Abstract

We reckon that the central bank has introduced an automatic peg mechanism which obliges them to buy euros at exactly 1.2010 and sell euros above this level (reasons and details here). If they sold more euros than they bought, they are happy to have offloaded some items of their overloaded balance sheet. If they bought more euros than they sold, however, there are some “superfluous” euros. Instead putting these euros on their balance sheet, they might sell these superfluous euros against the other SDR currencies USD, GBP and JPY, which pushes the euro down against this currency basket – something that German and Swiss exporters will appreciate.

Recent developments

The basic rule for a forex trader is to know that the main players of the forex games are the central banks. If he can (fore)see what these institutions are doing and will do, he can make a lot of profit. One of these ideas was that the Swiss National Bank (SNB) was going to rise the floor of the EUR/CHF to 1.25. Unfortunately the traders got bitterly disappointed, because it was the SNB that was buying francs and selling Euros.

Recent markets have seen a strong rise in the British Pound, even if the UK macro data were nearly as worse as the data in the eurozone. A probable reason is that central banks are intervening to diversify their currency exposure. One central bank that did this in the first quarter was the SNB. They might be doing what some smart analysts expected from them, namely NOT to peg the franc against an “institutionally insane currency” or like former UBS-chief Grübel called it “unpredictable by European voters influenced currency”. This strategy seems to continue and might go into the extreme: The SNB might be reducing the share of the euro in their reserves significantly and eventually peg the franc against a basket of currencies via the back-door of their currency reserves. This would be certainly not an official multi-currency peg, but would give the central bank the possibility to lower the EUR/CHF floor to 1.10 or lower in case of a Euro collapse without taking big losses on their balance sheet.

The SNB balance sheet

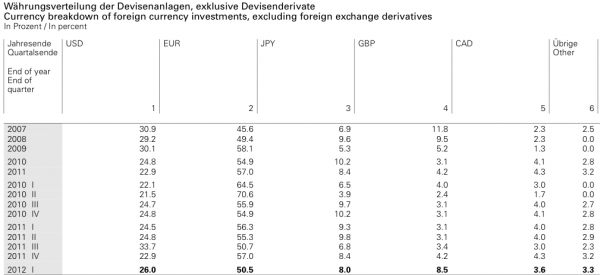

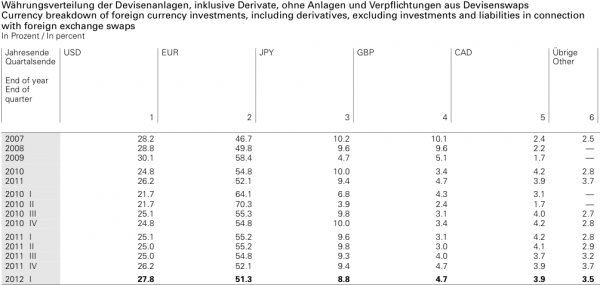

The SNB balance sheet has shown significant shifts between Q2/2010 (the Euro taking 70% of the reserves incl. derivatives) and Q1/2012 (Euro part only 51%):

The tables show that the pound rose from 4.2% of the Swiss currency reserves to 8.5%, however, it was hedged via derivatives down to 4.7% (see below but swaps are excluded). A reason to do this is that the UK 10 years has a better yield than the German bunds (1.87% vs. 1.44% by May 14th) and the UK bonds might be safer in case of a euro break-up.

The British pound in the SNB balance sheet

On May 14th the EUR/GBP breached the 0.80 barrier. The rise of the pound against the Euro was even stronger than the one of the USD and the JPY, a thing that in usual markets is not the case. Our conclusion is that the SNB might be still selling EUR/GBP. Any attempts to go long EUR/GBP would mean that you mess with a central bank (or maybe with a market movement that imitates the previous SNB move).

Certainly there is a second reason why the pound is rising: These are flows of eurozone investors, especially from peripheral countries, who seek safety in the British capital, the reversal of margin GBP-financed positions and the status of the pound as SDR currency, a reserve currency in times when higher-yielding currencies are not attractive any more. The IMF composition of SDR currencies is:

USD : 42%, EUR : 37%, GBP: 11%, JPY: 9.3%

Against the SDR basket, especially the dollar and the GBP are under-represented in the SNB balance sheet. For comparison, the Swiss trade balance according the Swiss export shares have the following values

EUR: 58%, GBP 9%, JPY: 5%, USD (incl. China &rest of the world): 28%

This gives a reason, why the dollar was underrepresented in the Swiss FX reserves, even in 2007 before the SNB started the strong EUR buyings. The pound is still underrepresented in the FX reserves (was 10.7% in 2007), even when compared against Swiss export shares.

Evolution of the SNB monetary data and the EUR/CHF peg

The Swiss central bank, however, seems to be perfectly on top of the situation. In fact, investors are not bullish any more on the franc, as apparently better alternative have arisen. The franc has lost a lot of investors’ interest and the SNB seems to be able to dominate the CHF market. Till May 11th the central bank was able to further reduce the money supply, measured in the counterposition of sight positions of local banks.

Interestingly, since the latest SNB balance sheet publication and my latest post on Zerohedge the rules of the CHF game have completely changed. According to the previous rules the franc had to fall against the EUR on bad economic data because traders expected the SNB to hike the floor in order to combat deflation. For example when the S&P500 dipped to 1188 on Nov 21st 2011, the EUR/CHF rose to 1.2375, but then the US recovery let the EUR/CHF fall again, a move mostly caused by SNB purchases of Swiss francs.

Now the rules are simple: If the SNB finds somebody to buy the EUR/CHF above 1.2010 then they are happy to sell the pair. If there is somebody who wants to sell for 1.20 or less then the central bank buys the pair (see why the SNB introduced a slim security margin above the floor).

This means that the SNB has implemented a peg and not a floor.

Since there are still many “lost” retail forex traders who still believe in a hike of the floor, the central bank might be able to get rid of some more euros against the franc, but on the other side there are sitting many traders and private investors who one day will abandon their EUR/CHF Long because they are simply bored.

In the meantime the SNB might go with the market and sell the Euro against the other SDR currencies GBP, USD and JPY, which results into a lower share of the euro in their reserves.

Having significantly reduced the part of Euros, the central bank might even raise the EUR/CHF floor later buying the strongly devalued Euro again using the appreciated USD, JPY and GBP reserves. To our views, this will happen only, when strong deflationary risks for the Swiss economy exist and concurrently the thread of flows into the Swissie caused by a US Quantitive Easing 3 are low. Our preview of the Swiss inflation shows that thanks to a booming Swiss housing market domestic inflation remains stable or is rising. Strong deflation can, hence, be caused only by a global recession that pushes down also the Swiss housing market.

Global growth scenario

On the flip side, having reduced the euro part of their reserves, global growth and a strong rise of the euro and Swissie against USD, GBP and JPY might break the floor and bring strong losses for the central bank together with a possible rise of inflation. This, however, is currently the lesser of the two evils for the Swiss National Bank.

Global deflationary scenario and the QE3 thread

The “back-door pegging” strategy works perfectly as long as nobody wants to sell dollars and the other basket currencies against francs. Should the recovery in the United States get stuck and Quantitative Easing 3 come, then flows will reverse and the SNB will need to quickly increase their Forex reserves again.

Global downturn due to a Greek exit from the euro zone and implications on the floor

To our view, the SNB is perfectly able to maintain the EUR/CHF of 1.20 as long as Swiss inflation not picks up and the US is not threatening with QE3.

Especially in a global recessionary scenario caused by a Greek exit from the euro zone, this strategy will hold.

The central bank will continue to buy as many euros against francs at exactly 1.20 as the floor dictates. Thanks to lost interest in the franc as crisis currency, the amounts will be limited. But each euro they must buy in excess will be diversified automatically via derivatives into USD, GBP and JPY which will send down the euro against these currencies. The negative side effect is that this strategy implicitly pushes the USD/CHF up and the Swiss imported inflation upwards. This inflation risk gets balanced again, if there is a global downturn, because oil prices will fall, too.

Global recovery despite a Greek exit from the euro zone

If, however, a Greek euro exit does not trigger a global downturn, but the global economy expands, then this SNB strategy might fail. German and Swiss exporters will probably take profit of the weakened euro and franc and the rising US and UK trade deficits. And this will increase German and Swiss GDP via foreign incomes. And the global upturn will further fuel the German and Swiss real estate booms.

If after a Greek exit the euro and the franc still remains undervalued (i.e. EUR/USD = 1.20 or below) despite a global recovery, the SNB could use this moment to switch strategy again and will offload their balance sheet and realize their gains in USD, JPY and GBP.

Are you the author? Previous post See more for Next postTags: Eurozone,floor,franc,German Bund,imported inflation,peg,QE3,SDR,Swiss National Bank