Many participants in the FX markets seem to be sure that the SNB will lift the EUR/CHF flow to 1.25

Here the pros and the cons:

The SNB will increase the floor to 1.25 because:

1) The Swiss economy continues to weaken.

The Swiss industrial PMI is at 44.8 at August 2009 levels.Employment has slowed from 4.11 Mil. to 4.05 Mil. in the third quarter.

2) The Swiss exporters of luxury goods are especially dependent on Asia. Due to the beginning real-estate crisis and slower growth in China, exports to China will slow down (or Krugman).

This comment speaks of a Chinese soft-landing

3) Prices continue to deflate. Swiss statistics expect prices to rise 0.3% in 2011, to decrease -0.3% in 2012 and to increase 0.3% in 2013. The reason for the deflation are mostly lower oil and food prices. link in German:

The latest CPI showed a price decrease of 0.2% against October and a decrease of 0.5% against last year. The main contributors were lower food and car prices, but the higher USD caused fuel prices already to increase. With higher competition and lower demand, car dealers were forced to give their Euro gains back to the consumers. link in German.

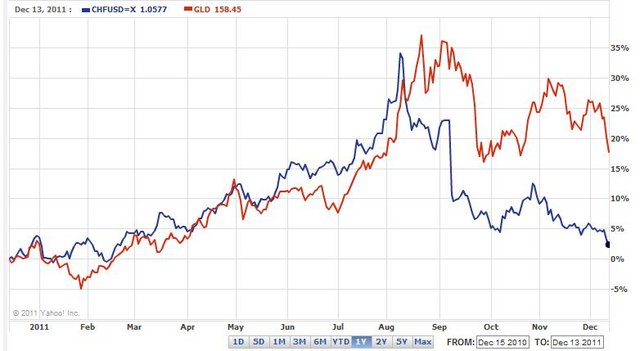

4) The previously strong correlation of the Swissie to the gold price via HFT algos might push the Swissie downwards against the USD, when the gold price continues to fall. The positive correlation between stocks and EUR implies that when gold falls more than stocks this might push also EUR/CHF down.

However this graph tells that thanks to the SNB the Swissie has already taken a harder hit than gold has (here the proxy GLD shares).

5) Left-wing political parties put pressure on the SNB to lift the peg. Recently the Swiss government promised to examine a left-wing proposal of negative interest rates.

SNB will NOT increase the floor to 1.25 because:

1) Lifting a floor against a falling currency (EUR) is very risky.

At even higher USD levels (e.g. EUR/USD = 1.20 and USD/CHF = 1.00) a renewed US Quantitative Easing will provoke a big money flow again into the Swissie. At this point the 1.25 floor might break and the SNB will loose credibility. The SNB has already lost the battle a couple of times against the market; therefore it will be reluctant to raise the floor.

The history of failed SNB interventions

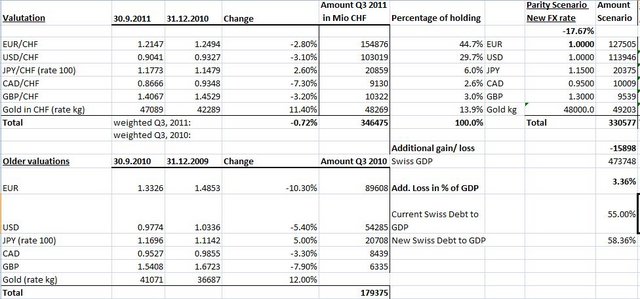

2) The SNB balance sheet is already far overblown.The Swiss have the fourth most foreign exchange reserves after far bigger states like China and Japan.On the basis of the current balance sheet a USD/CHF at 1.00 and a EUR/USD at 1.00 a loss of 3-4% of the Swiss GDP could result. The purchase of further Euro reserves will increase this percentage.

Here another comment on the SNB balance sheet from Zerohedge

3) With the USD strength Swiss exporters who operate globally have become more competitive. The CHF balance sheets for the big international companies (Nestle, Novartis) will improve again, because sales are mostly in USD, a stronger USD improves hence the income.

Effectively the trade balance has improved recently:

2.15 bil. in October vs. 1.91 in September and 0.81 bil. in August.

Exporters seem to be able to live with the floor of 1.20, especially because most of them can take advantage of buying preliminary goods in cheap Euros. A common German-Swiss export model (e.g.for industrial machines) sees the firm produce in Germany, whereas the sales-force works in Switzerland and sells to the whole world mostly based on USD prices. Most profits are taken in low taxed Switzerland. A falling Euro decreases costs, a higher USD improves sales margins.

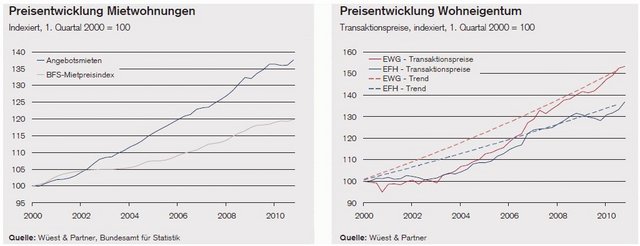

4) The SNB and even Moody’s are worried about a Swiss real-estate bubble. Switzerland lived the same problem in the 1990’s when SNB printing caused the bubble to burst.

After a small dip in 2009 Swiss apartment prices have increased by 55% since 2000 (right graph, EWH), but rents only by 36% (left graph). Remember that the prices are valued in the strong franc !

5) The Swiss economy is not deteriorating as much as the Southern European economies, unemployment is still around 3%. The Swiss safe-haven effect will risk to attract more capital into the CHF, especially for investors who want exposure in Europe.

6) The improving US situation might enhance the situation for Switzerland and the Swiss exporters.

7) Swiss consumers continue to enjoy a very low inflation. As opposed to countries with high inflation (e.g. UK), low inflation improves consumer confidence.Only recently with the global downturn Swiss consumer confidence has fallen from the previously high levels.

Further: (German)

Fritz Leutwiler, der Ende der Siebzigerjahre Chef der Schweizerischen Nationalbank war und die damaligen Massnahmen beschloss, hat seine Politik im Nachhinein übrigens als «grossen Fehler» bezeichnet.

Tags: China,Deflation,floor,franc,Gold,negative interest rate,peg,PMI,Quantitative Easing,Real Estate,Swiss National Bank,Switzerland,U.S. Consumer Confidence