Tag Archive: newsletter

FX Daily, July 12: Greenback Limps into the Weekend

Overview: Higher than expected US CPI and the second tepid reception to a US bond auction this week pushed US yields higher and helped stall the equity momentum. Asia Pacific yields, especially in Australia and New Zealand jumped 8-10 bp in response, and Spanish and Portuguese bonds bore the burden in Europe.

Read More »

Read More »

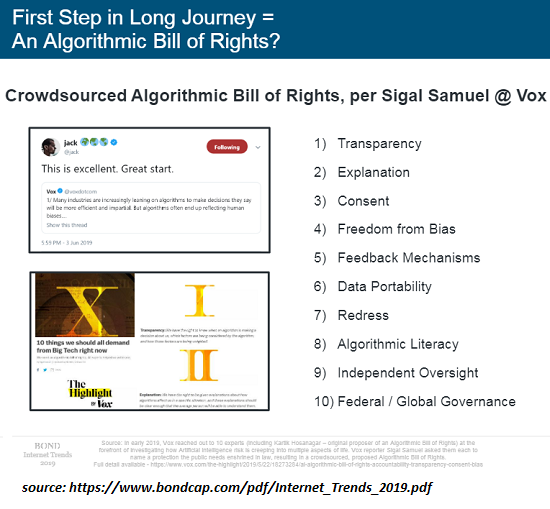

“Alexa, How Do We Subvert Big Tech’s Orwellian Internet-of-Things Surveillance?”

Convenience is the sales pitch, but the real goal is control in service of maximizing profits and extending state power. When every device in your life is connected to the Internet (the Internet of Things), your refrigerator will schedule an oil change for your car--or something like that--and it will be amazingly wunnerful.

Read More »

Read More »

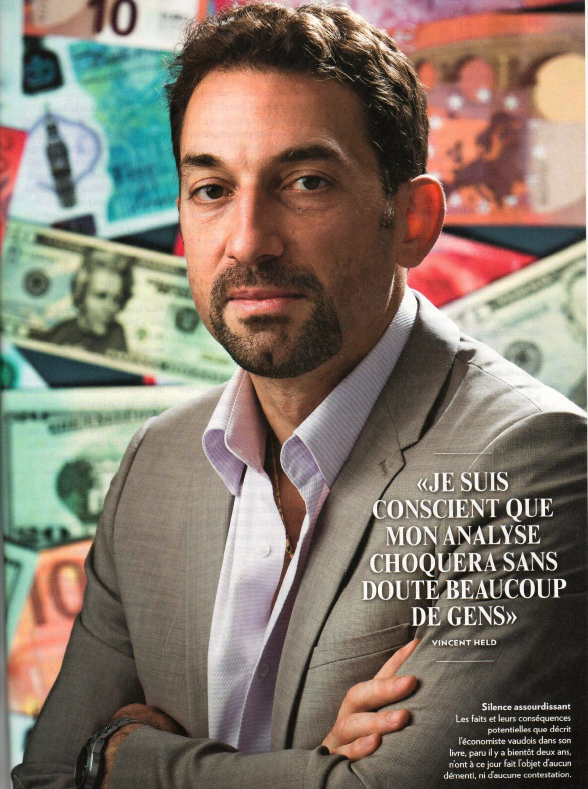

La BNS aspire l’épargne des Suisses. Entretien avec Vincent Held

Depuis une année, il ne se passe pas un jour sans que Donald Trump critique violemment la politique monétaire de la banque centrale américaine, pas un jour sans que le fantasque locataire de la Maison-Blanche crache son fiel au visage de Jerome Powell, le président de cette Réserve fédérale amarrée à une ligne beaucoup trop rigoureuse à ses yeux.

Read More »

Read More »

Hypothekarkredite: Selbstregulierung soll Risikoappetit bremsen

Die grössten Risiken für die Finanzstabilität gehen für die inlandorientierten Banken unverändert vom Hypothekar- und Immobilienmarkt aus, warnt die Schweizerische Nationalbank (SNB) im diesjährigen Bericht zur Finanzstabilität vom 13. Juni. Obwohl die Preise 2018 bei den Wohnrenditeliegenschaften leicht sanken, bleibe die Gefahr einer Preiskorrektur in diesem Segment besonders hoch.

Read More »

Read More »

Swiss exports to the US significantly exceed those to Germany for the first time

According to an analysis by the Swiss broadcaster RTS, Switzerland’s EU exports have declined in recent years. Over the first quarter of 2019, for the first time, exports to the US exceeded those to Germany by more than CHF 1 billion reaching CHF 15.7 billion. Exports to the US have risen from 8.3% to 16.3% of total Swiss exports over the last 30 years.

Read More »

Read More »

Some 60 percent of all Swiss banknotes are hoarded, study finds

The amount of Swiss CHF1,000 notes that are hoarded rather than being used in the economy for payments could be as high as 87%, a study by the Swiss National Bank (SNB) has shown. The report, “Demand for Swiss banknotes: some new evidence”, estimates the volume of Swiss banknotes being stashed – rather than spent or invested – over the period 1950-2017.

Read More »

Read More »

FX Daily, July 11: Powell Spurs Equity and Bond Market Rally, While the Greenback Falls Out of Favor

Overview: Fed's Powell confirmed a Fed rate cut at the end of this month by warning that uncertainties since the June FOMC had "dimmed the outlook" and that muted price pressures may be more persistent. It ignited an equity and bond market rally (bullish steepening) while the dollar was sold.

Read More »

Read More »

Hong Kong unrest

The extradition bill is 'dead' but political turmoil is not over yet.Since early June, a series of large-scale demonstrations took place in Hong Kong in protest of proposed legislation that would allow extradition of criminal suspects to certain jurisdictions, including mainland China.

Read More »

Read More »

FX Daily, July 10: North American Focus: Poloz and Powell

Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell's testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less.

Read More »

Read More »

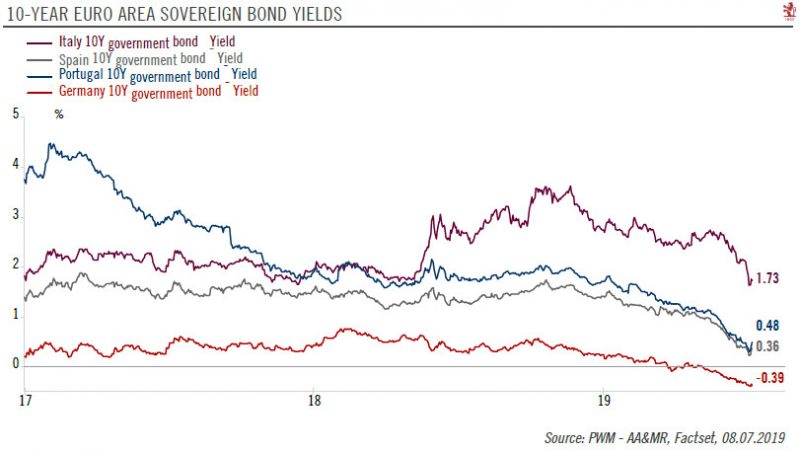

The ECB moves to keep euro bond yields down

Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds.Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below -0.4% (the same level as the...

Read More »

Read More »

Predatory “Green Capitalism” Is Monetizing the Air, and It’s Going to Cost You

You want to reduce CO2? Then trigger a global depression that reduces global consumption of everything by 50% and destroys 95% of the phantom wealth owned by the global elites trying to monetize the air. I recently asked What's Left to Monetize?, and longtime correspondent Mark G. provided the answer: the air we breathe, via carbon taxes and markets for trading carbon credits, i.e. financializing / monetizing Nature to benefit the few at the...

Read More »

Read More »

The rich get poorer for the first time since 2011

After seven years of growth, both the number of high-net-worth individuals (HNWIs) around the world and their total wealth declined in 2018, according to the latest World Wealth Report by consultants Capgemini. This trend was also seen in Switzerland.

Read More »

Read More »

FX Daily, July 9: No Turn Around Tuesday, as Equities Extend Losses and the Greenback Remains Firm

Overview: Global equity benchmarks are headed for their third consecutive loss today as caution prevails at the start of Q3 after a strong first half. Ten-year benchmark yields are edging higher after a soft start in Asia. Italian bonds continue to outperform. Greek bonds have been set back as the new government reiterated its commitment to ease fiscal commitments as if Tsipras did not try, and got a similar rebuff.

Read More »

Read More »

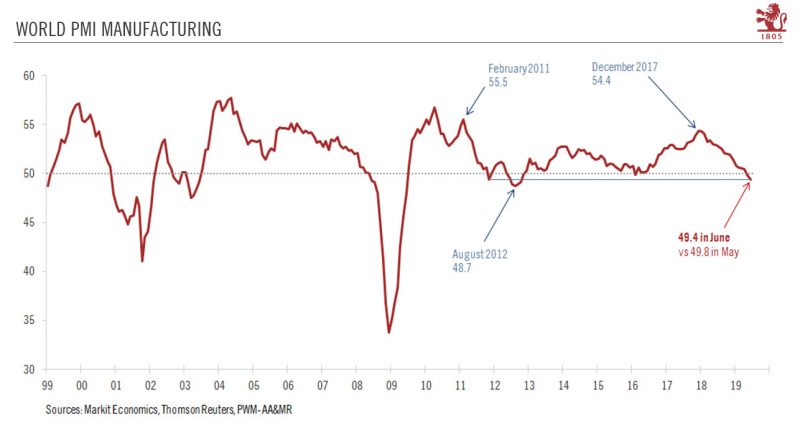

World trade and manufacturing hit by tariffs

In June, the world PMI manufacturing index recorded its second consecutive month below 50, suggesting that global manufacturing is contracting.Global manufacturing sentiment deteriorated further in June. Markit Economics’ World purchasing managers’ index for manufacturing fell to 49.4 from 49.8 in May, the second month in a row it was below the 50 threshold, suggesting that global manufacturing activity is contracting.

Read More »

Read More »

FX Daily, July 8: Macro Monday

Overview: The capital markets have begun the week in a mixed note. Asia Pacific equities tumbled, led by 2%+ losses in China and South Korea, but European shares are edging higher, and a positive close would be the seventh in the past eight sessions. The S&P is little changed. Asia Pacific bond yields moved higher, as anticipated after the jump in US yields after the jobs data.

Read More »

Read More »

When Everything from Bat Guano to Quatloos Is Soaring, Speculative Euphoria Has Reached an Extreme

The more extreme the speculative euphoria, the greater the risks of a reversal. One sentence sums up the speculative euphoria gripping markets: January and June of this year are the only months in the last 150 which have seen all assets post a positive total return. (Zero Hedge)

Read More »

Read More »

TGV trains run again between Geneva and France

The international TGV rail link between Geneva and France, which had been affected by the hot weather, has been repaired. Trains have been running since 5am on Sunday. Hot weather had buckled the tracks at La Plaine in canton Geneva, requiring repair work on Saturday, the Swiss Federal Railways said on Sunday.

Read More »

Read More »

FX Weekly Preview: In Bizzaro Beauty Contest, the US is Still the Least Ugly

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing.

Read More »

Read More »