Tag Archive: Emerging Markets

Emerging Markets: Week Ahead Preview

EM ended the weak on a soft note, as the hawkish Fed decision continued to have reverberations for global markets. Worst performers in EM last week were CLP (-3.3%), ZAR (-2%), and KRW (-1.5%). With little fundamental news expected this week, markets may take a more consolidative tone, especially with the holidays approaching. However, we continue to believe that the global backdrop for EM remains negative.

Read More »

Read More »

Emerging Markets: What has Changed?

China will raise the sales tax on small cars to 7.5% in 2017. New methodology used by Turkstat to measure Turkish GDP has led to significant upward revisions. Turkish authorities are growing more concerned about the weak lira. Fitch moved the outlook on Chile. Chile’s central bank shifted to an expansionary policy bias. Colombia selected Juan Jose Echavarria to be the new central bank governor. Fitch revised the outlook on Mexico’s BBB+ rating from...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

After the ECB meeting, we saw curve steepening in the eurozone. This is on top of curve steepening in the US since the elections. While we are nowhere near the magnitude of the 2013 Taper Tantrum, these yield curve dynamics remain negative for EM bonds and EM FX. EM equities are a different matter, supported in part by the continued post-election rally in DM equity markets. Higher commodity should also help insulate some EM countries from the...

Read More »

Read More »

Emerging Markets: What has Changed

Hong Kong Chief Executive Leung Chun-ying said he won’t seek a second term. Korea’s parliament voted 234-56 to impeach President Park. Czech National Bank raised the possibility of negative rates to help manage the currency. A Brazilian Supreme Court justice removed Senate chief Renan Calheiros from his post, but was later overturned by the full court. Brazil central bank signaled a possibly quicker easing cycle.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM remains a mixed bag. Despite the negative connotations of a rising US rate environment, EM gathered an element of stability last week as the dollar consolidated its recent gains. Rising commodity prices are also helping EM at the margin, with RUB and COP amongst the best last week on higher oil and CLP on higher copper.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended last week on a somewhat firmer note, though we note divergences remain in place. For the week, ZAR and KRW performed the best while TRY and BRL were the worst. US jobs data Friday will draw some attention, though a December Fed rate hike is pretty much fully priced in.

Read More »

Read More »

Emerging Markets: What has Changed

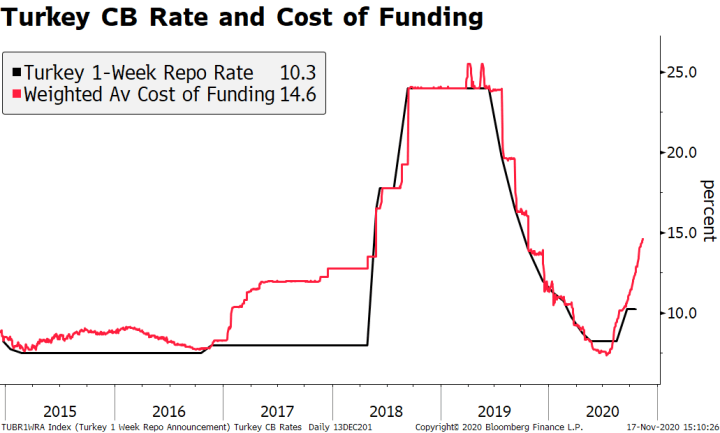

Philippine President Duterte will reportedly ask central bank. Governor Tetangco to stay on for a third term. South Africa’s government has proposed a national minimum wage. Fitch moved the outlook on South Africa’s BBB- from stable to negative. Turkey’s central bank surprised markets with a 50 bp hike in its benchmark repo rate to 8.0%. Political risk in Brazil is rising as President Temer’s top aide was implicated in an influence peddling...

Read More »

Read More »

Short Summary on US Thanksgiving

Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey's central bank surprised with a 50 bp hike in the repo rate.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week on a soft note, as higher US rates continue to take a toll. EM policymakers are getting more concerned about currency weakness, with Brazil, Malaysia, Korea, India, and Indonesia all taking action to help support their currencies. If the EM sell-off continues as we expect, more EM central banks are likely to act to slow the moves.

Read More »

Read More »

Emerging Markets: What has Changed

Malaysia appears to have enacted a subtle change in FX policy. Turkey cut foreign currency reserve requirements in an effort to increase the supply of foreign exchange. Brazil’s central bank suspended the sale of reverse currency swaps and started selling new regular swaps (equivalent to selling USD). Colombia reached a new peace agreement with FARC rebels. Mexico's central bank hiked cash rates by 50 bp.

Read More »

Read More »

Toward a New World Order?

A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM should trade firmer this week on news over the weekend that the FBI said its conclusion on Clinton’s emails remained unchanged. That should lift the cloud of suspicion that grew when the FBI said new emails had been uncovered. With risk appetite likely to rebound a bit, the Mexican peso should benefit the most as the week gets under way.

Read More »

Read More »

Emerging Market: Week Ahead Preview

EM ended the week on a soft note, as markets were taken off guard by news that the FBI was reopening its investigation of Hillary Clinton’s emails. Risk off trading hit MXN particularly hard. FOMC meeting this week should be a non-event, but markets are likely to remain volatile ahead of the November 8 elections in the US.

Read More »

Read More »

Emerging Markets: What has Changed

Chinese President Xi has strengthened his grip on power. Mozambique said it is in “debt distress” and hired advisors for a debt restructuring. South Africa revised its macro forecasts in the Finance Ministry’s Medium-Term Budget Program.Chile’s ruling center-left coalition lost municipal elections.In the EM equity space as measured by MSCI, Poland (+3.2%), Chile (+3.1%), and Hungary (+0.9%) have outperformed this week, while the Philippines...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX gained a little traction on Friday, but capped a week of steady losses. As the US election and FOMC meeting next month get closer, we believe markets and risk appetite will remain volatile. So far, September data from the US does not suggest any urgency to hike in November, and so we continue to believe that December is most likely for another hike.

Read More »

Read More »

Emerging Markets: What has Changed

Fitch upgraded Taiwan by a notch. Thailand has a new king. South Africa’s Finance Minister Gordhan has been summoned to appear in court to face charges. Brazil’s Congress voted to approve a constitutional amendment to freeze government spending in real terms for at least the next 10 years. Brazil’s Petrobras cut fuel prices and introduced a new pricing mechanism.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

Despite the weaker than expected US jobs report, the dollar remains firm and EM is ending the week on a soft note. The main culprit was higher US rates, with the 2-year yield moving up to 0.85% and is the highest since early June. Concerns about Brexit impact and as well the health of European banks remain ongoing and could weigh on risk sentiment this coming week. Lastly, oil may come under more pressure after Russia said it sees no deal with...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space as measured by MSCI, Brazil (+5.3%), Czech Republic (+4.4%), and Hungary (+3.0%) have outperformed this week, while Peru (-3.3%), UAE (-2.2%), and South Africa (-1.4%) have underperformed. To put this in better context, MSCI E...

Read More »

Read More »

Emerging Markets: What has Changed

Tensions between India and Pakistan are rising. The Philippine government ordered the suspension of three quarters of the nation’s mines. Czech central bank sounds more confident of the cap exit. Poland’s Finance Minister Szalamacha was sacked. Moody's downgraded Turkey one notch to Ba1 with a stable outlook. The Brazilian central bank's quarterly inflation report set the table for the easing cycle to start.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM initially benefitted from the FOMC decision, but softened into the weekend. One culprit was lower oil prices, as reports suggest an output deal is unlikely at the OPEC meeting this week in Algeria. But it wasn’t just EM, as the greenback closed firmer against the majors as well. We still believe that risk and EM should do fine over the next few weeks, as the Fed basically set a two-month window of steady rates.

Read More »

Read More »