Economic forecasts by the Federal Government’s Expert Group – summer 2017* – Although growth in the Swiss economy has steadily accelerated over the past two quarters, it has nevertheless fallen short of expectations. A further marked increase in economic momentum is to be expected over the coming quarters given the promising outlook for the global economy and positive leading indicators. The Federal Government’s Expert Group is therefore anticipating gross domestic product (GDP) to grow by 1.4% in 2017 (previously: 1.6%) and by 1.9% in 2018 (unchanged). Both domestic demand and Swiss foreign trade are expected to contribute to growth positively. As the economic situation brightens, the job market is also likely to continue its recovery. The Expert Group still anticipates an unemployment rate of 3.2% in 2017 and 3.1% in 2018.

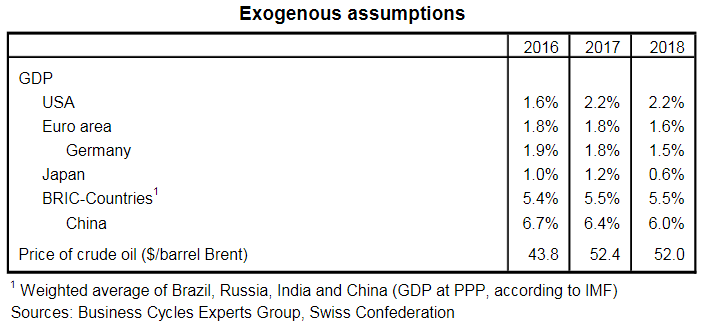

International economyThe moderate growth of the global economy continued at the beginning of 2017. There has been a sustained upward trend in world trade and sentiment indicators suggest that the economic upswing in many countries will persist. Although economic growth in the USA was disappointing in the 1st quarter of 2017 (+0.3%),** the robust state of the job market suggests there is no threat of an economic downturn. The US economy looks set to grow more strongly over the coming quarters and to more or less keep up with the momentum of the last few years. The euro area is continuing to recover, while GDP made gains in every member state without exception in the 1st quarter, resulting in a considerable growth rate of +0.6% for the monetary union overall. This is now the third time in a row that GDP growth has stepped up. Moreover, current leading indicators are showing clear signs of a positive 2nd quarter. The eurozone is due to grow at a slightly aboveaverage rate in the current and coming years. In Japan, the growth rate in the 1st quarter once again exceeded its potential; however, it is expected that some of this momentum will be lost over the course of the forecast period. The outlook for the BRIC countries (Brazil, Russia, India and China) appears mostly positive. Growth in China is expected to continue its gradual slowdown due to ongoing structural changes, whereas India’s prospects remain bright with anticipated growth rates of at least 7%. While Russia has emerged from the recession, the most recent upturn in Brazil remains fragile against a politically turbulent backdrop. The latest global economic developments have largely been in line with the Expert Group’s expectations thus far, with the eurozone developing at a somewhat faster pace to date than anticipated. The moderate global economic expansion is expected to continue in 2017 and 2018, with the current year actually due to end more positively than was suggested in the previous forecast. |

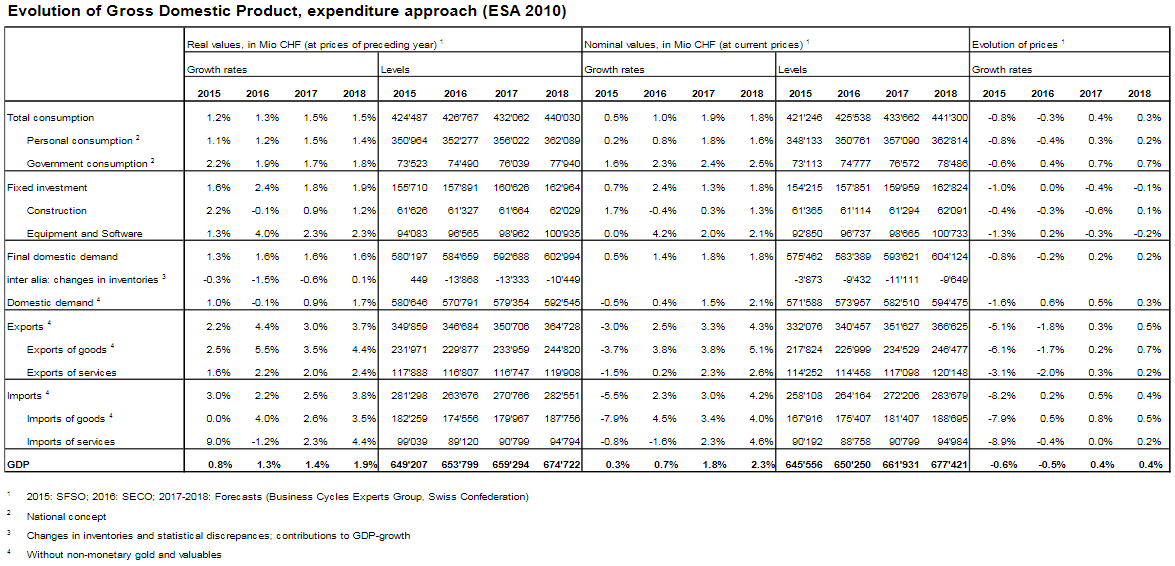

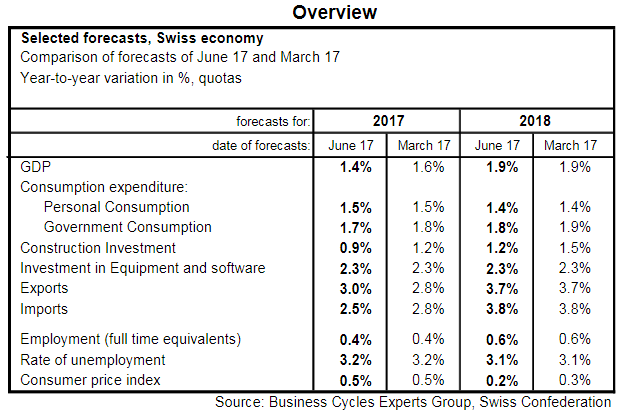

Comparison of Forecasts of June 17 and March 17 Source: news.admin.ch - Click to enlarge |

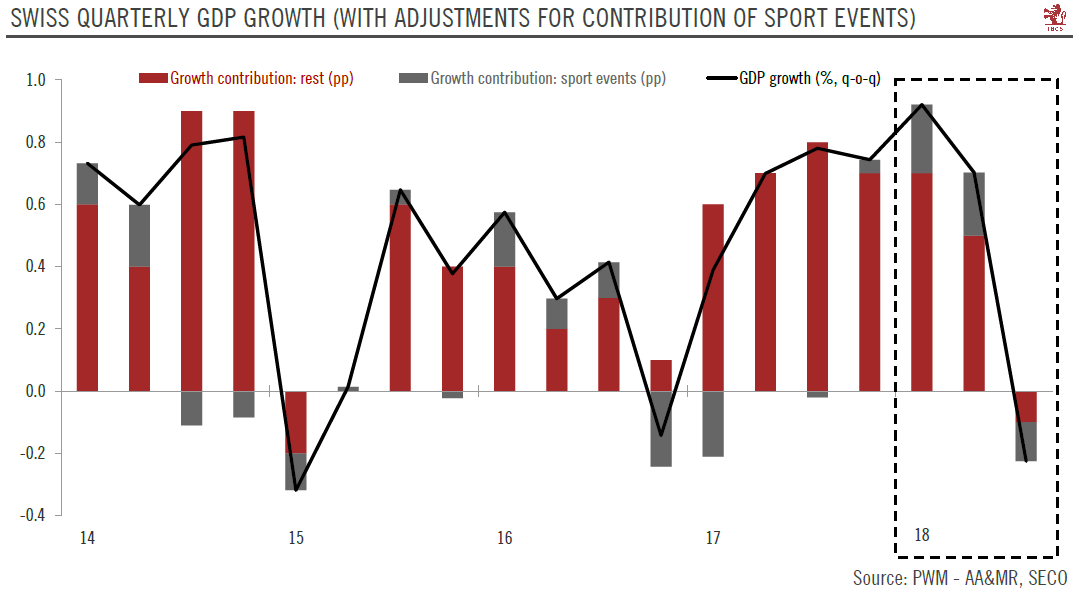

Economic situation and forecasts for SwitzerlandThe Swiss economy has undergone a slower recovery than expected over the past three quarters. Although GDP growth accelerated steadily, even the 1st quarter of 2017 fell slightly short of expectations with +0.3%, largely due to the weak development of virtually every service sector in that quarter. By contrast, manufacturing recorded a positive quarterly result. Although the key sentiment indicators (the PMI for the industrial and service sectors, the KOF barometer and the consumer sentiment) have recently dropped somewhat, they nevertheless remain high, indicating that the Swiss economy will continue to grow. The fact that companies in both the industrial and service sectors are once again receiving more orders (as measured by the PMI) bodes well for economic development in the near future. The Expert Group anticipates GDP growth of 1.4% for 2017 as a whole. The slight downward adjustment compared with the previous forecast (1.6%) takes into account the more sluggish growth seen in the 1st quarter. Economic growth is expected to accelerate substantially throughout the year due to favourable economic conditions at an international level and thanks to the continued strong sentiment indicators. The rate of recovery is anticipated to continue unchanged in 2018, with expected GDP growth of 1.9%. |

Source: news.admin.ch - Click to enlarge |

| Domestic demand is likely to be a key pillar of growth in the current and following year. After a rather subdued development in 2015 and 2016, consumption is set to grow more dynamically during the forecast period. This is suggested by the fact that the job market has already begun to recover and that the population is still growing. Due to low interest rates and a persistently high demand for real estate, investment in construction also looks set to gain a little momentum. Investment in equipment is expected to grow moderately.

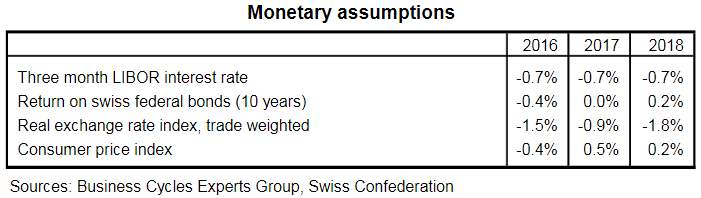

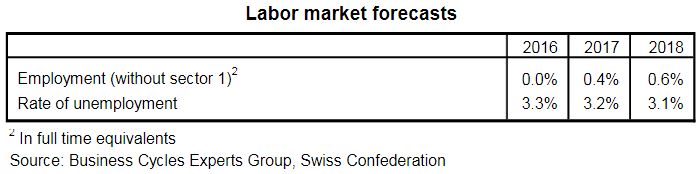

Foreign trade is expected to continue growing at a modest rate in 2017 and 2018, with the trade balance having a somewhat positive impact on GDP growth. Export activity of Swiss companies looks set to benefit from the upward trend in the global economy. As seen already in the 1st quarter of 2017, growth in exports is due to be more broadly based than it was last year. Apart from the chemical and pharmaceutical sector, both the machinery, electronics and metal industry and the watch industry are set to benefit from the increasing rate of growth in export markets. After the economic downturn due to the appreciation of the Swiss franc, the turnaround on the job market has already begun to solidify. The unemployment rate, adjusted for seasonal and irregular variations, fell from 3.3% to 3.2% during the first few months of the year. The Expert Group still expects this downward trend to continue, resulting in an average unemployment rate of 3.2% in 2017 that is then set to drop to 3.1% in 2018. While things do not yet appear to be improving for job growth, this trend now seems to be bottoming out and an increase in employment growth should kick in over the next few quarters. This is also apparent from the current rise in indicators on job market development. Employment growth of 0.4% is anticipated for 2017 and is expected to accelerate to 0.6% in 2018. Underpinned by oil prices, inflation in Switzerland is returning to normal and is due to settle at an annual average of 0.5% for 2017 and then 0.2% in 2018, due in part to the drop in the reference interest rate and the anticipated rent reductions. |

Source: news.admin.ch - Click to enlarge |

Economic risksThere still remains a significant amount of political risk in connection with the USA’s stance on trade and fiscal policy and the implementation of the Brexit referendum. If these risks materialise, they would, however, not be likely to have an impact on Switzerland until the second half of the forecast period. There is additional uncertainty in Italy at the moment. The country will be holding a general election during the forecast period. After the failure of the electoral reform, political instability is a possible threat. The associated risks must not be underestimated given the high level of government debt borne by this key member of the euro and the ongoing fragility of its banking sector. The Swiss franc could end up being pushed up sharply if the European debt crisis were to flare up again or the situation in the banking sector worsen significantly, with considerable consequences for the Swiss economy. For the global economic development, further risks arise from monetary policy developments in the USA, where economic growth could be heavily restricted if monetary policy is normalised more quickly than expected, jeopardising the global economy in turn via the trade channel. Higher interest rates in the USA could also lead to outflows of capital from key developing countries, with potentially severe consequences for international financial stability. By contrast, there is a positive economic risk that the trajectory of the global economy, and of the eurozone in particular, may accelerate more quickly than originally anticipated due to the surprisingly encouraging start to the year and some strong leading indicators. Such an upturn would benefit Swiss exports and ultimately the entire Swiss economy. Within the country, the development in the real estate sector poses a certain risk. The rising number of empty homes could lead to a greater slowdown in the construction market than was originally forecast. |

Source: news.admin.ch - Click to enlarge |

Tags: newslettersent,Swiss economy