Tag Archive: newslettersent

Dudley in a Good Place

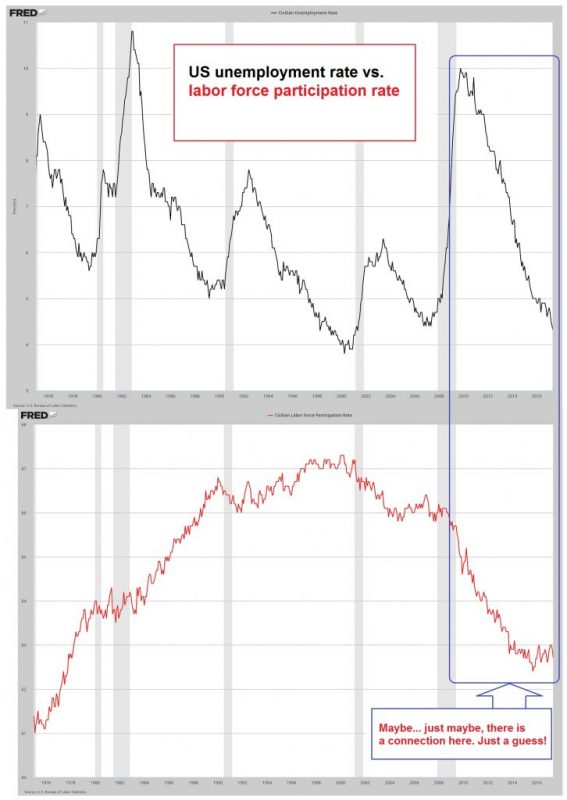

Dear Mr. Dudley, Your recent remarks in the wake of last week’s FOMC statement were notably unhelpful. In particular, your explanation that further rate hikes are needed to prevent crashing unemployment and rising inflation stunk of rotten eggs.

Read More »

Read More »

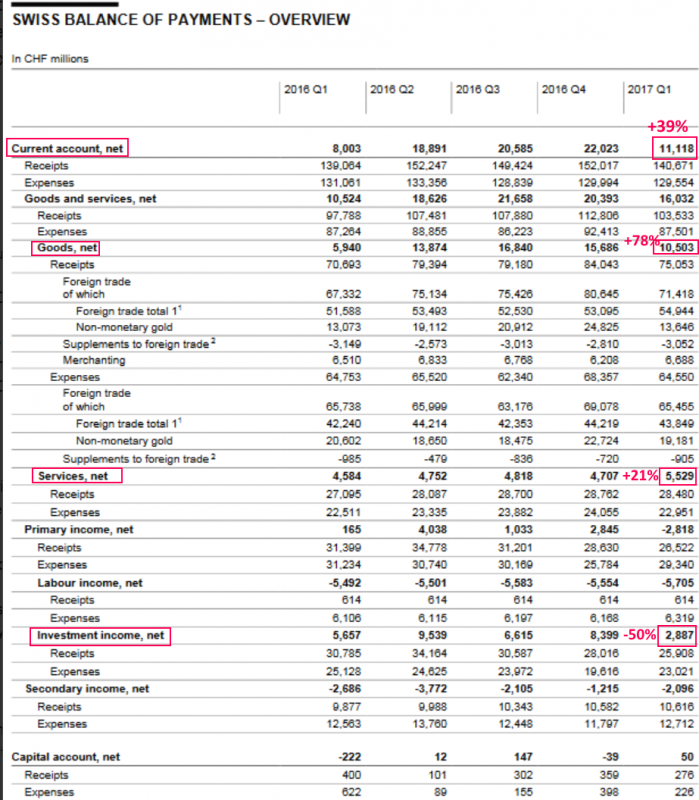

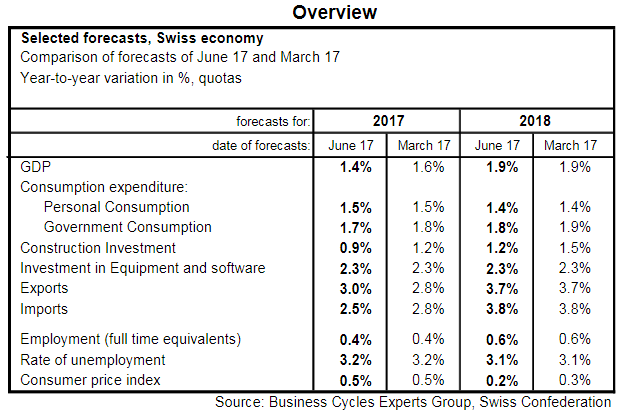

Swiss balance of payments and international investment position: Q1 2017

Key Figures, Current Account: +39% against Q1/2016, now +11.1 bn. CHF, Trade Balance: +78% to 10.5 bn, Services Balance: +21% to 5.5 bn, Investment Income: -50% to +2.9 bn.

Read More »

Read More »

FX Daily, June 26: Italian Markets Shrug off Banking Morass and Local Election Results

The US dollar is mostly slightly firmer as North American dealers return to their posts. Ideas that the UK Tories are getting close to a deal with the DUP appears to be lending sterling a modicum of support, as it tries to extend its uptrend into a fourth session. The Japanese yen is the weakest of the majors, rising equities, and yields, spurs the dollar to re-challenge last week's high near JPY111.80.

Read More »

Read More »

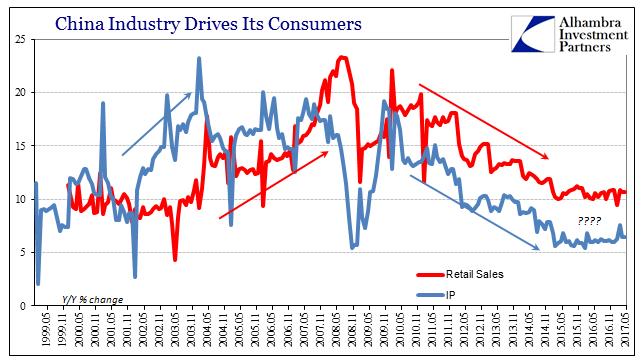

Chinese Basis For Anti-Reflation?

Yesterday was something of a data deluge. In the US, we had the predictable CPI dropping again, lackluster US Retail Sales, and then the FOMC’s embarrassing performance. Across the Pacific, the Chinese also reported Retail Sales as well as Industrial Production and growth of investments in Fixed Assets (FAI). When deciding which topics to cover yesterday, it was easy to leave off the Chinese portion simply because much of it didn’t change.

Read More »

Read More »

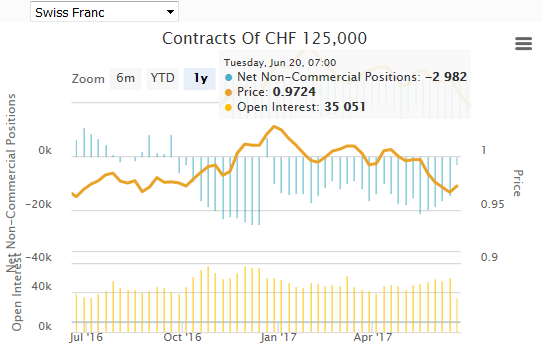

Weekly Speculative Positions (as of June 20): Surge in Positioning amid Currency Contract Roll

The net short CHF position has fallen from 14.5 short to 3K contracts short (against USD). The expiration of the June contracts and the roll into September positions appears to have boosted activity in the currency futures, and may obscure the signaling effect. Of the 16 gross positions we track, speculators add to exposure in all but four positions. There speculators covered gross short Swiss franc, Canadian, Australian, and New Zealand dollar...

Read More »

Read More »

FX Weekly Preview: Drivers A Couple Things that Aren’t on Your Economic Calendar

Fed, ECB and BOJ preferred inflation measures will be reported, but are unlikely to change views. Canada's Survey of Senior Loan Officers may be more important than April GDP. US healthcare bill in the Senate and likely action on steel could be the most significant events in the week ahead.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended last week on a firm note, though most were still down for the week as a whole. Commodity prices stabilized, but the balance remains fragile, in our view. We remain cautious, especially with regards to the high beta currencies such as BRL, MXN, TRY, and ZAR.

Read More »

Read More »

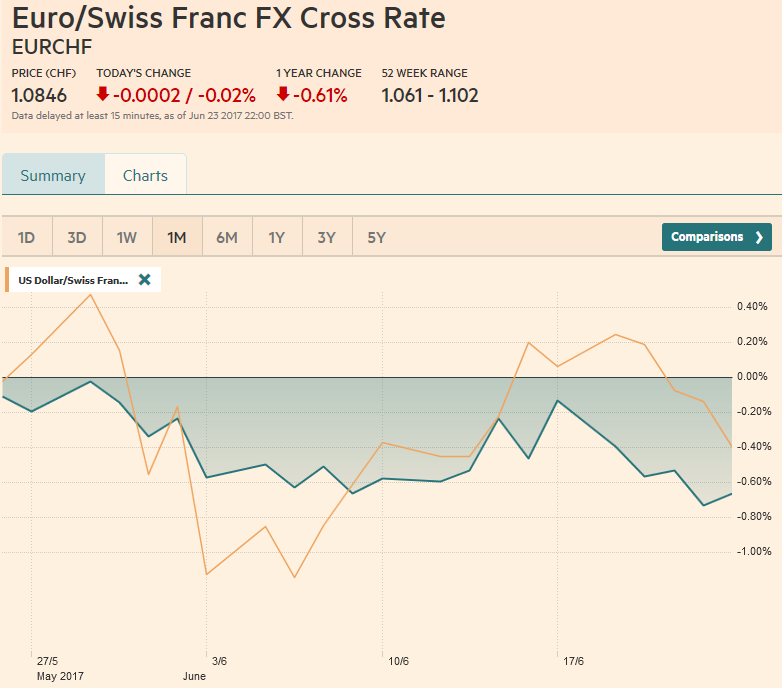

FX Weekly Review, June 19 – June 24: Stronger Franc with Fading Euro Enthusiam

Over the last month, the Swiss franc outpaced both EUR and USD. But the change is only little, the EUR fell by 0.60% and the dollar by 0.40%. The main reason for the stronger CHF is the fading enthusiasm after Macron's victory in the French elections and hence a weaker euro. Consequently SNB interventions are rising again.

Read More »

Read More »

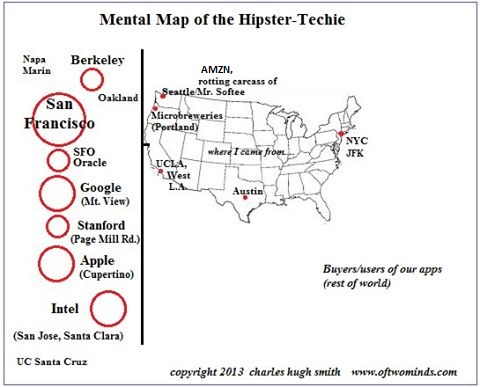

Can We See a Bubble If We’re Inside the Bubble?

If you visit San Francisco, you will find it difficult to walk more than a few blocks in central S.F. without encountering a major construction project. It seems that every decrepit low-rise building in the city has been razed and is being replaced with a gleaming new residential tower.

Read More »

Read More »

Short Summary Weekly MOF Portfolio Flows

Japanese investors bought the third largest amount of foreign bonds this year last week, but still not enough to offset sales in first part of the year. Japanese investors are buying around the same amount of foreign equities as last year. Foreign investors are buying more Japanese stocks and bonds than they did on average last year.

Read More »

Read More »

Go for Gold – Win a beautiful Gold Sovereign coin

The Irish Times has teamed up with GoldCore, Ireland’s first and leading gold broker, to offer you the chance to win a beautiful, freshly minted Gold Sovereign coin (2017) which contains nearly one quarter of an ounce of gold and is ‘investment grade’ 22 carat pure gold.

Read More »

Read More »

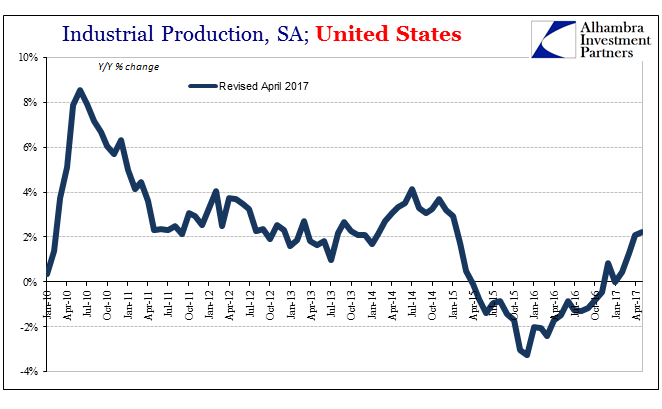

Defying Labels

Last month US Industrial Production rose rather quickly. Gaining more than 1.1% month-over-month, it might have appeared that the US economy once dragged into downturn by manufacturing and industry was finally about to experience its belated upturn. But frustration is how it has always gone, not just in this latest phase but for all phases since around 2011. Each good month is followed immediately by a disappointing one. What should be...

Read More »

Read More »

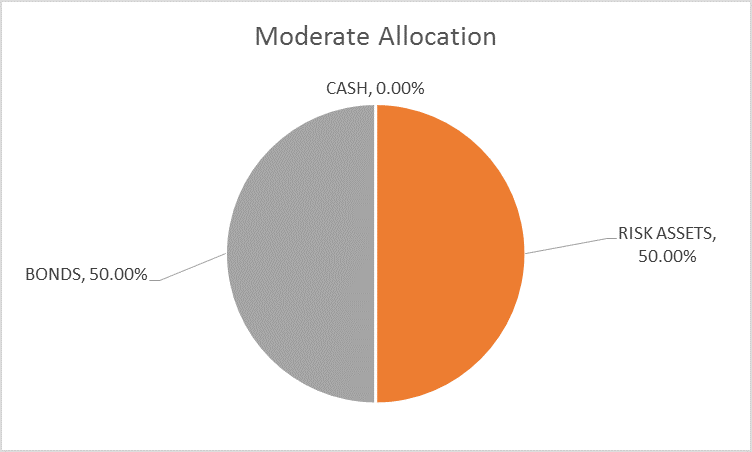

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month.

Read More »

Read More »

Emerging Markets: What’s Changed

MSCI announced it will include 222 China Large Cap A-shares in its Emerging Markets Index. Czech central bank is pushing out rate hike expectations. Hungary central bank eased again using unconventional measures. MSCI announced that it has launched a consultation on reclassification of Saudi Arabia from Standalone to Emerging Market status.

Read More »

Read More »

Bond Yields, Inflation, and More

Falling oil prices pushing down inflation expectations and lowering bond yields is the conventional narrative. It ignores that survey-based measures of inflation expectations are stable. It ignores a host of other demand factors.

Read More »

Read More »

Repeat 2015; An Embarrassing Day For The Fed

Today started out very badly for the FOMC. At 8:30am the Commerce Department reported “unexpectedly” weak retail sales while at the very same time the BLS published CPI statistics that were thoroughly predictable. Markets, at least credit and money markets, have gained a clearer idea what the Fed is actually doing and why. It’s not at all what the media suggests.

Read More »

Read More »

FX Daily, June 23: Dollar Pares Gains Ahead of the Weekend

The US dollar is trading lower against all the major currencies today, which pares its earlier gains. The greenback is holding on to small gains for the week against most of them, except the New Zealand dollar, Swiss franc and Norwegian krone.

Read More »

Read More »

Positive Economic Outlook Continues Despite Tentative Recovery to Date

Economic forecasts by the Federal Government’s Expert Group – summer 2017* - Although growth in the Swiss economy has steadily accelerated over the past two quarters, it has nevertheless fallen short of expectations. A further marked increase in economic momentum is to be expected over the coming quarters given the promising outlook for the global economy and positive leading indicators.

Read More »

Read More »

Only Gold Lasts Forever

his current state of play won’t last forever. Only Gold lasts forever. Some days it can feel a little rough being a gold investor. In today’s article Dominic Frisby is certainly feeling that way. Sometimes it can be all too easy to get caught up in the day to day chat around prices. Some forget that the reasons why they invested are still strong, even if it feels like the price isn’t.

Read More »

Read More »