Tag Archive: newsletter

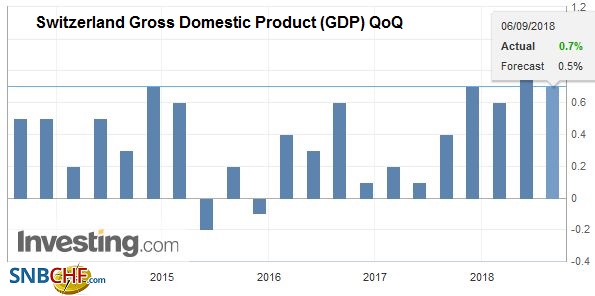

Switzerland GDP Q2 2018: +0.7 percent QoQ, +3.4 percent YoY

The Swiss economy once again recorded dynamic growth in the 2nd quarter of 2018. GDP (+0.7%) expanded at an above-average rate for the fifth quarter in a row. This ex-pansion was largely supported by manufacturing, which has been experiencing a re-markable upturn since spring of 2017. Exports of goods increased accordingly.

Read More »

Read More »

FX Daily, September 6: Fragile Calm Weighs on Greenback

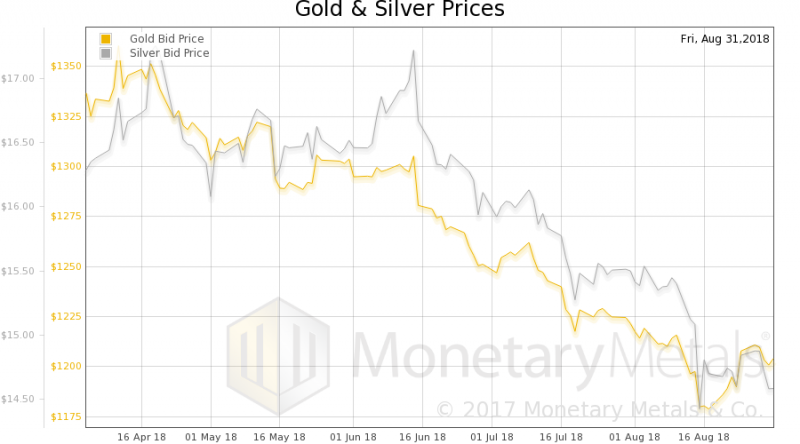

The global capital markets are calmer today. This is not preventing the MSCI Emerging Market Index from extending its drop into the seventh consecutive session, but there has been a respite in the sell-off of emerging market currencies, where the Mexican peso, South African rand, Turkish lira, and Indonesian rupiah are modest, modest gains. At the same time, the Philippine peso, Korean won, and Indian rupee continued to weaken.

Read More »

Read More »

FX Daily, September 05: Continuing EM Pain Helps the Dollar, but does Little for Yen

The dollar is posting gains against most of the emerging market and major currencies. The MSCI Emerging Markets Index is off 1.6% and extending the drop to a sixth consecutive session. Indonesia's bourse saw the largest decline (~3.75%) in the region. In part, it reflects concern that the rupiah's weakness (falling now nine of the past 10 sessions) will boost corporate debt servicing costs.

Read More »

Read More »

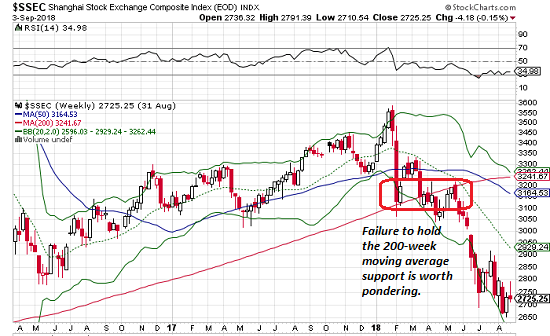

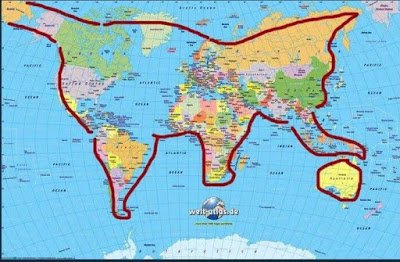

The Global Financial System Is Unraveling, And No, the U.S. Is Not immune

Currencies don't melt down randomly. This is only the first stage of a complete re-ordering of the global financial system. Take a look at the Shanghai Stock Market (China) and tell me what you see: A complete meltdown, right? More specifically, a four-month battle to cling to the key technical support of the 200-week moving average (the red line). Once the support finally broke, the index crashed.

Read More »

Read More »

Cool Video: Emerging Markets Continue to Sell-Off

I had the privilege of being on the Bloomberg set with Tom Keene and Francine Lacqua earlier today. Lakshman Achuthan, co-founder of ECRI also joined us for the discussion. This 6.5 min video clip captures the essence of the discussion. The US dollar was rallying against all the major and most EM currencies.

Read More »

Read More »

Swiss Consumer Price Index in August 2018: +1.2 percent YoY, Stable MoM

Neuchâtel, 4 September 2018 (FSO) - The consumer price index (CPI) remained stable in August 2018 compared with the previous month, remaining at 101.8 points (December 2015 = 100). Inflation was 1.2% compared with the same month of the previous year. These are the results from the Federal Statistical Office (FSO).

Read More »

Read More »

Novartis chief hints at job cuts in Switzerland

The president of pharmaceutical giant Novartis has announced job cuts in an interview with Swiss newspaper NZZ am Sonntag. Jörg Reinhardt said the Basel-based company wants to streamline its production sites and administration worldwide.

Read More »

Read More »

FX Daily, September 04: Dollar Gains Broadly

The US dollar is rising against all the major and emerging market currencies today. The signals from the White House suggest strong pressure will be exerted on Canada to sign on to NAFTA 2.0 or risk losing part of its auto sector, which of course is primarily the production of US brands. At the same time, the US is in no mood to negotiate with Europe or China.

Read More »

Read More »

Emerging Market Week Ahead Preview

EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday.

Read More »

Read More »

Die SNB-Zeitbombe tickt, die NZZ nickt

„Die Devisenreserve der SNB sind keine Zeitbombe, die uns einmal um die Ohren fliegt, sondern eine Art Volksvermögen“. Das behauptet die SNB-freundliche NZZ am Sonntag. Das Blatt bedient ein SNB-Klischee nach dem anderen und hat den Ernst der Lage unserer Schweizerischen Nationalbank (SNB) offensichtlich nicht begriffen.

Read More »

Read More »

Swiss Retail Sales, July 2018: +0.3 percent Nominal and -0.3 percent Real

Turnover in the retail sector rose by 0.3% in nominal terms in July 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.9% compared with the previous month.

Read More »

Read More »

Minister says state-guaranteed cantonal banks complicate EU talks

Swiss finance minister Ueli Maurer says state-guaranteed cantonal banks are an obstacle in ongoing negotiations with the European Union. “This point still needs to be clarified before a framework agreement can be accepted,” the minister is quoted as saying in an interview published on Saturday.

Read More »

Read More »

FX Weekly Preview: Trade Trumps US Jobs and Rising Stress in Spain and Italy is More Important than the PMI

The first week of a new month features the US jobs data. It is the most important economic report of a new month. It sets the broad tone for much of the economic data over the next several weeks, including consumption, industrial production, and construction spending. However, there are two reasons why it may not pack the punch it has in the past.

Read More »

Read More »

Emerging Markets: What Changed

China stepped up efforts to attract more foreign inflows to the onshore bond market. Russia has softened its unpopular pension reform proposal. The African National Congress withdrew an existing land expropriation bill. Moody’s downgraded twenty Turkish financial institutions. Turkey central bank Deputy Governor Erkan Kilimci has reportedly resigned.

Read More »

Read More »

Swiss cantons forced to fish for multinationals with non-tax lures

Proposed changes to Switzerland’s tax rules could have a dramatic effect on which cantons remain attractive locations for multinational companies in future. As a result, factors such as the cost of premises or concentration of high tech facilities, will play a greater role, according to UBS bank.

Read More »

Read More »

SkyWork lands its last ever plane in Bern Airport

The last SkyWork flight landed in Bern Airport on Wednesday night, as ongoing financial difficulties forced the company to declare itself bankrupt. Some 11,000 passengers are affected. The company, founded in 1983, cited the failure of negotiations with a potential partner to pull the company from recurring funding shortfalls that intensified in October last year.

Read More »

Read More »

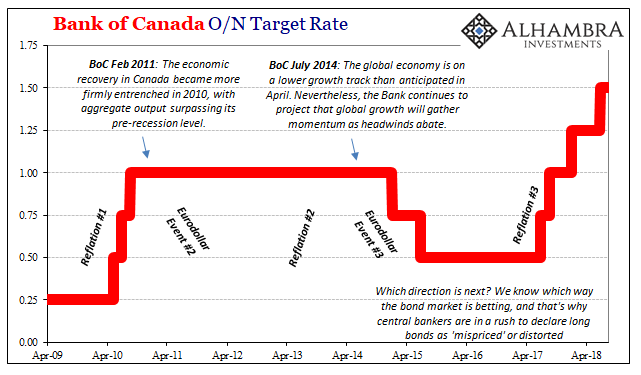

‘Mispriced’ Bonds Are Everywhere

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are.

Read More »

Read More »

The Big Picture 18-24-Month Outlook: Some Preliminary Projections

The winding down of the North's summer provides a suitable time to consider not the near-term outlook, which many investors do on a daily basis, but to reflect on where we are heading down the road a bit. What will the next 18-24 months hold? Of course, we harbor no illusions of prescient vision and accept the hazards of the assignment and so should the reader.

Read More »

Read More »