Summary:

- Fed, ECB and BOJ preferred inflation measures will be reported, but are unlikely to change views.

- Canada’s Survey of Senior Loan Officers may be more important than April GDP.

- US healthcare bill in the Senate and likely action on steel could be the most significant events in the week ahead.

It is not that the economic data are not important. They are. Indeed, with the focus shifting toward prices from real sector performance, as the key to the reaction function of central banks, it is notable that the US, Japan, and the eurozone all report their preferred inflation measure in the days ahead.

Maybe Canada is an exception to this generalization that the data is unlikely to change investor views or the trajectory of policy. The Bank of Canada has put the market on notice that it will review the level of accommodation that it has provided given the strength of the economy and fears of distortions caused by interest rates being too low for too long. However, it may not be April’s GDP (expected to slow from 0.5% in March to 0.3%, but the year-over-year pace may tick up to 3.3% from 3.2%) that sways investors or policymakers. The central bank’s Senior Loan Officer Survey may be key. An upbeat report would likely boost the chances of a hike at the July 12 meeting, which interpolating from the OIS, is less than 40% discounted.

At the same time, Italian officials seem to be dragging their feet, and the full details are not known with less than 24 hours before the local markets open on Monday. What is known, or at least reported, is that the shareholders and subordinated creditors will be liquidated, but depositors and senior creditors will be kept whole. The second largest Italian bank will take over the deposits and assets (for the token euro) and the bad assets will be absorbed by the state and warehoused in a “bad bank.”

Italy’s two banks become the second and third banks in the EMU, following Spain’s fifth largest bank (Banco Popular), that have been subject to the supervisory authority of the ECB (granted in 2014). Allowing banks to fail is relatively new for Europe. These are still the early days, and the processes and practices are still developing.

Italy tried all kinds of ways in recent weeks to avoid this outcome, which speaks to the resistance that is still present. Italy appears to be maneuvering around the strongest features of the Bank Recovery and Resolution Directive (BRRD). Unlike in Spain, the Intesa, the bank taking over the troubled bank assets will not have to take on the bad assets as well. The ultimate cost of “bad bank” (could be around 10 bln euros) will borne it appears by taxpayers through the government.

Italy also spared senior creditors unlike Spain. The logic was that some of the senior creditors were retail investors who were not necessary aware of the risks that were being assumed. There are other ways that such retail investors could have been protected (e.g., a refund process). European banking regulators are unlikely to be pleased with the Italian course, and their response will help shape the evolving process.

News that Moody’s upgraded Greece to Caa2 from Caa3 with a positive outlook is unlikely to have much of an impact. Greek bonds have rallied strongly, even before the latest tranche of the aid packaged was agreed. Moody’s at been the harshest of the big three rating agencies. Fitch had brought Greece to CCC ( the equivalent of Caa2) nearly two years ago. S&P has designated Greece as a B- credit since January 2016.

In any event, the US actions will likely be challenged at the World Trade Organization. There, no good outcome looks possible. If the WTO rules against the US, there is some risk that the Trump Administration would use this national security issue to ignore the WTO. It is consistent with what the US President and his top economic advisers have stated.

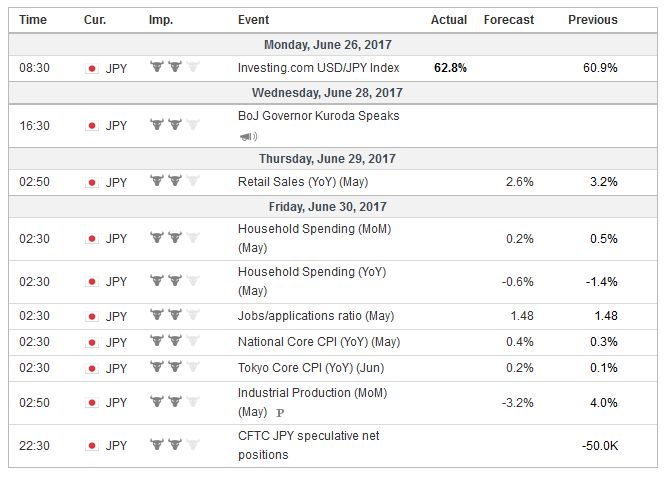

JapanHowever, the news may pose headline risk for short-term participants, but the inflation data is unlikely to alter the macro picture or the trajectory of policy. In Japan consumer prices are slowly rising, but remain sufficiently far from the desired pace that the BOJ continues to refrain from even discussing an exit strategy. The headline rate is expected to have ticked up to 0.5% in May, with the targeted measure, which excludes fresh food, rising 0.4% from 0.3%. |

Economic Events: Japan, Week June 26 |

EurozoneIn the eurozone, the flash June CPI reading is expected to be mixed. The headline rate is expected to continue to pull back after reaching 2% in February and sending hawks a flutter. After a 1.4% year-over-year reading in May, the pace is expected to have slowed to 1.2%. On the other hand, the core rate may have ticked up to 1.0% from 0.9%. We continue to expect the ECB to announce at the September meeting its plans to slow the 60 bln euro purchases and extend them into the first part of next year. A few years ago, news before the weekend that the ECB declared that two troubled Italian regional banks had either failed or were about to fail would have quickly risen to the level of systemic concern and rattled the capital markets. However, it speaks to the progress that has been made, and the institutional capacity built that it will be contained and localized. |

Economic Events: Eurozone, Week June 26 |

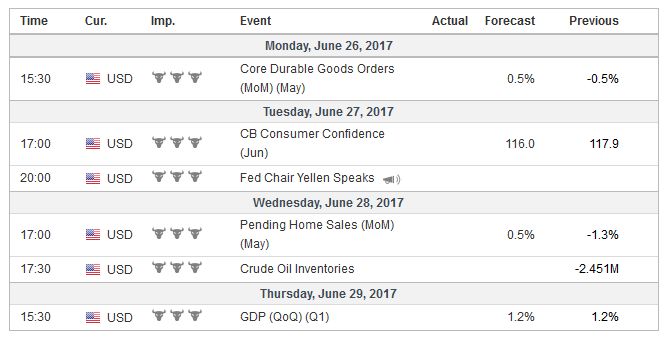

United StatesThe Federal Reserve already looked past the recent easing of price pressures when it hiked rates for the third time since the US election. The likely slippage of the May core PCE deflator to a 1.4% pace from 1.5% will be the fourth consecutive month that from the Fed’s point of view, the targeted inflation has moved in the wrong direction. It is evident in the commentary that some officials are turning cautious. There are two likely events in the US next week that are not to be found on the economic calendars but could have a profound impact on the investment climate in the period ahead. The first is the expected Senate vote on its version of national healthcare to replace the Affordable Care Act (“Obamacare). This is not the space to discuss the merits or demerits of the plan. The point is that the Republicans have little room to maneuver with a razor-thin majority of 52-48. There are already 4-5 Republican senators are have publicly indicated their lack of satisfaction. A couple may be able to be peeled back with a tweak to the bill, but some opposition appears fundamental and principled. The nonpartisan CBO is expected to publish their evaluation, which includes a forecast of the impact on the deficit. If the Senate cannot pass a healthcare reform bill, it will raise more doubts about the broader economic legislative agenda. In addition to the agenda, there are important maintenance measures that need to be taken by the end of Q3, namely the debt ceiling needs to be lifted (or abolished) and spending authorization (budget) needs to be granted before the start of the new fiscal year (October 1). Skepticism that tax reform and infrastructure spending measures can be adopted that will boost growth in the way the was previously suggested is a weight on medium and long-term US yields (while the short-end remains anchored by Fed policy). Lower US yields, in turn, are a drag on the dollar. The other important event that will not be on economic calendars is the expected announcement of the results of the investigation begun in April of the threat to US national security by steel imports. It seems there is a foregone conclusion to the investigation. Commerce Secretary Ross, who led the investigation, recognized that the law gave him 270 days for the investigation, but insisted all he needed was 90 days, which brings us to the end of June. The political dynamics warn that the more that the Trump Administration feels frustrated by Congress and the judiciary, the more that it may feel compelled to act forcefully where it has discretion. Separately, we see that several investment houses have recommended US steel stocks, which have been particularly strong recently. There is no free lunch. The value-added of US steel producers contributes about 0.2% to GDP (~$36 bln). The consumers of steel (think buildings, cars, appliances) account for about more than 5.5% of GDP (~$1 trillion). US domestic steel prices are already high compared with other high income countries. The result of either likely US response will be higher prices or narrower margins if the higher input costs cannot be passed through to others. |

Economic Events: United States, Week June 26 |

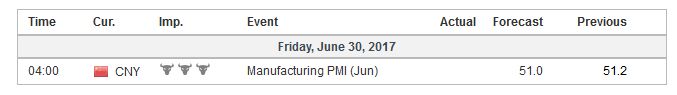

ChinaSome suspect China is the ultimate target. It is the largest producer. However, the top five sources of US steel imports are Canada, Brazil, South Korea, Mexico, and Turkey. These five account for 58% of US steel imports. The top 10 (which includes Russia with 6% market share and Germany’s 4% share) account for a little more than 80% of US steel imports. There are more than 200 anti-dumping and countervailing measures in place that have discouraged imports from China. That said, there has been a surge in steel imports from Vietnam that some suspect is a direct or indirect result of China’s producers. |

Economic Events: China, Week June 26 |

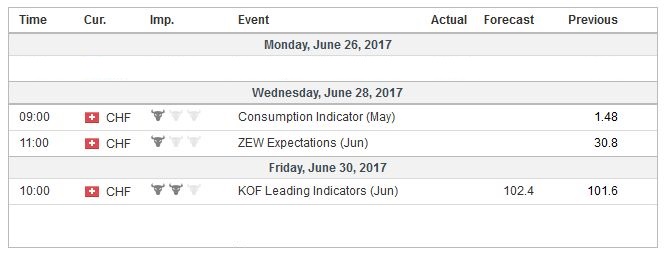

Switzerland |

Economic Events: Switzerland, Week June 26 |

On the other hand, if the WTO rules support the US position, and the national security exemption has not been explored, then other countries would claim the same rights. And before you know it, we have a new type of barrier to trade. The first path undermines the WTO as an institution. The second course weakens the multilateral trade system the WTO is to protect.

The combination of the US withdrawal from the Paris Accord and what appears to be its trade practice will make for awkward G-20 heads of state summit next month. The summit will by Germany and the broad theme has already been announced: Fair and free trade. Also news sanctions approved by the US Senate, and still need to be ratified by the House of Representatives would sanction European companies involved with the Nord Stream 2 project to ship Russian gas to Western Europe bypassing Ukraine is another source of antagonism.

This fits into what we think is the most likely scenario at this juncture: an announcement in September that the full maturing issues will not be replaced starting in October. A pause in the rate hikes, which Dudley had previously suggested, allows the Fed to wait until December to deliver the next rate hike, provided the economy evolves as the Fed expects.

The national security claim gives President Trump broad executive authority. Leaving aside, as we did with healthcare, the strengths, and weaknesses of the respective arguments, we focus on the practical results. The Trump Administration will likely announce either a broad tariff on all steel imports or a combination of quota and a tariff on amounts that exceed the cap. Some countries may be given exemptions. Reports suggest that some NATO members have been lobbying the Pentagon to intervene on their behalf. Some think that Canada and Mexico can be spared because NAFTA negotiations are about to begin.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$EUR,$JPY,$TLT,newslettersent