Tag Archive: Emerging Markets

Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note, due in large part to the attempted coup in Turkey. Weakness in the lira spilled over into wider EM weakness in thin Friday afternoon market conditions. The situation in Turkey has calmed, and so EM may gain some limited traction this week. However, that calm will likely be very fragile and so we retain a defensive posture with regards to EM.

Read More »

Read More »

Great Graphic: Equities Since Brexit

Since the UK voted to leave the EU, emerging market equities have outperformed equities from the developed markets. This Great Graphic, composed on Bloomberg, shows the MSCI Emerging Market equities (yellow line) and the MSCI World Index of developed equities (white line).

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM and other risk assets rallied on Friday after the strong US jobs data. It appears that markets are pricing in a benign backdrop for risk near-term; that is, the US economy is recovering but not by enough to warrant an imminent Fed rate hike. The July 27 meeting seems unlikely, and so the next likely window would be September 21. Yet EM typically weakens in the run-up to FOMC meetings and so investors should be very careful about taking on too...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space as measured by MSCI, Hungary (+3.0%), UAE (+2.0%), and Qatar (+0.7%) have outperformed this week, while Mexico (-3.4%), South Africa (-2.1%), and Colombia (-1.7%) have underperformed. To put this in better context, MSCI EM fell -1.2% this week while MSCI DM fell -0.3%. In the EM local currency bond space, the Philippines (10-year yield -22 bp), Singapore (-12 bp), and Brazil (-11 bp) have outperformed this week, while Russia...

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM and risk recovered nicely from the Brexit turmoil last week. Yet we think markets are getting too carried away with the "low rates forever" theme and are likely underestimating the capability of the Fed to tighten before 2018. This Friday, the June jobs data could spark a shift in sentiment with a strong reading. Consensus is currently 175k jobs created, up from 38k in May.

Read More »

Read More »

Emerging Markets: What has Changed

Indonesia’s parliament approved a tax amnesty bill. Korea announced KRW20 trln ($17 bln) in fiscal stimulus. Czech President Zeman said a referendum on EU and NATO membership should be held Russia ended its tourism ban to Turkey. Brazil’s central bank is sending hawkish signals

Read More »

Read More »

South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters.

Read More »

Read More »

Emerging Market Preview: Week Ahead

The Brexit vote is a game-changer for EM. While the direct impact on EM is limited, the damage to market sentiment is undeniable. And to make matters worse, there will be a protracted period of uncertainty as the UK and the EU negotiate the divorce proceedings.

Read More »

Read More »

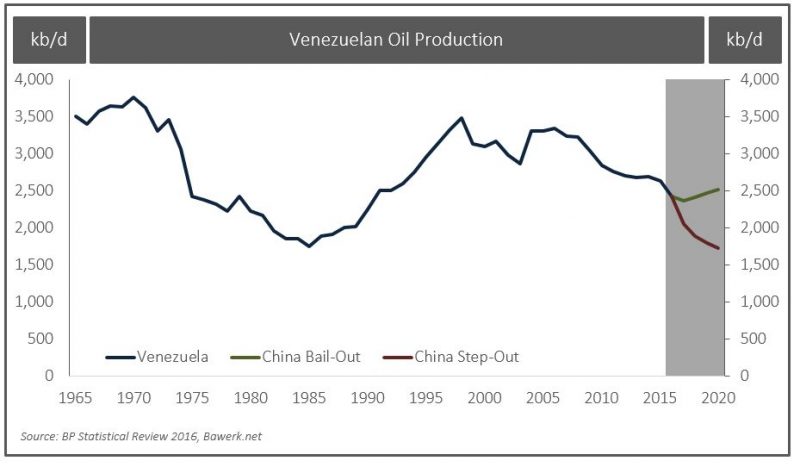

China the lender of last resort for many oil producers

Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week under pressure. With two potentially disruptive events (FOMC meeting and Brexit vote) still in play, we think that EM softness should carry over into this week.

Read More »

Read More »

Emerging Markets: What has Changed

China granted US asset managers a CNY250 bln ($38 bln) quota under the existing QFII system

Bank of Korea surprised the market by delivering a 25 bp rate cut to 1.25%

Oman issued its first global ...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

Russian central bank meets Friday and is expected to keep rates steady at 11.0%. However, the market is split. Of the 25 analysts polled by Bloomberg, 13 see no move and 12 see a 50 bp cut to 10.5%. The central bank has been on hold since the last...

Read More »

Read More »

Emerging Markets: What has Changed

Local press is reporting that RBI Governor Rajan does not want to serve another term

The incoming Philippine government is signaling looser fiscal policies ahead

Read More »

Read More »

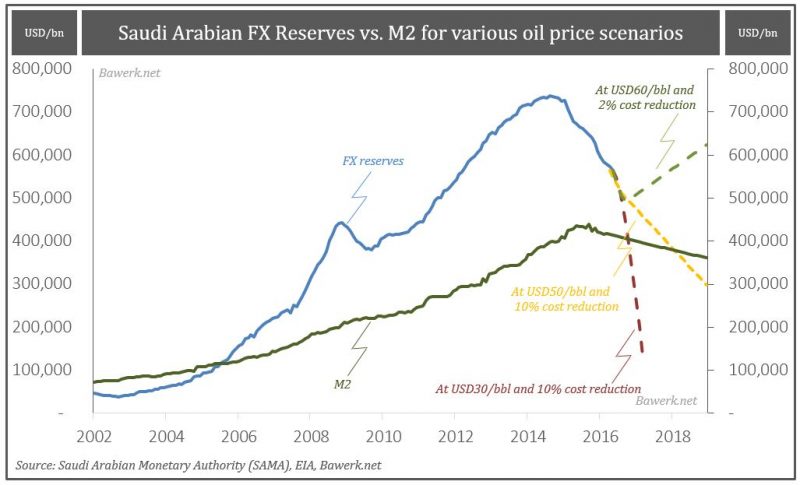

Saudi-Arabia: Peg or Banking Crisis?

During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the...

Read More »

Read More »

Emerging Market Preview

EM ended last week on a soft note. The icing on the cake was Yellen’s speech Friday afternoon, which confirmed the more hawkish stance seen in the FOMC minutes and other recent official comments. We warn tha...

Read More »

Read More »

Emerging Markets: What has Changed

Korea will extend trading hours for stock and FX markets by 30 minutes effective August 1 The Monetary Authority of Singapore said it will withdraw BSI Bank’s license for breaches of money-laundering rules The US lifted a decades-old arms embargo on Vietnam The Nigerian central bank said it would allow “greater flexibility” in the FX …

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM had another rocky week, but managed to end on a slightly firmer note Friday. Market repricing of Fed tightening risk was the big driver last week, and that could carry over into this week. There are several Fed speakers in the days ahead, capped...

Read More »

Read More »

Emerging Markets: What has Changed

The Philippine central bank moved to an interest rate corridor Saudi Arabia is preparing to sell its first global bond ever Transport Minister Yildirim, a close ally of President Erdogan, will become Turkey’s new Prime Minister The new Brazil cabinet continues to take shape with a market-friendly bias In the EM equity space, South Africa …

Read More »

Read More »

Emerging Markets Preview: Week Ahead

EM ended last week on a soft note, and that weakness seems likely to carry over into this week. Dollar sentiment turned more positive after firm retail sales data on Friday, though US rates markets have yet to reflect any increase in Fed tightening expectations. Over the weekend,

Read More »

Read More »

EM FX Technical Picture

Note that MSCI EM fell 21% from November 4 to January 21. It then rallied 25% to challenge the November highs, but it has since fallen back. MSCI EM has now retraced about a quarter of this year's rally. Major retracement objectives come in near 7...

Read More »

Read More »