Tag Archive: franc

Why the floor will never be lifted to 1.25 ?

Or why the biggest opponents of the SNB are not Weltwoche and the SVP (Swiss People’s Party) but the Federal Reserve

Read More »

Read More »

Will the SNB double or triple the forex reserves before they give in ?

Some economists have claimed that the Swiss National Bank (SNB) will be always able to maintain the floor. As opposed to George Soros’ defeat of the Bank of England, the SNB is able to print money ad infinitum, whereas the BoE had limited currency reserves to support sterling. The question, however, is where this “infinitum” …

Read More »

Read More »

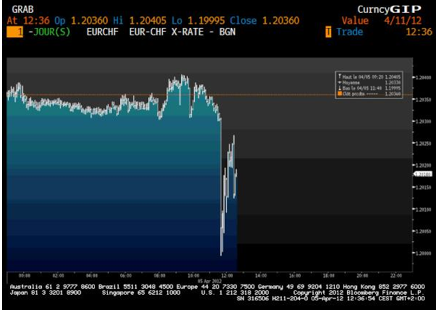

Why the SNB fixed the peg at 1.2010 and not at 1.2000 ?

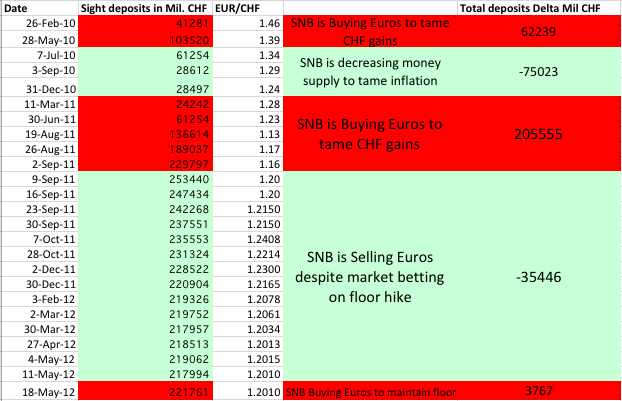

As we have showed in a preceding post, the SNB seems to have decided the peg the franc to the euro at 1.20. Therefore the SNB traders were actively selling euros and buying francs even close to the floor limit of 1.20. But then in the beginning of April some Asian traders managed to push the … Continue reading...

Read More »

Read More »

Is the play time over for the SNB ? SNB Buys Euros Again, but the EUR/CHF does not move a pip

As also noticed by Credit Suisse, the Swiss National Bank had to buy euros and sell Swiss francs in the week of May 11th to May 18th. Their recent easy strategy to sell euros and buy Swiss Francs and to diversify from euros into other currencies may not continue.

Read More »

Read More »

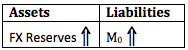

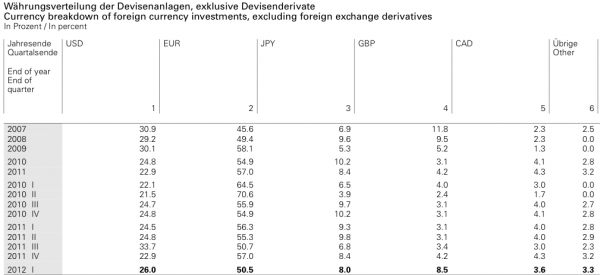

Is the SNB pegging away from the Euro to the SDR currency basket using their FX reserves ?

We reckon that the central bank has introduced an automatic peg mechanism which obliges them to buy euros at exactly 1.2010 and sell euros above this level (reasons and details here). If they sold more euros than they bought, they are happy to have offloaded some items of their overloaded balance sheet. If they bought more euros than they sold, however, there are some "superfluous" euros. Instead putting these euros on their balance sheet, they...

Read More »

Read More »

SNB buys Swiss Francs and sells Euro: Welcome to the EUR/CHF peg

Why the big Q1 loss of the SNB was actually a big win for the central bank Anybody watching the EUR/CHF exchange rate this year was wondering why the volatility the pair saw last year had completely left. The pair slowly fell from 1.2156 over 1.2040 at the end of Q1 to 1.2014 today. FX … Continue reading...

Read More »

Read More »

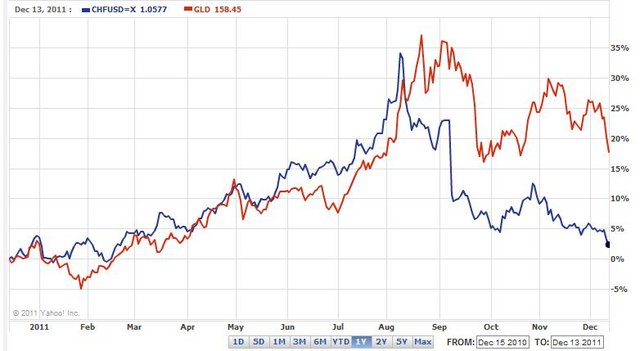

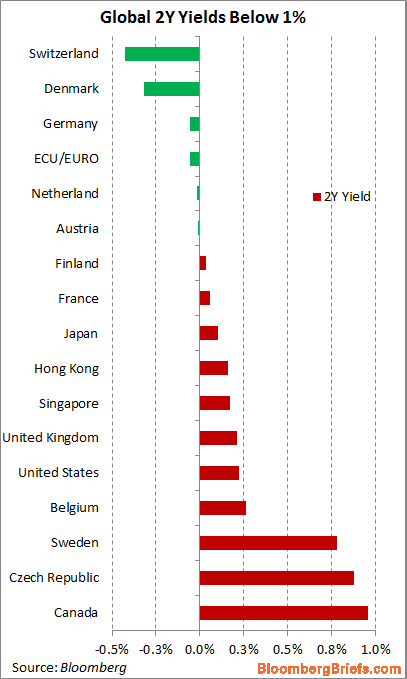

Why is the Swiss safe-haven so completely different from the Yen ?

4 future scenarios for the Swiss franc and the Japanese yen For many people it is astonishing that the Swiss franc continuously rises against the euro, especially when markets are up. Is the CHF no safe-haven any more ? This year the Japanese yen has strongly fallen against the major currencies. Together with the upturn …

Read More »

Read More »

SNB meeting on March 15th, 2012: Pure Speculation that SNB raises floor, How to Trade it ?

Between November 2011 and January 2012 mostly left-wing politicians and trade unions wanted the EUR/CHF floor to be risen to 1.30 or 1.40 and uttered their wishes regularly in the Swiss newspapers, triggering many FX traders to speculate on this hike. Recently these demands have become more silent even if some UBS analysts still see the floor to …

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »

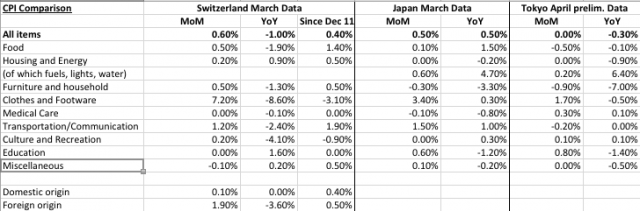

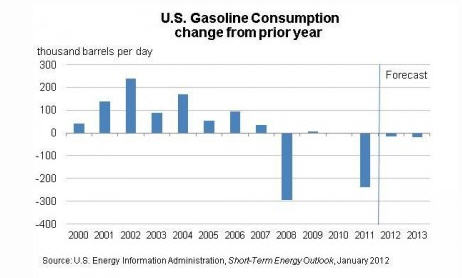

Oil price increases in 2012 and why they are not real

Oil prices Oil prices will rise quickly this year along with the recovery, the Iran issues and last but not least driven by investor demands of yield, implemented in the HFT algos. Interestingly the Iran issues already existed in December, but oil prices were falling, at that moment investors did not believe in a global recovery yet, …

Read More »

Read More »

SNB: Lift EUR/CHF floor or not ?

Many participants in the FX markets seem to be sure that the SNB will lift the EUR/CHF flow to 1.25 Here the pros and the cons:

Read More »

Read More »

Capital controls: The poison cupboard of the SNB

The SNB has already tried a lot to weaken the franc. A (google) translation of a list of capital controls of the Never Mind the Markets blog. The fear of the economic effects Brake by an overvalued franc increases. Massive interventions by the Swiss National Bank (SNB) with € purchases are now ineffective fizzles. Does it …

Read More »

Read More »

SNB Abandons Intervention (June 2010)

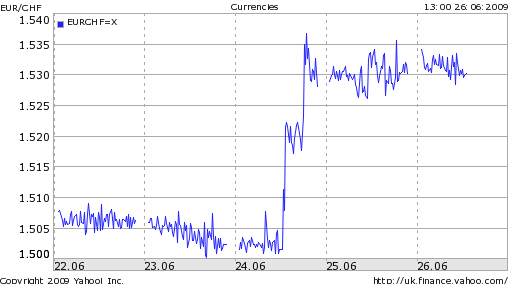

Jun. 22nd 2010 Extracts from the history of the Swiss Franc (June 2010) The Swiss National Bank (SNB) has apparently admitted (temporary) defeat in its battle to hold down the value of the Franc. ” ‘The SNB has reached its limits and if the market wants to see a franc at 1.35 versus the euro, … Continue reading »

Read More »

Read More »

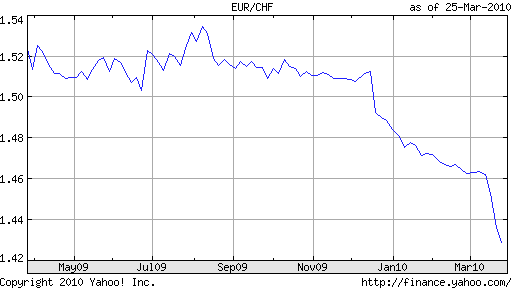

Swiss Franc Surges to Record High: Where was the SNB? (March 2010)

Mar. 26th 2010 Extracts from the history of the Swiss Franc (March 2010) One of the clear victors of the Greek sovereign debt crisis has been the Swiss Franc, which has risen 5% against the Euro over the last quarter en route to a record high. 5% may not sound like much until you … Continue...

Read More »

Read More »

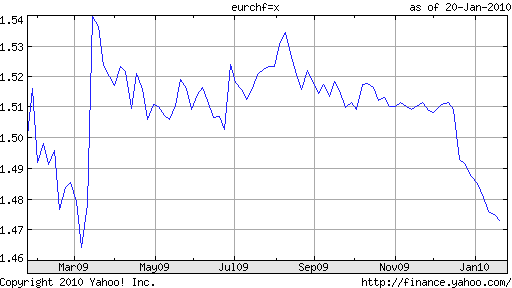

The Line in Sand of 1.50 Collapses (December 2009, January 2010)

Jan. 26th 2010 Extracts from the history of the Swiss Franc Pull up a 1-year chart of the Euro against the Swiss Franc, and you’ll quickly notice a salient trend: the exchange rate has hovered slightly above €1.50 since last March, with three notable deviations. The first occurred last March, when the Swiss National Bank (SNB) …

Read More »

Read More »

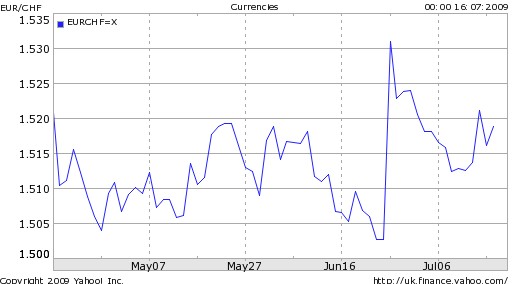

Swiss National Bank Still Committed to FX Intervention (July 2009)

Jul. 17th 2009 Extracts from the history of the Swiss franc (July 2009). When the Swiss National Bank (SNB) intervened three weeks ago in forex markets, the Swiss Franc instantly declined 2% against the Euro. Since then, the Franc has risen slowly, and it’s now in danger of touching the “line in the sand” of …

Read More »

Read More »

SNB Intervenes on Behalf of Franc (June 2009)

Jun. 26th 2009 Extracts from the history of the Swiss franc (June 2009) Back on March 12, the Swiss National Bank issued a stern promise that it would actively seek to hold down the value of the Swiss Franc (CHF) as a means of forestalling deflation. The currency immediately plummeted 5%, as traders made … Continue...

Read More »

Read More »

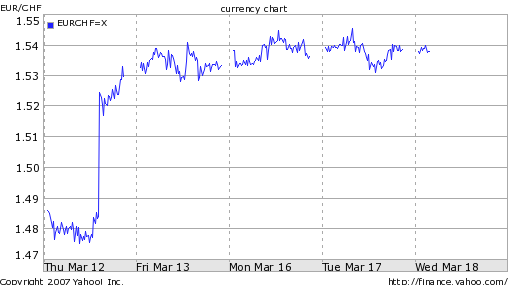

SNB Fulfills Promise of Forex Intervention, Franc Collapses (March 2009)

Extracts from the history of the Swiss franc (March 2009). Mar. 17th 2009 Last week, the Forex Blog concluded a post on the Swiss Franc by suggesting that the Swiss National Bank (SNB) could artificially depress the value of its currency, which had “not just posted strong gains against the eurosince late August …

Read More »

Read More »

Swiss Franc Rises on a Trade-weighted Basis, but Down against the Dollar (March 2009)

Mar. 11th 2009 Extracts from the history of the Swiss franc (March 2009). Most of the “safe haven” talk in forex circles has focused on Japan and the US. Switzerland, meanwhile, has also attracted is fair share of risk-averse investors, who are piling into Franc-denominated assets, despite the deteriorating Swiss economic situation. In fact, …

Read More »

Read More »

Swiss Franc in Spotlight (January 2009)

Jan. 29th 2009 Extracts from the history of the Swiss franc (January 2009). The Swiss Franc is in the same boat as the US Dollar and Japanese Yen, benefiting from an increase in risk aversion and an unwinding of carry trade positions. In other words, the currency rising on the back of the sound monetary … Continue reading...

Read More »

Read More »