Tag Archive: newslettersent

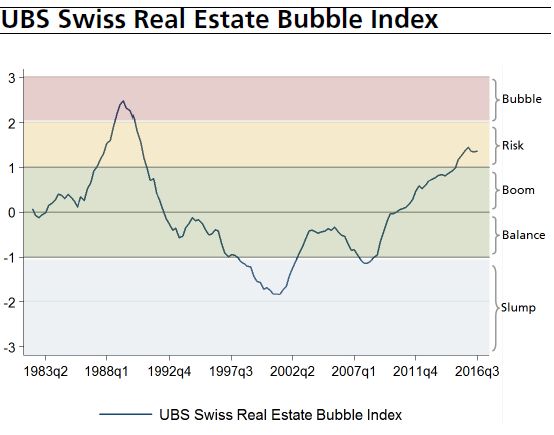

Swiss real estate market UBS Swiss Real Estate Bubble Index Q1 2017

The UBS Swiss Real Estate Bubble Index remained in the risk zone at 1.39 points in the first quarter of 2017 following a moderate increase. The increase in home prices outpaced the increase in rents and income. Demand for buy-to-let investments also rose, in spite of heightened market risks.

Read More »

Read More »

FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting.

Read More »

Read More »

Central Banks’ Obsession with Price Stability Leads to Economic Instability

For most economists the key factor that sets the foundation for healthy economic fundamentals is a stable price level as depicted by the consumer price index. According to this way of thinking, a stable price level doesn’t obscure the visibility of the relative changes in the prices of goods and services, and enables businesses to see clearly market signals that are conveyed by the relative changes in the prices of goods and services.

Read More »

Read More »

Gefühlskältester Event des Jahres: Die GV der grössten Zockerin aller Zeiten

Wie jedes Jahr fand auch diese letzte Aprilwoche der wohl gefühlskälteste Grossanlass der Schweiz statt: die Generalversammlung der Schweizerischen Nationalbank (SNB) im alten Casino in Bern. Der Ort „altes Casino“ hätte nicht treffender gewählt sein können von der grössten Zockerin aller Zeiten.

Read More »

Read More »

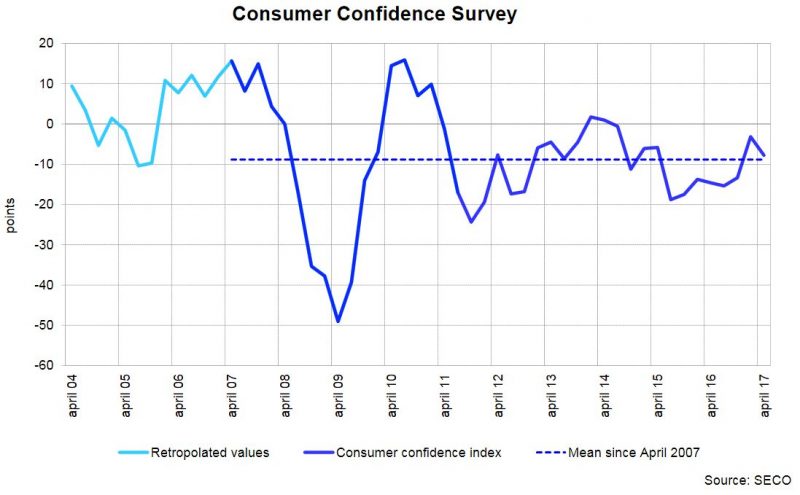

Consumer Sentiment Stands Near its Average

With an index value of -8 points, Swiss consumer sentiment in April 2017 is virtually at its long-term average, having been slightly more optimistic in January (-3 points). While expectations for overall economic developments are above average in April, they are less positive than they were in January.

Read More »

Read More »

FX Daily, May 04: Greenback Struggles to Sustain Upticks, Though Odds of June Hike Rise

The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation estimates the market is discounting around 70%-75% chance of a hike.

Read More »

Read More »

What is the Bank of Japan to Do?

Policy is on hold. There is several areas which the BOJ can adjust its forecast or forward guidance. BOJ is more likely to err on the side of caution.

Read More »

Read More »

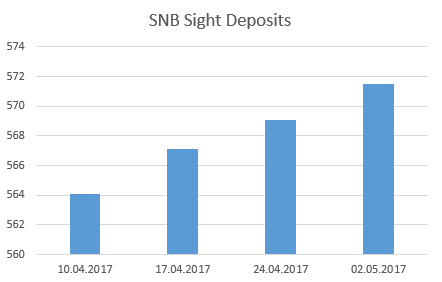

Weekly SNB Interventions and Speculative Positions: Interventions despite Positive Outcome in France

The centre-left politician Macron has won the French elections. He is a politician that - similar to Hollande four years ago - promises economic improvements, move investment, more jobs. Mostly probably he will fail similar to Hollande. His success moved the EUR/CHF up to 1.0865, mostly caused by FX speculators, but the SNB had to intervene.

Read More »

Read More »

FX Daily, May 03: Marking Time

The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact on the broader investment climate.

Read More »

Read More »

Euro Drivers

Correlation between the change in the US-German two-year differential and euro remains robust. The German two-year yield has jumped in recent weeks but looks poised to slip back lower. US two-year yield has eased but is knocking on 1.30%, an important level.

Read More »

Read More »

Clickbait: Bernanke Terrifies Stock Investors, Again

If you are a stock investor, you should be terrified. The most disconcerting words have been uttered by the one person capable of changing the whole dynamic. After spending so many years trying to recreate the magic of the “maestro”, Ben Bernanke in retirement is still at it.

Read More »

Read More »

FX Daily, May 02: Dollar and Yen Heavy, Equities Trade Higher and Bonds Lower

The US dollar is sporting a softer profile against most of the major and emerging market currencies. The Japanese yen is the main exception. The greenback is rising against the yen for the fourth session and the sixth of the past seven. The dollar's gains against the yen coincide with the 10-12 bp recovery in the US 10-year yields over the past ten sessions.

Read More »

Read More »

New Swiss company tax reform plan well received in Brussels

The Swiss government’s company tax reform plans have been reborn after the last plan met with defeat in a popular vote on 12 February 2017. The new plan, dubbed “Tax proposal 17”, aims to avoid issues that bedeviled the last project.

Read More »

Read More »

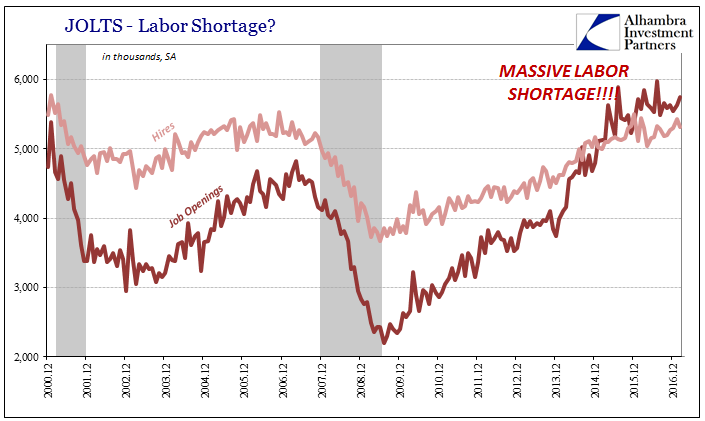

Defining Labor Economics

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to give those relationships some...

Read More »

Read More »

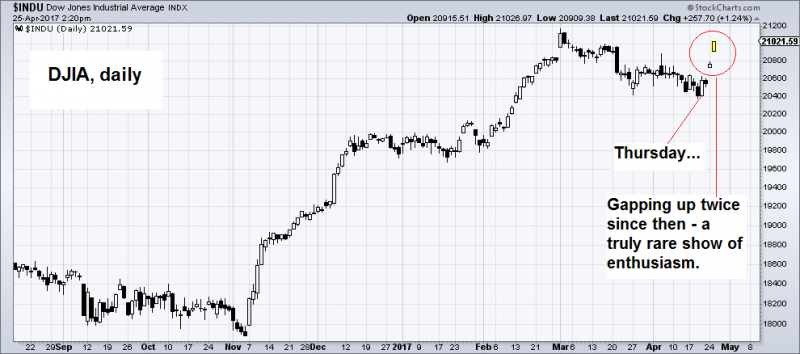

The Fed Will Blink

GUALFIN, ARGENTINA – The Dow rose 174 points on Thursday. And Treasury Secretary Steve Mnuchin said we’d have a new tax system by the end of the year. Animal spirits were restless. But which animals? Dumb oxes? Or wily foxes? Probably both.

Read More »

Read More »

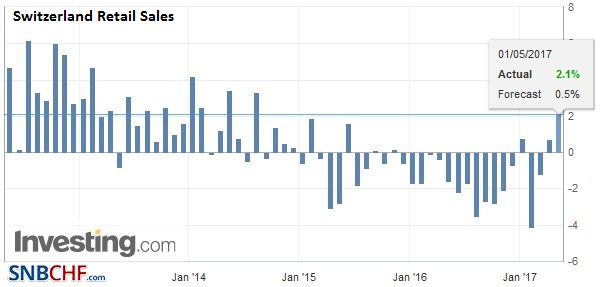

Swiss Retail Sales, March: +1.8 percent Nominal and +0.7 percent Real

Turnover in the retail sector rose by 1.8% in nominal terms in March 2017 compared with the previous year. This is the sharpest increase since June 2014. Seasonally adjusted, nominal turnover rose by 0.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, May 01: May Day Calm

Many financial centers are closed for May. Japanese markets were open today, but will be closed for three sessions beginning Wednesday for the Golden Week celebrations. The US dollar is narrowly mixed.

Read More »

Read More »