Listen to the Radio Rothbard version of this article.

President Trump issued a new executive order on August 8 directing the Treasury Department to defer the 6.2 percent Social Security tax on wages for employees making less than about $100,000 a year. The suspension on collections will be in effect from September 1 through December 31.

Unfortunately, the suspension on collections—which applies only to the employee share of payroll taxes—doesn’t amount to an actual tax cut, since collections could resume at any time after December 31. Moreover, once the September-December deferment period is up, employees would still be responsible for their tax liability back to September 1.

Potential Problems for Business Owners

If this is intended to be a “stimulus” policy of sorts, it may not accomplish what was intended. As the Wall Street Journal noted Tuesday:

Trump’s move…doesn’t change how much tax employees and employers actually owe. Only Congress can do that.

Employers’ biggest worry: If they stop withholding taxes without any guarantee that Congress will actually forgive any deferred payments, they could find themselves on the hook. That is a particular risk in cases where employees change jobs and employers can’t withhold more taxes from later paychecks to catch up on missed payments.

“The Internal Revenue Service will come to that deep pocket” of employers to collect payroll taxes, said Marianna Dyson, a lawyer at Covington & Burling LLP in Washington who specializes in payroll taxes. “Liability is going to stick to the employer like flies to flypaper.”

Any business owner who has navigated the hassles of payroll tax collection understands the problem here. The tax has gone away only temporarily. And come January, employers may have to make sure all the payroll tax obligations are paid back to September.

For many employers, this may be a paperwork nightmare. For this reason, many employers will try to avoid changing their payment schemes at all. They’ll want to just keep withholding taxes, because they may need that cash on hand come January 1.

Unfortunately for employers, this could cause employer-employee strife, since some employees may complain to employers that they received no “tax cut” if employers continue to collect payroll taxes as usual. How much of a headache this may be for employers is still unclear.

The situation remains unpredictable from the employers’ perspective, and if they take a “wait and see” approach to changing payroll tax collections, there won’t be much stimulus to consumer spending (not that goosing consumer spending actually improves economic growth anyway).

But it could be that economic stimulus was never the point. Trump’s executive order is likely to be interpreted by much of the general public as an effort to give ordinary people (i.e., those earning under $100,000 per year) a tax cut. If Trump opponents complain about this, they’re basically putting themselves in the position of arguing against a middle-class tax cut. Moreover, the move puts pressure on Congress to follow up with a statutory tax cut so that the deferment turns into a bona fide reduction in taxes.

Will Trump’s Opponents Now Care about Deficits?

Naturally some will complain that this will cut tax revenues and drive up deficits. But most of these complaints will come from people who have in no way opposed this fiscal year’s $3 trillion deficit. The idea that anyone in Washington—aside from a few misfits like Thomas Massie—care anything at all about “fiscal responsibility” is clearly something of a joke at this point. We’re now looking at possibly a $7 trillion spending total for the 2020 fiscal year. Nearly half of that is going to be funded through deficits and money printing. Washington is fine with this.

But now, when it comes down to a tax cut for working-class families, will Trump’s opponents have suddenly turned into deficit hawks? Many voters will see through that pretty easily.

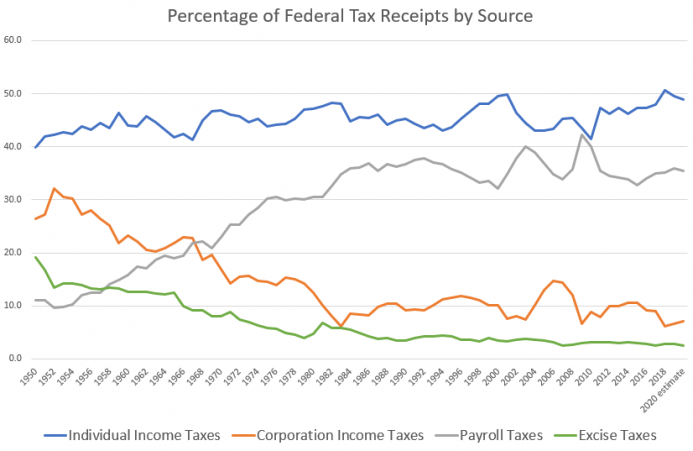

All Wage Earners Pay Income TaxesThe entire controversy is also a helpful reminder that virtually all wage earners pay taxes on income. For years, many wealthy conservatives have whined and complained that many people “don’t pay enough” when it comes to income taxes. Mitt Romney once famously claimed that half of Americans pay no income tax. This is only true in a very narrow, technical sense. Yes, many low-paid wage earners do not have a tax liability as part of the graduated income tax. But virtually all earners pay taxes on income through payroll taxes, or the “self-employment tax.” Morerover, workers pay a hidden tax in the form of the employer share of payroll taxes, which lessens an employer’s ability to expand employment overall. As a Brookings report concluded, “When looking more specifically at middle-aged workers with jobs, 96 percent paid federal income or payroll taxes” (emphasis in original). In fact, the payroll tax has taken on a growing role as a central source of federal revenues in recent decades. Payroll taxes were once a small part of the federal revenue scheme, with less than 20 percent of federal tax revenue coming from payroll taxes. But by the late 1980s—in part after countless women moved from untaxed at-home work to taxable wage work—payroll taxes had increased to over one-third of all federal tax revenue. During this period the graduated income tax remained flat in its share of overall tax revenue. Since 1950, excise taxes have fallen from 20 percent of federal revenues to only 2 percent. This shift to payroll taxes has been beneficial for the federal government during periods of economic crisis, when high wage earners often see sizable drops in income. This naturally reduces tax receipts from the graduated income tax. But payroll taxes tend to not fall quite as rapidly, and this helps buoy federal tax receipts overall. We saw this in the wake of both the dot-com bust and the 2008 financial crisis. Stated simply, Americans are paying plenty in income taxes, and Trump’s executive order may be interpreted by many as an attempt at much-needed tax relief for middle-income wage earners. Whether or not this ever moves beyond perceptions into reality remains to be seen. |

Percentage of Federal Tax Receipts by Source |

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter