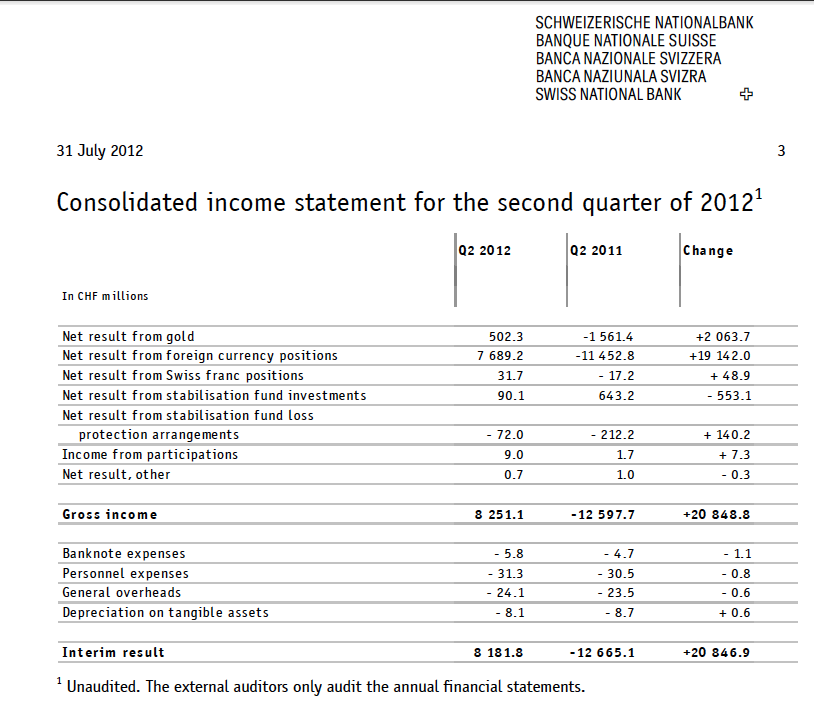

The Swiss National Bank (SNB) reported a profit of 6.5 billion Swiss Franc for the first half year (H1). After a loss of 1.7 bln. francs in the first quarter (Q1), it had a 8.2 billion profit for the second quarter (Q2).

The Q2 SNB results of 8.2 bln. CHF were less than our estimate of 10.65 bln.

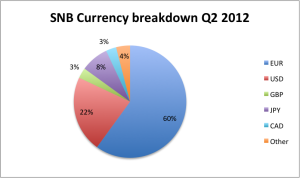

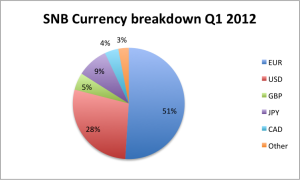

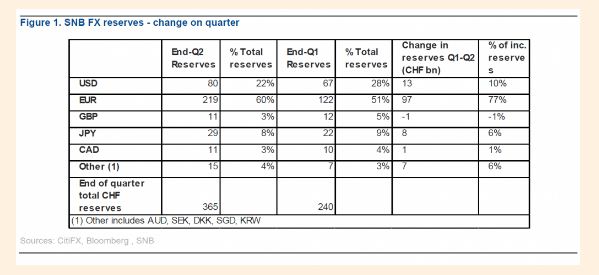

Euro part increased to 60%, AAA part increasing

The gold holdings brought more profit to the SNB than we expected (details to be examined). The foreign exchange positions (incl. forex holdings and seignorage effects) saw a clearly smaller profit than our estimate; the main reason for the lower profit was that the share of euro positions has increased to 60%. AAA government bonds have increased to 85% from 82% which means that the central bank bought primarily German Bunds/Bobls/Schatz in the second quarter.

SNB did not want or did not succeed in diversifying ?

We warned that a higher euro share would reduce the SNB profit. The recycling of euros into other SDR currencies (USD, GBP, JPY) did not happen that strongly as many (examples here, here, including ourselves) expected.

The SNB increased her currency reserves by 125 bn. CHF in the second quarter (Q2), investing 77% of it in Euros, only 13% in dollar and even reduced the share of GBP.

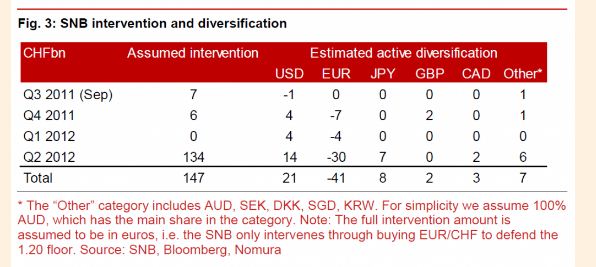

According to Nomura the SNB diversified 30 bln. CHF into different currencies in the second quarter, mostly into USD, JPY and other currencies (presumably AUD, SEK, NOK).

Citi’s Englander saw a range between 33%, when the SNB was able to sell all newly bought euros and 67% of EUR share, when the central bank had maintained all euros in their balance sheet.

The ones claiming “The SNB remains determined to buying your euros” were “more right”. Why the SNB just diversified just 25% of the masses of new currency reserves acquired in the second quarter remains open. It might have searched a cheap entry point for buying euros. The average EUR/USD rate of 1.25 seemed to be enough.

Sustainability of the peg strongly in question

As stated in FT Alphaville, major banks begin to doubt if the SNB is able to defend the peg, because the higher Euro share means also a higher risk.

(Citi also suggest this outcome could lead investors to question the sustainability of the floor as investors may see greater risk of severe capital losses and some desperate selling down the road)

Tags: Gold,Norwegian Krone,profit,Reserves,results,SNB Gold Holdings,SNB results,Swiss National Bank