As also noticed by Credit Suisse, the Swiss National Bank had to buy euros and sell Swiss francs in the week of May 11th to May 18th. Their recent easy strategy to sell euros and buy Swiss Francs and to diversify from euros into other currencies may not continue.

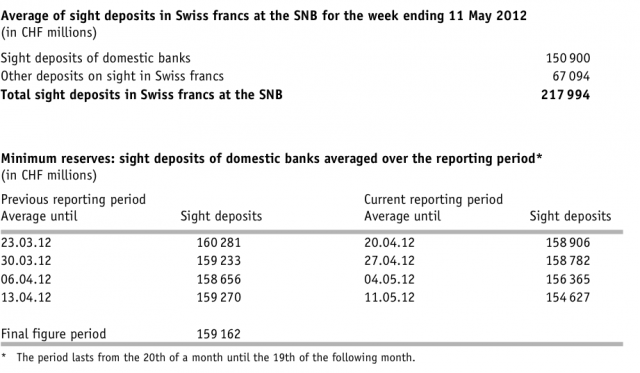

Till May 11th, the SNB world seemed fine: Risk-averse investors preferred to invest in the US dollar instead in the franc. The SNB was able to reduce money supply (as measured in domestic bank deposits) from 160281 mil to 154627 mil. in the preceding 1 1/2 months, they sold francs and borrowed at the Swiss confederation (main component of the 67094 mil. above).

The intensification of the Greek crisis and newly and even more IMPORTANTLY bad US economic data and new QE3 speculations, however, let the global demand of francs and therefore the SNB money supply quickly increase again. The increase of the US dollar index seems to be limited at the long-term (here see why).

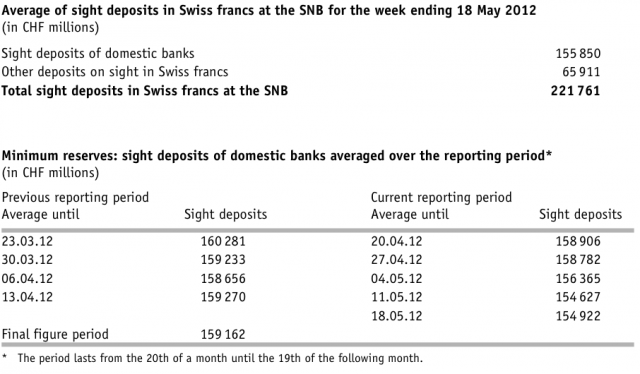

Even if the SNB seemed to have reduced liabilities at the confederation (Other deposits from 67094 mil. to 65911 mil.), net sight deposits increased by 3.7 bln CHF (from 218 bln to nearly 222 bln), a clear sign that the central bank is buying euros again. Unfortunately for the SNB the EUR/CHF did not move a pip.

Are you the author? Previous post See more for Next postTags: Credit Suisse,Deposits,Dollar Index,floor,franc,peg,QE3,SNB sight deposits,Swiss National Bank,Switzerland Money Supply