We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true.

Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans.

But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

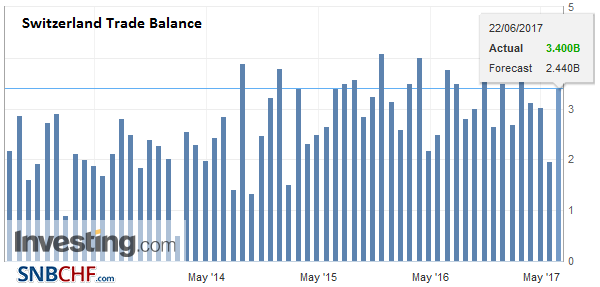

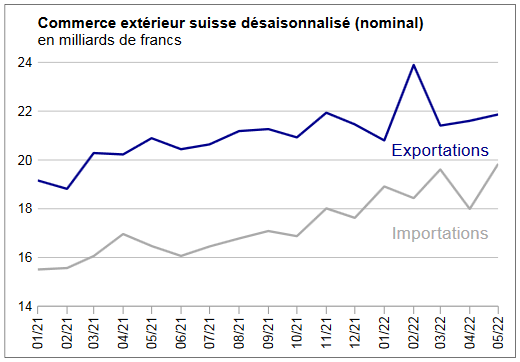

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

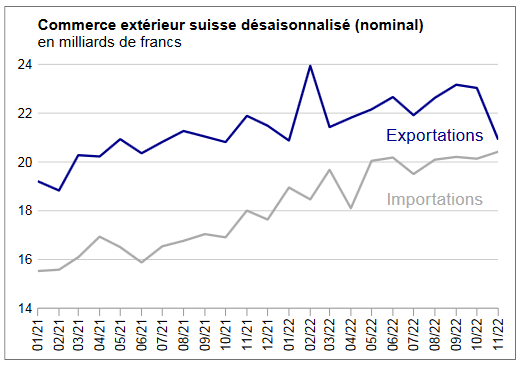

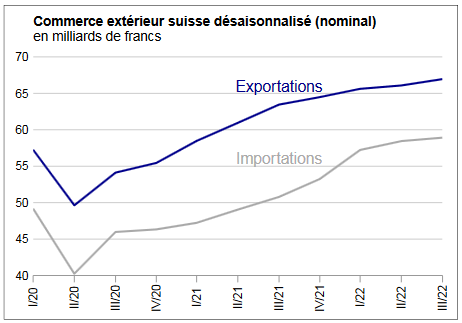

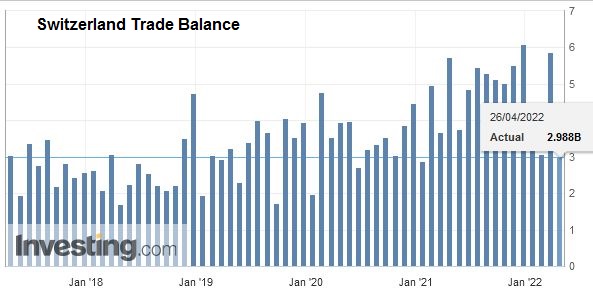

Texts and Charts from the Swiss customs data release (translated from French).

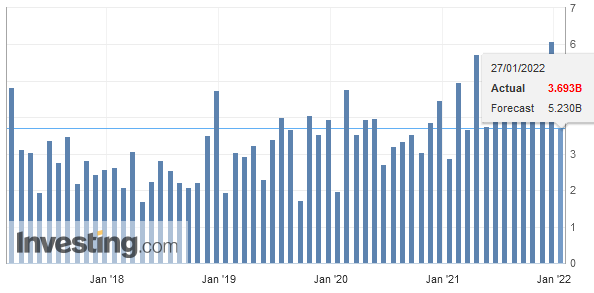

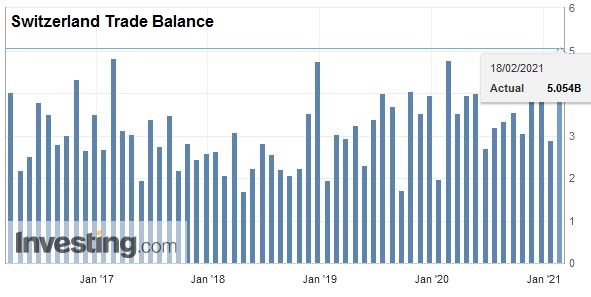

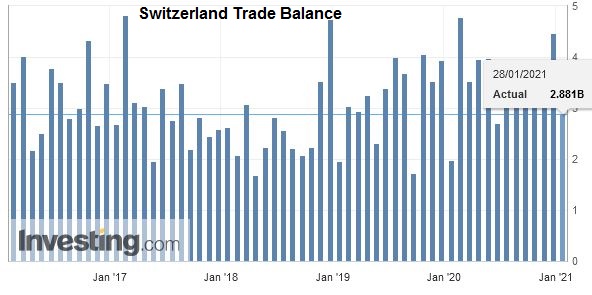

Exports and Imports YoY DevelopmentIn May 2017, Swiss foreign trade was dynamic. Adjusted for working days, exports increased by 7.5% and imports by 8.7%. Chemicals and pharma boosted growth in both directions. The balance of trade closed with an impressive surplus of 3.4 billion francs. ▲ Watch exports recover colors |

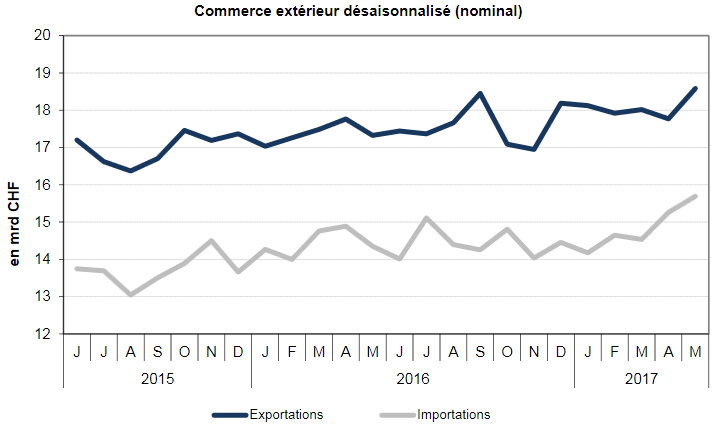

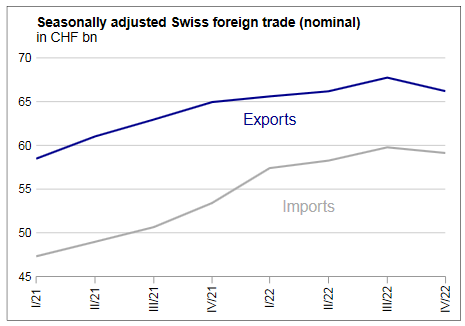

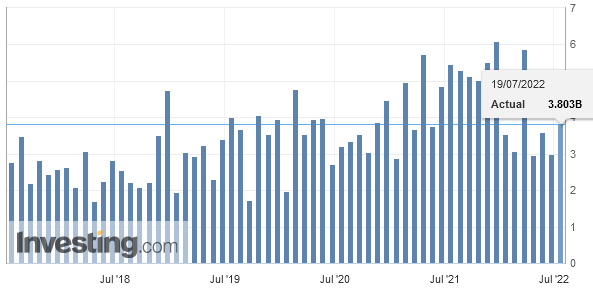

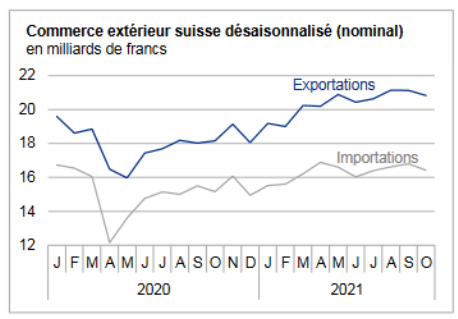

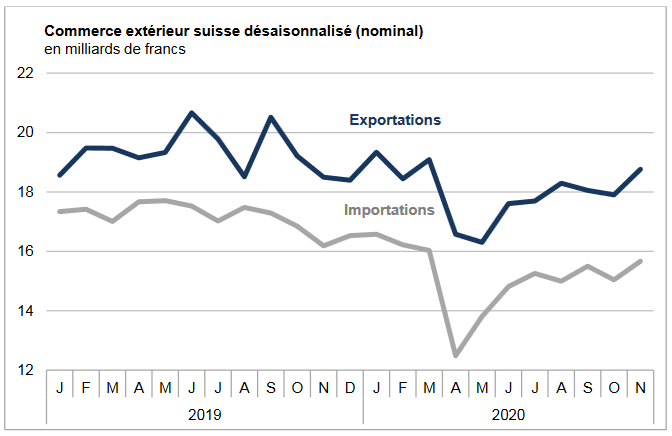

Swiss exports and imports, seasonally adjusted (in bn CHF), May 2017(see more posts on Switzerland Exports, Switzerland Imports, ) Source: Swiss Customs - Click to enlarge |

Overall EvolutionIn May 2017, exports adjusted for working days were consolidated by 7.5% over one year (actual: + 4.5%). In seasonally adjusted terms (compared with the previous month), they also increased, even by 4.6%. Slight decline since the beginning of the year, the trend is back to the top. Imports increased by 8.7% year on year (real: + 4.5%). Compared to April 2017 and after seasonal adjustment, they increased by 2.8%. The upward trend since December 2016 has thus increased. |

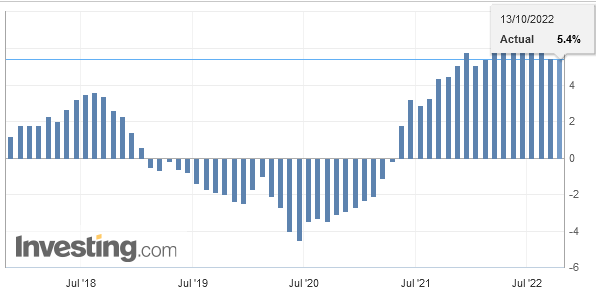

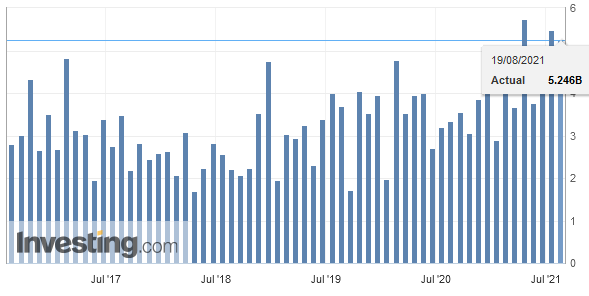

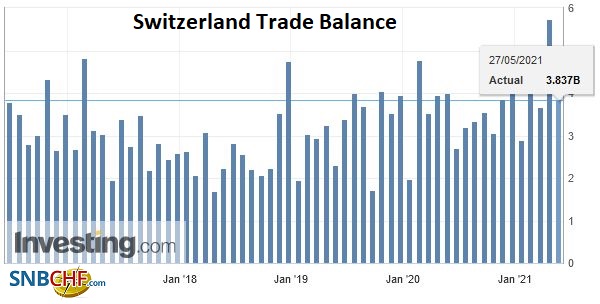

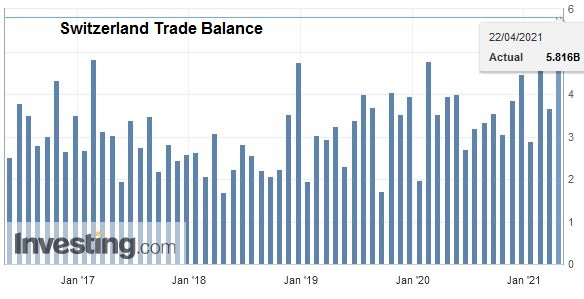

Switzerland Trade Balance, May 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge |

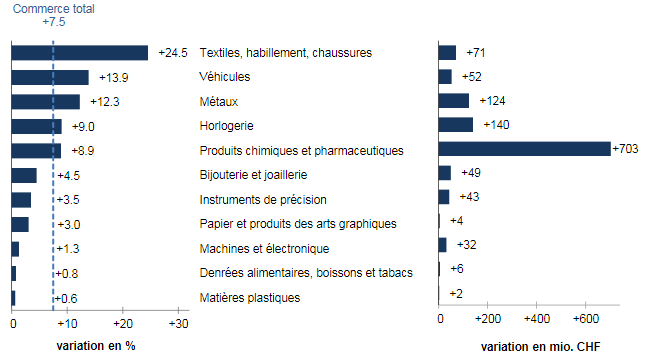

ExportsExports to China rise by 1.1 billion Swiss francsAfter adjusting for business days, all sectors posted higher sales; However, it is staggered between +1 and + 25%. Over half of the total increase of CHF 1.3 billion was driven by chemicals and pharmaceuticals (+ 9%). The textile, clothing and footwear sector was the most dynamic, boosted by the expansion of merchandise returns. Vehicles, especially railways, and metals also showed double-digit growth. For the first time in a long time, watchmaking rose sharply (+ 9%, +140 million francs). In pharma-pharma, sales of active ingredients jumped by more than half (+497 million) while that of immunological products increased by 7%. Machinery and electronics (+ 59%) contributed significantly to the positive development of the number two export (+ 1%). On the markets, export growth was mainly driven by the two main markets, Asia (+ 16%) and Europe (+ 8%, EU: + 9%). Asian side, Singapore, China and Japan stand out; The demand for this trio increased from 30 to 50% (total: +590 million francs). On the Old Continent, Austria gained a quarter while Germany and Italy grew by 16 and 12% respectively. On the other hand, sales declined by 5% in North America (-5%) and Latin America by 4%. |

Swiss Exports per Sector May 2017 vs. 2016(see more posts on Switzerland Exports, Switzerland Exports by Sector, ) Exports by commodity group: Nominal changes adjusted for working days compared with May 2016 Source: Swiss Customs - Click to enlarge |

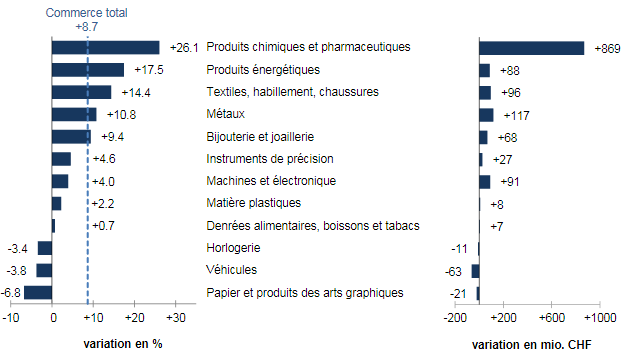

ImportsImports: 70% of growth is based on pharmaceuticalsIn May 2017, imports adjusted for working days increased by 9%. Three-quarters of the groups have progressed. With a flight of a quarter, the arrivals of chemical and pharmaceutical products have carded. This sector has generated more than 70% of the increase in entry. The performance of chemicals and pharmaceuticals increased the value of drugs (+630 million francs) and active ingredients (+406 million), of which imports were halved by three-quarters. Energy products also shone (+ 18%, price effect only). The textile, clothing and footwear (+ 14%) and metals (+ 11%) sectors also showed double-digit growth. With the exception of North America (-20%), imports from all continents have gained ground. Those in Europe (+ 14%) were more dynamic than the average. The leap from Ireland (+ 70%) and Austria (+ 45%) was driven by the vitality of pharmaceutical products. Two neighbors, Germany (+ 17%, +649 million francs) and France (+ 16%, +164 million), also shone. Imports from Asia, Switzerland’s second largest supplier, increased by 3%. The decline in North America was the result of the opposite trend in aeronautics: shipments from the US fell (-371 million francs), while those in Canada tripled (+106 million). |

Swiss Imports per Sector Mayl 2017 vs. 2016(see more posts on Switzerland Imports, Switzerland Imports by Sector, ) Imports by commodity group: Nominal changes adjusted for working days compared with May 2016 Source: Swiss Customs - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,Switzerland Exports,Switzerland Exports by Sector,Switzerland Imports,Switzerland Imports by Sector,Switzerland Trade Balance

1 comment

Stefan Wiesendanger

2017-06-23 at 20:10 (UTC 2) Link to this comment

The Swiss trade balance misses one essential component: wages for cross-border commuters. When this figure is included, the trade surplus shrinks by two thirds already. This ought to make Swiss politicians less content and hopefully alleviate som of the finger-pointing by foreign trade negotiators.

Why should these wages be included in the trade balance? Salaries paid to incoming cross-border commuters are an input cost of the Swiss production just like software license fees paid to Microsoft and professional service fees paid to a call center in Ireland. They are services bought from foreign entities.

The phenomenon has grown to massive proportions in recent years: 320’000 FTEs or 8% of the Swiss workforce commute from abroad daily, representing aggregate salaries of about 2bn CHF per month or 24bn CHF per year. Subtracting this from the trade surplus brings the latter down from 3bn to 1bn per month. At the same time, the net income part of the current account increases by the same amount, from maybe 0.5 to 2.5bn CHF per month, bringing it to a much more reasonable level for a country with a NIIP far in excess of 100% of GDP.

Why then does the IMF treat salaries of cross-border commuters in the same way as investment income? The IMF seems to regard these salaries in text-book fashion as “factor income” just like income from capital. I argue that this is incorrect.

As a tought experiment, let us first look at a capital good, for example a German-owned factory building in Switzerland. Rent is paid to a German entity for the use of the building which is reflected in the income part of the current account and not in the trade part. This is entirely correct since the German financing of either the construction or the purchase of the factory was previously booked in the capital account.

For cross-border commuter, there is no such counter entry in the capital account. Slavery has been abolished, after all. In the age of the Internet, how is a cross-border commuter different from purchasing a service? Why would a programmer in Lörrach working for a Basel pharma giant be treated differently depending on whether he was employed directly or through a German subcontractor? He might be telecommuting most of the time in both cases.

In conclusion, the Swiss trade balance is certainly overstated due to not including the massive expense for foreign labor. This exposes the country to harsh criticism from foreign trade diplomats and needs to be countered firmly. Including foreign labor in trade will not change the size of the current account surplus which is considerable – as it should be due to the income stream generated by a century and maybe more of continuous capital exports.

Other countries similarly affected by this bias are Luxemburg and Liechtenstein, who are natural partners for making the argument.