Tag Archive: Emerging Markets

Emerging Market Preview for the Week Ahead

EM FX was mostly softer last week, though it ended the week firmer, buoyed by outsized MXN gains Friday. The Fed is sending very strong signals for a March hike, which should keep EM FX on its back foot. However, with the March 15 FOMC embargo coming into effect, there will be no Fed speakers after Kashkari on Monday. Jobs data on Friday will be the highlight, but given the Fed’s signals, we do not think a soft report will derail a hike next...

Read More »

Read More »

Emerging Markets: What has Changed?

A Korean special prosecutor indicted Samsung chief Jay Y. Lee on bribery charges. Korean press is reporting that China has told its travel agents to halt sales of holiday packages to South Korea. Bulgaria’s interim government said it may apply to join the eurozone within a month. South Africa’s main labor union Cosatu accepted a government-proposed minimum wage.

Read More »

Read More »

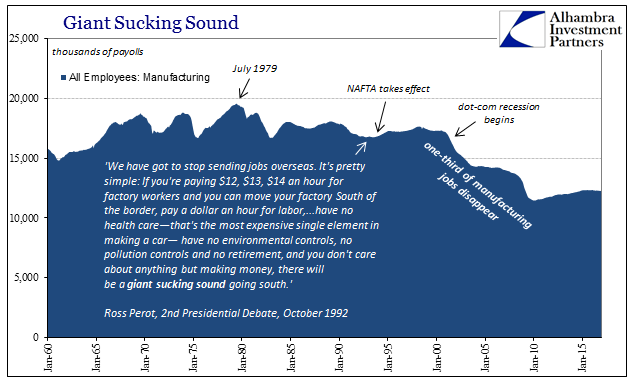

It Was ‘Dollars’ All Along

Ross Perot famously declared the “giant sucking sound” in the 1992 Presidential campaign. The debate over NAFTA did not end with George H. W. Bush’s defeat, as it simmered in one form or another for much of the 1990’s. Curiously, however, it seemed almost perfectly absent during the 2000’s, the very decade in which Perot’s prophecy came true. Americans didn’t notice because there was a bubble afoot.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a soft note despite lower US rates. The dollar regained some traction that it lost over the course of the week, when markets pushed out Fed tightening beyond March. Treasury Secretary Mnuchin also seemed to push out fiscal stimulus. There is a full slate of Fed speakers this week, and Wednesday sees the release of the Fed’s Beige book that was prepared for the March 15 FOMC meeting.

Read More »

Read More »

Emerging Markets: What has Changed

PBOC tweaked its process for determining the yuan reference rate. Singapore is reportedly studying measures to boost revenue, including higher taxes. Moody’s upgraded the outlook on Russia’s Ba1 rating from negative to stable. Nigerian President Buhari extended his stay abroad. Nigerian central bank tweaked its FX restrictions, but was aimed at retail demand. Brazil political risk is back on the table. Brazil’s central bank hinted at a faster pace...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy.

Read More »

Read More »

Emerging Markets: What has Changed

Head of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. The Polish central bank is tilting more hawkish. The Turkish central bank said it will allow domestic companies to use liras to repay export loans.

Read More »

Read More »

Emerging Market Preview of the Week Ahead

EM FX ended last week on a firm note. Falling US rates allowed many foreign currencies to gain some traction. This week, a heavy US data slate is likely to test the market’s convictions on the Fed, with January PPI, CPI, IP, and retail sales all being reported. Yellen also testifies before Congress on Tuesday and Wednesday.

Read More »

Read More »

Emerging Markets: What Has Changed

Reserve Bank of India signaled an end to the easing cycle. S&P moved the outlook on Indonesia’s BBB- rating from stable to positive. The ruling Law and Justice party in Poland may be backing off of plans to force banks to convert $36 bln in foreign currency loans. Romanian Justice Minister Lordache resigned. Local press is reporting that Brazil’s central bank may cut the 2019 inflation target from 4.5% to 4.25%.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended the week on a firm note, with markets digesting what they perceived as a dovish Fed bias. We disagree, and continue to believe that markets are underestimating the Fed’s capacity to tighten this year. EM FX could continue gaining some traction if the dollar correction continues, but we think US interest rates will ultimately move higher and put pressure on EM once again.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine Environment Department suspended 5 mines and closed 21 after a nationwide audit. The Turkish central bank raised its end-2017 forecast from 6.5% to 8% due largely to the weak lira. Central Bank of Turkey finally got around to releasing the schedule of its MPC meetings this year. Fitch downgraded Turkey last Friday to sub-investment grade BB+, as expected. Allies of Brazil President Michel Temer now head up both houses of congress. Press...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM was truly mixed last week, pulled in both directions by both idiosyncratic risks and global developments. MXN, BRL, and ZAR were the best performers on the week, while TRY, HUF, and RON were the worst. MXN gained despite signs that Trump will maintain a bellicose stance towards Mexico, but we think the peso remains vulnerable to further selling.

Read More »

Read More »

Emerging Markets: What has Changed

Press reports suggest that China’s central bank has ordered banks to limit new loans in Q1. Fitch revised the outlook on Nigeria’s B+ rating from stable to negative. Russia announced details of the FX purchase plan. Brazil’s central bank confirmed it will simplify the reserve requirement system for banks. S&P cut the outlook on Chile’s AA- rating from stable to negative.

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM FX ended last week on a firm not, led by a huge MXN rally on Inauguration Day. We believe that the peso rally was largely driven by positioning and technicals, and so we view Friday’s gains as a correction since the fundamental outlook remains unchanged. Indeed, we think the broader EM rally will be short-lived too, as US interest rates remain elevated. The 10-year yield flirted with the 2.5% level, and we believe it will eventually head even...

Read More »

Read More »

Emerging Markets: What has Changed

Prime Minister Phuc said Vietnam will ease the limits on foreign ownership of banks this year. Russia’s government is working on measures to limit ruble volatility, including possible FX purchases. Turkey’s central bank start auctioning FX swaps to help support the lira. Brazil’s central bank resumed rolling over FX swaps. Brazilian Supreme Court Judge Zavascki was tragically killed in a plane accident. Chile’s central bank started the easing...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week mixed. Markets continue to grapple with the outlook for the so-called Trump Trade, which we believe is intact. MXN and TRY recovered from the relentless selling of recent days, but both remain vulnerable. Indeed, if the jump in US yields on Friday continues this week, most of EM should remain under pressure.

Read More »

Read More »

Emerging Markets: What has Changed

China’s government has asked banks to balance their yuan inflows and outflows. Indonesia partially lifted a ban on exports of nickel ore and bauxite. Czech President Zeman picked two new central bankers as the end of the koruna cap looms. Turkish central bank is taking limited measures to support the lira. Turkey’s parliament voted 338-134 to discuss proposed constitutional changes that would increase the power of the presidency.

Read More »

Read More »

Emerging Market: Week Ahead Preview

EM FX was a mixed bag over the past week. Dollar softness vs. the majors allowed some in EM to gain traction, with ZAR and PEN the biggest gainers since Christmas. On the other hand, ARS TRY, and INR were the biggest losers. With markets coming back to life, we expect EM to remain broadly under pressure as the same major investment themes remain in place.

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM gained some limited traction as last week ended. However, renewed concerns about China could limit this bounce as President Xi signaled the possibility that growth could fall below the government’s 6.5% target.

Read More »

Read More »

Emerging Markets: What has Changed

China President Xi raised the possibility of sub-6.5% growth. Fitch moved the outlook on Indonesia’s BBB- rating from stable to positive. The Philippine central bank raised its 2017 inflation forecasts for 2017 and 2018.

Read More »

Read More »