On July 31st the Swiss National Bank will publish interim results for the second quarter 2012. Already now we offer an estimate to our readers.

Our estimate does not cover the central bank’s Forex trading results, they are difficult to estimate. A central bank is not a day trader, therefore the influence should be limited. We also assume that the composition of forex reserves, about 51% EUR, 26% USD, 8% JPY and 5% GBP does not change significantly. The error margin could therefore be up to 3-5 billion Swiss francs.

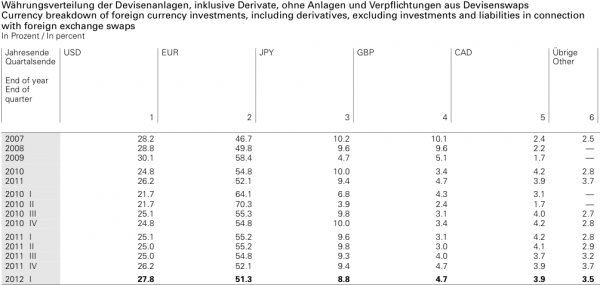

Composition of the SNB currency reserves

As opposed to the weekly monetary data and the monthly IMF forex reserves data, distribution of forex reserves in different currencies are only published once a quarter.

After the SNB reduced the euro reserves from 70% in Q2/2010 to 51% in Q2/2012, one might assume that central bank has further lowered the euro share. This is accomplished implicitly by the falling price of the euro in relation to dollar et. al. and by actively recycling euros into other SDR currencies like we described here. This recycling contributed to the strong fall of EUR/USD rate, but also to the rise of German Bunds and even more to the rise US treasury bond prices in the second quarter.

The current 51% EUR share in the SNB reserves were in between the IMF (standard) composition and the Swiss trade balance. The IMF composition of SDR currencies is:

USD : 42%, EUR : 37%, GBP: 11%, JPY: 9.3%

In the Swiss trade balance according to the Swiss exports, the different currencies have the following shares:

EUR: 58%, GBP 9%, JPY: 5%, USD (incl. China &rest of the world): 28%

The fall of the EUR/USD rates (and others), would automatically reduce the euro share in the FX composition from 51% to values around 48%, any lower EUR share would mean the central bank has even more actively sold their EUR reserves.

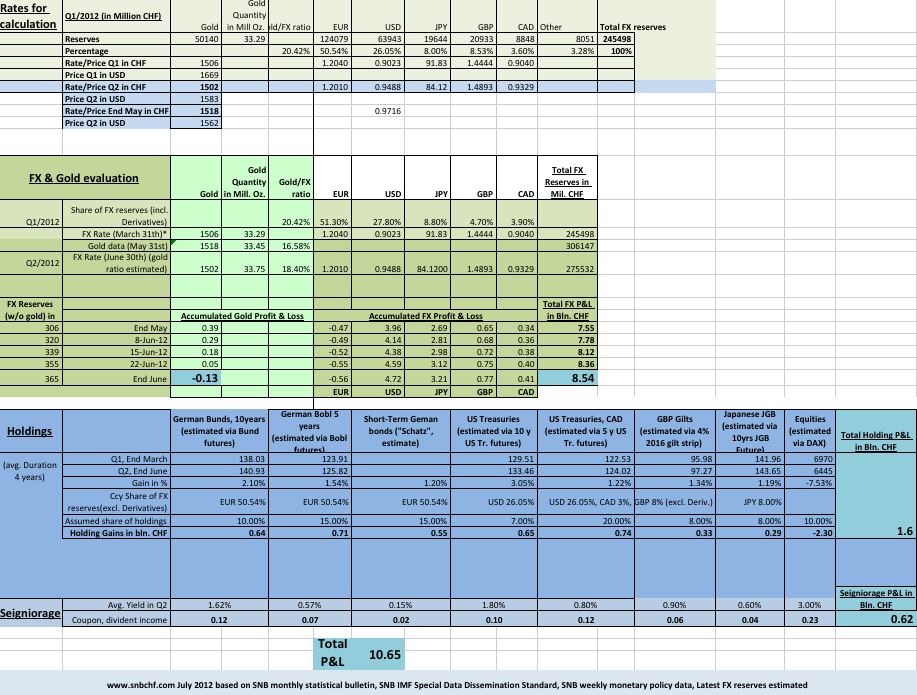

Calculation estimate of the SNB results for Q2/2012

As we expected already in May (here our May guest post on Zerohedge), the Q2 results should be very strong. Based on our computation, the central bank would see a quarterly profit of 10.65 billion Swiss francs.

Our calculation is based on four components:

- P&L on the foreign currency reserves: 8.54 bln. CHF, thanks to appreciation of USD, CAD, GBP and JPY.

- P&L on the gold holdings: -0.13 bln. CHF

- Pre-tax P&L on other holdings, i.e. government bonds (82%), equities (10%): 1.6 bln. CHF, roughly estimated. Strong gains in German Bunds and other government bonds, but losses in the equity positions. See here more details of the holdings. We assume that the euro holdings are mostly composed of German and some French government bonds, based on the 84% share of AAA government bonds. Based on the 4 years average duration, we (very roughly) estimated 10% of German Bunds of around 10 years duration, 15 of German Bobls of more or less 5 years, 15% of shorter duration German bonds, 3-5 % of French government and 5% other euro-denominated bonds.

- Seigniorage effect (in the larger sense, i.e. coupon and dividend payments received vs. interest paid on SNB debt): 0.62 bln. CHF. An estimated 230 million francs payout in dividends could help against the losses in the equity holdings. Since SNB interest rates are close to zero and cash is without interest, we can ignore it.

More details of the development of SNB currency reserves can be seen here.

What would happen if the SNB gave up the peg ?

We do not explain here in detail, what would happen if the SNB gave up the peg against the euro. A 10% appreciation of the CHF against the other currencies, would instead of a big profit, result in a loss of about 25 to 30 bln. CHF in same quarter, easily calculated with our Excel. More details will come soon with the SNB results publication next week.

Tags: Duration,franc,German Bund,Gold,monetary data,profit,Reserves,results,Seigniorage,SNB Gold Holdings,SNB results,Swiss National Bank