Tag Archive: credit spreads

Bi-Weekly Economic Review: Gridlock & The Status Quo

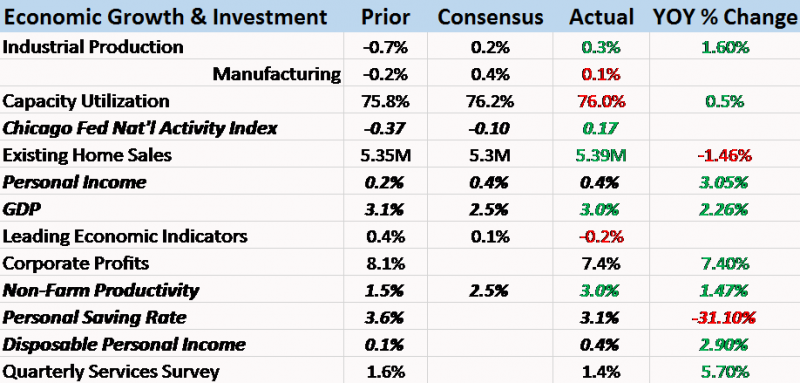

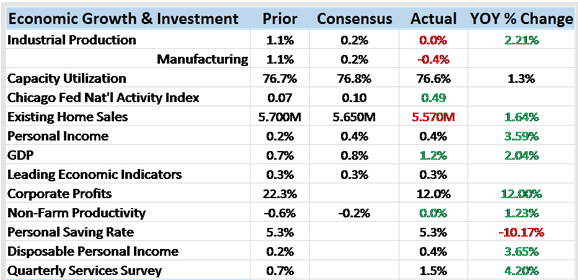

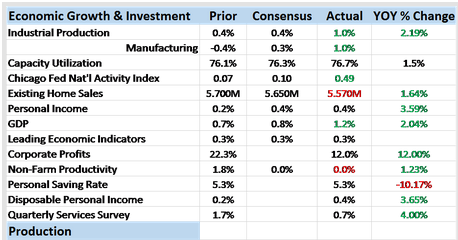

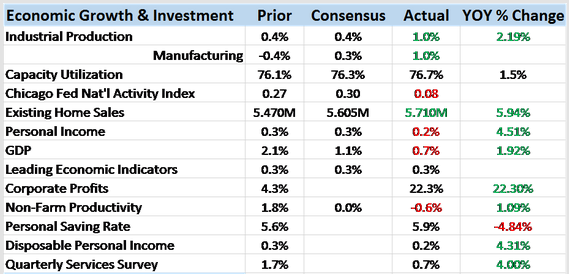

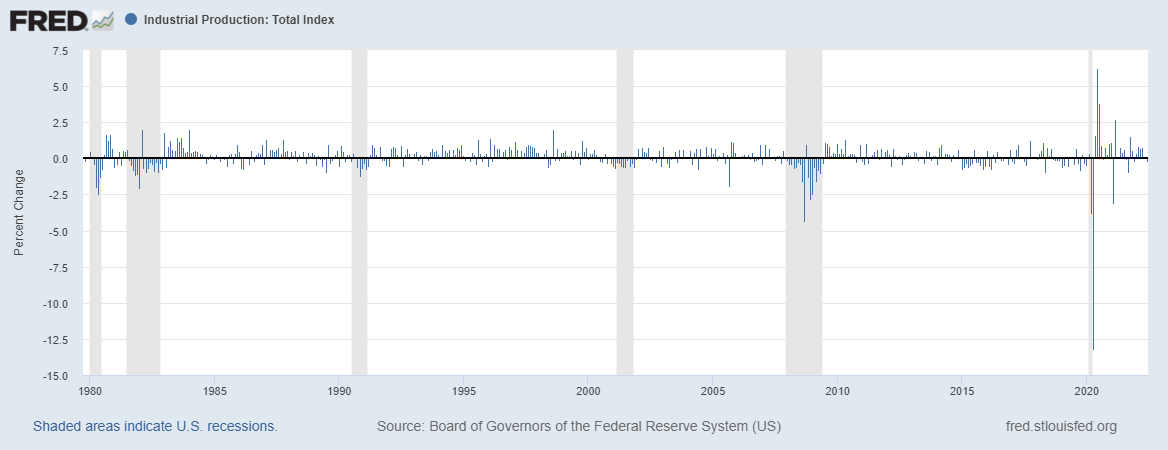

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017.

Read More »

Read More »

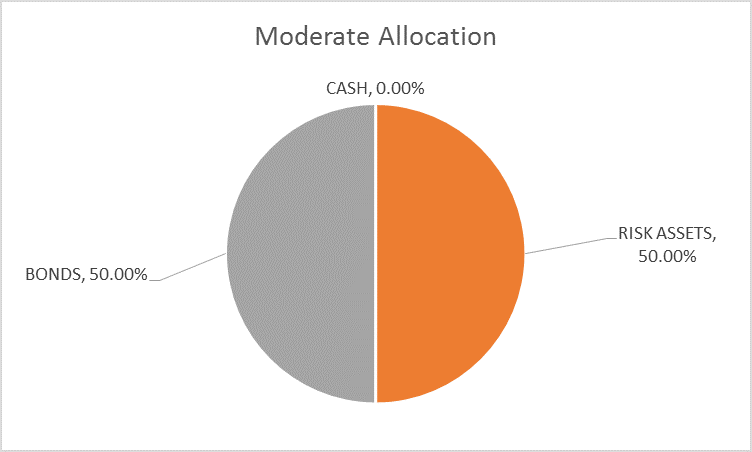

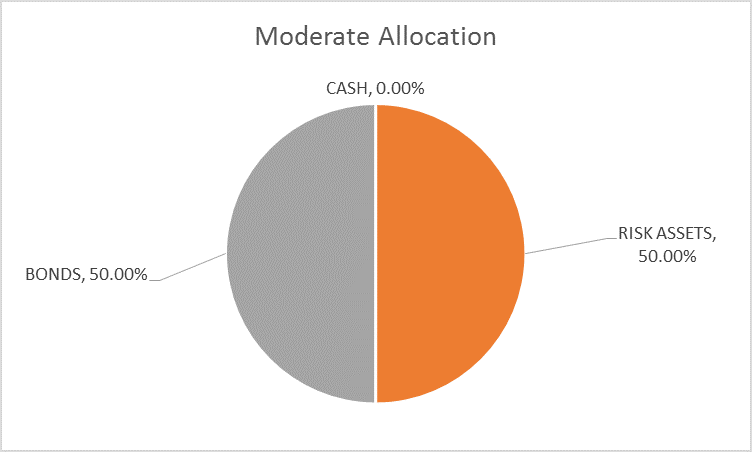

Global Asset Allocation Update

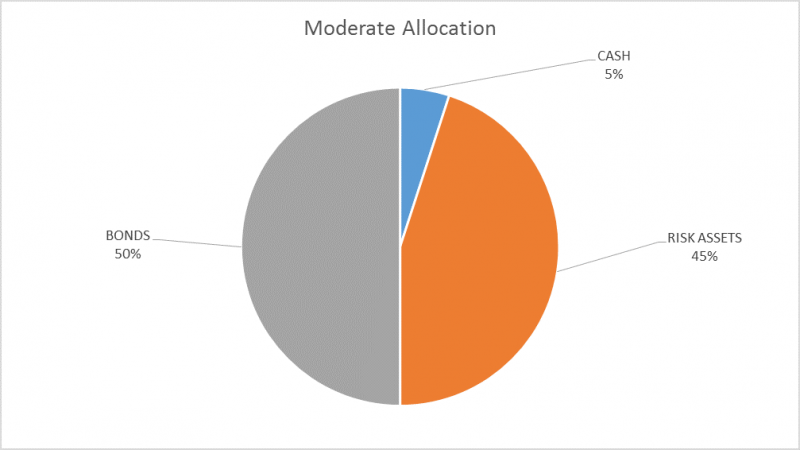

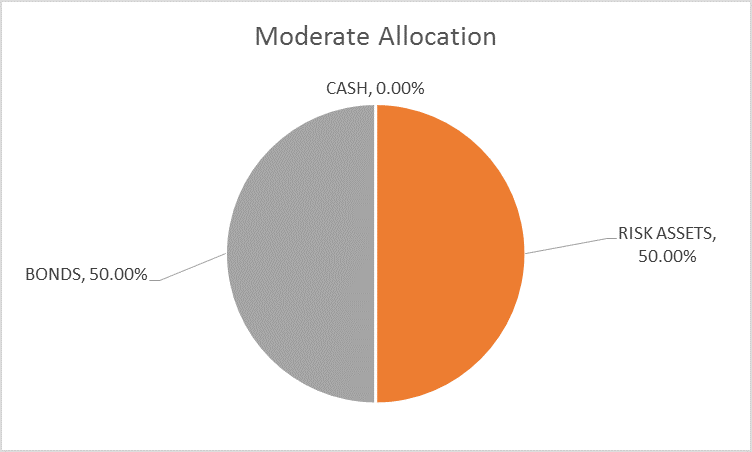

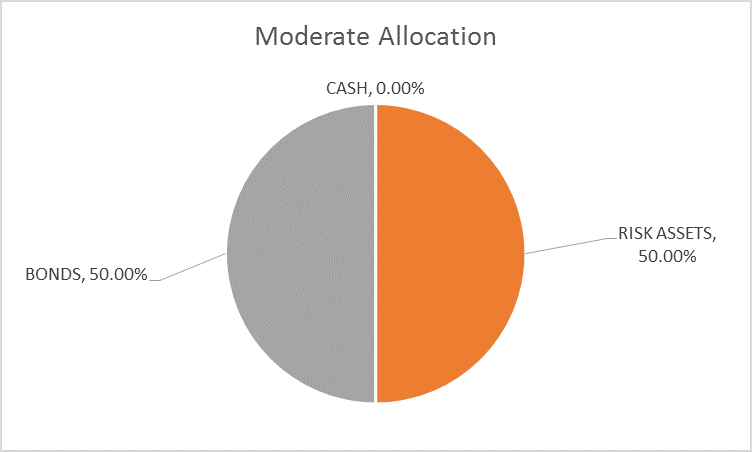

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise.

Read More »

Read More »

Bi-Weekly Economic Review: Yawn

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky.

Read More »

Read More »

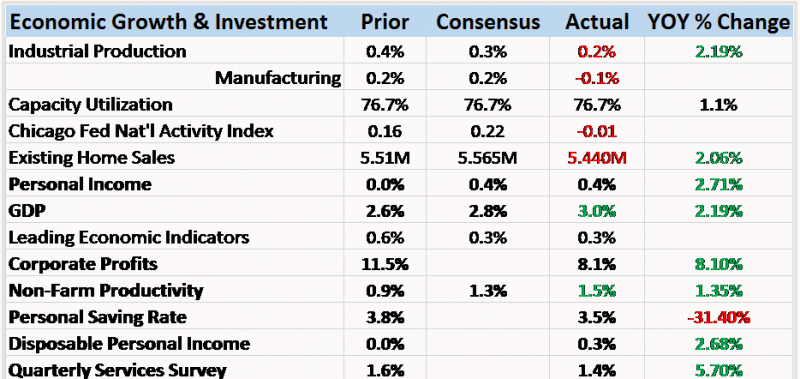

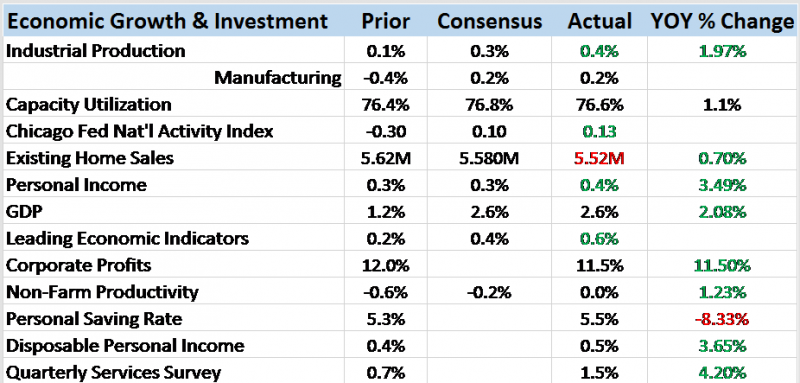

Bi-Weekly Economic Review: Maximum Optimism?

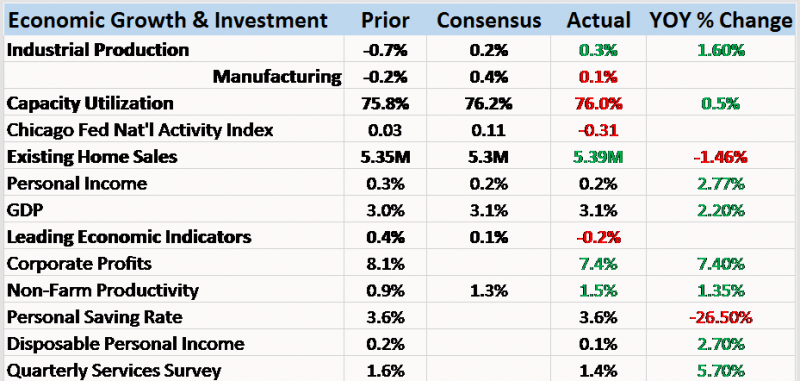

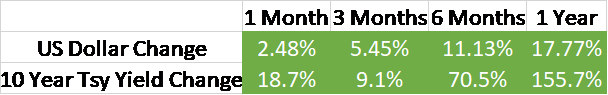

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady stream of all time highs, bond...

Read More »

Read More »

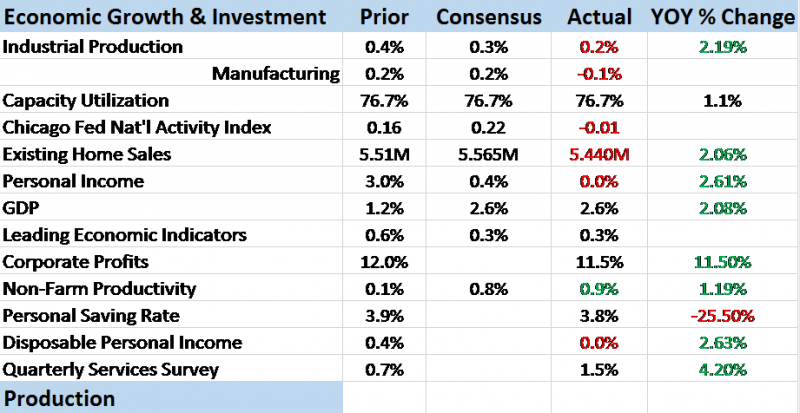

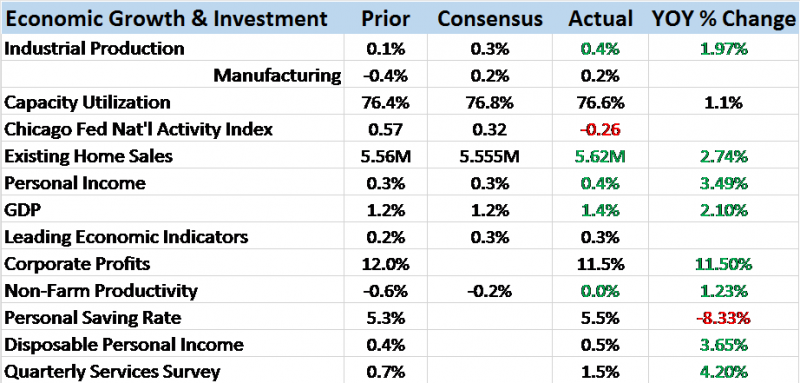

Bi-Weekly Economic Review: As Good As It Gets

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble papered over the annoying lack of...

Read More »

Read More »

Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a different hymnal.

Read More »

Read More »

Bi-Weekly Economic Review: Waiting For Irma

This update will be a bit shorter than usual. I’m in Miami awaiting Hurricane Irma. As of now, it looks like the eye of the storm will make landfall near Key West and continue west of us with the Naples/Ft. Myers area at risk. Or at least that’s the way it looks right now. I’ve done a lot of these storms though – I lost a house in Andrew in ’92 – and you never know what these things will do. We are secure in a house that survived Andrew with barely...

Read More »

Read More »

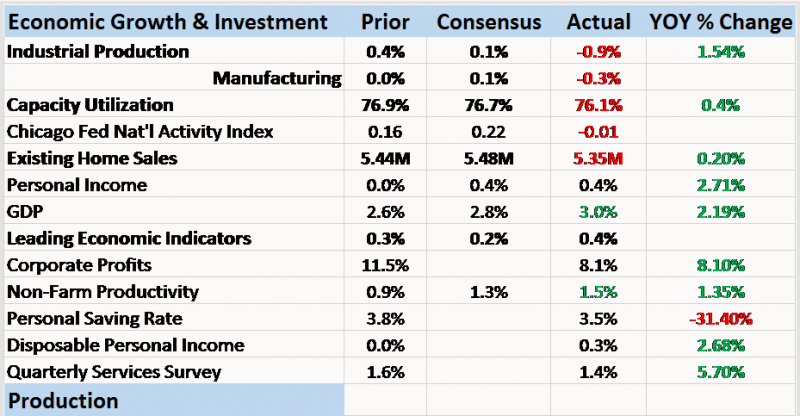

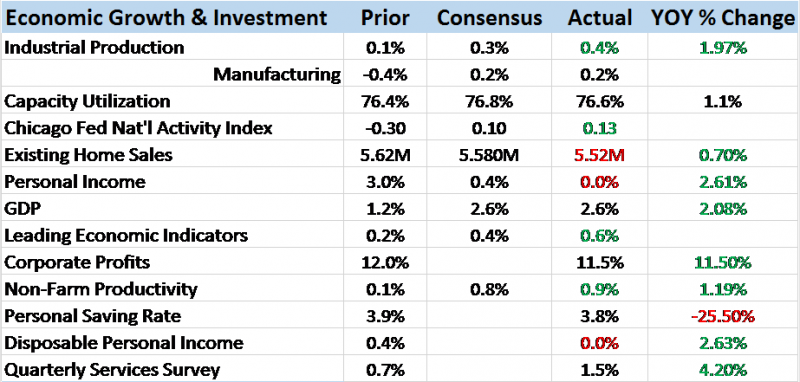

Bi-Weekly Economic Review: Don’t Underestimate Gridlock

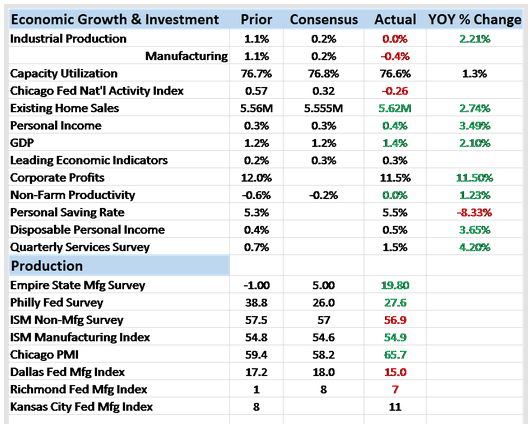

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index probably says it all, coming...

Read More »

Read More »

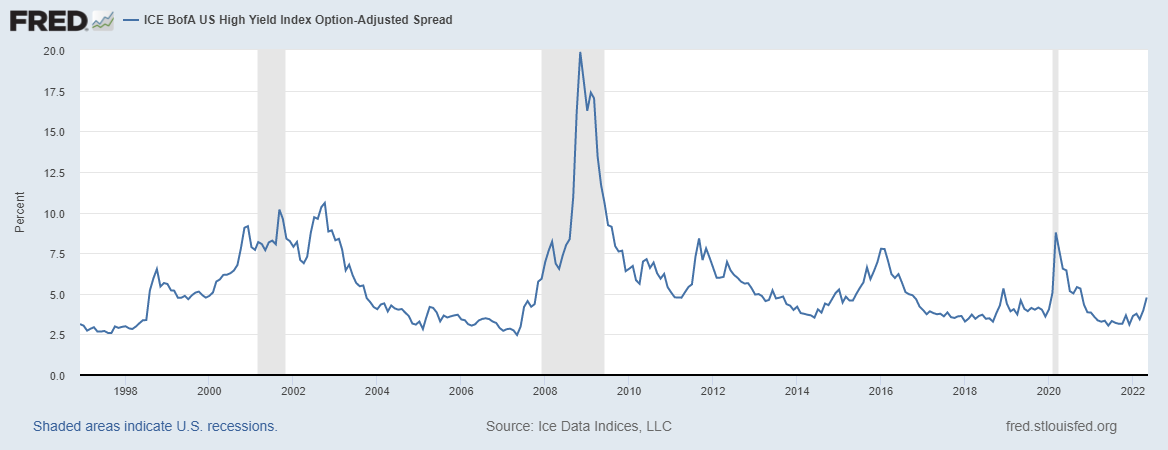

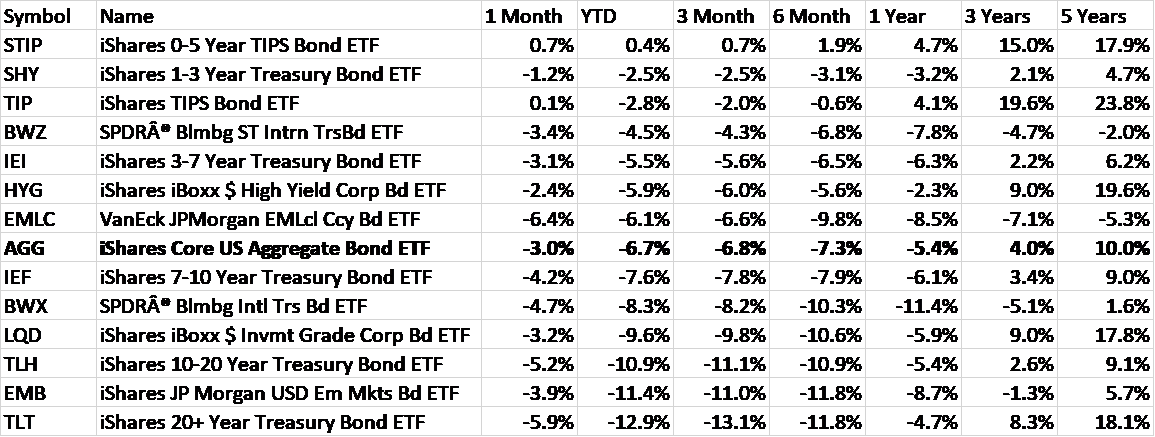

Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

Bi-Weekly Economic Review: Extending The Cycle

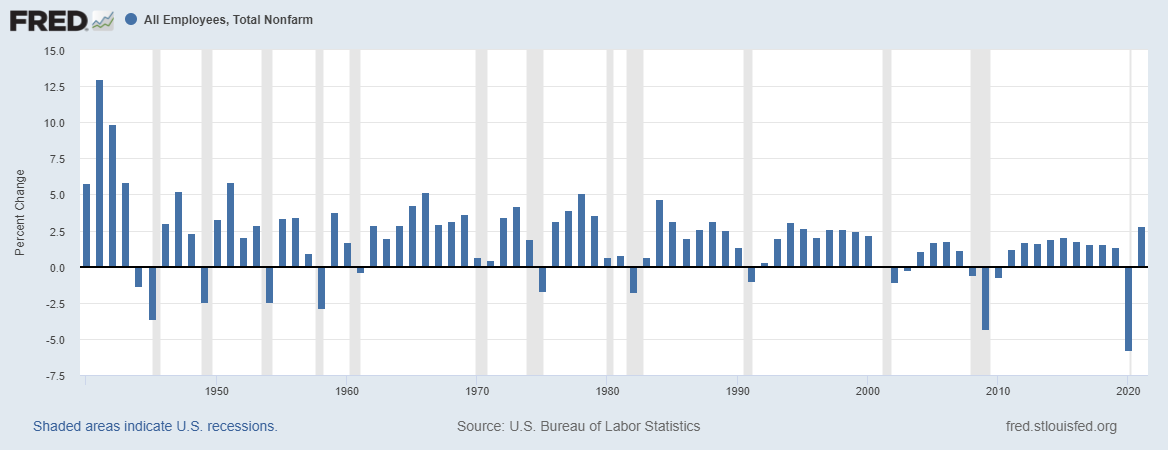

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear.

Read More »

Read More »

Global Asset Allocation Update: Not Yet

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months.

Read More »

Read More »

Bi-Weekly Economic Review: Attention Shoppers

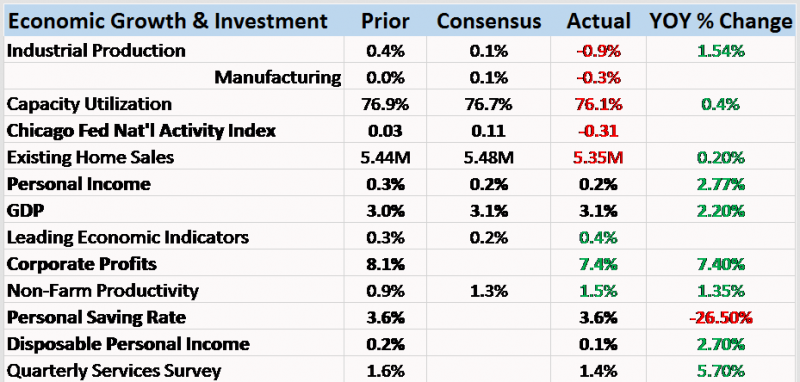

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels.

Read More »

Read More »

Bi-Weekly Economic Review: Draghi Moves Markets

In my last update two weeks ago I commented on the continued weakness in the economic data. The economic surprises were overwhelmingly negative and our market based indicators confirmed that weakness. This week the surprises are not in the economic data but in the indicators. And surprising as well is the source of the outbreak of optimism in the bond market and the yield curve.

Read More »

Read More »

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month.

Read More »

Read More »

Bi-Weekly Economic Review: Has The Fed Heard Of Amazon?

The economic surprises keep piling up on the negative side of the ledger as the Fed persists in tightening policy or at least pretending that they are. If a rate changes in the wilderness can the market hear it? Outside of the stock market one would be hard pressed to find evidence of the effectiveness of all the Fed’s extraordinary policies of the last decade.

Read More »

Read More »

Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters.

Read More »

Read More »

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs.

Read More »

Read More »

Bi-Weekly Economic Review

The economic data releases since the last update were generally upbeat but markets are forward looking and the future apparently isn’t to their liking. Of course, it is hard to tell sometimes whether bonds, the dollar and stocks are responding to the real economy or the one people hope Donald Trump can deliver when he isn’t busy contradicting his communications staff.

Read More »

Read More »