running 20 percent point lead over Labour. Next election would be in 2022, after the Brexit negotiations conclude.

Read More »

Read More »

Now You Tell Us

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions.

Read More »

Read More »

Fall in Swiss property prices accelerates

Over the year ending 31 March 2017, apartment prices across Switzerland dropped by 6.8%, according to a property price report published by the Zurich-based research and consulting firm Fahrländer Partner FPRE.

Read More »

Read More »

.jpg)