Tag Archive: newsletter

No longer a question of “if” or even “when”, instead “how long” and “how bad.”

We have big and growing economy problem on our hands, one that is confirmed more every passing day by ominous, persistently negative developments. Yet, when you examine a specific class of data, you see none of this.

Read More »

Read More »

Done with the Nasdaq Bear Market for Good? Watch this Strong Technical Hint

Are you tired of the Nasdaq bear market? Want to know when it's time to make a move? Watch this video to learn about a powerful technical hint that may indicate a market attitude shift.

Weekly candle charts in technical analysis can reveal key support and resistance levels, patterns, and successive candles that can assist traders in making better decisions. Don't miss this opportunity to improve your profit potential.

Watch now!

Read More »

Read More »

Inflation, Rezession – wie steht es um 2023? (LIVESTREAM 23.01)

Wie würde ich investieren, was halte ich von unserer jetzigen Politik, würde ich immer noch Bitcoin empfehlen und wie ist eigentlich meine Prognose für 2023? Inflation, Rezession? All das und noch mehr, nachher. Ich freue mich auf euch!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder...

Read More »

Read More »

Journaling Is More Than Writing Down Your Feelings

Expanding on why #journaling is more than writing down your feelings with @jayshetty2758 . #raydalio #principles

Read More »

Read More »

Trading Coach Oli

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

►Folge Oliver auf...

Read More »

Read More »

Biden Officials Float $1 Trillion Platinum Coin Scheme to Monetize Debt

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As global elites gathered in Davos this week to discuss their plans for controlling the world economy, the gold market is delivering an alternative message.

Among the issues being discussed at this year's World Economic Forum is that of central bank digital currency.

Read the Full Transcript Here:...

Read More »

Read More »

Davos: Das sind die Pläne der Supermächte!

► Meinen Podcast findest Du hier: https://lars-erichsen.de/podcasts.html

Die Supermächtigen haben sich, mal wieder, in Davos getroffen um die Agenda für die nächsten Jahre festzulegen. Wie sieh aussieht und was das aus meiner Sicht, für Folgen und Konsequenzen hat. Das möchte ich gern in diesem Video besprechen.

► Link zum Global Risks Report 2023: https://www.weforum.org/reports/global-risks-report-2023/digest

► Sichere Dir meinen Report, mit...

Read More »

Read More »

Unsichtbare MAUER soll Menschen vom AUSWANDERN abhalten!

Wenn du übers Auswandern nachgedacht hast, solltest du einige wichtige Punkte unbedingt berücksichtigen, damit es nicht zu bösen Überraschungen kommt. Ich gebe dir einige Praxis-Tipps zum auswandern.

bis zu 100 Euro bei Depoteröffnung für ETFs & Sparpläne ► http://link.aktienmitkopf.de/Depot *

Bitcoin sicher kaufen? 20 Euro Bonus bei Bison

► https://link.aktienmitkopf.de/Bison *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT...

Read More »

Read More »

4 Jahresvergleich 2019-2022: E3/DC S10 E 912 Pro Hauskraftwerk mit PV Anlage 22kWp und Akku 26kWh

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Nach vier Jahren Betrieb vergleiche ich die Jahresdaten meiner PV-Anlage mit #E3/DC Hauskraftwerk und großem #Li-Ionen #Akkumulator. Damit die Jahre 2019 bis 2022 nicht so alleine stehen, vergleiche ich deren Ertrag mit dem Jahresschnitt meiner PV-Firmenanlage.

-

Playlist PV ► https://www.youtube.com/playlist?list=PLqSQHoWVoIpDwpj-aSCqO2FWksD2cN1Re

-

0:00 Einleitung

6:40...

Read More »

Read More »

Hält sich das positive Bild? – US Opening Bell mit Marcus Klebe – 23.01.23

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de...

Read More »

Read More »

DAX nur noch 7% bis zum ALL-TIME-HIGH | Blick auf die Woche | KW 04

Die US-Indizes hinken weiterhin hinter dem DAX her – das deutsche Leitbarometer braucht sogar nur noch etwas mehr als 7 % bis zum Allzeithoch. Damit will ich gar nicht mal sagen, dass es bei den US-Indizes nicht durchaus auch zu attraktiven Kurssteigerungen kommen kann. Aber für mich spielt das eben zunächst keine Rolle, denn für mich und mein Trading sind folgende Dinge wichtig... Infos dazu in diesem Video!

► Sichere dir Marios Watchliste der...

Read More »

Read More »

Inflation, Rezession, wie investieren? – 18 Uhr LIVE #FragMarc

Merkt euch 18 Uhr (23.01.2023), denn dann könnt ihr mich in einem neuen #FragMarc Livestream ausfragen! Wie würde ich investieren, was halte ich vom WEF, würde ich immer noch Bitcoin empfehlen und wie ist eigentlich meine Prognose für 2023? All das und noch mehr, nachher. Ich freue mich auf euch!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller...

Read More »

Read More »

Why Small Businesses are More Optimistic

(1/23/23) Despite a Fed focused on hiking rates beyond 5%, Treasury Markets are calling for a different scenario, which could result in a softer approach by the FOMC. What is the impact on Google, Microsoft, and Bing from ChatGPT? Markets are forming bottoms with higher lows. What's the linkage between increasing middle-aged suicides and not going to church? what happens with a negative view and no hope. NFISB survey: why business expectations are...

Read More »

Read More »

Geheimtipps für unbekannte Investments – Experteninterview mit Thorsten Wittmann

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

? Kostenfrei anmelden: https://thorstenwittmann.com/top-freiheitslaender-2023

➡️ Homepage und Tippvideos: https://thorstenwittmann.com/

? Geldtraining https://thorstenwittmann.com/anmeldun...

Land Nr. 1: Das Freiheitsland Paraguay

Paraguay ist in vielerlei Hinsicht ein besonderes Land, für viele aber kaum bekannt. Hier ein paar Eckpunkte zu diesem faszinierenden Land in Südamerika und das Auftaktland...

Read More »

Read More »

Euro Pokes Above $1.09. Will it be Sustained?

Overview: The Lunar New Year holiday has shut many centers in Asia until the middle of the week, though China's mainland is on holiday all week. The signaling of a downshift in the pace of Fed tightening by some notable hawks helped lift risk appetites ahead of the weekend and saw the

S&P 500 snap a four-day decline.

Read More »

Read More »

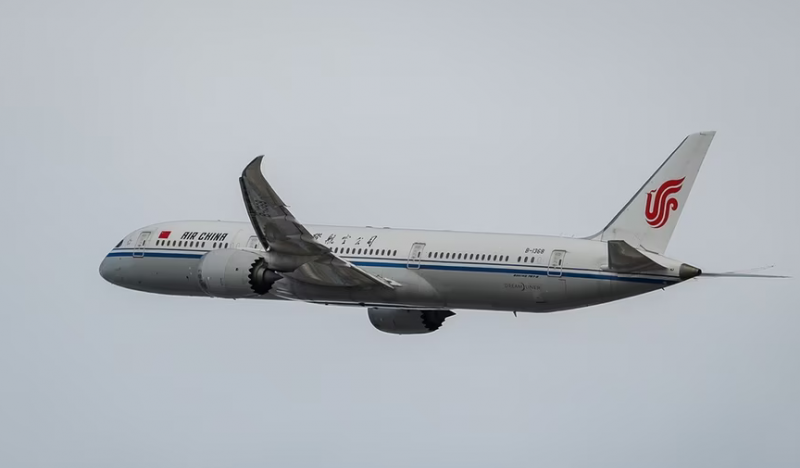

China-Switzerland flights struggle to resume after three years

Geneva airport was expected to see the return of direct flights from China next week, but the scheduled Air China flights of January 26 and February 2 have been cancelled due to lack of passengers, reports Swiss public broadcaster RTS.

Read More »

Read More »

Macron-Scholz meet in Paris: Macron says sending tanks to Ukraine must not escalate the crisis

German Chancellor Olaf Scholz is in Paris to meet French President Macron. The French President said that sending tanks to Ukraine must not escalate the crisis.

Read More »

Read More »