Tag Archive: newsletter

Switzerland number one for expat pay and stability

In 2019, Switzerland came top overall in a ranking of destinations for expatriates to live and work, moving up from eighth last year. Singapore, which had held the top spot for four years in the HSBC’s list of the best countries for expatriates, dropped to second place.

Read More »

Read More »

Quantum says Swiss prosecutors close Angola-related case

The Office of the Attorney General has closed an investigation into events surrounding the Zug-based asset manager Quantum Global and its founder Jean-Claude Bastos, the firm says. Bastos has been in the spotlight over ties to Angola’s sovereign wealth fund.

Read More »

Read More »

Vested Interests in Charge = Guaranteed Failure

It boils down to two very simple principles: accredit the student, not the institution and teach every student how to rigorously learn on their own. Vested interests have every incentive to maintain the status quo: specifically, those who currently own the assets, income streams and power will continue to own the assets, income streams and power.

Read More »

Read More »

Swiss car importers fined over higher CO2 emissions

For the third year running, newly registered cars in Switzerland have failed to meet the national CO2 emissions target, largely due to the growth in the number of 4x4s and fall in diesel cars, the Federal Office of Energy has warned.

Read More »

Read More »

Planned pension reform sees women working a year longer

The Swiss government plans to incrementally increase the retirement age of women to 65 while offering incentives for all people to work longer. The CHF2.8 billion ($2.84 billion) savings measures would be accompanied by a sales tax hike and extra pension payments for hardship cases.

Read More »

Read More »

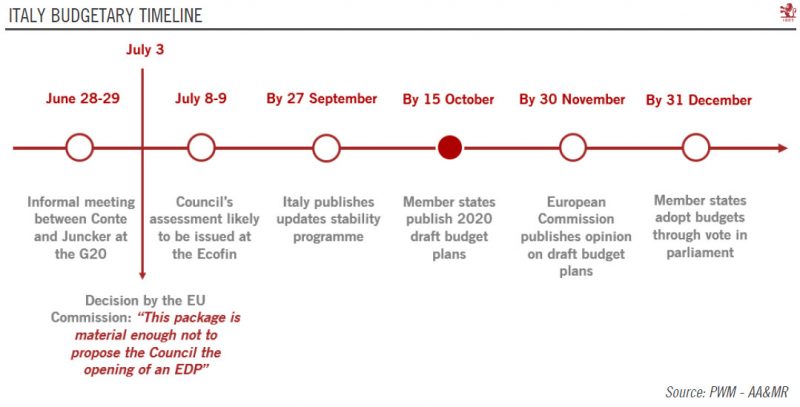

A truce between Rome and Brussels

For now, Italy has avoided Brussels' Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package.In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other revenues (including dividends...

Read More »

Read More »

FX Daily, July 05: Dollar is Bid Ahead of Jobs Report

Overview: The dovish response to news that Lagarde was nominated to replace Draghi was extended by the dismal German factory order report that has pushed the euro to new two-week lows and kept bond yields near record lows. The focus ahead of the weekend is squarely on the US employment data, where a second consecutive poor report will fan expectations for a large Fed cut to initiate an easing cycle.

Read More »

Read More »

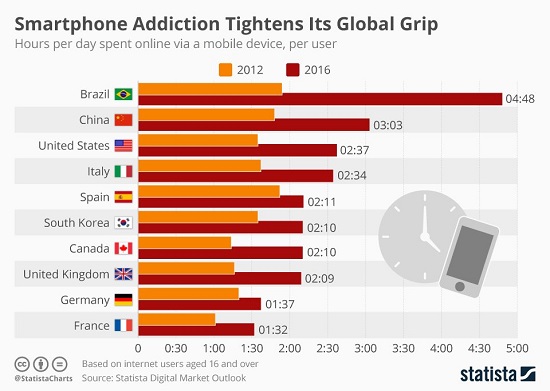

What’s Left to Monetize?

What's left to monetize? It appears the answer is "very little." Advertising has always monetized consumers' time and attention, what we call engagement today. Newspapers and periodicals publish advertisements, radio/TV networks and stations air adverts, movie theaters run trailers/ads, billboards occupy our mental space while driving and websites and apps post adverts.

Read More »

Read More »

First-half investment in Swiss start-ups doubles to more than CHF1 billion

Venture capital investment in Swiss start-ups doubled during the first half of 2019 to exceed CHF1 billion ($1.01 billion). After record investment in 2018, the venture capital market has stayed strong in 2019, according to data published on Tuesday by Swiss company Venturelab.

Read More »

Read More »

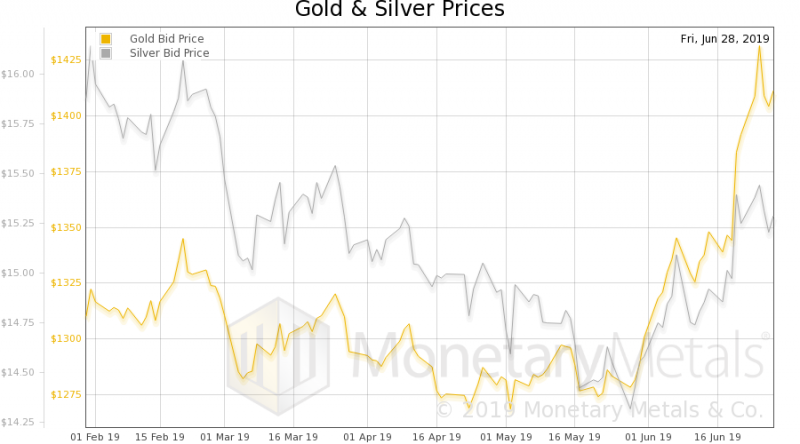

Gold and Silver Will Surge to Record Highs Over $1,900 and $50 Per Ounce – IG TV Interview

Mark O’Byrne, founder at GoldCore, gives IG TV’s Victoria Scholar his outlook for gold and silver prices and why he believes they will surpass their record nominal high prices of 2011 in the coming years.

Read More »

Read More »

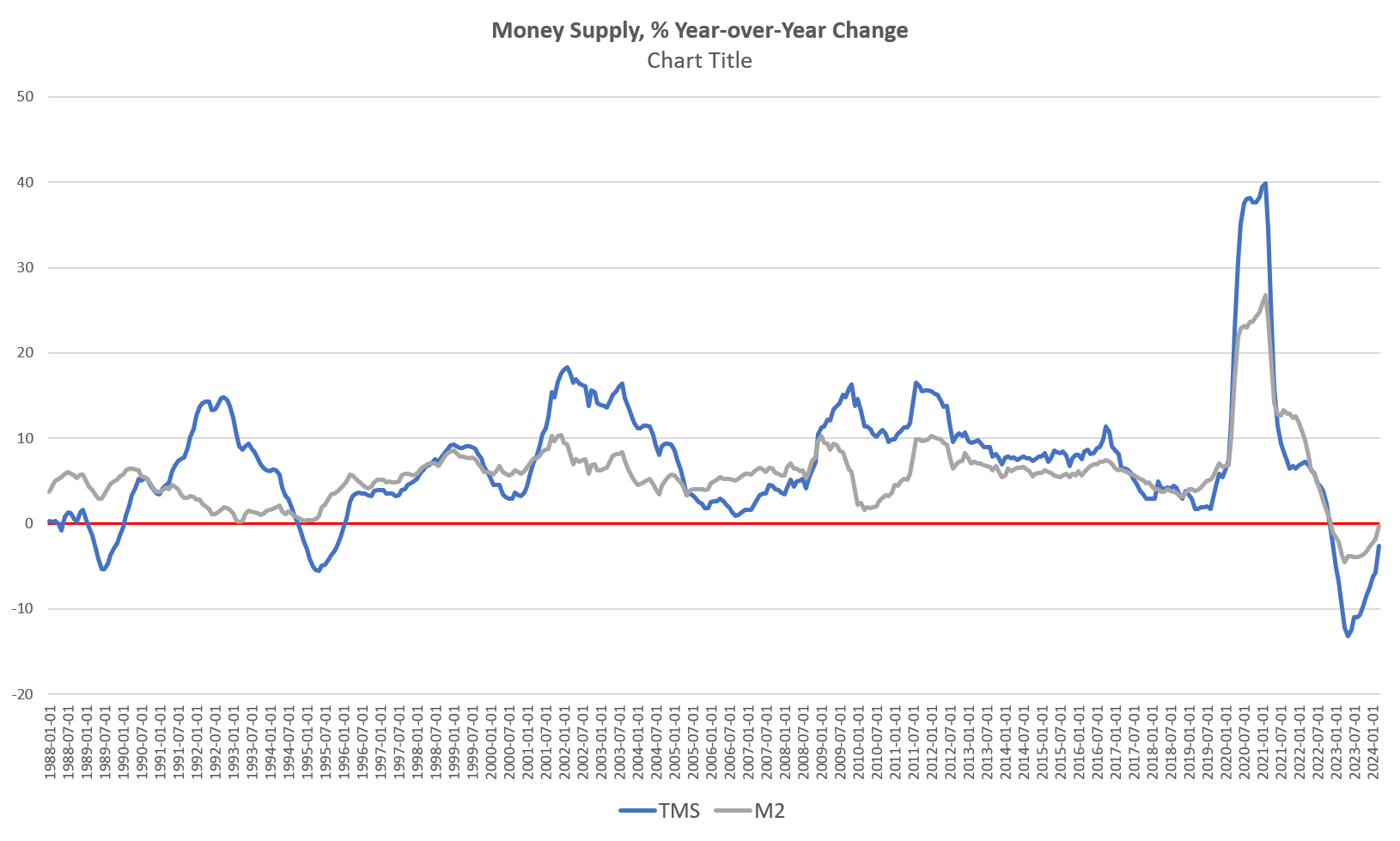

How To Properly Address The Unusual Window Dressing

Unable to tackle effective monetary requirements, bank regulators around the world turned to “macroprudential” approaches in the wake of the Global Financial Crisis. It was mostly public relations, a way to assure the public that 2008 would never be repeated. A whole set of new rules was instituted which everyone was told would reign in the worst abuses.

Read More »

Read More »

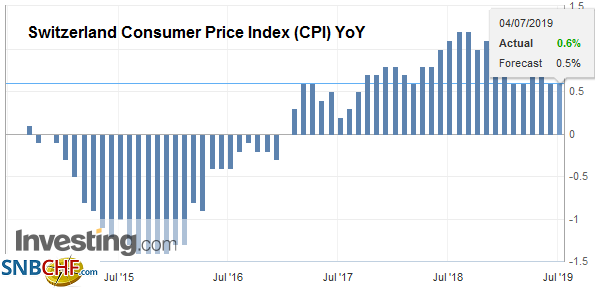

Swiss Consumer Price Index in June 2019: +0.6 percent YoY, 0.0 percent MoM

04.07.2019 - The consumer price index (CPI) remained stable in June 2019 compared with the previous month, remaining at 102.7 (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

Another Swiss bank settles German tax evasion probe

The Schaffhausen Cantonal Bank has settled a tax evasion dispute with the German state of North Rhine-Westphalia with a €3.9 million (CHF4.3 million) payment. The penalty clears the bank for all damages in Germany.

Read More »

Read More »

FX Daily, July 03: Yields Extend Decline

Overview: Interest rates are lurching lower. The US 10-year yield is at new two-year lows, but the driver is European bonds where peripheral yields are 6-7 bp lower, though Italy's benchmark is off 12 bp, while core yields are down 2-3 bp to new record lows. The German benchmark is almost minus 40 bp, while the Swiss 10-year is beyond minus 100 bp. Italy's two-year is breaking more convincingly below zero.

Read More »

Read More »

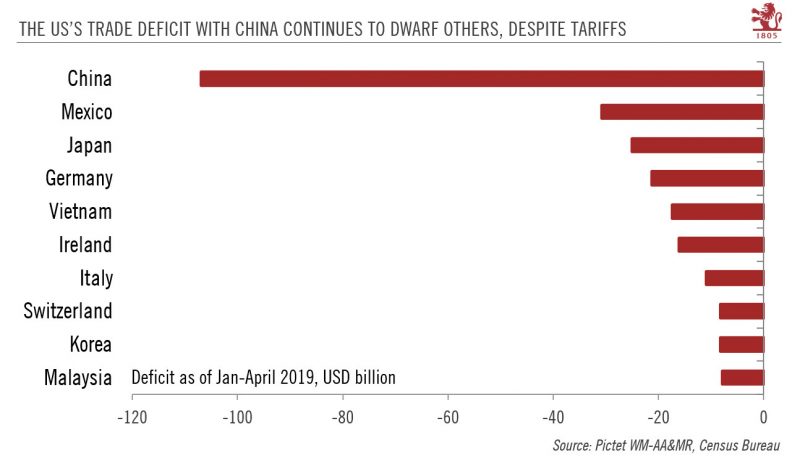

Fragile truce in Osaka

The US and China reached a ‘trade truce’ on the margins of the G20 summit this weekend, but existing tariffs remain in place. And we are only a tweet away from more Trumpian upheaval.The US and China leaders agreed on a truce during their much-anticipated meeting at the G20 summit in Osaka this weekend. Bilateral trade talks will restart.

Read More »

Read More »

FX Daily, July 2: Post-G20 Euphoria Fades, Stuck with Same Reality

Overview: The euphoria that greeted the resumption of US-China and US-North Korea talks has subsided. Global equities have turned mixed after yesterday's surge. Hong Kong played catch-up, and despite ongoing demonstrations, the Hang Seng rallied over one percent, and the Hong Kong Dollar strengthened beyond its band midpoint for the first time in nine months.

Read More »

Read More »

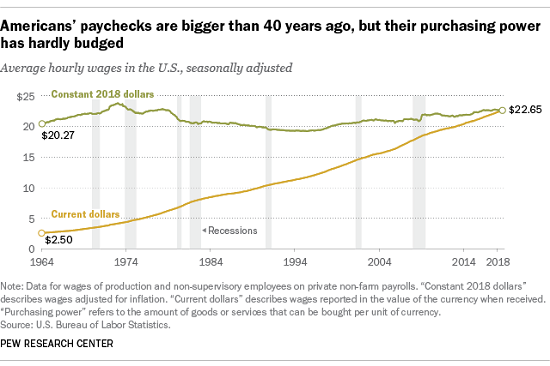

America’s Concealed Crisis: Fifty Years of Economic Decline, 1969 to 2019

If we consider the long term, it's clear America's economy and society have been declining for the average household for 50 years. What if the "prosperity" of the past 50 years is mostly a statistical mirage for the bottom 80% of households?

Read More »

Read More »

FX Daily, July 01: Trade Optimism Meet Reality of Disappointing PMI

Overview: A new tariff truce between the US and China, coupled with the North Korean diplomacy and Russia-Saudi tentative agreement boosted investor confidence and sharp equity rallies. Japanese and Chinese equities rallied 2-3%. Most markets rallied in Asia-Pacific except for South Korea's Kospi and Hong Kong markets were closed as the handover was commemorated.

Read More »

Read More »