As we have showed in a preceding post, the SNB seems to have decided the peg the franc to the euro at 1.20. Therefore the SNB traders were actively selling euros and buying francs even close to the floor limit of 1.20.

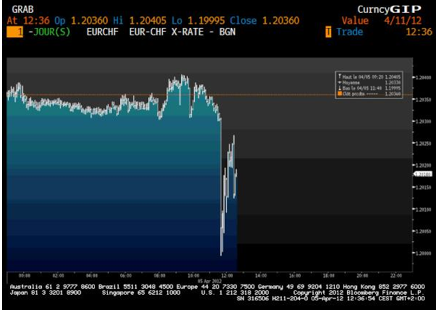

But then in the beginning of April some Asian traders managed to push the EUR/CHF under 1.20 (see below) and the SNB had reason to be very embarrassed. Some Swiss papers reported that this had destructed more SNB credibility than the Hildebrand affair did.

At the beginning of May the SNB seem to have decided to introduce a safety margin of 10 pips in order to give these traders, (and implicitly the own traders !) less chances to hurt the EUR/CHF floor and reduce the SNB credibility.

We reckon that the central bank has introduced an automatic peg mechanism which obliges them to buy euros at exactly 1.2010 and sell euros above this level. If they sold more euros than they bought, they are happy to have offloaded some items of the overloaded balance sheet. If they bought more euros than they sold, however, there are some “superfluous” euros. They might sell these superfluous euros against a basket of USD, GBP and JPY, which pushes the euro down against this currency basket – something that Swiss and German exporters will appreciate. More details about this “slow move towards a CHF peg against USD, JPY and GBP via currency reserves” can be found here.

This strategy works perfectly as long as nobody wants to sell dollars against francs. But this exactly happened last week and now flows seemed to reverse: Money was flowing from the dollar (and the other basket currencies) back into the franc.

Are you the author? Previous post See more for Next postTags: floor,franc,peg,Swiss National Bank