Tag Archive: peg

How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract.

Read More »

Read More »

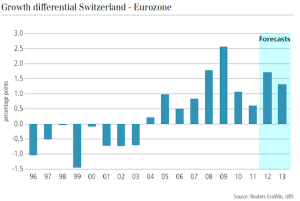

Warum die SNB nicht Hongkong, sondern Singapur imitieren wird

Im Gegensatz zu Hongkong mit dem USD/HKD-Peg kann die Schweiz ein Currency Board, einen fixen Kurs zum Euro nicht für Jahre durchhalten. Die Gründe auf snbchf.com

Read More »

Read More »

Jordan: Dropping Peg Is Premature

The Swiss National Bank's cap on the franc of 1.20 per euro remains the right policy tool for now and talk of dropping it is premature, Chairman Thomas Jordan said. See Reuters

Read More »

Read More »

The next SNB rumor: Wall Street Journal and our response

A bit breathlessly…. The next SNB rumor story comes from the so-well established Wall Street Journal, its columnist Nick Hastings. WSJ: The Swiss National Bank was bold before. And the central bank would be well advised to be just as bold again. When the SNB announced just over a year ago that it was setting a …

Read More »

Read More »

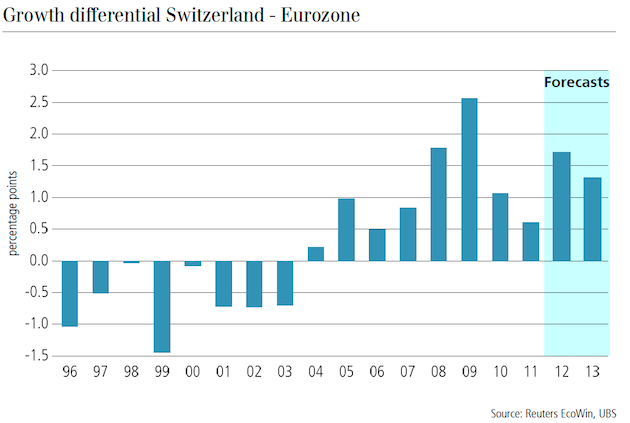

The End of Swiss and Japanese Deflation

At a time of speculations about global deflation, we show an interesting and very different aspect. Our CPI and wage data comparison among different developed countries, shows that Switzerland and Japan will see both inflation, whereas other countries like Australia will see disinflation.

Read More »

Read More »

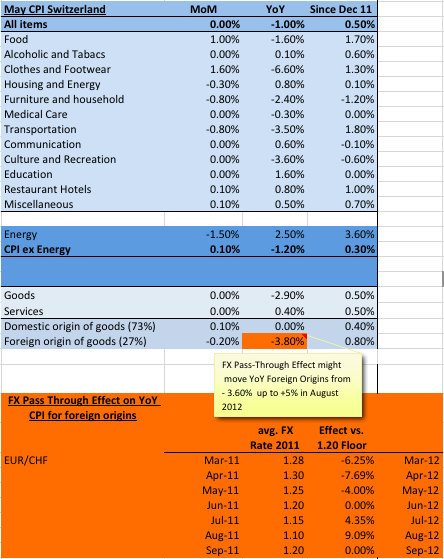

Switzerland in MoM deflation due to cheaper energy and clothes

Slowing energy prices (MoM -4.2%) and seasonal effects for clothes and footwear (MoM -2.8%) drove Switzerland in a slight deflation on monthly basis again.

Read More »

Read More »

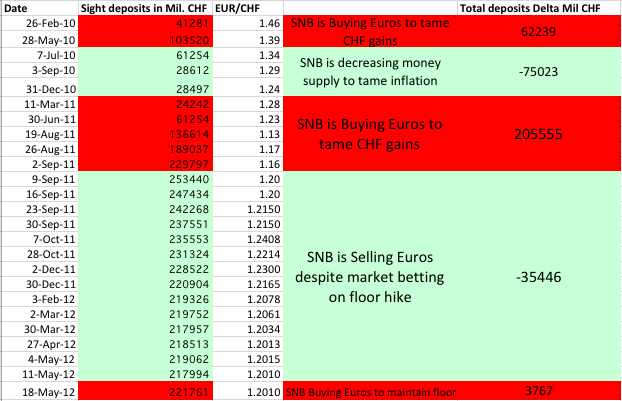

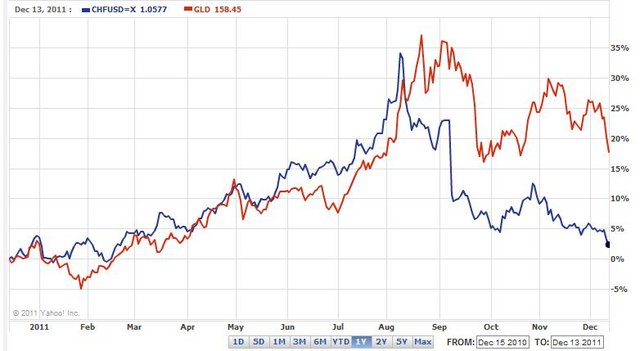

A central bank running suicide ? SNB prints at pace never seen since EUR/CHF parity in August 2011

The most recent money supply data from the Swiss National Bank (SNB) has shown increases of huge amounts. As compared with its loss of 19 bln. francs in 2010 (3% percent of the Swiss GDP), the central bank printed tremendous 17.3 bln. in the week ending in June 1st and 13 bln. in the one …

Read More »

Read More »

CNBC rumors: Different peg methods for the SNB

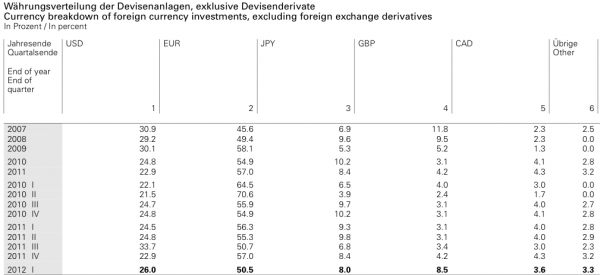

There are currently rumors going on on CNBC that the SNB is planning something this night. As we explained here, the SNB had to strongly restart the printing press and printed tremendous 13 bln francs in one week. Moreover, they probably sold some of their in Q4 2011 and Q1 2012 acquired GBP, JYP and …

Read More »

Read More »

Rumors about tax on Swiss deposits for foreigners and further SNB measures: SNB begging for pips

Exactly when the US had a relatively good Markit Flash PMI, rumors are sent out that deposits in CHF for foreigners should be taxed. To send out this rumor together with good US data seems to be intentional. According to Banque CIC the SNB has declined to comment. We remember the last SNB meeting when similar rumors circulated.

Read More »

Read More »

Will the SNB double or triple the forex reserves before they give in ?

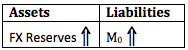

Some economists have claimed that the Swiss National Bank (SNB) will be always able to maintain the floor. As opposed to George Soros’ defeat of the Bank of England, the SNB is able to print money ad infinitum, whereas the BoE had limited currency reserves to support sterling. The question, however, is where this “infinitum” …

Read More »

Read More »

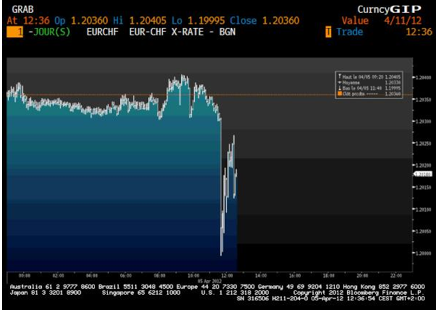

Why the SNB fixed the peg at 1.2010 and not at 1.2000 ?

As we have showed in a preceding post, the SNB seems to have decided the peg the franc to the euro at 1.20. Therefore the SNB traders were actively selling euros and buying francs even close to the floor limit of 1.20. But then in the beginning of April some Asian traders managed to push the … Continue reading...

Read More »

Read More »

Is the play time over for the SNB ? SNB Buys Euros Again, but the EUR/CHF does not move a pip

As also noticed by Credit Suisse, the Swiss National Bank had to buy euros and sell Swiss francs in the week of May 11th to May 18th. Their recent easy strategy to sell euros and buy Swiss Francs and to diversify from euros into other currencies may not continue.

Read More »

Read More »

Is the SNB pegging away from the Euro to the SDR currency basket using their FX reserves ?

We reckon that the central bank has introduced an automatic peg mechanism which obliges them to buy euros at exactly 1.2010 and sell euros above this level (reasons and details here). If they sold more euros than they bought, they are happy to have offloaded some items of their overloaded balance sheet. If they bought more euros than they sold, however, there are some "superfluous" euros. Instead putting these euros on their balance sheet, they...

Read More »

Read More »

SNB buys Swiss Francs and sells Euro: Welcome to the EUR/CHF peg

Why the big Q1 loss of the SNB was actually a big win for the central bank Anybody watching the EUR/CHF exchange rate this year was wondering why the volatility the pair saw last year had completely left. The pair slowly fell from 1.2156 over 1.2040 at the end of Q1 to 1.2014 today. FX … Continue reading...

Read More »

Read More »

SNB meeting on March 15th, 2012: Pure Speculation that SNB raises floor, How to Trade it ?

Between November 2011 and January 2012 mostly left-wing politicians and trade unions wanted the EUR/CHF floor to be risen to 1.30 or 1.40 and uttered their wishes regularly in the Swiss newspapers, triggering many FX traders to speculate on this hike. Recently these demands have become more silent even if some UBS analysts still see the floor to …

Read More »

Read More »

SNB: Lift EUR/CHF floor or not ?

Many participants in the FX markets seem to be sure that the SNB will lift the EUR/CHF flow to 1.25 Here the pros and the cons:

Read More »

Read More »