Tag Archive: newsletter

Warum ich DIVIDENDEN mehr Traue als der AHV (Gesetzliche Rente)

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Warum ich Dividenden mehr Traue als der AHV (Gesetzliche Rente) ?

In diesem Video erkläre ich warum ich Dividenden als stabilere und vorhersehbarere Einkommensquelle betrachte als die AHV. Ich gehe auf die Vorteile von Dividenden-Aktien ein und wie man langfristig ein passives Einkommen aufbauen kann. Schauen Sie sich...

Read More »

Read More »

Dirk Müller: Die Zinsen sind zurück Kommt es jetzt anders als gedacht? #shorts

?? Jetzt Cashkurs-Mitglied werden ►► 1 Monat für €9,90 statt €17,70 ►https://bit.ly/Cashkurs9_90

3️⃣ Tage gratis testen ►►► https://bit.ly/3TageGratis

? Gratis-Newsletter ►►►https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►► https://www.youtube.com/@cashkurscom

Cashkurs.com - Wirtschaft. Finanzen. Börse. Ehrlich! Unabhängig! Direkt!

?????? ??? ????? ?? ????! ???? ?ü???? ??? ??? ??????? ????????-???? ?????? ???? ??? ???!

Bildrechte:...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #49

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Wie Sie mit Humor ein besseres Leben führen werden (Business und Beziehungen)

Wie Sie die Kraft des Humors einfach nutzen können! Allerdings sollten Sie sich auch in Acht nehmen. Hier erfahren Sie einige Anekdoten und Beispiele als Inspiration für Sie.

Read More »

Read More »

Study: solar panels only pay off in half of Swiss cities

Solar panel installations are only profitable in half of Swiss cities according to a new study. This could create hurdles for the expansion of solar energy in the country.

Read More »

Read More »

Michael Mross: Denn sie weiss nicht, was sie tut

#michaelmross #freiheit #untergang #boom #aktien

Michael Mross ist ein bekannter deutscher Börsenexperte, Buchautor, Wirtschaftsjournalist und Moderator.

Read More »

Read More »

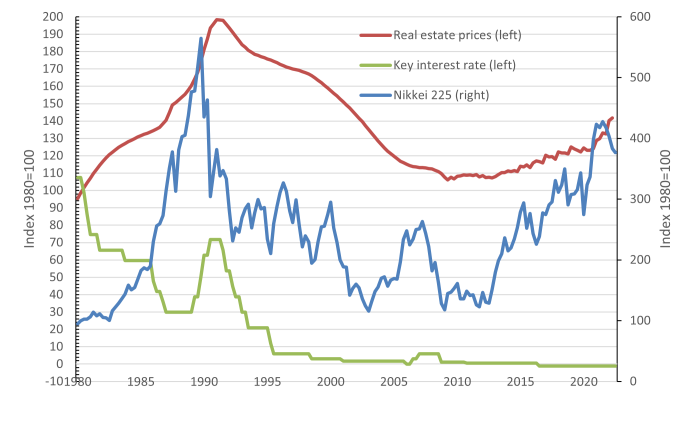

Is the Japanese Low Inflation–Low Interest Rate Model at an End?

The macroeconomic situation in Japan seems to be coming to a head. When the Bank of Japan, under its President Haruhiko Kuroda, announced on December 20, 2022, that it would raise its interest rate ceiling on ten-year Japanese government bonds from 0.25 percent to 0.50 percent, share prices in Tokyo plummeted and the Japanese yen appreciated sharply.

Read More »

Read More »

Triangulation Is One of My Keys to Success

#Triangulation is one of my keys to #success because it gives me #perspective and allows me to stress-test my thinking. From my conversation with @jayshetty2758. #principles #raydalio

Read More »

Read More »

Bargeldabschaffung, der Weg zum “THE GREAT RESET” | Sparkojote Dividenden Donnerstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDonnerstag Livestream findet jeden Donnerstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDonnerstag #2023 #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★...

Read More »

Read More »

Gravitas: Is Russia planning a new offensive?

Is Russia planning a new offensive? Ukraine's Defence Minister says Putin could launch a new offensive on February 24. Is there any credit to his claims? Molly Gambhir reports.

Read More »

Read More »

SIND DIE USA KRIEGSTREIBER?

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

►Folge Oliver auf...

Read More »

Read More »

TAGESSCHAU LÄSST BOMBE PLATZEN!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

Deutsche Panzer gegen Russland / FreeTV-Variante Themencheck mit Hans A. Bernecker am 01.02.2023

Themencheck von Hans A. Bernecker ("Die Actien-Börse") im Rahmen von Bernecker.TV. An dieser Stelle gibt es dieverkürzte FreeTV-Variante inkl. (teils nicht direkt zusammenhängenden) Einblicken in die ansonsten längere Sendung vom 01.02.2023.

Read More »

Read More »

Migration vs. Emigration und Wirtschaftliche Konsequenzen in Deutschland – Dr. Stelter im Interview!

Dr. Daniel Stelter spricht über Migration und Emigration nach und aus Deutschland. Dabei geht es vor allem um die ökonomischen Aspekte und wie sich Deutschland in Zukunft aufstellen muss, um mehr von Migration zu profitieren

Hier geht es zu Dr. Stelters Podcast https://think-beyondtheobvious.com/

? bis zu 100 Euro bei Depoteröffnung ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine...

Read More »

Read More »

Prof. Max Otte mit hochbrisanten Aussagen! Die Welle rollt auf uns zu! Alles läuft nach Plan!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Wichtige Ereignisse zusammengefasst! Wird der Euro scheiten? Kommt die Bankenkrise? Wie schützen wir uns vor der Inflation? Kommt der Lastenausgleich?

Hier auf dem Kanal von Finance Experience bekommt ihr täglich neue...

Read More »

Read More »

Andreas Beck: DARUM gehören diese ETFs jetzt in jedes Portfolio!

Andreas Beck gehört zu den besten Experten in puncto #ETFs. Grund genug ihn zu fragen, wie er die steigenden #Zinsen im #Portfolio abbildet. Im Interview mit Timo spricht sich Beck explizit für eine von Privatanlegern sträflich vernachlässigte Anlageklasse aus: #Anleihen. In diesem Video erfährst du, warum diese jetzt wieder sinnvoll sind für deine #Finanzen und wie du damit #Rendite erwirtschaften kannst. Viel Spaß mit dem Gespräch zwischen Timo...

Read More »

Read More »