Swiss FrancThe Euro has risen by 0.09% to 1.0848 CHF.

|

EUR/CHF - Euro Swiss Franc, June 23(see more posts on EUR/CHF, ) |

GBP/CHFPound to Swiss Franc rates of exchange has been in limbo recently since the election, with traders still on the starting line waiting for further news on the UK election. CHF rates regularly see additional movement during uncertain political periods. Effectively the Pound has suffered given that this election has been dragging on now since the 9th. The second sting for CHF buyers for anyone holding Sterling is that Swiss Franc rates also gain expense during anxious periods as a safe haven currency. The only saving grace for CHF buyers is that they do not lose out as heavily as US Dollar buyers, as the negative interest rate on the Swiss Franc currently keeps its demand from getting out of control during these periods. Essentially holding CHF has a sting of its own despite its other benefits. Until this election fiasco is officially resolved this will likely continue to weigh on Sterling, and the Swiss Franc alike. This will likely be exaggerated tomorrow. Friday afternoons bring their own abnormal trading patterns, as traders flock to stable currencies ahead of the closing bell for trading at the weekend. Again, this will be benefit CHF sellers in the same fashion. However, next week with the final process for the Government to be formed, we are seeing potential opportunity for CHF buyers, with some of the anxiety keeping the Pound down lifted with the re instigation of near normal activity. Therefore, CHF sellers may wish to take advantage of the expected improvements in your situation tomorrow afternoon, whilst CHF buyers can expect some form of conciliation next week. |

GBP/CHF - British Pound Swiss Franc, June 23(see more posts on GBP/CHF, ) |

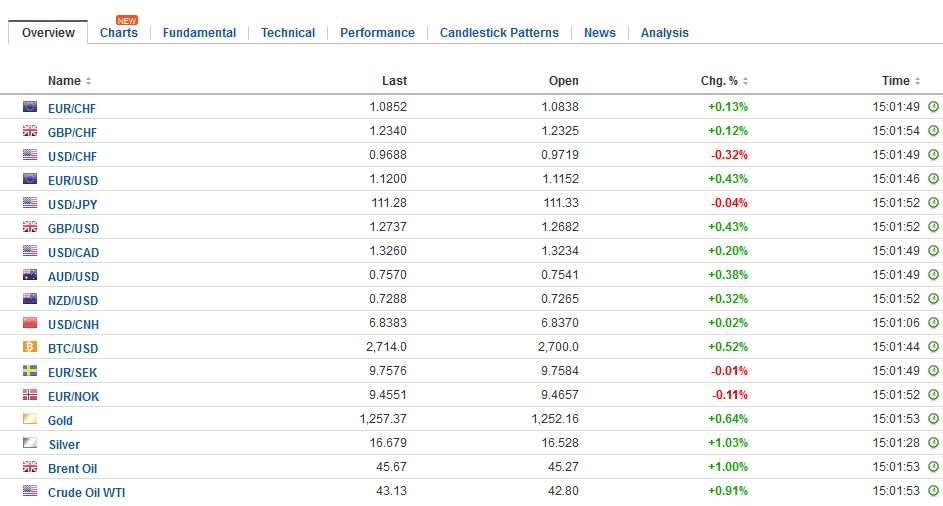

FX RatesThe US dollar is trading lower against all the major currencies today, which pares its earlier gains. The greenback is holding on to small gains for the week against most of them, except the New Zealand dollar, Swiss franc and Norwegian krone. Like the yen, the euro’s range this week was set on Monday (~$1.1215) and Tuesday (~$1.1120). There are nearly 2.2 bln euro of options struck between $1.1175 and $1.1200 that expire today. The euro has not been above $1.12 since the start of the week. In May and June, the euro has alternated between advancing and declining weeks. True to the pattern, last week it rose, and this week it fell. In the US, politics is eclipsed economics in the week after the FOMC hiked the Fed Funds target for the third time since last November’s election and signaled its intention to begin reducing the balance sheet “relatively soon,” which we take to mean an announcement in September to start in October. The Republicans won both special congressional elections this week, which would seem to suggest that despite the President’s low support rating, his base remains intact. The would seem to bode well for the legislative agenda. However, the Senate is having similar problems as the House of Representatives did in agreeing on health care reform. Specifically, the strategy of bypassing the opposition Democrats entirely does not leave the Republicans with much room for dissent. The Republicans can afford to lose no more than two votes, assuming no Democrats support it. A 50/50 vote would allow Vice President Pence to cast the tie-breaker. |

FX Daily Rates, June 23 |

| After a quiet week for data, the flash manufacturing PMI for Japan and the flash PMIs for the eurozone filled the vacuum, with little impact on the capital markets. The takeaway from the PMIs is that as Q2 came to close, economic momentum was flagging. Meanwhile, the immediate doubts cast on the US Senate health care reform raised questions over Trump Administration’s legislative agenda.

The flash eurozone PMI does not change the macro picture much. The September ECB meeting, with updated staff forecasts, is seen as a likely venue for officials to announce its intention to reduce its asset purchases, but extend them into the first part of next year. Three Fed officials speak ahead of the weekend. Governor Powell, who is very much part of the centrists on the Board. Bullard has proposed a new paradigm, which sets him a bit apart. His comments earlier this week suggest a greater desire to begin reducing the balance sheet rather than hiking rates. Mester from Cleveland is seen more with the Yellen, Fischer, Dudley bloc inclined to gradually hike rates to avoid a more disruptive pace if it slips behind. Yesterday it was announced that all 34 large US banks passed the stress test. Essentially the test was how this institution would cope with a severe recession. The results of the second part of the test, where it is determined if the banks have a sufficient cushion to raise dividends and/or buy back shares. The Trump Administration has proposed changes to the stress tests and their frequency. |

FX Performance, June 23 |

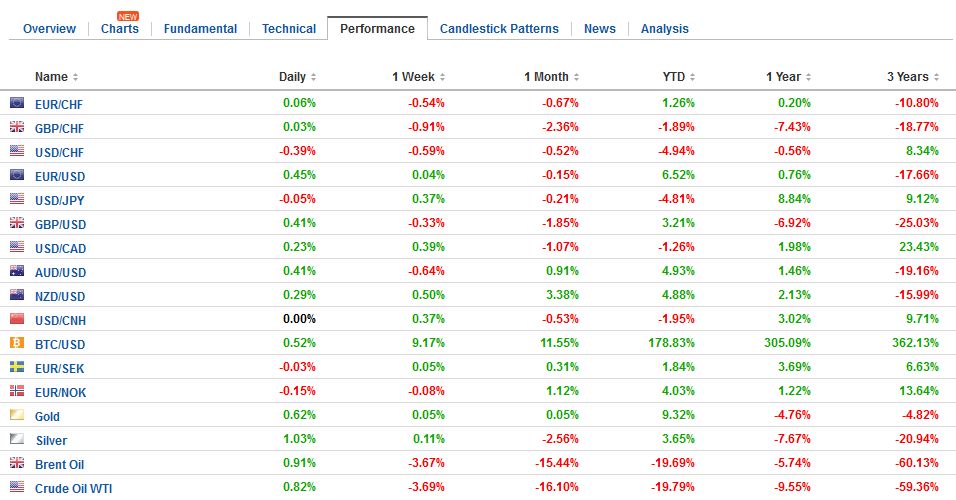

JapanJapan’s flash manufacturing PMI slowed to 52.0 from 53.1 in May. This is the lowest reading since last November and represents twice the decline that was expected. Weaker output (52.1 vs. 54 in May) and a decline in new orders to their lowest level in seven months were notable drags. Still, the dollar remains within this week’s ranges against the yen that were set in the first two days of the week (~JPY110.75-JPY111.80). We note there is near $1 bln of options struck between JPY111.30-JPY111.50 that are expiring today. |

Japan Manufacturing Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

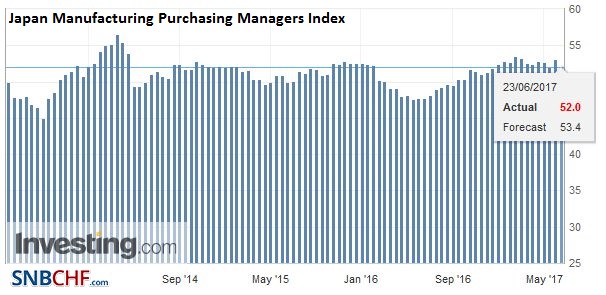

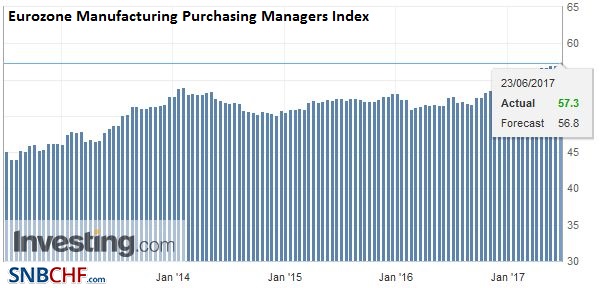

EurozoneThe eurozone flash PMIs were reported. Although activity is still at an elevated level, it slowed and by more than expected in June. The composite eased to a five-month low of 55.7 from 56.8. |

Eurozone Markit Composite Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| The median forecast was for 56.6. Manufacturing edged up to 57.3 from 57.0. |

Eurozone Manufacturing Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

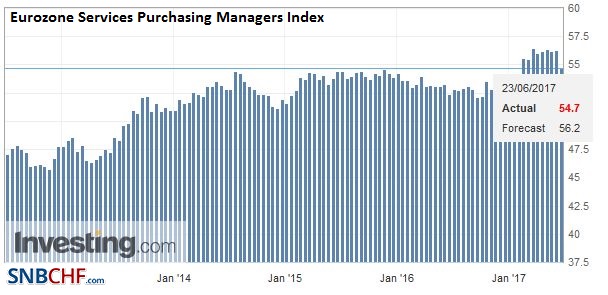

| New orders rose (58.5 from 57.8), though new export orders softened and employment eased. Prices also decelerated (output prices 54.0 vs. 54.1, and input prices 58.3 vs. 62.0). Services were the source of disappointment. The headline activity eased to 54.7 from 56.3. Forward-looking new business fell to 54.6 from 55.1. |

Eurozone Services Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

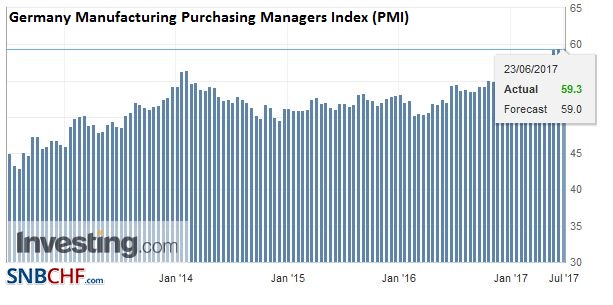

GermanyGerman manufacturing slowed to a still lofty 59.3 from 59.5 in May. New orders rose, and at 61.5 is the highest in more than six years. |

Germany Manufacturing Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

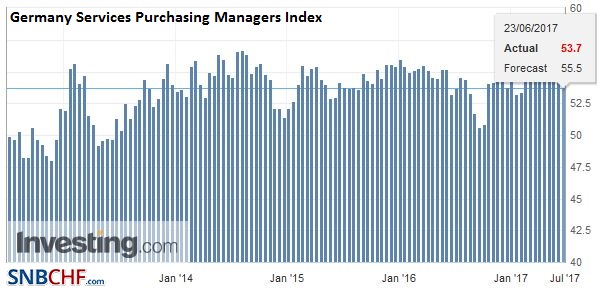

| Services slowed to 53.7 from 55.4. |

Germany Services Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

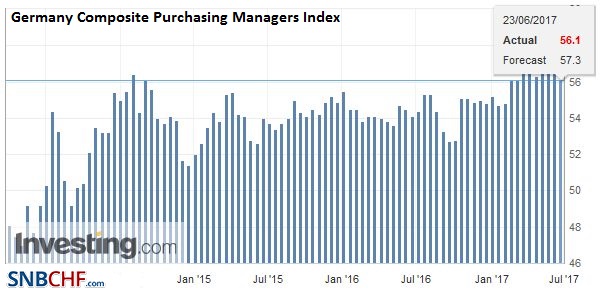

| Together, this led to a drop in the composite to 56.1 from 57.4. |

Germany Composite Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

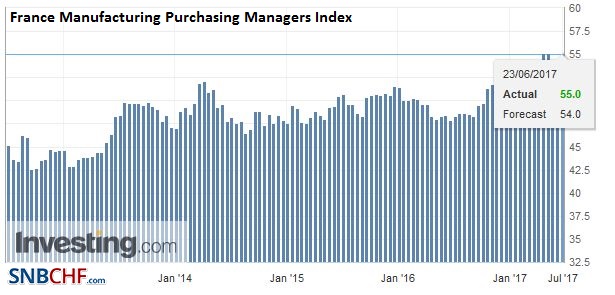

FranceFrance’s manufacturing PMI rose (55.0 from 53.8), |

France Manufacturing Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

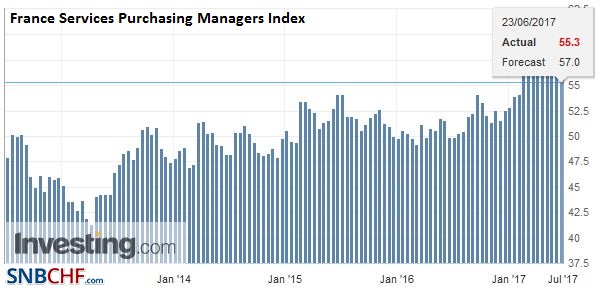

| but the decline in services (55.3 from 57.2) dragged the composite to 55.3 from 56.9, which is a five-month low. |

France Services Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

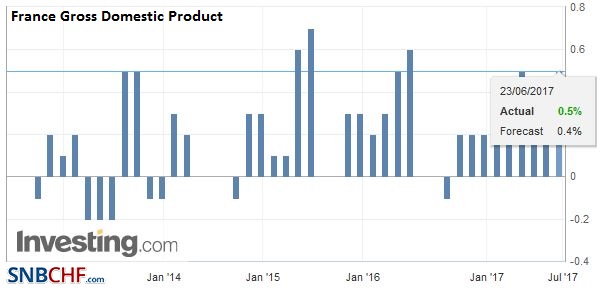

| Separately, France revised up Q1 GDP to 0.5% from 0.4% to match the Q4 performance. This represents the strongest six-month pace for France since Q4 10-Q1 11. |

France Gross Domestic Product (GDP) QoQ, Q1 2017(see more posts on France Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

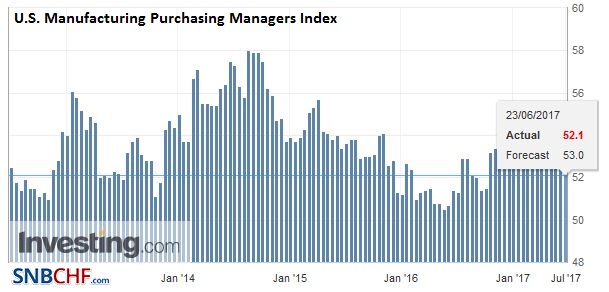

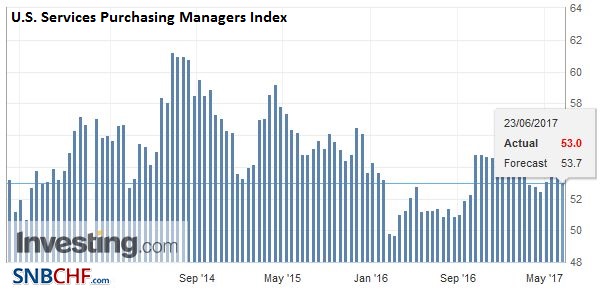

United StatesMarkit reports the flash PMIs for the US today, and the government reports existing home sales. |

U.S. Manufacturing Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

U.S. Services Purchasing Managers Index (PMI), June 2017 (flash)(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

|

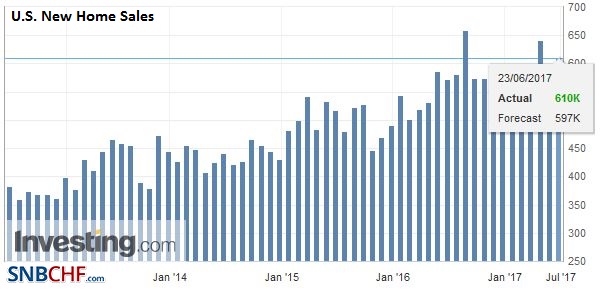

| New home sales reported earlier this was a bit stronger than expected (1.1% vs. expectations for -0.4%). Existing homes is a much larger market, of course, and are expected to snap back after a shockingly poor report in April (11.4% decline, the largest in two years). The median forecast from the Bloomberg survey is for a 3.7% rise. If this is borne out, the annual pace will rise to 590k, which would put it back above its 12-month average. March saw the cyclical high near 640k, which was the highest since the financial crisis. |

U.S. New Home Sales, May 2017(see more posts on U.S. New Home Sales, ) Source: Investing.com - Click to enlarge |

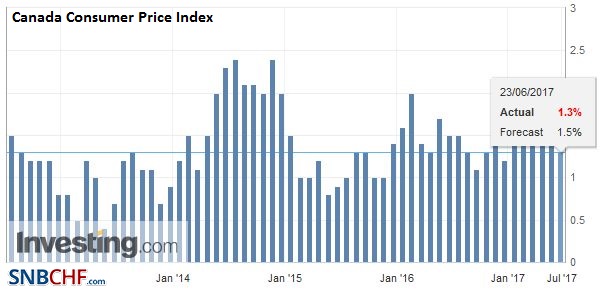

CanadaCanada reports May CPI. The headline pace may slow due to the base effect, but the risk is that the core ticks higher. Following yesterday’s stronger than expected retail sales report, any upside surprise today would further fan ideas that the Bank of Canada could hike rates as early as the July 12 meeting. The market appears to have discounted a little more than a 50% chance of a hike at that meeting. The Canadian dollar is practically flat in the week as yesterday’s recovery recouped the week’s earlier losses. Initial US dollar support is seen near CAD1.3200 and then CAD1.3165. |

Canada Consumer Price Index (CPI) YoY, May 2017(see more posts on Canada Consumer Price Index, ) Source: Investing.com - Click to enlarge |

United Kingdom

Lastly, we note today FTSE Russell implement its annual rebalancing of its equity indices. Over the past several years, it spurred a large rise in trading volume, though the impact on prices may be difficult to decipher.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$CAD,$EUR,$JPY,Canada Consumer Price Index,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,France Gross Domestic Product,France Manufacturing PMI,France Services PMI,FX Daily,gbp-chf,Germany Composite PMI,Germany Manufacturing PMI,Germany Services PMI,Japan Manufacturing PMI,newslettersent,Norwegian Krone,U.S. Manufacturing PMI,U.S. New Home Sales,U.S. Services PMI