We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

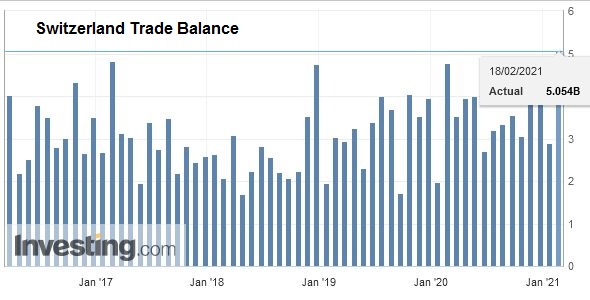

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

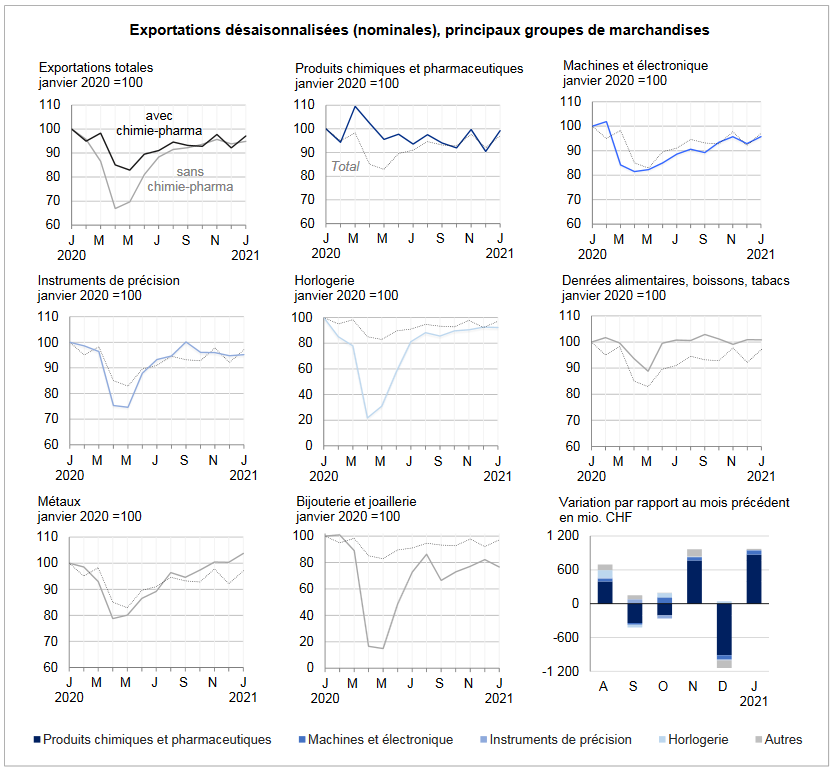

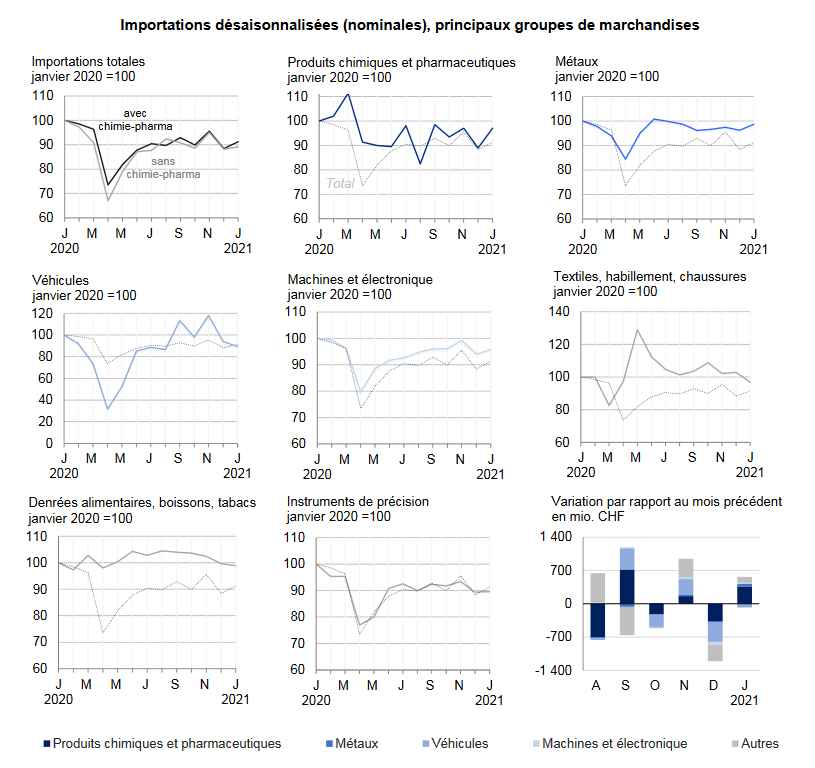

Texts and Charts from the Swiss customs data release (translated from French).

Exports and Imports YoY DevelopmentAfter declining in December 2020, Swiss foreign trade again showed a strong increase at the start of 2021. In January and in seasonally adjusted terms, exports rose 5.4% to 18.9 billion francs and imports by 3.3% to 15.3 billion. In both directions of trafficking, the boom relied heavily on chemicals and pharmaceuticals. The trade balance closed with a surplus of 3.6 billion francs. In short ▲Pharma-chemistry plays the role of a locomotive in both traffic directions ▲Exports: machinery and electronics as well as metals continue to recover ▲Sends to the USA swell by 502 million francs ▲Imports of energy products jump by a quarter over a month |

Swiss exports and imports, seasonally adjusted (in bn CHF), January 2021(see more posts on Switzerland Exports, Switzerland Imports, ) |

Global evolutionAfter their contraction in December 2020, seasonally adjusted exports increased by 5.4% (+967 million francs) in January 2021 (actual: + 5.7%). Since August 2020, they have thus stagnated. Imports also rose, reaching 3.3% (+485 million; actual: + 1.4%). A flat trend has thus emerged at the entry level since mid-2020. The trade balance closed with a surplus of 3.6 billion francs. |

Switzerland Trade Balance, January 2021(see more posts on Switzerland Trade Balance, ) Source: investing.com - Click to enlarge |

Drop in exports to JapanAlmost half of the sectors saw their exports increase in January 2021. Up by one tenth, chemicals and pharmaceuticals (+871 million francs) contributed the most to growth. Here, the turnover of medicines swelled by a third (+976 million) while that of active ingredients jumped by a quarter. The machinery and electronics sector grew by 3.1% and that of metals by 3.4%. For this duo, the recovery that began in May 2020 has continued. Precision instruments and watchmaking stalled while jewelry and jewelry – after three months of increases – fell 6.8%. These three sectors have shown stagnation since the third quarter of 2020. In January 2021, Swiss exports gained ground in the three main markets. Those to North America jumped 18.0% (USA: +502 million francs; chemistry-pharma). Deliveries to Europe increased by 5.9%; Germany, Austria and Belgium alone generated an increase of around half a billion francs. Exports to Asia are strengthened by 3.6%. Here, the boom with China (+100 million), Singapore and Hong Kong contrasted with the plunge of a quarter of Japan (-178 million; chemistry-pharma). |

Swiss Exports per Sector January 2020 vs. 2021(see more posts on Switzerland Exports, Switzerland Exports by Sector, ) |

Further decline in imports of passenger carsAlso at entry, chemicals and pharmaceuticals (+ 9.1%; + CHF 362 million) largely supported growth. Imports of immunological products as well as drugs were on the rise. Arrivals of energy products increased by a quarter or 105 million francs (price effect above all; actual: + 3.3%). Jewelery and jewelry, as well as the machinery and electronics sector, have also grown. Conversely, in the vehicle sector, imports of passenger cars (-143 million francs) weakened for the second consecutive month. Shipments from Asia (+ 2.2%) and Europe (+ 2.0%) accelerated while those from North America weakened by 2.4%. On the Asian side, Singapore’s imports increased by two-fifths (+112 million francs; chemicals-pharma). With the European partner, arrivals from Ireland jumped by almost half (+139 million). Germany (+168 million) and Italy (+115 million) also shone. The downturn in North America can be attributed to a halving of Canadian shipments. |

Swiss Imports per Sector January 2020 vs. 2021(see more posts on Switzerland Imports, Switzerland Imports by Sector, ) |

Tags: Featured,newsletter,Switzerland Exports,Switzerland Exports by Sector,Switzerland Imports,Switzerland Imports by Sector,Switzerland Trade Balance