The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of one US investment “bank”) the recovery from the crisis wasn’t proceeding smoothly.

[Google Translate] From an international perspective, the recovery process of the world economy is difficult and tortuous, and the international financial crisis is still developing. Some countries’ sovereign debt crisis is difficult to ease in the short term. The unemployment rate in the major developed economies is high and the growth momentum is insufficient. The emerging economies are facing the dual pressures of inflation and economic growth.

That last part was the general consensus; there was to be a “new normal” in the Western world particularly the US and Europe but business as usual mostly in Asia driven by China’s uninterrupted industrial transformation. Thus, the governance challenges over there were, in Wen’s opinion, very different from those over here.

The State Council in addition to ruling pretty much everything is also the keeper of the economic targets as part of its processes for governing. For 2012, it set “around 4%” as its mandate for consumer price increases. Though the CPI had already decelerated from its peak the July before, 2011, there was widespread dissatisfaction among Chinese workers as the index achieved 6.5% at its top.

This was the main problem Wen and the Communist government prioritized. In a world without growth, China feared having perhaps too much. Still, by setting the goal for the CPI in 2012 at 4%, authorities were making it very clear they would tolerate quite a bit of inflation if it meant keeping their economy on track in an increasingly indeterminate world.

Just one year later suddenly conventional wisdom was proved wildly inaccurate. It continued as convention for a few more years but exposing the lack of wisdom it had contained. A world without growth would indeed be the whole world without growth.

Maybe because China is so over-exposed to the risks, politically as well as along other lines, the Chinese haven’t had the luxury of fooling themselves into calling what isn’t a recovery a recovery as have Western officials (completely detached from the consequences of their cumulative, ongoing failures). They hadn’t figured it all out all at once, of course, but you can see their evolving thoughts and expectations starting the very next year.

In March 2013, Wen Jiabao had a very different message for the State Council:

In 2012, under the circumstances that the world’s major economies experienced a general slowdown in growth and various risks were exposed, we rationally grasped the policy intensity, kept the scale of fiscal budget expenditure unchanged, optimized the expenditure structure, reversed the economic downturn, and fully realized the initial year.

Expectations as well as targets would begin being adjusted accordingly:

The main target is GDP growth of 7.8%, urban new employment of 12.66 million, and consumer price increase to 2.6%, laying a good foundation for economic development this year.

It would be several more years further before the State Council would grasp the horrifying situation more completely. This was not some prolonged intermediate stage between pre-crisis growth levels and the eventual return to them. The 2014-16 worldwide “dollar” shortage would propose in economic terms this post-2011 unfolding global “L.”

There are all sorts of questions surrounding China’s economic statistics including the construction and maintenance of its CPI. Setting those aside, one thing has become amply clear in the nearly seven years since that slowdown in 2012. The whole world has tipped toward deflationary rather than inflationary risks.

Sure, there was a lot of heated rhetoric last year about how “globally synchronized growth” was going to change all that. Even commodity prices were bet on the chance that might be the case. The recovery from the Great “Recession” was, as many officials saw it, delayed and it had finally, mercifully arrived. If 2017 was the setup, 2018 was its delivery.

Except, obviously, it hasn’t been. This year was the year of rolling over rather than exploding upward. As it rolls itself toward the end of the calendar, economically that process is already shifting – the downside has re-emerged.

| Everyone wants to talk about trade wars and tariffs. Fine; those haven’t helped but they are all contained within this much larger, and longer, global economic problem. Wen Jiabao hadn’t imagined a populist US President in 2013 because one wasn’t necessary for things to go very wrong – and stay that way. The 2012 transition is the least appreciated and most consequential economic period in generations. Even more momentous, I would argue, than 2008.

Which is really, really instructive (about attitudes and ideology in Economics) because it shows up everywhere. In China, most of all: Despite rising food prices over the past few months, the Chinese CPI hasn’t managed the State Council’s reconfigured goal of 3%. The PBOC, China’s central bank, isn’t obligated to do everything in its power to reach that goal, either. Rather, the State Council has prioritized other tasks for its monetary authority. |

China PBOC Balance Sheet and CPI, Nov 2006 - 2018 |

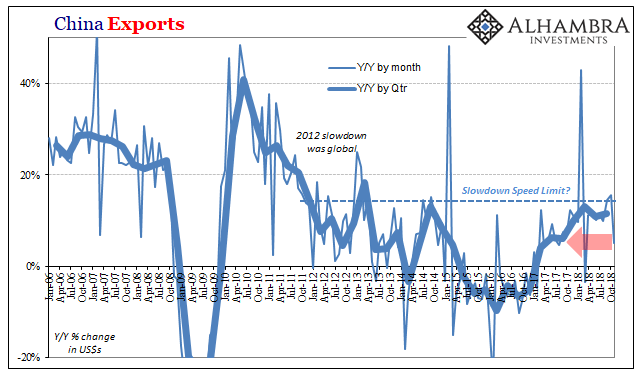

| Those have become much more difficult to achieve, too. Massive financial imbalance must now be scaled against what appears to be the next looming downturn. China’s General Administration of Custom’s reported this weekend very alarming numbers on China’s end of global trend. Export growth sank to just 5% year-over-year in November 2018. That’s the lowest non-affected monthly gain since August 2017. |

China Exports, Jan 2006 - Oct 2018(see more posts on China Exports, ) |

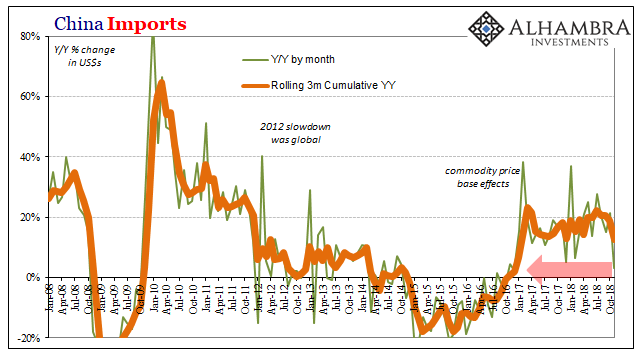

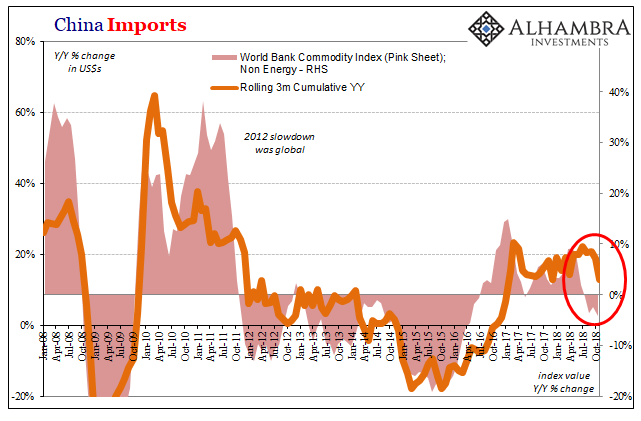

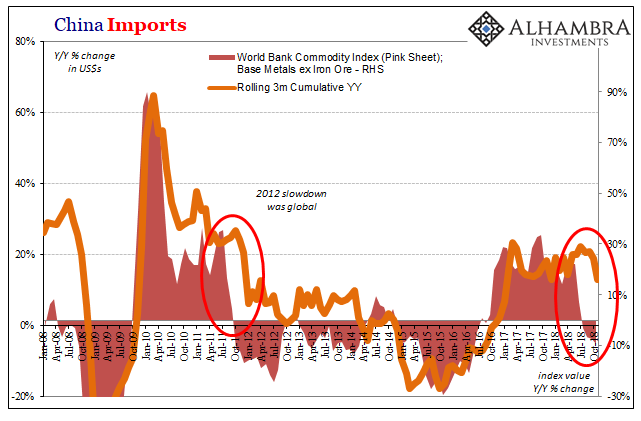

| More concerning was the import number, rising just 3% year-over-year last month. That was the worst since December 2016. While imports have provided some bad months before, there is one key difference this time around. Commodity prices have been foreshadowing not just a few low spots but the ever-increasing chance one bad month is the start of another slowdown period – or, like 2014-16, worse. |

China Imports, Jan 2008 - Oct 2018(see more posts on China Imports, ) |

China Imports, Jan 2008 - Oct 2018(see more posts on China Imports, ) |

|

| This is how it all goes, a fact of economic life the Chinese began to more readily perceive during that last downturn. The turmoil of 2015 and early 2016 proved that no matter how good things might seem globally at any one time, they really aren’t no matter how Western officials will over-hype positive numbers.

There can be no recovery because the global economy is trapped by “something.” It was in 2011 when the last small steps toward eurodollar healing were violently and ruthlessly erased. Back then, everyone just blamed Greece and Italy. The world just hasn’t been the same since, and more than that can never be the same. People just can’t believe how central banks could fail so badly and continuously and that economic growth isn’t a given. |

China Imports, Jan 2008 - Oct 2018(see more posts on China Imports, ) |

| If China’s Communists began to piece it all together starting in early 2013 (one reason why that summer was what it was) they sure know enough about it now. Reactionary repression isn’t an accident. And that was before eurodollar #4 really gets going on the downside. |

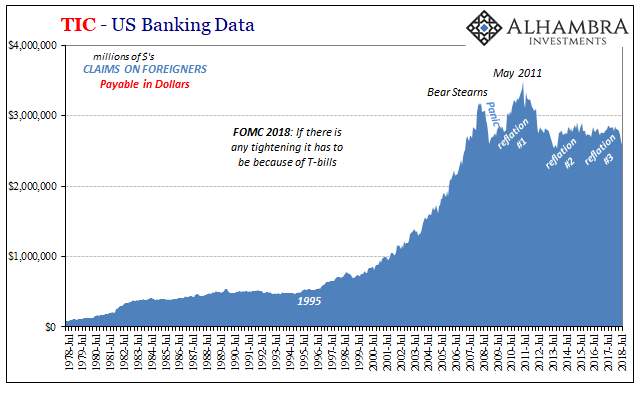

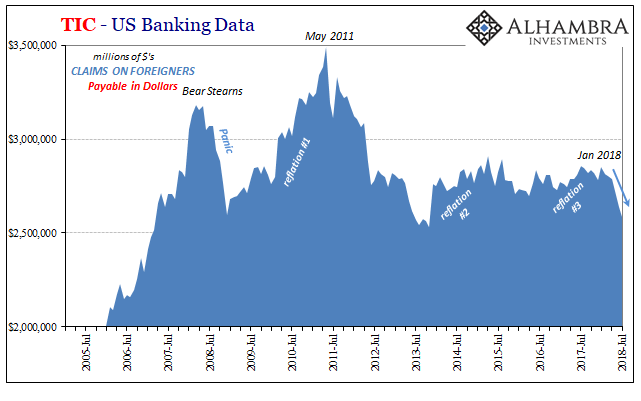

Claims on Foreigners, Payable in Dollars, Jul 1978 - 2018 |

Claims on Foreigners, Payable in Dollars, Jul 2005 - 2018 |

|

Money Markets Equivalents, Jul 2009 - Nov 2018 |

Tags: China,China Exports,China Imports,Consumer Prices,CPI,currencies,Deflation,economy,EuroDollar,eurodollar system,exports,Federal Reserve/Monetary Policy,global trade,imports,inflation,Markets,newsletter,PBOC