Tag Archive: newslettersent

Nikki Haley – Warmonger Extraordinaire

Beating the War Drums at the UN. It must now be a prerequisite of those who become an American ambassador to the UN to possess certain characteristics and traits, the most important of which are rabid warmonger, child killer, and outright liar.

Read More »

Read More »

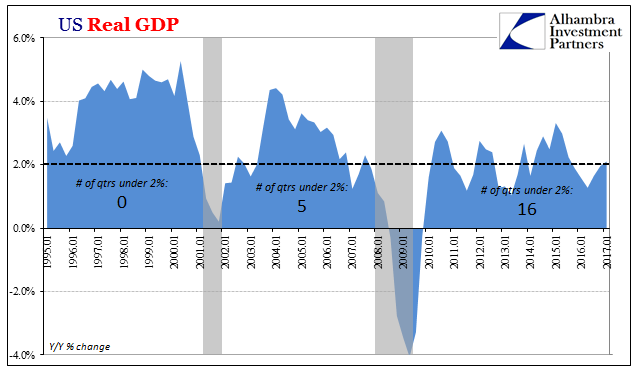

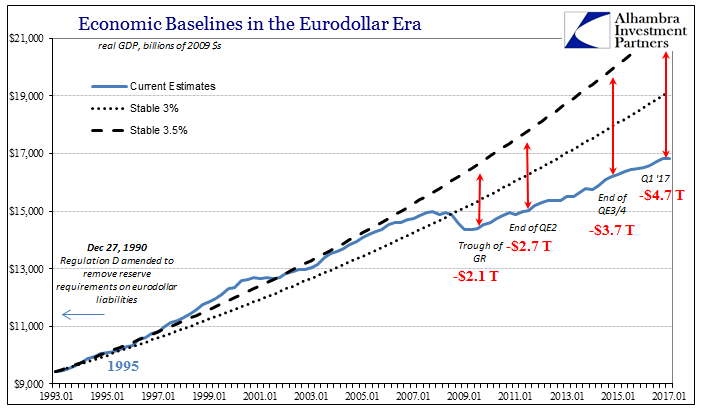

U.S. Gross Domestic Products: Near Record Expansion (Really Reduction)

Real GDP in the US was revised up to 1.41% quarter-over-quarter (annual rate), still the fourth of the last six to be less than 1.5%. While economists and policymakers have taken to judging the economy by its downside, that is only because the extent of the global problem is revealed by complete absences of an upside. The occasional decent quarter doesn’t come close to making up for the more plentiful disappointing ones, let alone to still resolve...

Read More »

Read More »

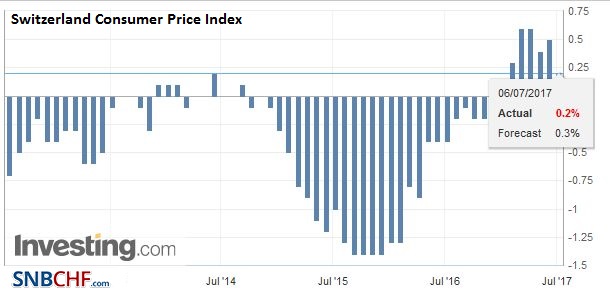

Swiss Consumer Price Index in June 2017: Up +0.2 percent against 2016, -0.1 percent against last month

The consumer price index (CPI) fell by 0.1% in June 2017 compared with the previous month, reaching 100.9 points (December 2015=100). Inflation was 0.2% compared with the same month of the previous year.

Read More »

Read More »

Swiss franc outstrips other currencies over last 117 years

Recent analysis by Credit Suisse, London Business School and Cambridge Judge Business School shows the Swiss franc’s enduring strength. The reports says that for a small country with just 0.1% of the world’s population and less than 0.01% of its land mass, Switzerland punches well above its weight financially.

Read More »

Read More »

FX Daily, July 06: Stocks and Bonds Mostly Heavier, while Dollar Hovers Little Changed

The US dollar is narrowly mixed against the major currencies after being confined to tight ranges through the Asian session and European morning. Equities are nursing small losses, and interest rates are pushing higher. The yield on the 10-year German Bund reached 50 bp for the first time since early 2016. Oil prices have steadied after yesterday's slide.

Read More »

Read More »

Buy Gold Near $1,200 “As Insurance” – UBS Wealth

Yesterday North Korea sent the US a ‘package of gifts’ for Independence Day. Unsurprisingly the successfully tested and launched intercontinental ballistic missile (ICBM) was not well received. US Secretary of State Rex Tillerson called the move a “new escalation of the threat” to the U.S. and its allies and that “global action is required to stop a global threat.”

Read More »

Read More »

Swiss banks asked to give Swiss expats fair deal

New moves are underway in parliament to ensure that Swiss expatriates are granted unrestricted access to services of Swiss banks. The Organisation of the Swiss Abroad (OSA) says two motions were filed, asking the government to reform regulations, providing services, including credit cards of the state-owned Post Finance, to expats with the same conditions as Swiss residents.

Read More »

Read More »

Pending Home Sales: Home Attitude Adjustments

The National Association of Realtors (NAR) reported today that pending home sales declined for the third straight month. As with so many other accounts, it’s not really the downside that is relevant but how instead there has been little to no growth for quite some time now. The NAR’s index value, which is how the organization reports the level of pending sales, was 108.5 in May 2017. That’s up 42% from the low in 2010, but also slightly less than...

Read More »

Read More »

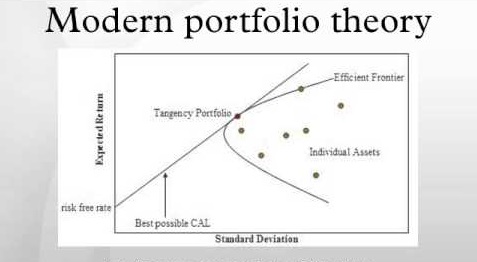

Moderne Portfoliotheorie bringt dem Anleger mehr Schaden als Nutzen

Die Bankiervereinigung zeigt in einer Studie (SBS) auf, dass einschränkende Anlagevorschriften für Pensionskassen kontraproduktiv sind. Dies deckt sich mit meinen jüngst propagierten Forderungen unter anderem in der NZZ nur scheinbar. Die SBS argumentiert nämlich auf der Basis der modernen Portfoliotheorie (MPT), die volatilitätsarme alternative Anlagen angeblich als interessante Diversifikatoren erscheinen lässt. Das ihr zugrundeliegende...

Read More »

Read More »

FX Daily, July 05: Dollar Firm as Investors Await Fresh Directional Cues

The US dollar is enjoying a firm tone today. Yesterday's two weakest major currencies, the Australian dollar and Swedish krona are the strongest currencies, but little changed on the session. After a strong rebound in the greenback to start the week, it mostly consolidated yesterday.

Read More »

Read More »

Artisan gelaterias shake up ‘mediocre’ ice-cream market

Ice-cream consumption in Switzerland hasn’t change since the 1990s and is far behind that in neighbouring countries. But small local gelaterias are challenging the dominance of industrial manufacturers. The 5.4 litres of ice cream that the average Swiss spoons down every year is put in the shade by the eight litres in Germany and Italy and 12 litres in sweltering Sweden and Finland. While these figures from Glacesuisse, the association of Swiss...

Read More »

Read More »

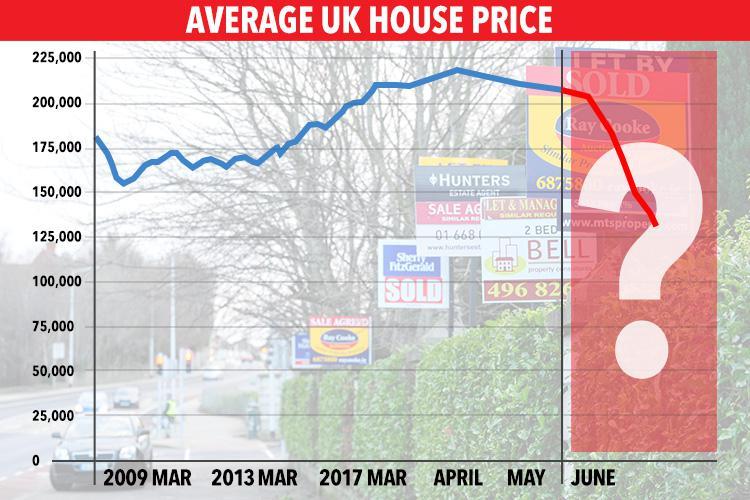

UK At ‘Edge of Worst House Price Collapse Since 1990s’

UK house prices on brink of massive 40% collapse. UK at ‘edge of worst house price collapse since 1990s’– Two leading economists warn of property crash– “We are due a significant correction in house prices”– Brexit and wages failing to keep up with inflation to trigger collapse. Trend starting in London before fanning out to rest of UK. UK homeowners unconcerned – 58% expect prices to rise. Over 1 million mortgages under threat in UK. Concerns of...

Read More »

Read More »

Maybe Deep Dissatisfaction Has A Point

To complete a trifecta, maybe someone could interview Alan Greenspan about rational exuberance. The last of the latest Fed Chairmen, Janet Yellen, purports today that the next financial crisis will not be in “our lifetimes.” The issue, however, isn’t even crisis so much as credibility. Given that she and the rest of them had no idea about the last one until it was almost over, we might be forgiven for rejecting her thesis outright – and it having...

Read More »

Read More »

The Money Velocity Myth

For most financial commentators an important factor that either reinforces or weakens the effect of changes in the money supply on economic activity and prices is the “velocity of money”.

Read More »

Read More »

Swiss Retail Sales, May: -0.3 percent Nominal and -0.3 percent Real

Turnover in the retail sector fell by 0.3% in nominal terms in May 2017 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.3% compared with the previous month. Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.3% in May 2017 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade...

Read More »

Read More »

Swiss start-ups to enjoy huge cash boost

On Friday 15 big names from banking, insurance, foundations and business signed a declaration to support the Swiss Entrepreneurs Foundation, the NZZ am Sonntag reportedexternal link.

Read More »

Read More »

Gold Up 8 percent In First Half 2017: Builds On 8.5 percent Gain In 2016

Gold up 8% in first half 2017; builds on 8.5% gain in 2016. U.S. dollar down 6.5% – worst quarter in seven years. Gold higher in all currencies except Draghi’s euro – Gold outperforms bonds; similar gains as stock indices. S&P 500 and Dax outperform gold marginally. World stocks (MSCI World) up 10%; gold outperforms Eurostoxx (+6%) & FTSE (+2.3%). Silver up 3.7% in first half ; builds on 15% gain in 2016.

Read More »

Read More »

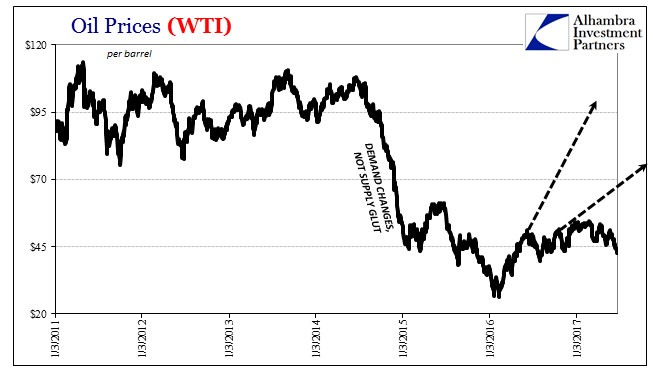

Oil Prices and Manufacturing PMI: No Backing Sentiment

When the price of oil first collapsed at the end of 2014, it was characterized widely as a “supply glut.” It wasn’t something to be concerned about because it was believed attributable to success, and American success no less. Lower oil prices would be another benefit to consumers on top of the “best jobs market in decades.”

Read More »

Read More »

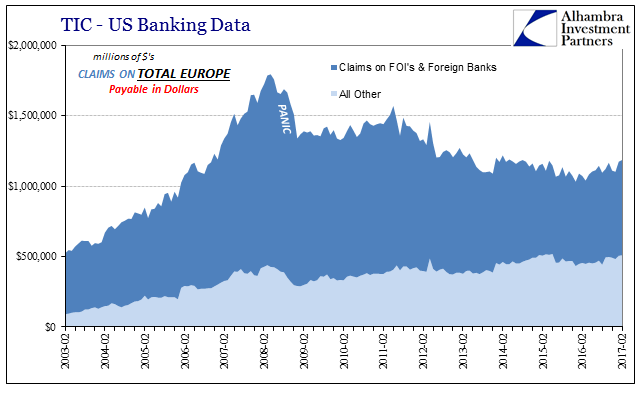

Weird Obsessions

People often ask why I care so much about China. In some ways the answer is obvious, meaning that China is the world’s second largest economy (the largest under certain methods of measurement). Therefore, marginal changes in the Chinese economy are important to understanding our own global situation.

Read More »

Read More »