Tag Archive: imports

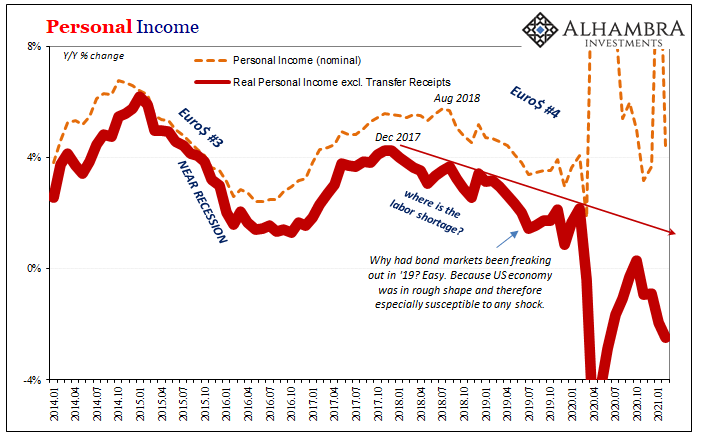

The Damage Started Months Before Harvey And Irma

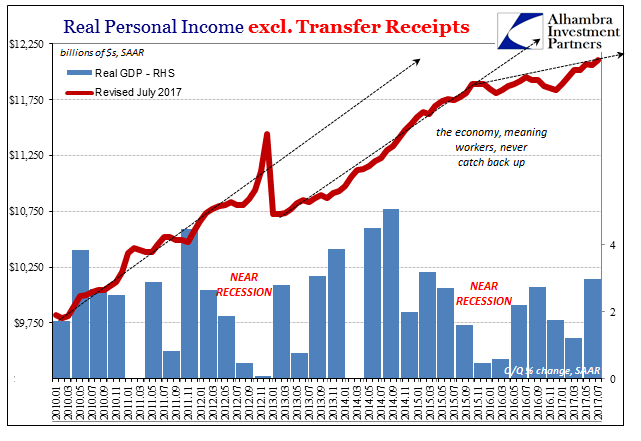

Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe.

Read More »

Read More »

US Export/Import: ‘Something’ Is Still Out There

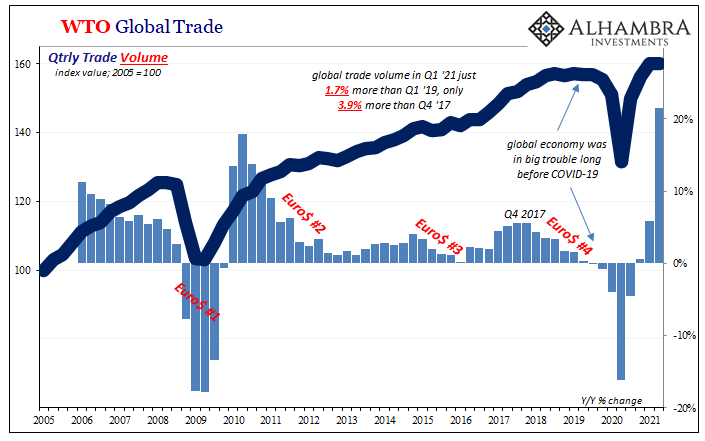

In January 2016, just as the wave of “global turmoil” was cresting on domestic as well as foreign shores, retired Federal Reserve Chairman Ben Bernanke was giving a series of lectures for the IMF. His topic wasn’t really the so-called taper tantrum of 2013 but it really was. Even ideologically blinded economists like Bernanke could see how one might have followed the other; the roots of 2016 in 2013.

Read More »

Read More »

U.S. Export/Import: Losing Economic Trade

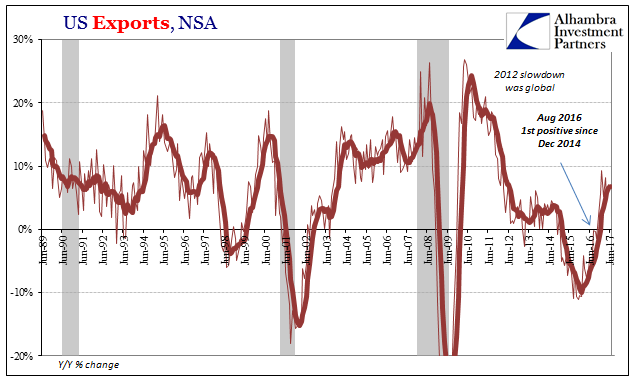

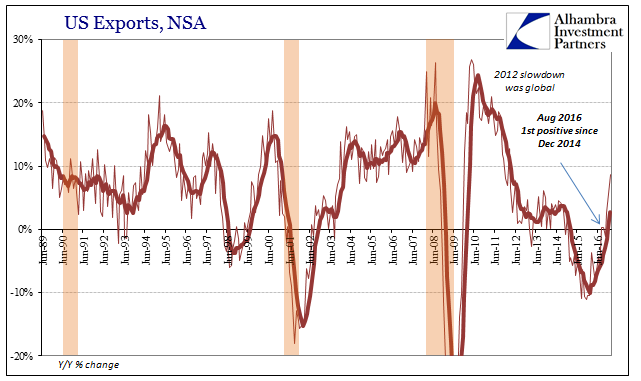

The oil effect continued to recede in late spring for more than just WTI prices or inflation rates. US trade on both sides, inbound and outbound, while still positive has stalled since the winter.

Read More »

Read More »

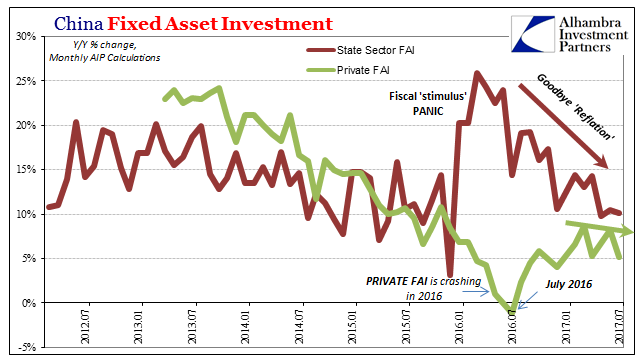

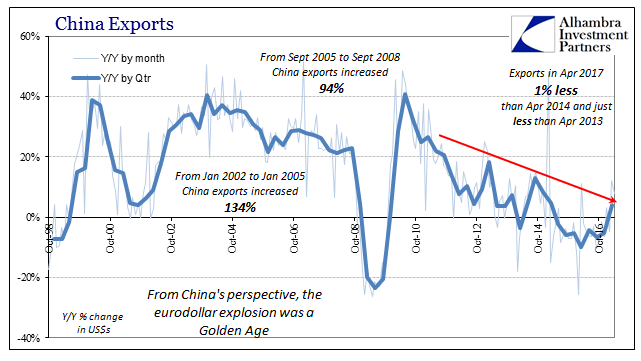

China: Losing Economic ‘Reflation’

If “reflation” was born last year in Japan, and I think it was, it was surely given its most tangible dimensions in China. The idea that the Bank of Japan was going to do something magnificent was perhaps always a longshot, but enough given the times for people to hope (sentiment) they might try (helicopter). The Chinese, however, have been relatively more pragmatic. Authorities began 2016 with an actual rather than imagined “stimulus” injection...

Read More »

Read More »

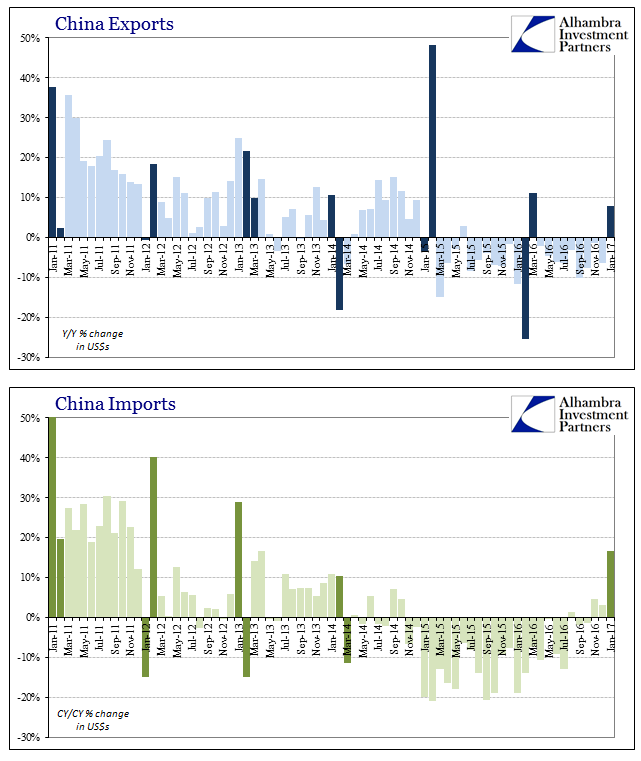

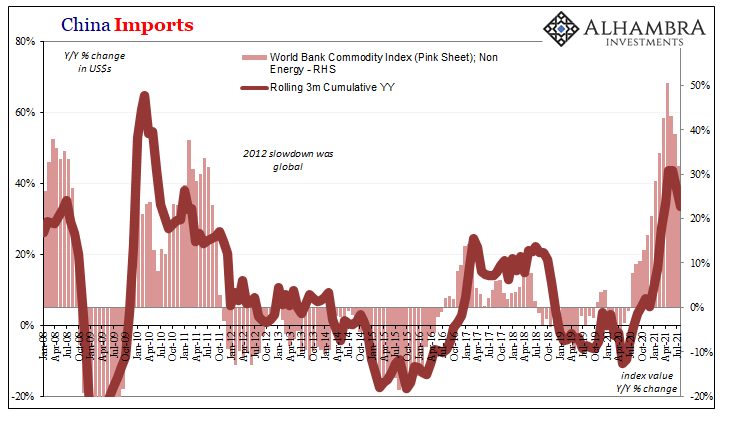

China Exports, China Imports: Textbook

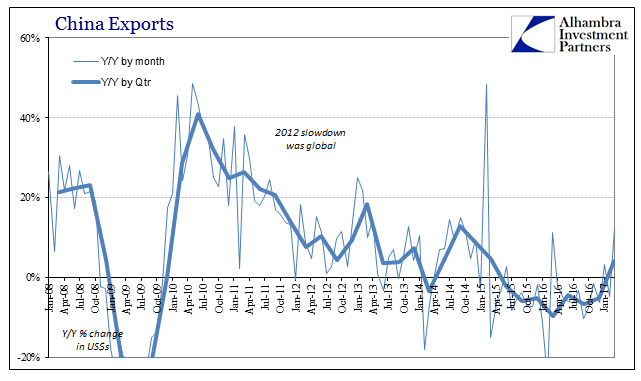

China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand.

Read More »

Read More »

China Imports and Exports: The Ghost Recovery

To the naked eye, it represents progress. China has still an enormous rural population doing subsistence level farming. As the nation grows economically, such a way of life is an inherent drag, an anchor on aggregate efficiency Chinese officials would rather not put up with.

Read More »

Read More »

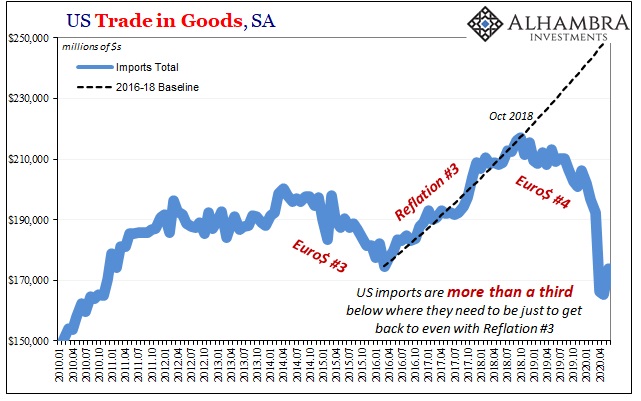

US Imports, Exports and Trade Stalls, Too

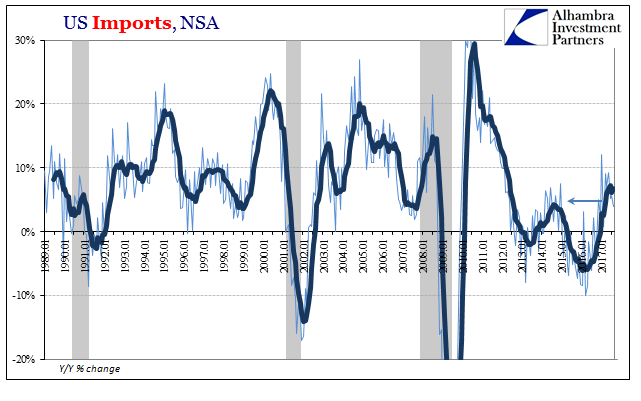

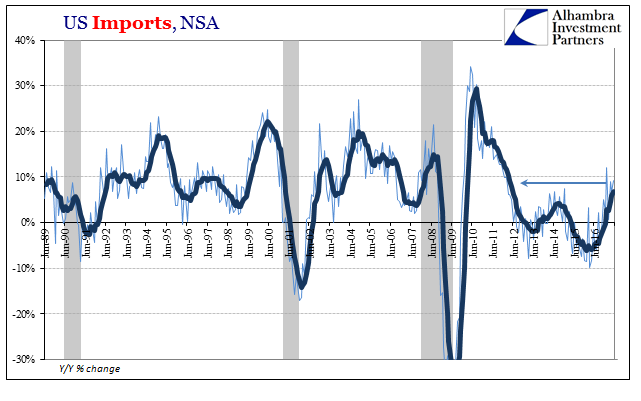

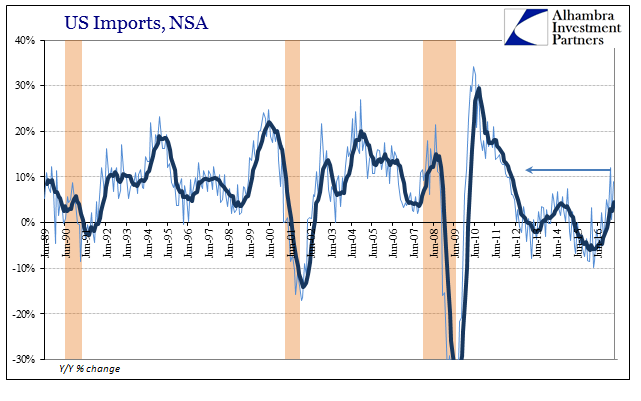

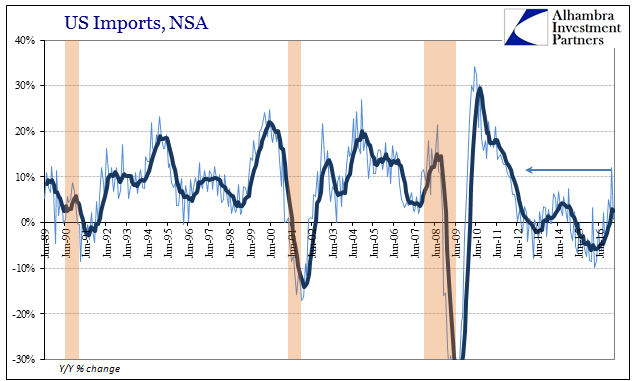

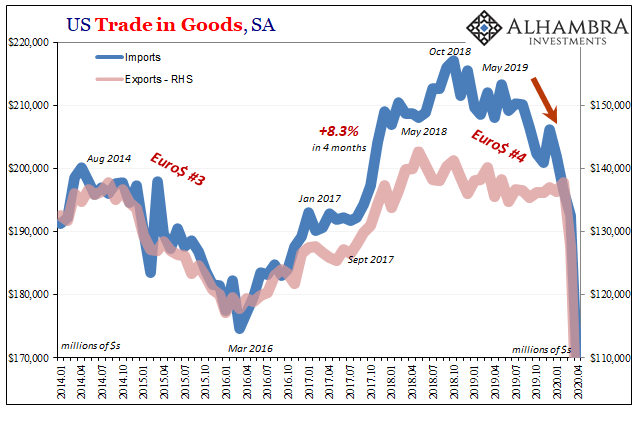

US imports rose year-over-year for the seventh straight month, but like factory orders and other economic statistics there is a growing sense that the rebound will not go further. The total import of goods was up 9.3% in May 2017 as compared to May 2016, but growth rates have over the past five months remained constrained to around that same level. It continues to be about half the rate we should expect given the preceding contraction.

Read More »

Read More »

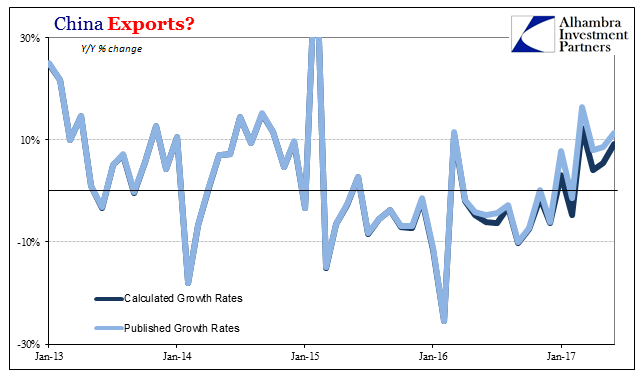

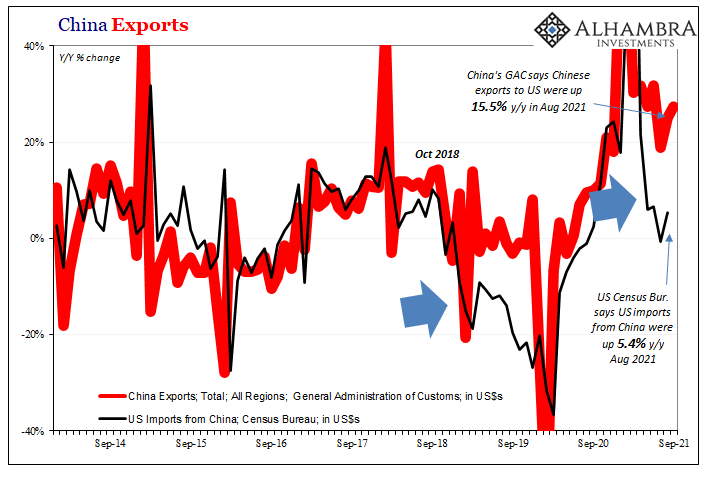

Questions Persist About China Trade

Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became noticeable.

Read More »

Read More »

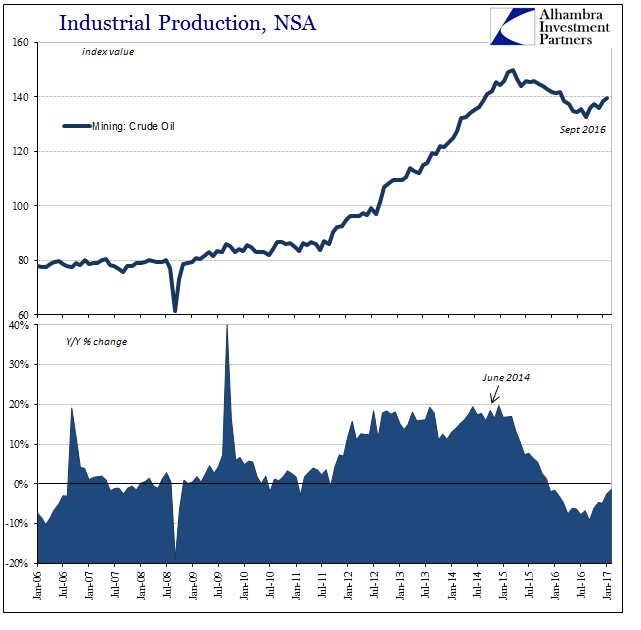

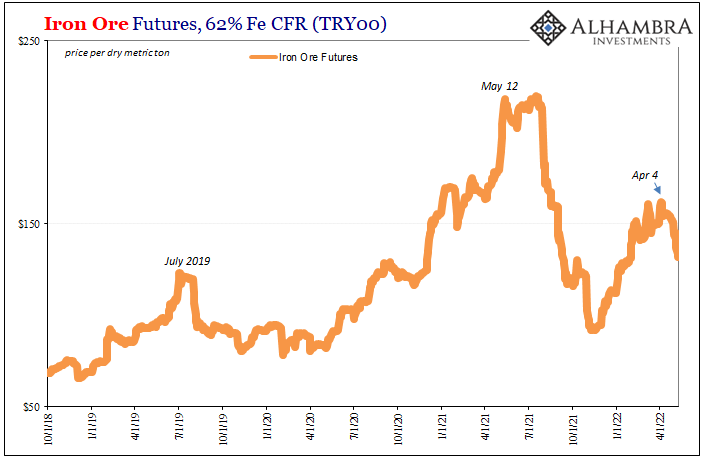

Commodity and Oil Prices: Staying Suck

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their pain.

Read More »

Read More »

Lackluster Trade, China April Edition

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth.

Read More »

Read More »

Lackluster Trade

US imports rose 9% year-over-year (NSA) in March 2017, after being flat in February and up 12% in January. For the quarter overall, imports rose 7.3%, a rate that is slightly more than the 2013-14 comparison. The difference, however, is simply the price of oil.

Read More »

Read More »

What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency.

Read More »

Read More »

February US Trade Disappoints

The oversized base effects of oil prices could not in February 2017 push up overall US imports. The United States purchased, according to the Census Bureau, 71% more crude oil from global markets this February than in February 2016. In raw dollar terms, it was an increase of $7.3 billion year-over-year. Total imports, however, only gained $8.4 billion, meaning that nearly all the improvement was due to nothing more than the price of global oil.

Read More »

Read More »

US Trade Skews

US trade statistics dramatically improved in January 2017, though questions remain as to interpreting by how much. On the export side, US exports of goods rose 8.7% year-over-year (NSA). While that was the highest growth rate since 2012, there is part symmetry to account for some of it.

Read More »

Read More »

No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays.

Read More »

Read More »

China: Best way to manipulate GDP is to lower inflation

Many claim that China manipulates its economic data. We explain why the best way not to get caught is to lower the GDP deflator, as lower inflation helps to increase real GDP. Lombard Street Research assumes that Chinese officials followed that approach.

Read More »

Read More »

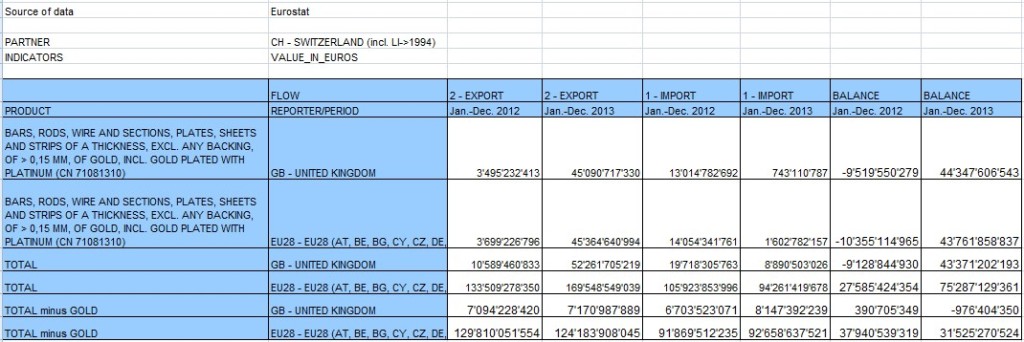

Official Eurostat Trade Balance Massively Distorted by UK Sales Of 1464 Tonnes of Gold To Switzerland

In 2013, private investors from the UK sold net (!) 1464 tons of physical gold (and similar) for a value 44.3 billion EUR. This was 1 464 000 kilograms each at the current price of 30254€ per kilo

Read More »

Read More »

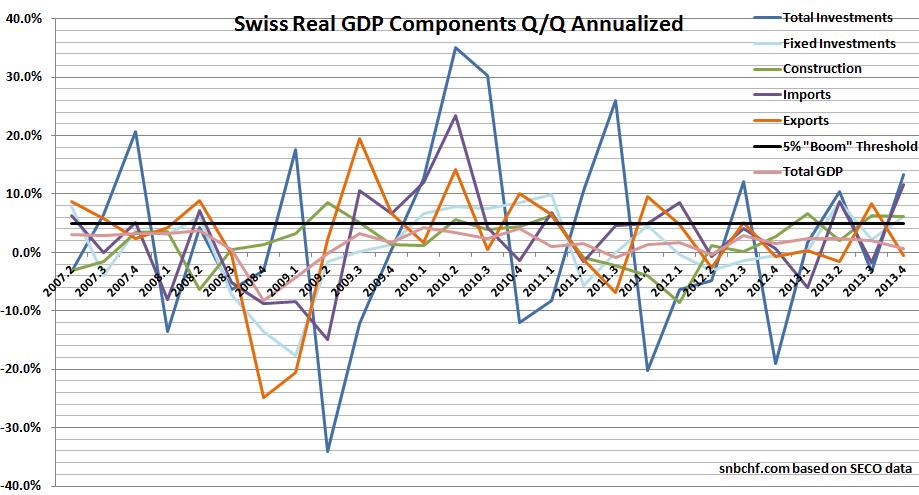

GDP: Switzerland Enters Boom and.. incredibly.. SNB is Still Printing Money

According to the latest data from the SECO,Swiss GDP rose by 0.2% in Q4/2013. Despite the relatively weak headline, the detailed data showed a couple of characteristics that speak for an upcoming boom. At the same time, the Swiss National Bank is printing money again: both the monetary base and money supply are increasing.

Read More »

Read More »

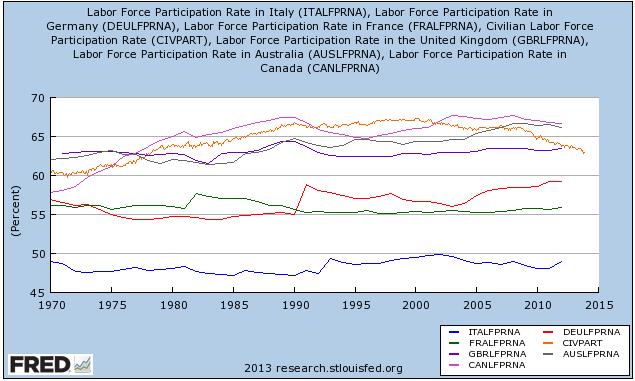

An Upcoming Italian Success Story?

Higher exports show that Italy's economy is trying to become a new German Companies seem to hide their competitiveness. A question remains: Will Italian companies really invest in Italy and create jobs?

Read More »

Read More »

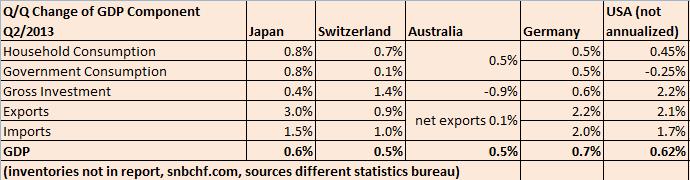

Swiss Q2 GDP Details Compared to Japan, Germany, Australia and U.S.

The Swiss GDP for Q2/2013 was in line with its peers in developed countries. The quarterly (not annualized) change was +0.5% compared to 0.6% for Japan and the United States, +0.7% for Germany and +0.5% for Australia. Swiss and Japanese growth was driven more by consumption, while the U.S. advances were based more on …

Read More »

Read More »