Fixation on the Consumer Price IndexFor most economists the key factor that sets the foundation for healthy economic fundamentals is a stable price level as depicted by the consumer price index. According to this way of thinking, a stable price level doesn’t obscure the visibility of the relative changes in the prices of goods and services, and enables businesses to see clearly market signals that are conveyed by the relative changes in the prices of goods and services. Consequently, it is held, this leads to the efficient use of the economy’s scarce resources and hence results in better economic fundamentals. |

|

The Rationale for Price-Stabilization PoliciesFor instance, let us say that demand increases for potatoes versus tomatoes. This relative strengthening, it is held, is going to be depicted by a greater increase in the price of potatoes than for tomatoes. Now in an unhampered market, businesses pay attention to consumer wishes as manifested by changes in the relative prices of goods and services. Failing to abide by consumer wishes will result in the wrong production mix of goods and services and therefore lead to losses. Hence in our example, by paying attention to relative changes in prices, businesses are likely to increase the production of potatoes versus tomatoes. According to the stabilizers’ way of thinking, if the price level is not stable, then the visibility of relative price changes becomes blurred and consequently, businesses cannot ascertain the relative changes in the demand for goods and services and make correct production decisions. Thus, it is feared that unstable prices will lead to a misallocation of resources and to the weakening of economic fundamentals. Unstable changes in the price level obscure changes in the relative prices of goods and services. Consequently, businesses will find it difficult to recognize a change in relative prices when the price level is unstable. Based on this way of thinking it is not surprising that the mandate of the central bank is to pursue policies that will bring price stability, i.e., a stable price level. By means of various quantitative methods, the Fed’s economists have established that at present, policymakers must aim at keeping price inflation at 2 percent. Any significant deviation from this figure constitutes deviation from the growth path of price stability. Note that in this way of thinking changes in the price level are not related to changes in relative prices. Unstable changes in the price level only obscure, but do not affect the relative changes in the prices of goods and services. So if somehow one could prevent the price level from obscuring market signals obviously this will set the foundation for economic prosperity. At the root of price stabilization policies is a view that money is neutral. Changes in money only have an effect on the price level while having no effect whatsoever on the real economy. In this way of thinking changes in the relative prices of goods and services are established without the aid of money. |

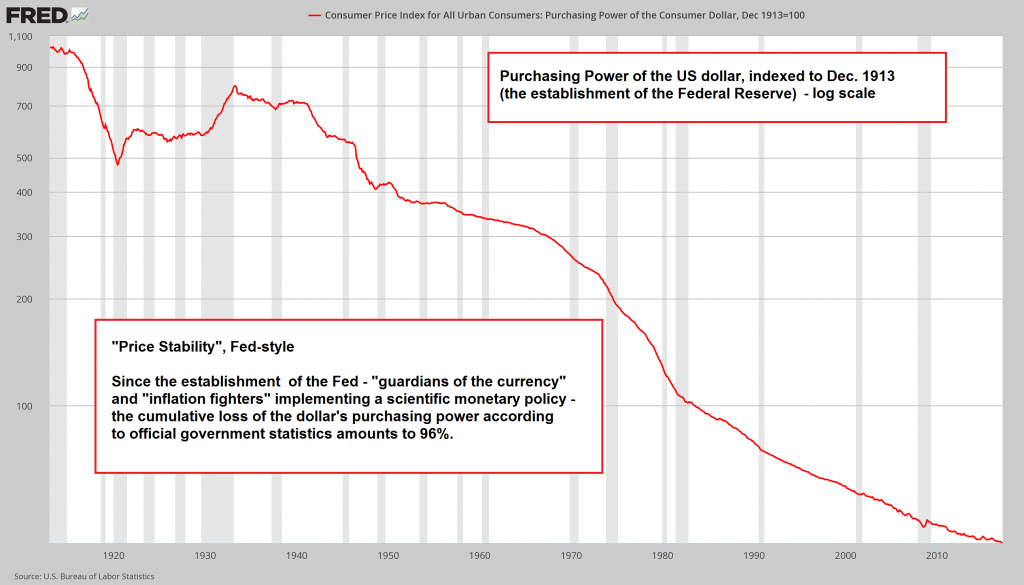

Central Bank Purchasing Power, 1920 - 2017 |

There Is a Problem – Newly Created Money Is Not NeutralWhen new money is injected there are always first recipients of the newly injected money who benefit from this injection. The first recipients with more money at their disposal can now acquire a greater amount of goods while the prices of these goods are still unchanged. As money starts to move around the prices of goods begin to rise. Consequently, later receivers benefit to a lesser extent from monetary injections or may even find that most prices have risen so much that they can now afford fewer goods. Increases in money supply lead to a redistribution of real wealth from later recipients, or non-recipients of money, to the earlier recipients. Obviously this shift in real wealth alters individuals demands for goods and services and in turn alters the relative prices of goods and services. Changes in money supply sets in motion new dynamics that give rise to changes in demands for goods and to changes in their relative prices. Hence, changes in money supply cannot be neutral as far as the relative prices of goods are concerned. Now, the Fed’s monetary policy that aims at stabilizing the price level by implication affects the rate of growth of money supply. Since changes in money supply are not neutral, this means that a central bank policy amounts to the tampering with relative prices, which leads to the disruption of the efficient allocation of resources. Furthermore, while increases in the money supply are likely to be revealed in general price increases, this need not always be the case. Prices are determined by both real and monetary factors. Consequently, it can occur that if real factors are pulling things in an opposite direction to monetary factors, no visible change in prices might take place. In other words, while money growth is buoyant, prices might display low increases. |

The ECB proclaims its ignorance on the topic in several places on its own web site, where it is inter alia asserted in a speech by a member of the council that “Money is neutral and super-neutral in the longer run”. - Click to enlarge The speech is quite interesting in its emphasis on various models and empirical evidence (and its frequent admissions that the planners are actually groping in the dark). All the models mentioned – and that holds even more for the interpretation of the statistics of economic history (“empirical evidence”) – are deeply flawed in that they assume that there are actually quantities that can be sensibly measured. What is the constant underlying such measurements? It does not exist. It has been known that money is not neutral since at least the early 18th century, when Richard Cantillon first described the effect named after him. A concerted effort to banish the monetary theory of the trade cycle from economic debate has been in train for nearly 150 years, mainly because accepting the theory would make it rather awkward for inflationist and “stabilizers” alike to justify their claims (and policies). And yet, if one is in possession of even a shred of common sense, one should be able to debunk all competing theories with one hand tied behind one’s back (beginning with Jevons’ idea that “sunspots” are responsible for the business cycle). It is utterly baffling to us that there really appear to be people who believe in the illogical notion of the neutrality of money. |

Conclusion: The “General Price Level” May Mislead Rather than Illuminate Economic ObserversClearly, if we were to pay attention to the so-called price level, and disregard increases in the money supply, we would reach misleading conclusions regarding the state of the economy. On this, Rothbard wrote:

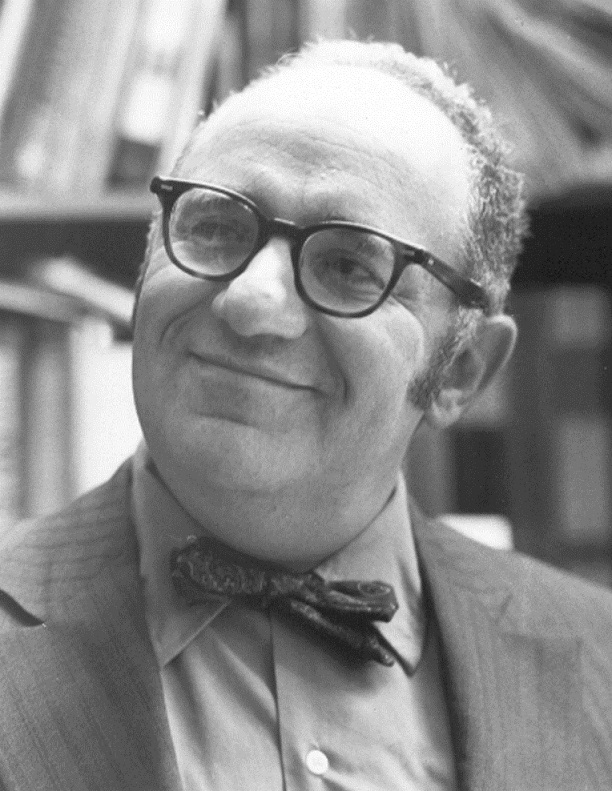

From 1926 to 1929, the alleged stability of the price level caused most economic experts, including the famous American economist Irving Fisher, to conclude that US economic fundamentals were doing fine and that there was no threat of an economic bust. Addendum: Additional Reading MatterLong time readers are probably aware that we have repeatedly harped on the dangers of the price stability policy discussed by Dr. Shostak above. It cannot be said often enough though – awareness of the problems concerned still needs to be raised. In this context, readers may also want to review an in-depth discussion of the topic we posted some time ago, which goes into quite a bit of detail: “The Errors and Dangers of the Price Stability Policy”. |

In his book America’s Great Depression Murray Rothbard describes how economists were misled by Irving Fisher’s misguided ideas on price stability. Photo via mises.de - Click to enlarge Long after the depression Hayek once asked rhetorically: “Haven’t the stabilizers done enough damage yet?”. Evidently not, since they are still at it. |

Full story here Are you the author? Previous post See more for Next post

Tags: central-banks,newslettersent