Tag Archive: newslettersent

Weekly Speculative Positions (as of July 04): Speculators Still Dollar Negative

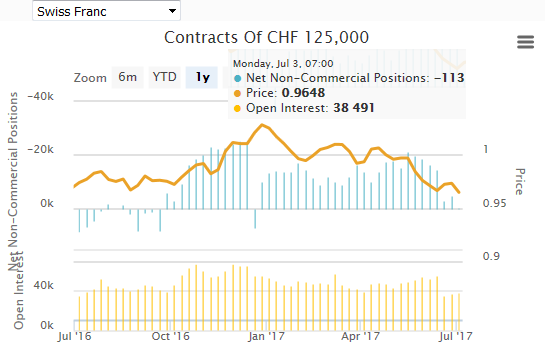

The net short CHF position has fallen from 4.7k short to 0.1k contracts short (against USD). Speculators in the futures market made several significant position adjustments in the CFTC reporting week ending July 4, despite it being a holiday-shortened week.

Read More »

Read More »

G20 demos draw Swiss involvement

Swiss news media reported on Sunday that at least one Swiss was among those arrested at violent protests during the Group of 20 summit in Hamburg, Germany.

Swiss newspaper SonntagsBlick said the train bringing Swiss protesters back home to Switzerland was stopped and searched at the border, and that the head of police in Bern suggested there might have been fewer police injured in Hamburg if they used rubber bullets like police do in the Swiss...

Read More »

Read More »

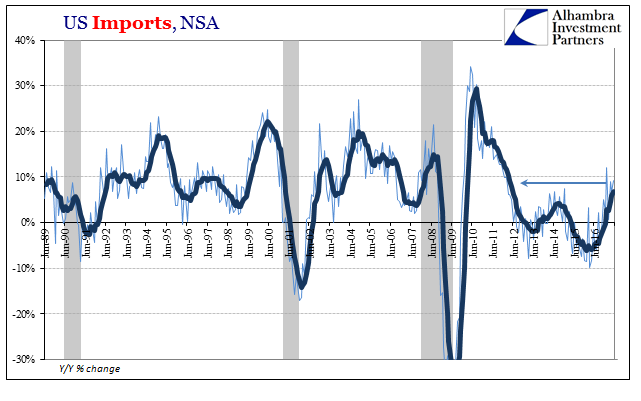

US Imports, Exports and Trade Stalls, Too

US imports rose year-over-year for the seventh straight month, but like factory orders and other economic statistics there is a growing sense that the rebound will not go further. The total import of goods was up 9.3% in May 2017 as compared to May 2016, but growth rates have over the past five months remained constrained to around that same level. It continues to be about half the rate we should expect given the preceding contraction.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed last week on a firm note, as the stronger than expected US jobs gain was mitigated by lower than expected average hourly earnings. Still, we believe that global liquidity conditions will continue to move against EM, as the Fed continues tightening and others join in.

Read More »

Read More »

FX Weekly Preview: Bank of Canada, US CPI, and UK Labor Update Featured

Yellen will unlikely deviate from general tone of post-FOMC meeting remarks. FOMC minutes were clear, most members see the decline in inflation due to transitory developments. Bank of Canada is expected to hike rates and will likely leave the door open to another rate cut in Q4. UK wage growth has continued to slow.

Read More »

Read More »

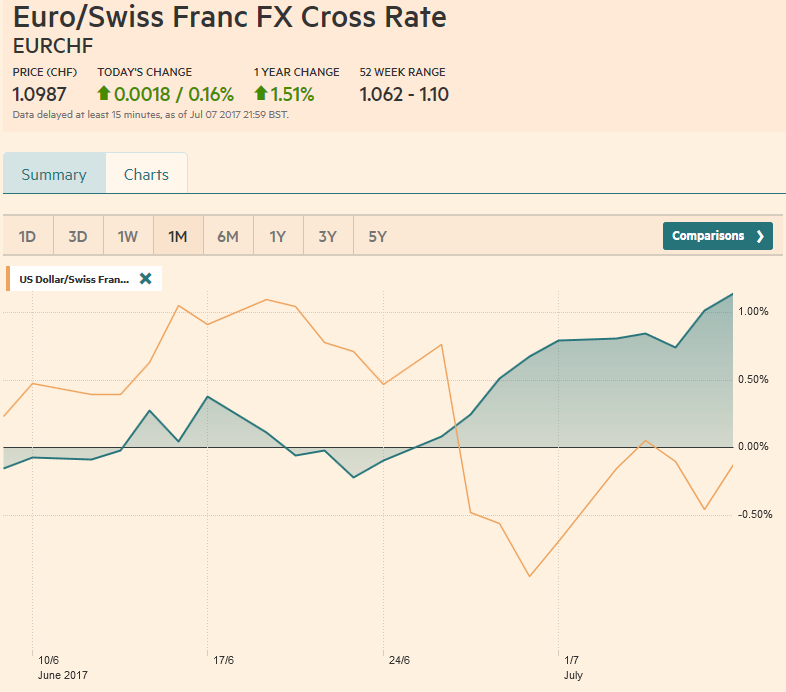

FX Weekly Review, July 03 – July 08: Second Euro appreciation phase

The ECB appears to be preparing investors for a further adjustment of its risk assessment and a reduction of its asset purchases as they are extended into next year.

This assessment has marked a new phase of an appreciating EUR/CHF rate. It followed the previous phase, the one with and after the French elections.

Read More »

Read More »

Ethical Coffee Company to bow out of capsule business

The timing may seem strange: over the past year, the Ethical Coffee Company (ECC), which has long been embroiled in patent-related battles with capsule giant Nespresso, has seen several verdicts go in its favour. But ECC founder and CEO Jean-Paul Gaillard revealed to Le Temps on Thursday that the company will be retiring from the capsule market over the next six months.

Read More »

Read More »

Swiss at table in G20 finance talks

The financial aspect to the talks, one of two main “tracks” for discussions at the two-day summit, will focus on coordinated steps to stabilise the global economy, structural measures to promote growth and reform proposals for the international financial system, according to the Swiss State Secretariat for International Financial Matters, or SIF.

Read More »

Read More »

Silver Prices Bounce Higher After 7% Fall In Minute

– Silver prices ‘flash crash’ before rebound– Silver hammered 7% lower in less than minute in Asian trading– Silver fell from $16 to $14.82, before recovering to $15.89– Silver plunge blamed on another ‘trading error’– Gold similar ‘flash crash’ last week and similar recovery– Hallmarks of market manipulation as $450 million worth of silver futures sold in minute– Trading ‘errors’ always push gold and silver lower. Why never...

Read More »

Read More »

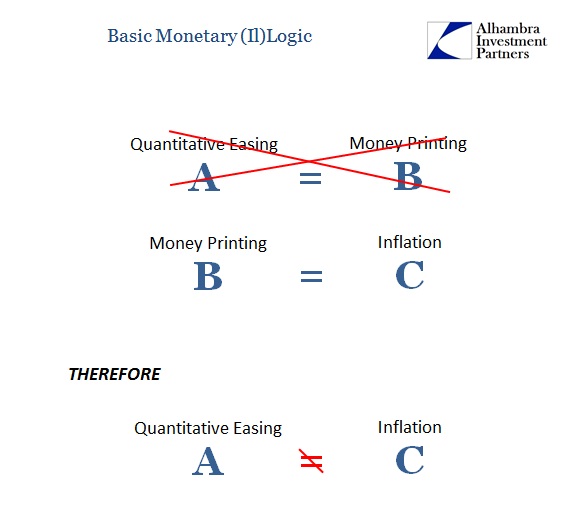

Global Manufacturing PMI’s, Inflation and CPI: Some Global Odd & Ends

When it comes to central bank experimentation, Japan is always at the forefront. If something new is being done, Bank of Japan is where it happens. In May for the first time in human history, that central bank’s balance sheet passed the half quadrillion mark.

Read More »

Read More »

Emerging Markets: What has Changed

The US confirmed North Korea's claims that it tested an intercontinental ballistic missile. The Pakistani rupee was devalued, prompting a new central bank governor to be named. Vietnam’s central bank cut interest rates for the first time since March 2014. Egypt’s central bank surprised markets with a 200 bp hike to 18.75%. South Africa's ruling ANC reportedly proposed that SARB be state-owned. Petrobras announced two separate cuts to fuel prices.

Read More »

Read More »

Over two thirds of Swiss would like to change jobs

A survey shows that 71% of those working in German-speaking Switzerland would change jobs if they could. Dream jobs vary significantly by gender. The survey, conducted by Marketagent.com on behalf of XING Switzerland, questioned around 1,000 employees in German-speaking Switzerland between the ages of 18 and 65.

Read More »

Read More »

VW to recall thousands of cars in Switzerland

The Swiss newspaper Blick, which broke the story on Wednesday, said that the issue mainly concerned the VW Golf, Jetta, Audi A3 and Skoda Octavia models that went on the road between 2008 and 2009. The company was set to start contacting owners from July 17.

Read More »

Read More »

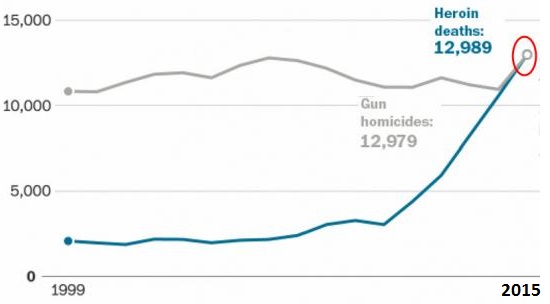

The Real Cause of the Opioid Epidemic: Scarcity of Jobs and Positive Social Roles

The employment rate for males ages 25-54 has been stairstepping down for 30 years, but it literally fell off a cliff in 2009. We all know there is a scourge of addiction and premature death plaguing the nation, a scourge that is killing thousands and ruining millions of lives: the deaths resulting from the opioid epidemic (largely the result of "legal" synthetic narcotics) are mounting at an alarming rate: We also know that the proximate cause of...

Read More »

Read More »

Worin die populäre Geldschöpfungskritik irrt – Teil 1

Eine Kritik ist im Aufwind. Was vor ein paar Jahren noch als Phantasterei verrückter Verschwörungstheoretiker abgetan wurde, beschäftigte jüngst sogar die Deutsche Bundesbank. Gemeint ist die Idee des Vollgeldes und der damit zusammenhängenden Abrechnung mit unserem modernen Geldsystem.

Read More »

Read More »

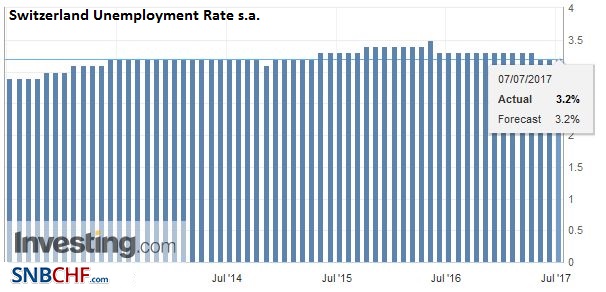

Switzerland Unemployment in June 2017: Decreased from 3.1 percent to 3.0 percent, seasonally adjusted unchanged at 3.2 percent

Registered unemployment in June 2017 - According to the State Secretariat of Economic Affairs (SECO) surveys, 133'603 unemployed persons were registered at the Regional Employment Centers (RAV) at the end of June 2017, 6'175 less than in the previous month. The unemployment rate thus fell from 3.1% in May 2017 to 3.0% in the reporting month. Compared to the previous month, unemployment fell by 5'524 persons (-4.0%).

Read More »

Read More »

FX Daily, July 07: Taper Tantrum 2.0 Dominates

Taper Tantrum 2.0, emanating from Europe rather than the United States continues to overshadow other developments. Yesterday, the yield on the 10-year German Bund pushed through the 50 bp mark that has capped the occasional rise in yields in recent months. The record of the ECB meeting was understood as indicating that the official assessment had surpassed the actual communication in order try to minimize the impact.

Read More »

Read More »

Addax settles Nigeria corruption claims

Geneva-based oil and gas extractor Addax Petroleum has paid CHF31 million ($32 million) to settle a criminal investigation into allegations of corrupt payments in Nigeria. Geneva’s cantonal prosecutor has in return dropped the probe.

Read More »

Read More »