Tag Archive: newsletter

The Relevant Word Is ‘Decline’

The English language headline for China’s National Bureau of Statistics’ press release on November 2018’s Big 3 was, National Economy Maintained Stable and Sound Momentum of Development in November. For those who, as noted yesterday, are wishing China’s economy bad news so as to lead to the supposed good news of a coordinated “stimulus” response this was itself a bad news/good news situation.

Read More »

Read More »

FX Daily, December 17: Markets Quiet to Start Fed Week

Activity in the global capital markets is subdued as investors move to the sidelines as the year-end approaches. The Federal Reserve headlines the holiday week that also features a Bank of England a Bank of Japan meeting. Only the Fed is expected to change rates.

Read More »

Read More »

FX Weekly Preview: FOMC Dominates Week Ahead Calendar

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise.

Read More »

Read More »

Swiss prepare to fight age discrimination

A people's initiative, allowing workers over 50 to sue for age discrimination, will be launched soon, the NZZ am Sonntag reported on Sunday. According to Heidi Joos, the CEO of Avenir 50 plus, one of the organisations behind the project, this proposed constitutional provision should allow employees to sue a company if they believe they have been dismissed for age-related reasons or if their application for employment has not been taken into account...

Read More »

Read More »

“Yellow Vests” and the Downward Mobility of the Middle Class

Capital garners the gains, and labor's share continues eroding. That's the story of the 21st century. The middle class, virtually by definition, is not prepared for downward mobility. A systemic, semi-permanent decline in the standard of living isn't part of the implicit social contract that's been internalized by the middle class virtually everywhere:living standards are only supposed to rise.

Read More »

Read More »

How Faux Capitalism Works in America

Stars in the Night Sky. The U.S. stock market’s recent zigs and zags have provoked much squawking and screeching. Wall Street pros, private money managers, and Millennial index fund enthusiasts all find themselves on the wrong side of the market’s swift movements. Even the best and brightest can’t escape President Trump’s tweet precipitated short squeezes.

Read More »

Read More »

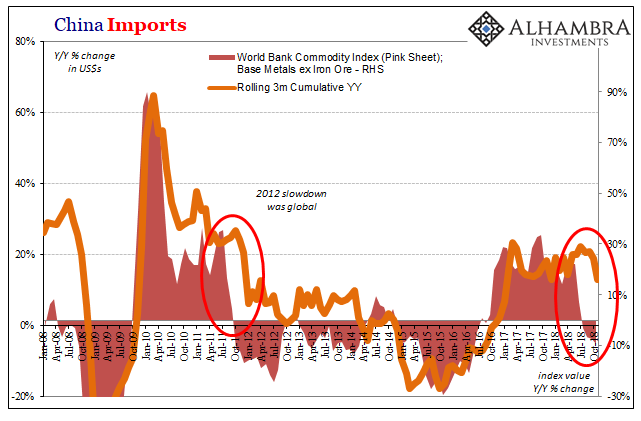

Sometimes Bad News Is Just Right

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019).

Read More »

Read More »

SNB leave interest rates on hold, what next for GBP/CHF rates?

This morning the Swiss National Bank have left interest rates on hold at 0.75%, and market reaction between GBP/CHF has been limited. The Swiss Franc has rallied slightly against the US dollar and the Euro as forecasters were suggesting the SNB could cut interest rates further, however the events last night in the UK I believe outweighs the interest rate decision in Switzerland.

Read More »

Read More »

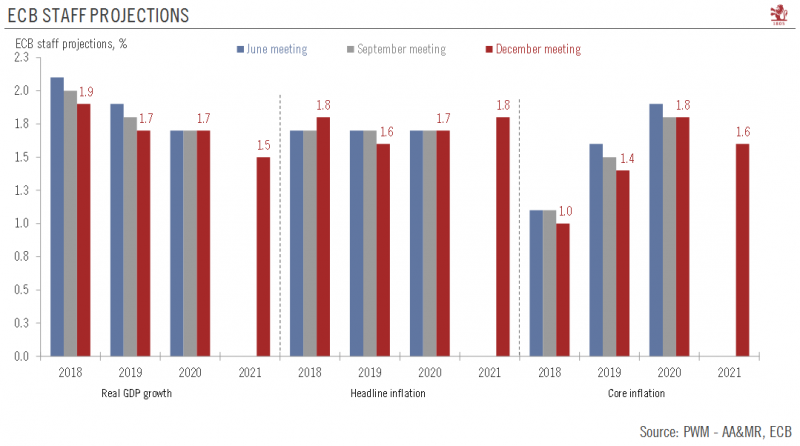

ECB: Still Broadly Confident, but Caution Increasing

The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer of 2019”.

Read More »

Read More »

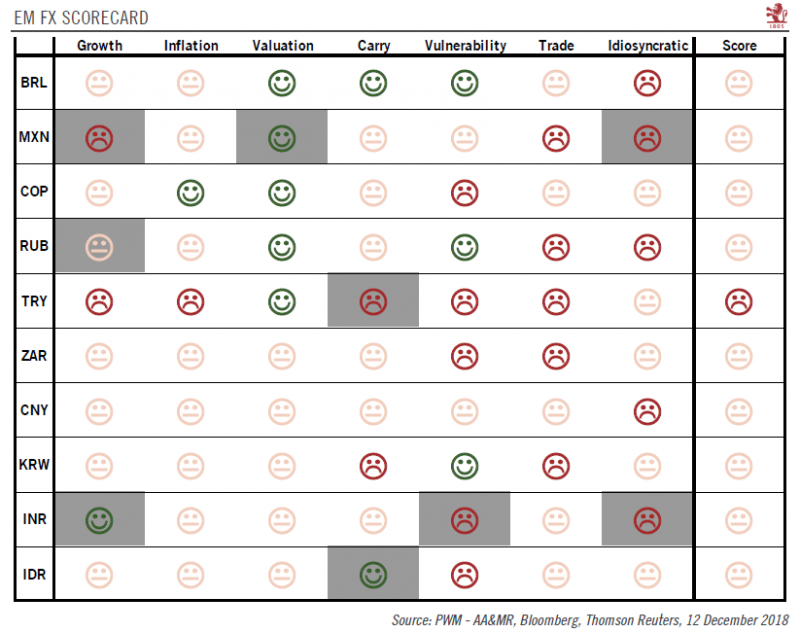

Emerging market currencies: idiosyncratic risks strike back

The environment will remain challenging for EM currencies next year.Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latestEM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single attractive EM currency among the...

Read More »

Read More »

FX Daily, December 14: Week Closing on a Disappointing Note

Overview: A string of disappointing economic is spurring risk-off sentiment today. Global shares prices are being punished and core bonds are being snapped up. The US dollar is trading higher against most major and emerging market currencies. The MSCI Asia Pacific Index was flat on the week coming into today's session.

Read More »

Read More »

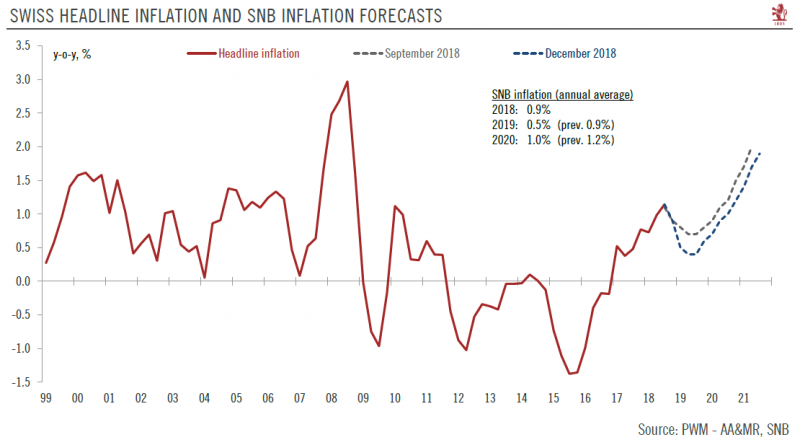

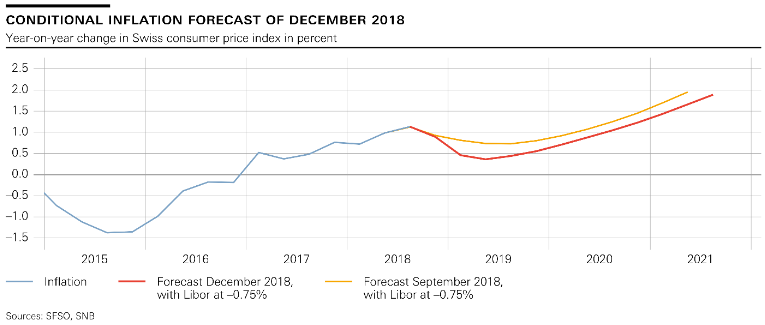

Large downward revisions to the Swiss National Bank’s inflation forecasts

Fresh inflation projections likely to keep the central bank on the path of prudence.The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today.The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge.

Read More »

Read More »

Swiss Supermarkets Selling Products with no Country of Origin on Label

For example, a piece of farmed salmon will typically be labelled only with its country of origin, containing no information on what the fish has been fed. Contaminated fish feed can significantly push up the level of dioxins found in the fish’s fat. Mad cows disease is another example of how animal feed contaminated food.

Read More »

Read More »

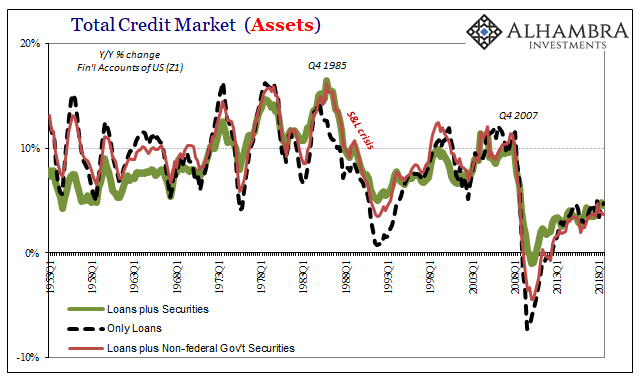

US Banks Haven’t Behaved Like This Since 2009

If there is one thing Ben Bernanke got right, it was this. In 2009 during the worst of the worst monetary crisis in four generations, the Federal Reserve’s Chairman was asked in front of Congress if we all should be worried about zombies. Senator Bob Corker wasn’t talking about the literal undead, rather a scenario much like Japan where the financial system entered a period of sustained agony – leading to the same in the real economy, one lost...

Read More »

Read More »

FX Daily, December 13: May Survives but its Draghi’s Day

Overview: There is a sense of optimism among investors today that may be tested as the session progresses. News that China may reconsider its "Made in China 2025" initiative as an apparent concession to the US while reports suggest it has bought 1.5-2.0 mln tons of soy is easing trade tension fears.

Read More »

Read More »

Monetary Policy Assessment of 13 December 2018

The Swiss National Bank (SNB) is maintaining its expansio nary mo netary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%.

Read More »

Read More »

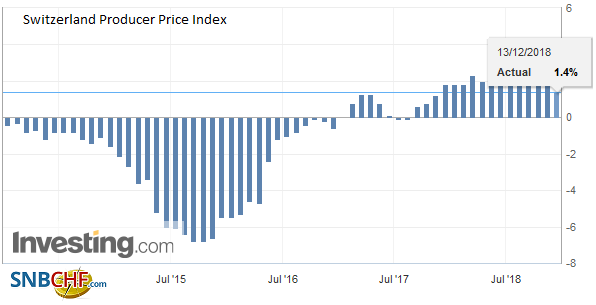

Swiss Producer and Import Price Index in November 2018: +1.4 percent YoY, -0.3 percent MoM

The Producer and Import Price Index fell in November 2018 by 0.3% compared with the previous month, reaching 103.1 points (December 2015 = 100). This decline is due in particular to lower prices for pharmaceutical products. Compared with November 2017, the price level of the whole range of domestic and imported products rose by 1.4%.

Read More »

Read More »

EU Recession Imminent – Euro Disunion as Brexit, Italy and End of QE Loom

Someone asked recently how many times I had “crossed the pond” to Europe. I really don’t know. Certainly dozens of times. It’s been several times a year for as long as I remember. That makes me an extremely unusual American. Most of us never visit Europe, except maybe for a rare dream vacation. And that’s okay because our own country is wonderful and has a lifetime of sights to see.

Read More »

Read More »

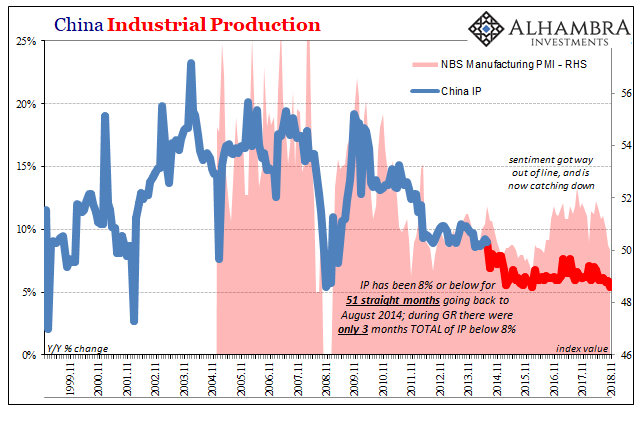

China Going Back To 2011

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of one US investment “bank”) the...

Read More »

Read More »

FX Daily, December 12: Markets Calm on May Day

The US S&P 500 failed to sustain the early upside momentum, but global equities are moving higher today, and there is some optimism on the trade front. Emerging market equities and currencies are also doing well today.

Read More »

Read More »