George Dorgan

My articles My siteAbout meMy videosMy books

Follow on:LinkedINTwitterSeeking Alpha

CFA SocietyEconomicBlogs

Extracts from the history of the Swiss Franc

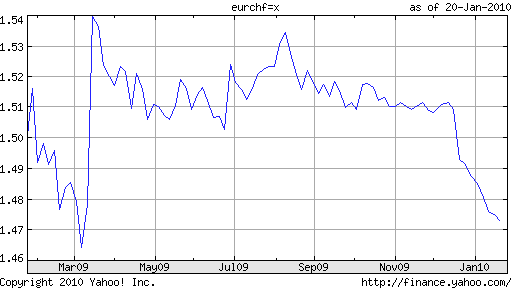

Pull up a 1-year chart of the Euro against the Swiss Franc, and you’ll quickly notice a salient trend: the exchange rate has hovered slightly above €1.50 since last March, with three notable deviations. The first occurred last March, when the Swiss National Bank (SNB) intervened in currency markets on behalf of the Swiss Franc, causing the Franc to shoot up instantly by more than 5%. The second took

place in June, when the SNB threatened(it may or may not have actually intervened) intervention again, and the Franc shot up in order to create a buffer zone. The final deviation can be seen at the end of December, when a generalized decline of the Euro also manifested itself against the Swiss Franc, as it fell significantly below the €1.50 threshold.It’s not clear whether €1.50 was ever conveyed by the Swiss National Bank explicitly, or whether it was merely accepted implicitly by the forex markets. Regardless, traders certainly respected this boundary, and for most of 2009, dared not challenge it.

At the end of December, as I said, there were two important developments, which bore on the EUR/CHF cross. First, credit downgrades and the (far-off) prospect of sovereign default in the EU set loose a wave of panic, after which the Euro has generally fallen. The second development was a subtle change in the wording of the SNB’s forex policy. Previously, it had promised to prevent any “appreciation” in the Swiss Franc, whereas now it is only interested in stopping an “excessive” appreciation.

It’s not clear whether the Swiss Franc suddenly blasted through the €1.50 because investors believe(d) it was undervalued, or if instead it merely got caught up in the Euro’s weakness. Perhaps, investors realized that now they had an excuse to sell the Euro and no longer had to worry about whether actually doing so would risk provoking the SNB. It was probably a combination of both.

For its part, the SNB (through its President and chief mouthpiece Philipp Hildebrand) is already sending subtle clues to the forex markets about the Franc’s prospects. Hildebrand recently told reporters both that “Raising interest rates would be inappropriate,” and “Since the recovery is still fragile, the current expansionary monetary stance will need to be maintained until the recovery strengthens and deflationary pressures recede.” In other words, those that bet on Franc’s appreciation shouldn’t expect any return on their investment, in the form of higher interest rates.

He also reiterated the SNB’s stance on the Franc more explicitly: “Our policy is clear: we will resolutely prevent an excessive appreciation as long as there are deflationary risks.” Given that the markets called his bluff in December, investors are unfazed: “The difference in the number of wagers by hedge funds and other large speculators on an advance in the franc compared with those on a drop, so-called net longs, was 13,926 on Jan. 12 compared with net shorts of 2,780 a week earlier.”

In all likelihood, the Franc will continue to hover around €1.50, only below that barrier, rather than above it. As long as the Franc remains basically stable, either in literally not moving, or in appreciating at a snail’s pace, the SNB probably won’t get involved. After all, the change in wording to its forex policy is a tacit admission that €1.50 is arbitrary and that perhaps the Franc could stand to gain a little bit, especially in the context of the EU fiscal issues. Not to mention that intervention is expensive and ineffective in the long-term.

If traders really get ahead of themselves, though, Hildebrand has already proven that he’s not afraid to act.

No related photos.

Tags: franc,intervention,line in sand,Swiss National Bank,Switzerland